New Jersey Short Form Agreement to Dissolve and Wind up Partnership

Description

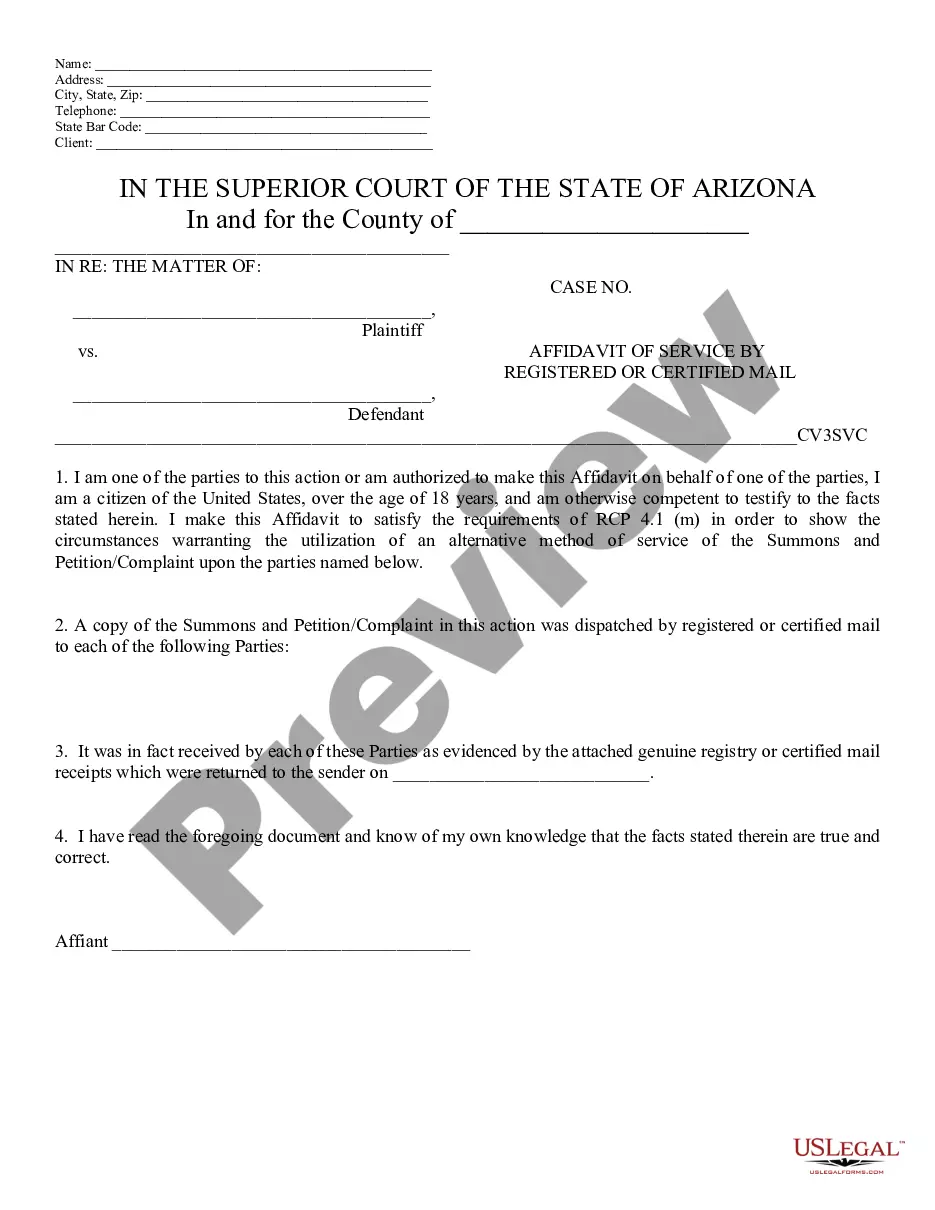

How to fill out Short Form Agreement To Dissolve And Wind Up Partnership?

