New Jersey Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

If you wish to thoroughly explore, download, or print legal document templates, make use of US Legal Forms, the largest repository of legal forms available online.

Employ the site's user-friendly search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or by keywords.

Every legal document template you purchase is yours permanently.

You have access to all forms you have downloaded in your account. Visit the My documents section to choose a form to print or download again. Be proactive and download and print the New Jersey Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- Use US Legal Forms to obtain the New Jersey Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption within just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to get the New Jersey Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

- Additionally, you can access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure that you have selected the form for the correct city/state.

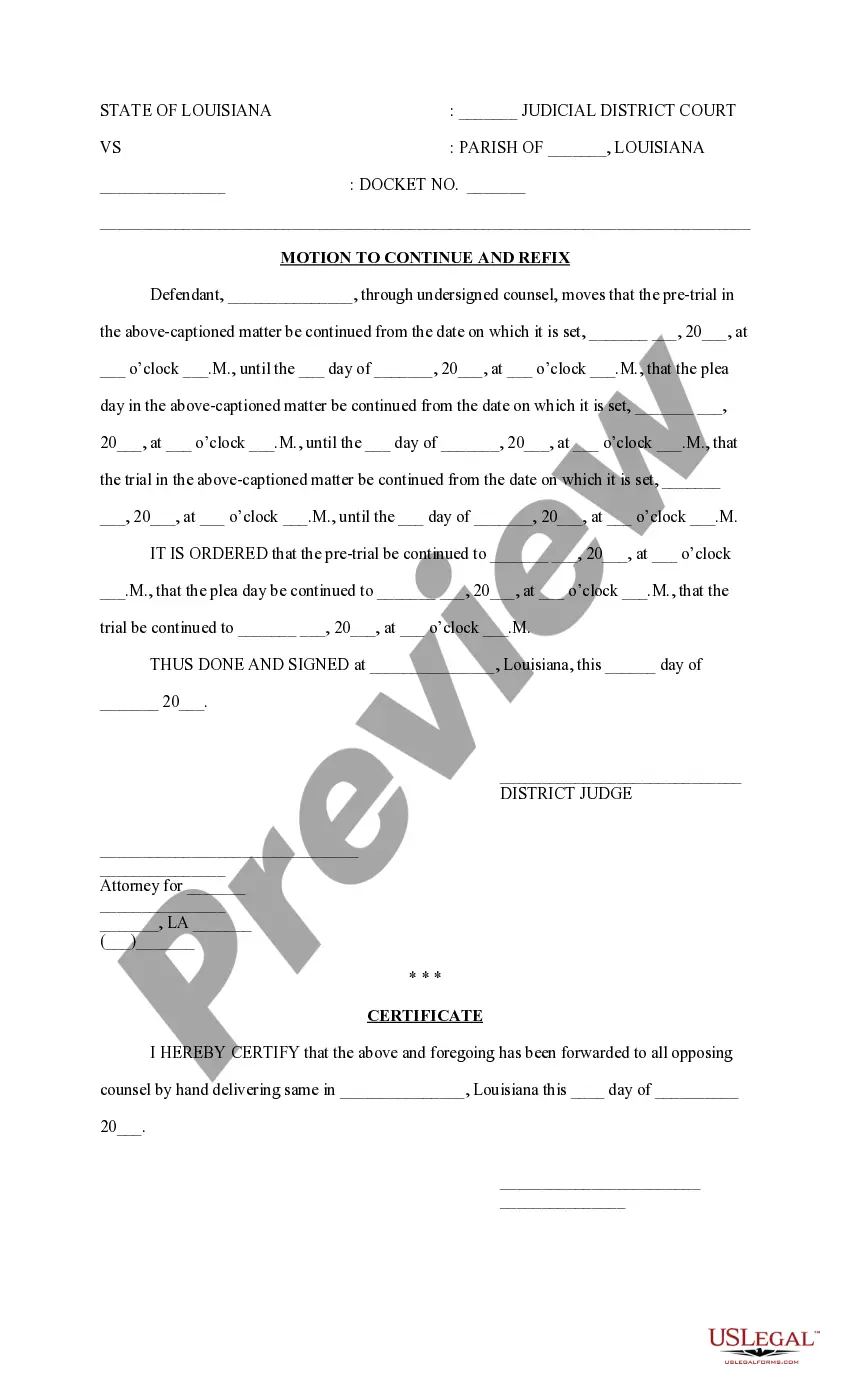

- Step 2. Utilize the Preview option to review the content of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative types in the legal form template.

- Step 4. Once you have located the form you need, click the Acquire now button. Choose your desired pricing plan and enter your details to register for an account.

- Step 5. Complete the transaction. You can use a credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the New Jersey Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

Form popularity

FAQ

New Jersey Sellers Must Disclose Known, Latent, Material Defects. In order to protect buyers from unwittingly purchasing real estate with hidden defects, a New Jersey home seller has a duty under the common law to tell prospective buyers about known, latent (concealed) material defects in the property.

Certificates of occupancy are not required in New Jersey for all sales. A temporary certificate of occupancy may be granted for a set time period to accomplish necessary repairs. A certificate of transfer title is sometimes used to transfer ownership where a property fails the municipal inspection.

A Certificate of Continuing Occupancy (CCO) is also required for every non-residential property whenever a change in occupancy occurs; which involves re- inspection of all areas of life safety. Construction permits must be obtained for all proposed modifications.

The purpose of a seller's disclosure statement is to disclose all known defects or issues with the residence to a potential purchaser.

Certificate of Occupancy is not required to close; only to occupy the house. This includes moving in personal effects. If the certificate of occupancy is not obtained prior to the closing, then the new owner can apply and schedule after the closing and before moving in.

In New Jersey, home sellers have a legal obligation to buyers to disclose information about their property's known defects. Failure to disclose can result in costly legal skirmishes that most homeowners would rather avoid.

Sales Tax: Sales Tax is not due on home sales. Realty Transfer Fee: Sellers pay a 1% Realty Transfer Fee on all home sales. The buyer is not responsible for this fee. However, buyers may pay an additional 1% fee on all home sales of $1 million or more.

New Jersey Sellers Must Disclose Known, Latent, Material Defects. In order to protect buyers from unwittingly purchasing real estate with hidden defects, a New Jersey home seller has a duty under the common law to tell prospective buyers about known, latent (concealed) material defects in the property.

Here are eight common real estate seller disclosures to be aware of, whether you're on the buyer's side or the seller's side.Death in the Home.Neighborhood Nuisances.Hazards.Homeowners' Association Information.Repairs.Water Damage.Missing Items.Other Possible Disclosures.

Seller's Residency Certification/Exemption InstructionsIndividuals, estates, trusts, or any other entity selling or transferring property in New Jersey must complete this form if they are not subject to the Gross Income Tax estimated payment requirements under N.J.S.A.