This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Jersey Notice of Non-Responsibility of Wife for Debts or Liabilities

Description

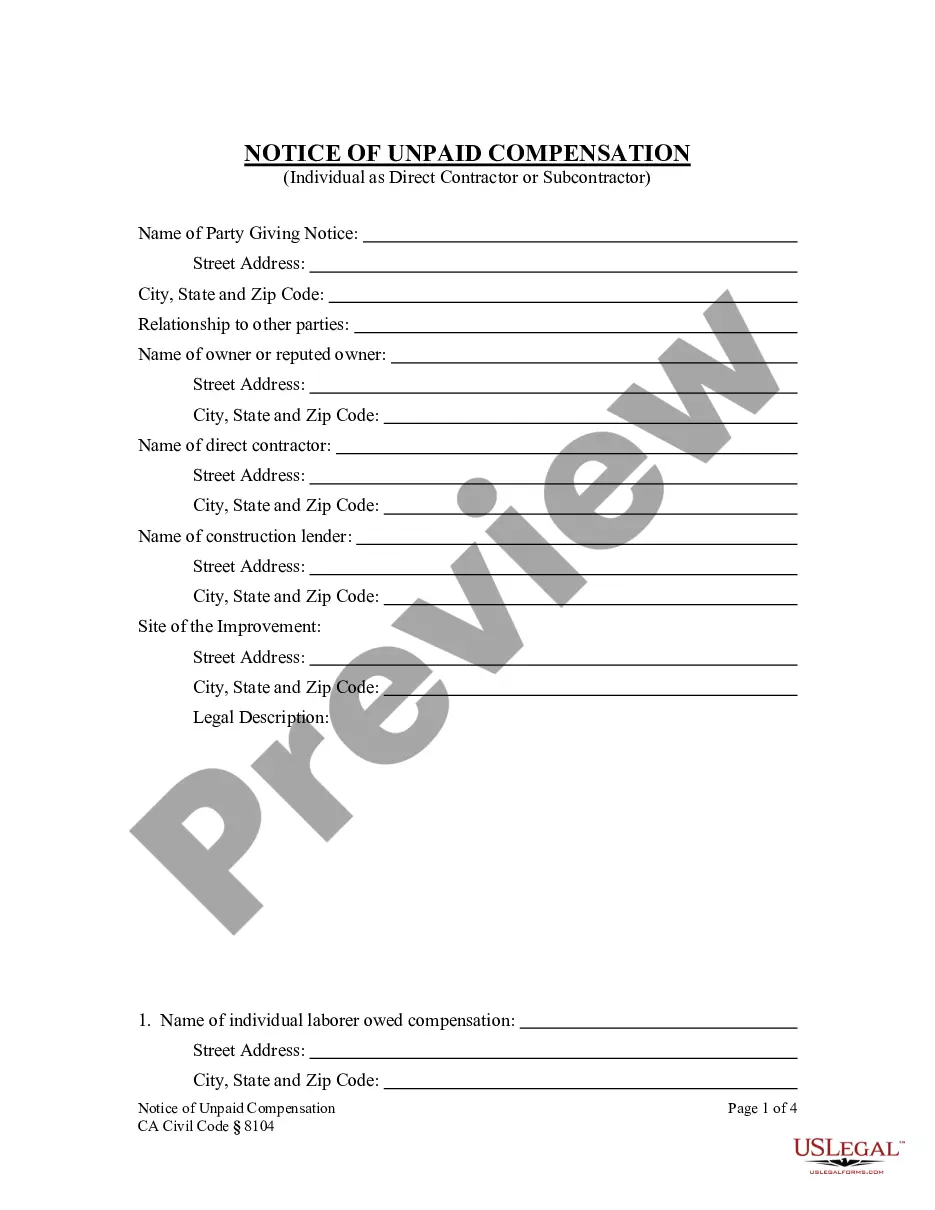

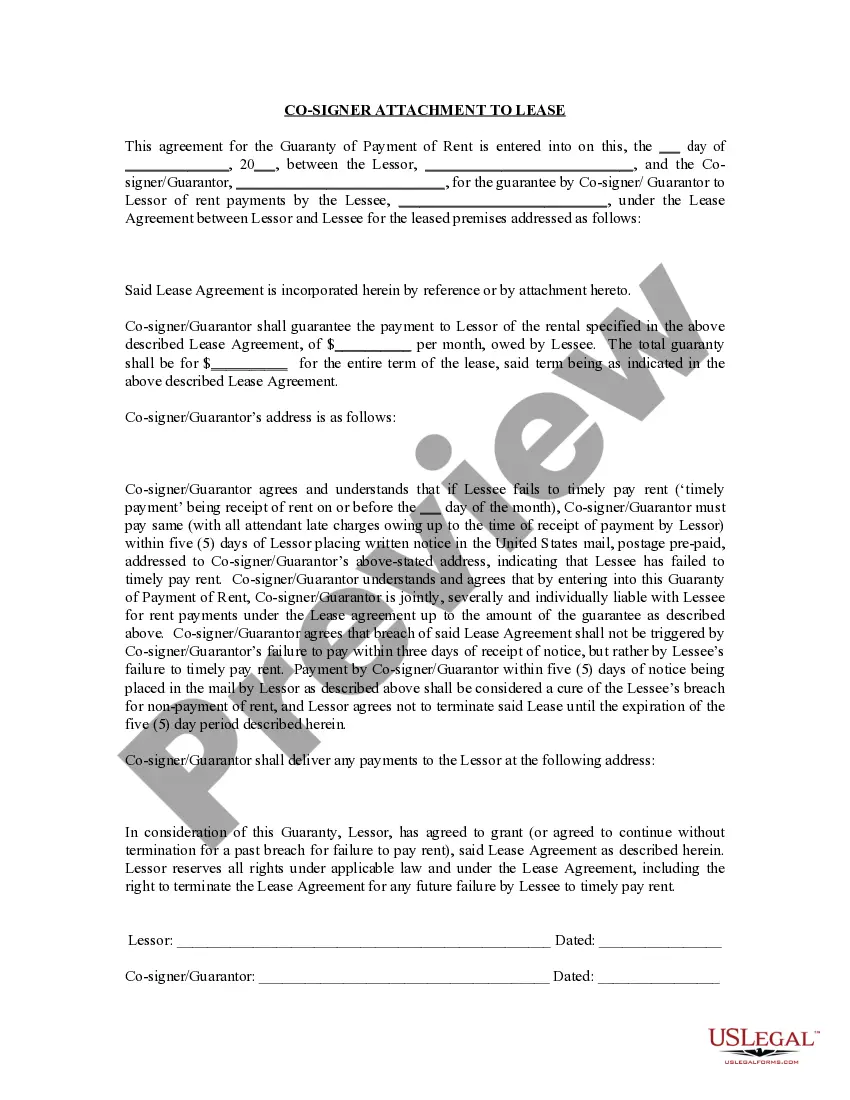

How to fill out Notice Of Non-Responsibility Of Wife For Debts Or Liabilities?

US Legal Forms - one of the foremost collections of legal documents in the USA - provides a range of legal form templates that can be downloaded or printed.

By using the website, you can discover thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can access the latest versions of forms such as the New Jersey Notice of Non-Responsibility of Wife for Debts or Liabilities within moments.

If you currently hold a subscription, Log In and download the New Jersey Notice of Non-Responsibility of Wife for Debts or Liabilities from your US Legal Forms library. The Obtain button will appear on each form you view. You have access to all previously downloaded forms within the My documents section of your account.

Process the purchase. Use a credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill in, alter, print, and sign the downloaded New Jersey Notice of Non-Responsibility of Wife for Debts or Liabilities. Each form added to your account does not have an expiration date, which means it is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the New Jersey Notice of Non-Responsibility of Wife for Debts or Liabilities with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you want to utilize US Legal Forms for the first time, here are straightforward instructions to assist you in getting started.