Are you currently situated in a location where you require documents for either business or personal purposes daily.

There are numerous lawful document formats available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast assortment of document templates, including the New Jersey Short Form Agreement to Dissolve and Wind up Partnership, which can be customized to satisfy federal and state regulations.

Once you find the correct document, click Acquire now.

Select the pricing plan you prefer, provide the necessary information to set up your account, and complete your purchase through PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Subsequently, you may download the New Jersey Short Form Agreement to Dissolve and Wind up Partnership template.

- If you do not have an account and would like to start using US Legal Forms, follow these instructions.

- Find the document you need and ensure it is for your specific city/state.

- Utilize the Review button to evaluate the document.

- Check the details to confirm you have selected the correct document.

- If the document is not what you are looking for, use the Look for field to search for the document that meets your needs.

Form popularity

FAQ

In New Jersey, a partnership does not require an extension when using the New Jersey Short Form Agreement to Dissolve and Wind up Partnership. However, partners must agree on how to handle the winding up process and address outstanding obligations. This agreement provides a structured way to officially conclude the partnership’s affairs, allowing for the proper distribution of assets. If you need guidance in creating such an agreement, consider using the USLegalForms platform to streamline the process.

Failing to dissolve your LLC in New Jersey can lead to ongoing obligations, such as annual fees and tax filings, even if the business is inactive. Additionally, you may remain personally liable for any debts or obligations tied to the LLC. To avoid these issues, consider using a New Jersey Short Form Agreement to Dissolve and Wind up Partnership to formalize the dissolution.

To dissolve a partnership, start by reviewing your partnership agreement for any specific terms regarding dissolution. Then, settle debts and liabilities, notify stakeholders, and file necessary forms with the state. Creating a New Jersey Short Form Agreement to Dissolve and Wind up Partnership can guide you through these steps effectively.

Dissolving a partnership in New Jersey generally involves filing a Certificate of Dissolution with the state, settling debts, and distributing remaining assets to partners. You should also inform creditors and clients about the partnership's dissolution. Utilizing a New Jersey Short Form Agreement to Dissolve and Wind up Partnership can help streamline this complex process.

Removing a partner from an LLC in New Jersey typically requires a formal process set out in your operating agreement. If no procedure is outlined, you may need a vote from the remaining members to approve the removal. Consider drafting a New Jersey Short Form Agreement to Dissolve and Wind up Partnership to ensure the removal process is smooth and legally binding.

Dissolution refers to the process of ending a partnership, which involves settling debts and distributing assets. Termination is the final step that officially concludes the existence of the partnership after dissolution is complete. Understanding these differences is essential when creating a New Jersey Short Form Agreement to Dissolve and Wind up Partnership.

To dissolve a company in New Jersey, you need to file a New Jersey Short Form Agreement to Dissolve and Wind up Partnership with the state. This document outlines the intention to dissolve the partnership and facilitates the winding up of its affairs. Following the filing, it is crucial to notify creditors and settle any outstanding debts. Finally, ensure that you complete all necessary tax obligations before formally closing the business.

To dissolve a partnership in New Jersey, partners should follow specific steps, including settling debts and distributing remaining assets. It is vital to document the dissolution agreement to avoid future disputes. Using the New Jersey Short Form Agreement to Dissolve and Wind up Partnership can aid partners in ensuring a smooth process and compliance with state regulations.

In New Jersey, a certificate of dissolution formally ends the existence of an LLC, while dissolution and termination are the broader processes of winding up operations and settling accounts. Both are crucial steps in concluding business affairs. For clarity and proper execution, referring to the New Jersey Short Form Agreement to Dissolve and Wind up Partnership can assist in navigating these terms effectively.

Dissolving an LLC in New Jersey requires fulfilling legal requirements, such as notifying creditors and settling liabilities. Members also need to distribute any remaining assets after liabilities are cleared. To officially complete this process, you should use the New Jersey Short Form Agreement to Dissolve and Wind up Partnership, ensuring everything is documented and compliant.