New Jersey Credit Memo

Description

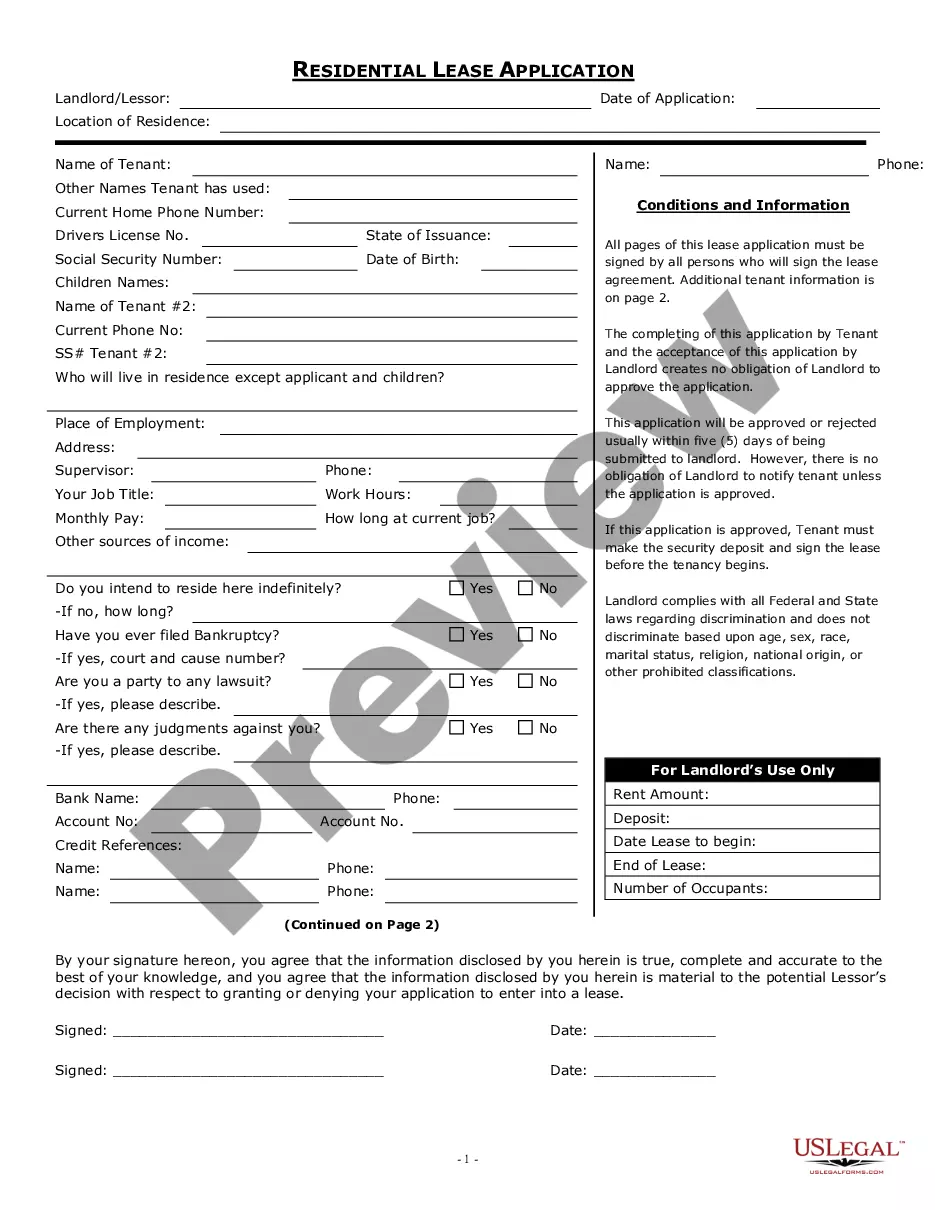

How to fill out Credit Memo?

US Legal Forms - one of the largest collections of approved documents in the USA - provides an extensive array of legal document templates that you can download or print.

By using the website, you will obtain numerous forms for business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of forms such as the New Jersey Credit Memo in a matter of seconds.

Refer to the form outline to confirm that you have selected the correct form.

If the form does not meet your requirements, utilize the Search area at the top of the screen to find the one that does.

- If you have a subscription, Log In and download the New Jersey Credit Memo from your US Legal Forms library.

- The Download option will appear on each form you view.

- You can find all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have chosen the correct form for your city/county.

- Select the Review option to examine the form's content.

Form popularity

FAQ

To avoid exit tax in New Jersey, properly establish your residency status before moving out of the state. Completing required forms and meeting tax obligations can minimize complications. For anyone considering a move, the New Jersey Credit Memo offers valuable insights on managing tax responsibilities during the transition.

Yes, New Jersey implements a 183 day rule that affects taxation and residency status. Being aware of this rule is crucial for individuals who travel frequently or move. Utilizing resources such as the New Jersey Credit Memo will provide you with more detailed information to help you comply with state tax laws.

The 183 day rule works by evaluating the total number of days you are physically present in New Jersey within a tax year. If you exceed this threshold, you are deemed a resident and subject to state taxes. Tools like the New Jersey Credit Memo can help you track your days and manage your tax residency status effectively.

The 183 day rule in New Jersey refers to a tax guideline determining residency based on the number of days spent in the state. If you are present in New Jersey for more than 183 days in a tax year, you may be considered a resident for tax purposes. Understanding this rule is crucial, and using resources like the New Jersey Credit Memo can assist in navigating your tax obligations.

Yes, if you work in New Jersey, you need to complete the NJ W4 form for accurate tax withholding. This form helps determine how much state tax your employer should withhold from your paycheck. Using tools like the New Jersey Credit Memo can clarify your responsibilities and optimize your tax situation.

The new immigration law in New Jersey aims to enhance protections for immigrant workers. It focuses on ensuring fair treatment and preventing discrimination in the workplace. For individuals navigating this complex system, the New Jersey Credit Memo can provide insights into legal aspects regarding employment and taxation.

You received a New Jersey Credit Memo likely due to an adjustment made by your bank or financial institution. Common reasons include a refund for an overpayment, a billing error, or an adjustment for fees. To fully understand why it was issued, check your recent transactions and statements. If the reason is unclear, reaching out to your bank can provide greater insight and clarity.

A New Jersey Credit Memo is typically viewed as a positive entry on your account. It indicates that funds have been credited, leading to an increase in your account balance. However, it’s crucial to consider the circumstances surrounding the memo, as it may reflect a correction rather than a typical income. Always review your records to understand its implications better.

The New Jersey Fair Credit Reporting Act is a law that aims to protect consumers regarding their credit information. It regulates how credit reports are created, accessed, and used by different entities. This act ensures that you can challenge inaccuracies and maintain the integrity of your personal credit history. Understanding this act can be beneficial if you deal with financial institutions and credit-related issues.

When you receive a New Jersey Credit Memo, it signifies that an adjustment has been made to your account. This memo usually reflects either a reduction in charges or a return of funds. It can result from issues like transactional errors or service cancellations. Being informed about these statements helps you manage your finances effectively.