New Jersey Vendor Evaluation

Description

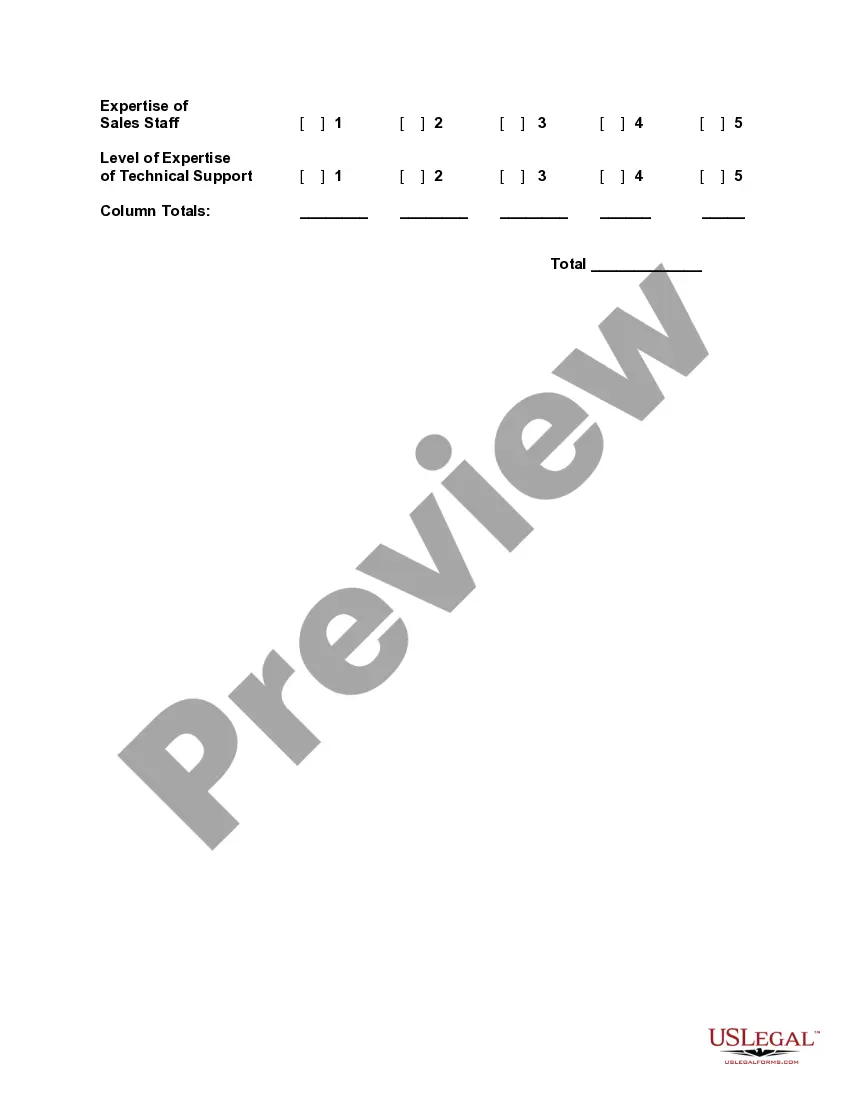

How to fill out Vendor Evaluation?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates that you can download or print.

By using the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can obtain the latest forms such as the New Jersey Vendor Evaluation in just minutes.

If you already have an account, Log In and retrieve the New Jersey Vendor Evaluation from the US Legal Forms library. The Download button will be displayed on every form you view. You can access all previously acquired forms in the My documents section of your profile.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and obtain the form onto your device. Make edits. Fill out, modify, print, and sign the downloaded New Jersey Vendor Evaluation. Each template you add to your account does not expire and is yours permanently. Therefore, if you wish to obtain or print another copy, simply visit the My documents section and click on the form you need. Gain access to the New Jersey Vendor Evaluation with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/region.

- Preview the form to review its details by clicking the Preview button.

- Read the form information to confirm that you have selected the appropriate form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose your preferred pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

To obtain a New Jersey certificate of authority, first, you need to register your business with the New Jersey Division of Revenue. This process typically involves submitting necessary forms, providing information about your business structure, and paying the required fees. After registering, you can apply for the certificate, which allows your business to conduct sales in the state. Consider using US Legal Forms for tailored templates and guidance throughout this process, ensuring a smooth New Jersey Vendor Evaluation.

Becoming a certified vendor in New Jersey involves undergoing a specific application and review process. First, determine the certification that suits your business needs, such as Minority or Women-owned Business Enterprise certification. Complete the required forms and gather supporting documents. Once submitted, you will go through the New Jersey Vendor Evaluation to ensure compliance and qualifications, which can enhance your market visibility.

To secure government contracts in New Jersey, familiarize yourself with the state's procurement process and identify available opportunities. Businesses can register on the New Jersey State Contracting website to gain access to current bidding projects. Participating in networking events and engaging with other businesses can also enhance your chances. Using tools that facilitate New Jersey Vendor Evaluation will help you understand requirements and strengthen your proposals.

To become a New Jersey state vendor, start by registering your business with the New Jersey Division of Revenue and Enterprise Services. Next, complete the Vendor Registration Application, which you can find on the state's website. Ensure that you provide all necessary documentation and information. Once registered, you can participate in New Jersey Vendor Evaluation processes for upcoming procurement opportunities.

Filling out a general resale certificate requires you to provide necessary business information, including your resale number. Clearly specify the type of goods you plan to resell and make sure to include your signature. A properly completed general resale certificate is essential for successful transactions and will assist you in meeting the requirements of the New Jersey Vendor Evaluation.

Avoiding the New Jersey exit tax involves understanding the residency rules and ensuring compliance before leaving the state. You can talk to a tax professional to clarify your situation and responsibilities. By knowing your obligations, you can smoothly manage your transition without facing unexpected costs or penalties during your New Jersey Vendor Evaluation.

Yes, in New Jersey, a vendor's license is typically required to operate legally. This license allows you to engage in selling goods or services and is a common requirement to pursue the New Jersey Vendor Evaluation. Not obtaining this license might hinder your ability to bid on state contracts or participate in governmental projects.

Filling out a sales tax exemption certificate requires you to provide your business details and reason for the exemption. You will need to include your tax-exempt number and specify the exact use of the purchased goods. Accurate completion of this certificate is vital for passing the New Jersey Vendor Evaluation and avoiding tax liabilities.

To fill out the CRT 61 certificate of resale, start by entering your personal and business information correctly. Include your New Jersey resale number, and describe the nature of the items being purchased. Ensure you sign and date the certificate, as this is crucial for compliance during the New Jersey Vendor Evaluation process.

An Employer Identification Number (EIN) and a resale number serve different purposes. An EIN is used for tax identification for your business, while a resale number is specifically for tax-exempt purchases. If you are completing a New Jersey Vendor Evaluation, it's essential to understand both numbers and how they apply to your business operations.