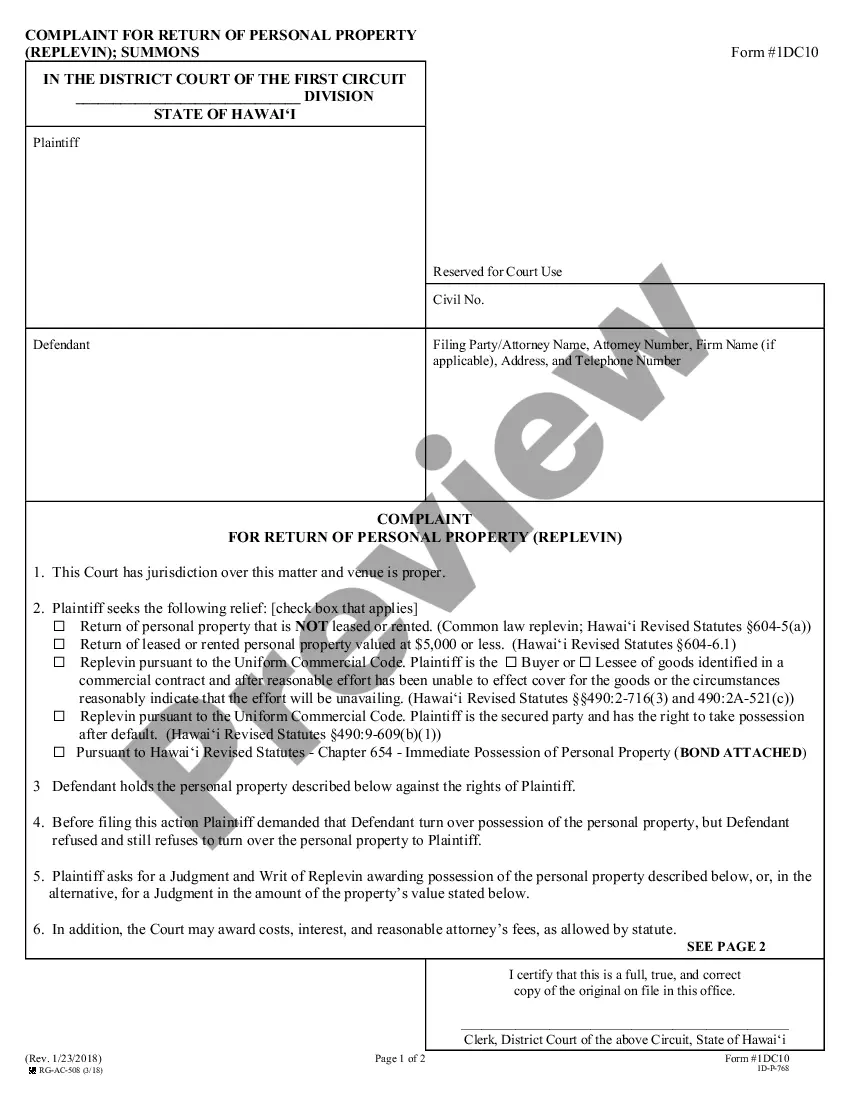

New Jersey Customer Invoice

Description

How to fill out Customer Invoice?

Have you ever been in a location where you require documents for either business or personal reasons regularly.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of form templates, such as the New Jersey Customer Invoice, which are designed to comply with federal and state regulations.

When you find the right form, simply click Buy now.

Select the pricing plan you want, fill in the required details to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New Jersey Customer Invoice template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

- Utilize the Preview button to view the form.

- Check the description to confirm you have selected the right form.

- If the form is not what you need, use the Search field to find the form that fits your requirements.

Form popularity

FAQ

To mail your NJ tax return, you should use the address specified on the form based on whether you are enclosing a payment or not. Ensure you send it to the correct processing center to avoid delays. Keeping your records organized can help simplify this process greatly. For efficient handling of your tax documents, US Legal Forms offers guidance and templates related to the New Jersey Customer Invoice, ensuring you have the necessary resources at your disposal.

Form N-600, known as the Application for Certificate of Citizenship, is utilized to obtain a citizenship certificate for individuals who have claims to U.S. citizenship. While this form is essential for establishing citizenship, it is especially relevant for those who reside outside of the U.S. To learn more about related processes, you might also find useful tools on the US Legal Forms site regarding the New Jersey Customer Invoice.

You must file a NJ nonresident return if you earned income from New Jersey sources while residing in another state. This includes earnings from employment, business activities, or rental properties located in New Jersey. Fulfilling this requirement is essential to avoid potential penalties. For a clear understanding of your responsibilities, the US Legal Forms platform can provide the necessary documents related to the New Jersey Customer Invoice.

Form NJ 600 is the New Jersey Nonresidents Income Tax Return. It is specifically designed for individuals who earned income in New Jersey but do not live in the state. Completing this form correctly is crucial for ensuring compliance with state tax laws. If you need assistance navigating this process, consider exploring solutions like US Legal Forms for resources related to the New Jersey Customer Invoice.

To establish a payment plan for your New Jersey taxes, start by visiting the New Jersey Division of Taxation’s website. They provide clear steps to set up a manageable payment plan based on your financial situation. If you receive a New Jersey Customer Invoice indicating an outstanding balance, following this process can prevent further penalties. Remember, utilizing US Legal Forms can simplify accessing necessary documents and forms to facilitate this setup.

To reach the Anchor Program in New Jersey, you can visit their official website for contact information. They offer support through email and phone, making it easy for you to ask questions about your benefits. If you require a New Jersey Customer Invoice for documentation, having your account information handy helps expedite the process. This ensures you connect quickly with the assistance you need.

New Jersey requests your W2 to ensure accurate reporting of your income. This information helps verify your tax liability and assess any potential credits. If you receive a New Jersey Customer Invoice, understanding your income documentation is crucial. Providing the correct information promotes a smoother processing of your tax return.

In the context of taxation, TGI stands for 'Tax Growth Income,' which relates to the income subject to tax increases over time. For anyone navigating the complexities of a New Jersey customer invoice, being aware of how TGI impacts your finances can help ensure compliance with state tax regulations.

A customer invoice is issued to request payment for goods or services provided to a client, while a vendor invoice is sent by suppliers to request payment for their products or services received. Understanding this distinction is vital when managing a New Jersey customer invoice, especially for accurate bookkeeping and accounting.

New Jersey consumer taxes include sales tax, use tax, and various excise taxes that affect purchases made within the state. If you issue a New Jersey customer invoice, it is important to factor in these taxes to ensure legal compliance and accurate billing. Make sure your invoices reflect the current tax rates to avoid any disputes.