New Jersey Agreement to Compromise Debt

Description

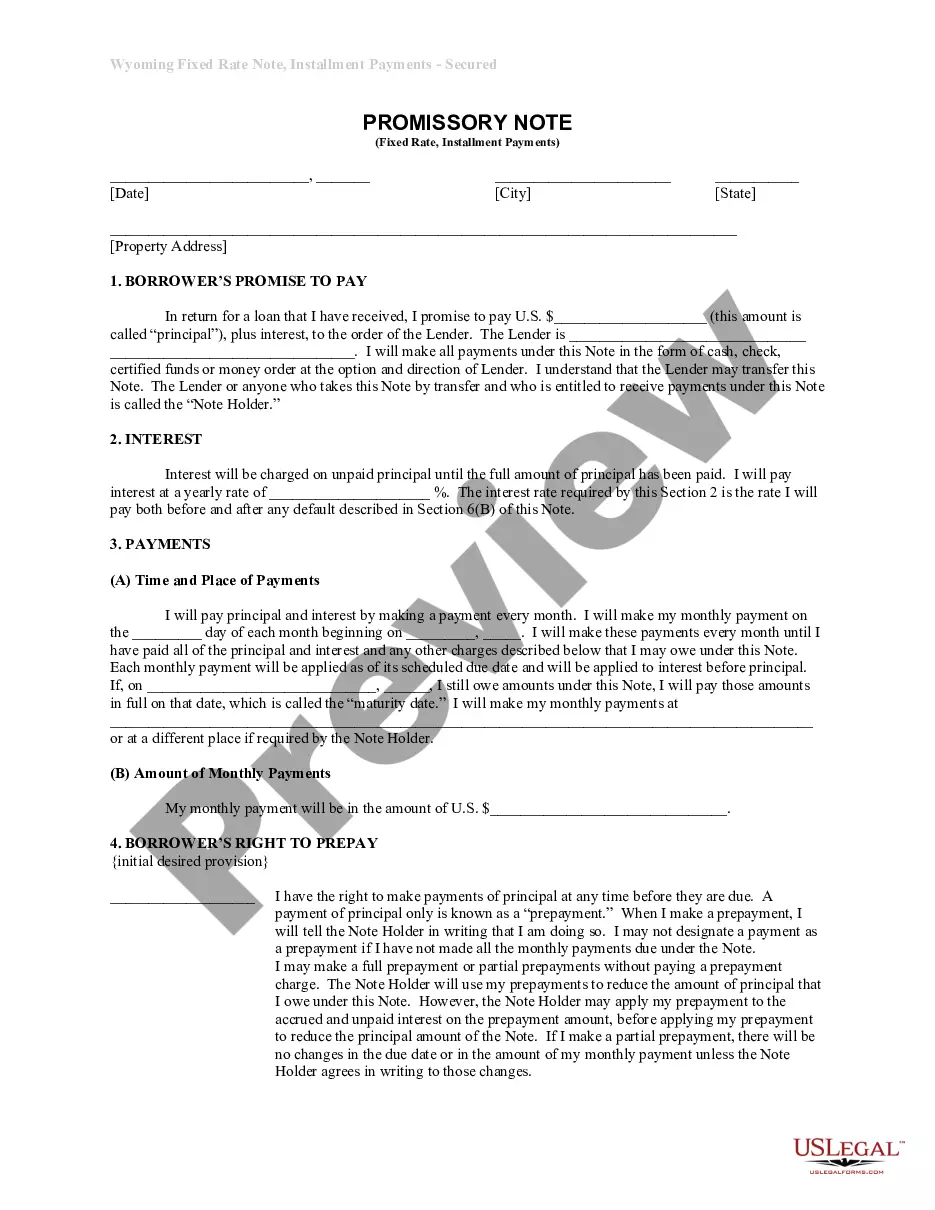

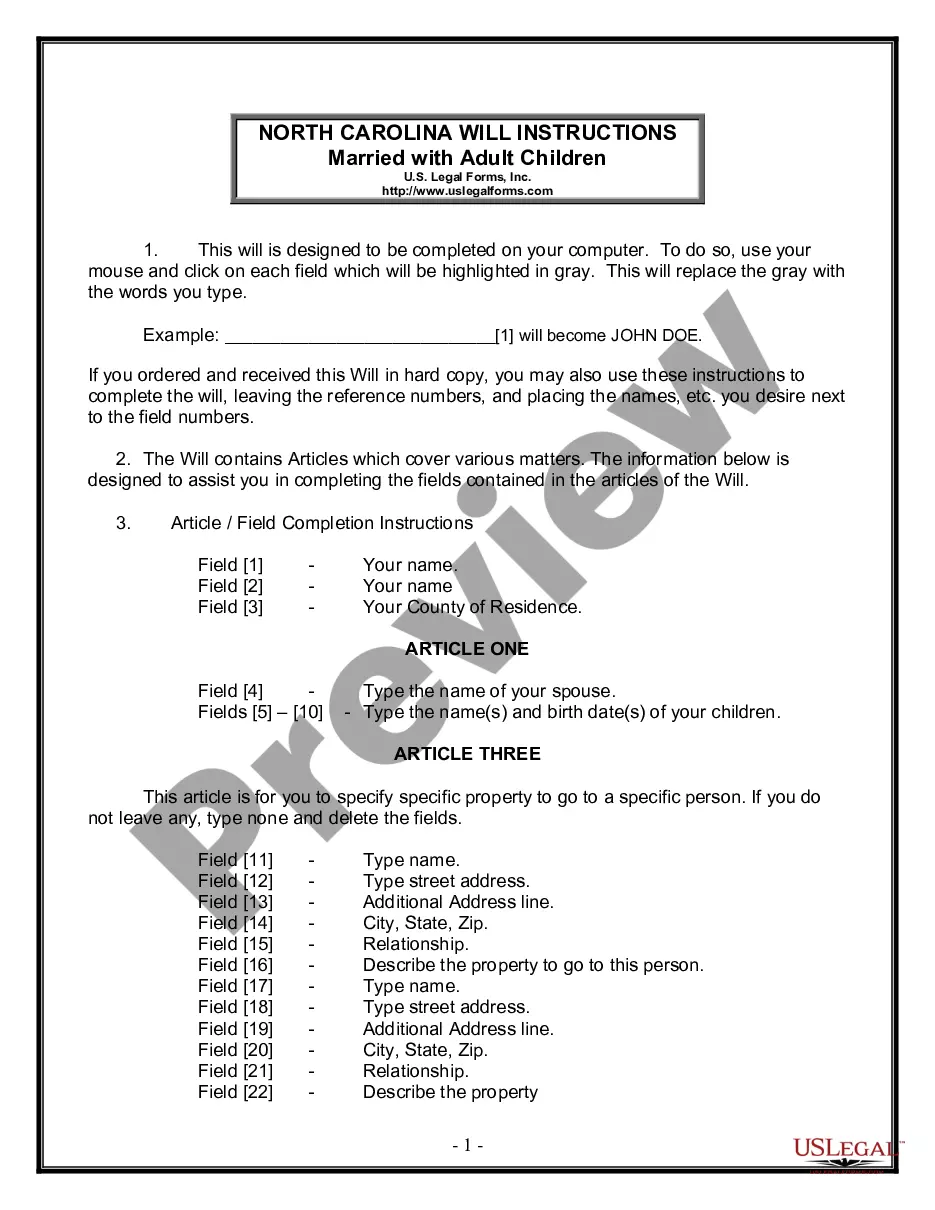

How to fill out Agreement To Compromise Debt?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide range of legal document templates that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest document templates like the New Jersey Agreement to Compromise Debt within seconds.

