New Jersey Credit Memo Request Form

Description

How to fill out Credit Memo Request Form?

It is feasible to allocate several hours online attempting to discover the legal document template that aligns with the local and national prerequisites you need.

US Legal Forms offers thousands of legal documents which are evaluated by experts.

You can effortlessly acquire or print the New Jersey Credit Memo Request Form from our services.

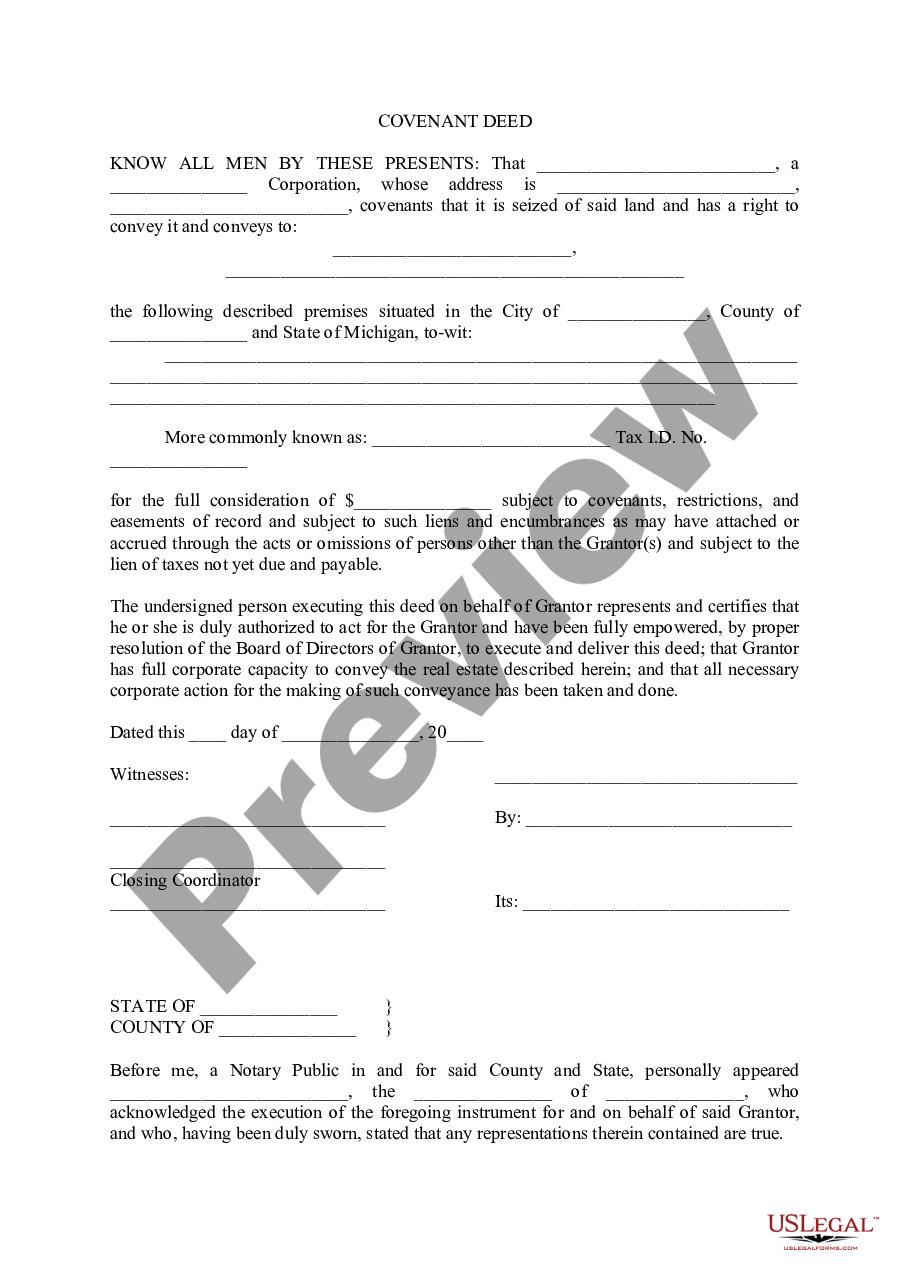

If available, utilize the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click on the Download button.

- Afterward, you can fill out, edit, print, or sign the New Jersey Credit Memo Request Form.

- Every legal document template you obtain is yours for an extended period.

- To acquire an additional copy of the purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Review the form overview to confirm that you have chosen the right document.

Form popularity

FAQ

Convenient Locations in Your Community: During the tax filing season, many libraries and post offices offer free tax forms to taxpayers. Some libraries also have copies of commonly requested publications. Many large grocery stores, copy centers and office supply stores have forms you can photocopy or print from a CD.

To stop the withholding of New Jersey Income Tax, complete an Employee's Certificate of Nonresidence in New Jersey (Form NJ-165) and give it to your employer.

NJ Taxation The Corporation Business Tax rate is 9% on adjusted entire net income or on the portion allocable to New Jersey. The rate is 7.5% for all corporations with entire net income of $100,000 or less. The rate is 6.5% for all corporations with entire net income of $50,000 or less.

A foreign corporation that owns a New Jersey partnership must file Form CBT-100S to claim the tax paid on their behalf by the part- nership. The foreign corporation cannot transfer the tax paid by the partnership on its behalf to any of its shareholders. Out-of-Business Corporations.

Note: Form CBT-100 is online for reference purposes only. Returns must be filed electronically. On and after January 1, 2019, all payments must be made electronically. On and after January 1, 2019, all payments must be made electronically.

FAQs on Gross Income Tax (GIT) Forms Required For Sale or Transfer of Real Property in New Jersey. What is a GIT/REP (real property) form? A GIT/REP form is a Gross Income Tax form required to be recorded with a deed when real property is transferred or sold in New Jersey. Several types of forms are in use.

(a) Every corporation that has elected and qualifies pursuant to Section 1361 of the Internal Revenue Code and has qualified and been accepted as a New Jersey S Corporation is required to file a CBT-100S.

Every partnership that has income or loss derived from sources in the State of New Jersey, or has any type of New Jersey resident partner, must file Form NJ-1065. Form NJ- CBT-1065 must be filed when the entity is required to calculate a tax on its nonresident partner(s).

To order State of New Jersey tax forms, call the Division's Customer Service Center (609-292-6400) to request income tax forms and instructions. To obtain State of New Jersey tax forms in person, make an appointment to visit a Division of Taxation Regional Office. See a list of locations here.

To order State of New Jersey tax forms, call the Division's Customer Service Center (609-292-6400) to request income tax forms and instructions. To obtain State of New Jersey tax forms in person, make an appointment to visit a Division of Taxation Regional Office. See a list of locations here.