- Ensure you have selected the correct form for your city/state. Click the Review button to examine the form's details.

- Check the form summary to ensure you have selected the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to locate one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, select the pricing option you prefer and provide your details to create an account.

Form popularity

FAQ

In New Jersey, the time you can wait to sue someone depends on the type of claim you have. Generally, you have a limited period defined by the statute of limitations, which can be as short as one year or as long as six years. It is important to be aware of these time frames, particularly in cases related to a New Jersey Notice of Non-Responsibility of Wife for Debts or Liabilities, to ensure you do not lose your chance to file.

Yes, you can file a lawsuit without a lawyer in New Jersey, as individuals can represent themselves in court. However, navigating the legal system can be complex, especially if your case involves specific issues like a New Jersey Notice of Non-Responsibility of Wife for Debts or Liabilities. Using resources such as USLegalForms can help guide you through the necessary steps and paperwork.

In New Jersey, the amount you can sue for in civil court typically depends on the nature of your case and the specific damages you seek. For most civil cases, there is no cap on the amount you can claim, but small claims court has a limit of $3,000. If your case involves a New Jersey Notice of Non-Responsibility of Wife for Debts or Liabilities, ensure you calculate your damages accurately to support your claim.

In New Jersey, the statute of limitations for filing a civil suit varies depending on the type of case, typically ranging from one to six years. For personal injury cases, you usually have two years to file your claim. It is crucial to act promptly, especially in cases involving matters like a New Jersey Notice of Non-Responsibility of Wife for Debts or Liabilities. Missing the deadline may bar you from seeking justice.

In general, creditors cannot pursue you for your spouse's debts if they are solely in your spouse's name, especially if you did not sign on any loans or credit accounts. However, some exceptions exist, particularly if debts are related to joint assets or accounts. To ensure your financial safety, you may consider using the New Jersey Notice of Non-Responsibility of Wife for Debts or Liabilities to clarify your non-responsibility, thereby offering you peace of mind.

A wife is not usually liable for her husband's debts in New Jersey unless she has co-signed or guaranteed the debt. It's crucial to understand that marital property may be subject to claims if debts arise during the marriage. The New Jersey Notice of Non-Responsibility of Wife for Debts or Liabilities can provide legal protection by officially stating that you do not accept responsibility for any debts incurred by your husband without your agreement.

In New Jersey, the law generally protects you from your wife's debts unless you co-signed for those obligations or took out common loans together. By filing a New Jersey Notice of Non-Responsibility of Wife for Debts or Liabilities, you can further establish your non-liability for her individual debts. This notice serves as a clear declaration that you are not responsible for any financial responsibilities solely incurred by your spouse. To ensure your protection and navigate any complexities, consider using US Legal Forms to easily prepare and file this notice.

To terminate a domestic partnership in New Jersey, one must file a notice of termination with the state. Both partners must agree to the termination, or one partner must prove that they have met specific legal criteria. The New Jersey Notice of Non-Responsibility of Wife for Debts or Liabilities may also play a role in how debts are managed post-termination. Consulting a legal professional can ensure the process goes smoothly.

In New Jersey, the statute of limitations for most debts is generally six years. After this period, creditors can no longer sue you for the debt, though they may still attempt collection. Understanding the New Jersey Notice of Non-Responsibility of Wife for Debts or Liabilities can also clarify how marital status impacts liability for debts. It's wise to keep track of your financial obligations within that time frame.

Collection laws in New Jersey focus on protecting consumers from abusive collection practices. These laws dictate how and when collectors can contact debtors, ensuring communication is respectful and fair. The New Jersey Notice of Non-Responsibility of Wife for Debts or Liabilities further shields spouses from unexpected debt liability. Knowing these laws helps you act confidently in any debt situation.