If you possess an account, Log In and download the New Jersey Agreement to Compromise Debt from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously acquired forms in the My documents tab of your profile.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the document onto your device. Edit. Complete, modify, and print, and sign the downloaded New Jersey Agreement to Compromise Debt. Each template you added to your account has no expiration date and is yours forever. So, to download or print another copy, simply go to the My documents section and click on the form you need. Access the New Jersey Agreement to Compromise Debt with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you select the correct form for your region/area.

- Click the Preview button to review the content of the form.

- Check the form summary to make sure you have chosen the correct document.

- If the form does not meet your needs, use the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Purchase now button.

- Then, choose the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

The 777 rule is a guideline that suggests you should aim to make payment arrangements with debt collectors within 30 days of their contact. This helps establish a clear plan and can prevent additional fees. Following this rule might ease negotiations and lead to a more favorable settlement. Utilizing a New Jersey Agreement to Compromise Debt can help solidify these arrangements and protect your rights throughout the process.

A debt agreement can often be a beneficial option for managing overwhelming debt. It allows you to negotiate a lower repayment amount and can provide a clear path to financial recovery. However, it's essential to consider your individual circumstances and potential impacts on your credit score. A New Jersey Agreement to Compromise Debt can offer you a structured approach to handle your obligations responsibly.

To write a debt agreement, begin by identifying all parties involved and specify the debt owed. It’s important to detail the payment terms, including amounts, deadlines, and potential interest rates. Make sure to include any conditions for default or changes, aiming for clarity and consensus. You can simplify this process by utilizing resources like the New Jersey Agreement to Compromise Debt from U.S. Legal Forms.

Writing a debt settlement agreement involves clearly defining the terms between you and the creditor. Start by outlining the total debt amount, the proposed settlement amount, and the payment schedule. Ensure both parties sign the document to make it legally binding. Using a New Jersey Agreement to Compromise Debt template can streamline this process and help you cover essential details effectively.

The offset program in New Jersey allows the state to withhold certain payments to collect outstanding debts, such as unpaid taxes or child support. Under this program, the state can take part of your tax refund or other payments to apply toward your debt. It's essential to understand how this may impact your finances if you're considering a New Jersey Agreement to Compromise Debt, as it might affect your ability to negotiate.

A good debt settlement letter should clearly describe your situation and the reason for your request. Start with a brief introduction of your financial hardships, followed by your proposed settlement amount and the rationale behind it. Ensure that you include your contact information and express willingness to negotiate further. In doing so, consider utilizing a New Jersey Agreement to Compromise Debt template for guidance.

Typically, you should aim to settle your debt for about 30% to 50% of the total amount owed, but this can vary based on your financial situation and the creditor's policies. Offering a lower percentage may be more effective if you can demonstrate financial hardship. It’s crucial to negotiate respectfully and to document all agreements. Utilizing a New Jersey Agreement to Compromise Debt can provide a clear framework for these negotiations.

To submit an offer in compromise, start by completing IRS Form 656 along with the necessary documentation that details your finances. After thoroughly checking for accuracy, send these forms to the appropriate IRS address based on your location. You can also utilize online platforms, like USLegalForms, to ensure that all information is correctly filled out and submitted. By following these steps and providing clear evidence of your financial hardship, you can increase your chances of approval.

While it is not mandatory to hire an attorney to file an offer in compromise, having legal support can enhance your chances of success. An attorney can provide valuable insights into your financial situation and help you prepare a compelling case for your New Jersey Agreement to Compromise Debt. Additionally, they can represent you and communicate with the IRS on your behalf, which may relieve some stress during the process. Consider whether you feel comfortable navigating the system on your own.

Filing an offer in compromise can be challenging due to the extensive paperwork and detailed financial disclosures required. The IRS assesses your application thoroughly, which means accuracy and completeness are vital for approval. Many find it helpful to work with a professional or utilize user-friendly platforms like USLegalForms to guide them through the submission process. Ultimately, with the right preparation, you can navigate this challenge successfully.