New Jersey Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Agreement To Compromise Debt By Returning Secured Property?

You can dedicate hours online searching for the appropriate legal document template that meets both federal and state requirements you need.

US Legal Forms provides thousands of legal documents that can be reviewed by experts.

You can easily download or print the New Jersey Agreement to Settle Debt by Returning Secured Property from their service.

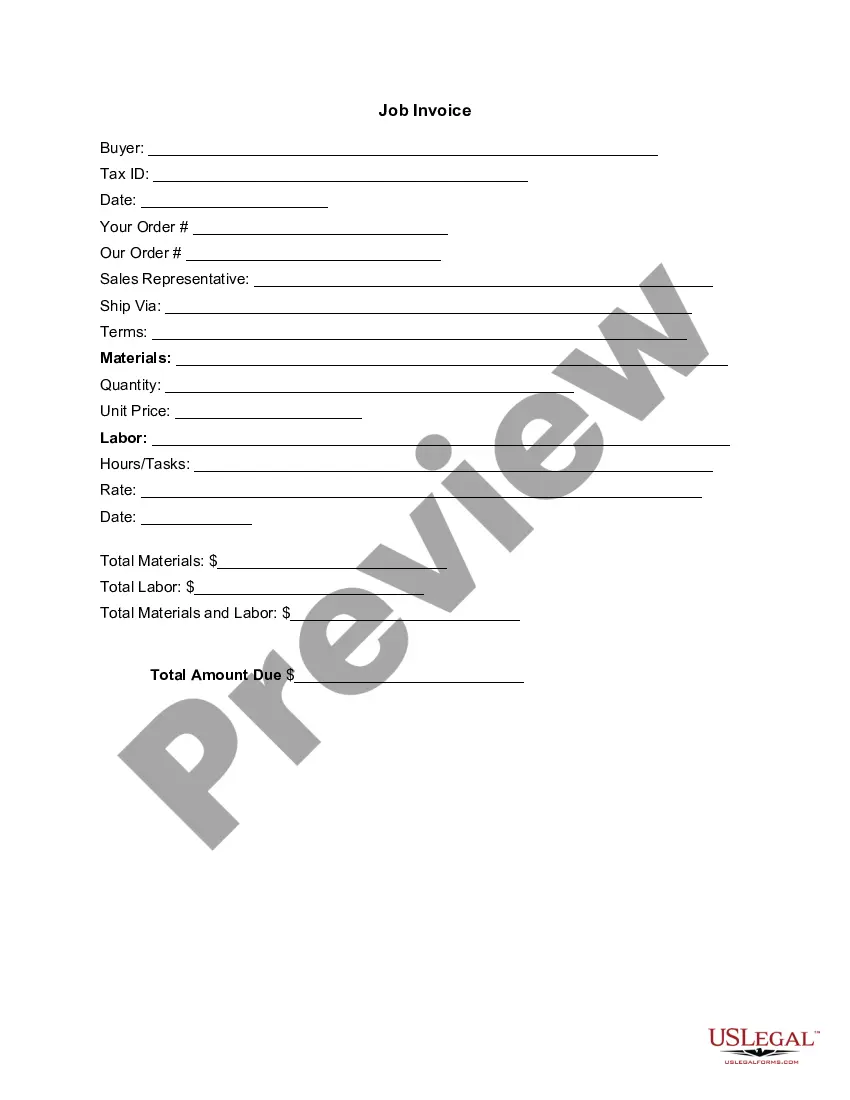

First, ensure you have selected the correct document template for the region/city of your choice. Review the form description to confirm you have chosen the right form. If available, utilize the Preview button to examine the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click on the Download button.

- Next, you can complete, edit, print, or sign the New Jersey Agreement to Settle Debt by Returning Secured Property.

- Every legal document template you purchase belongs to you indefinitely.

- To obtain another version of any acquired form, navigate to the My documents section and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

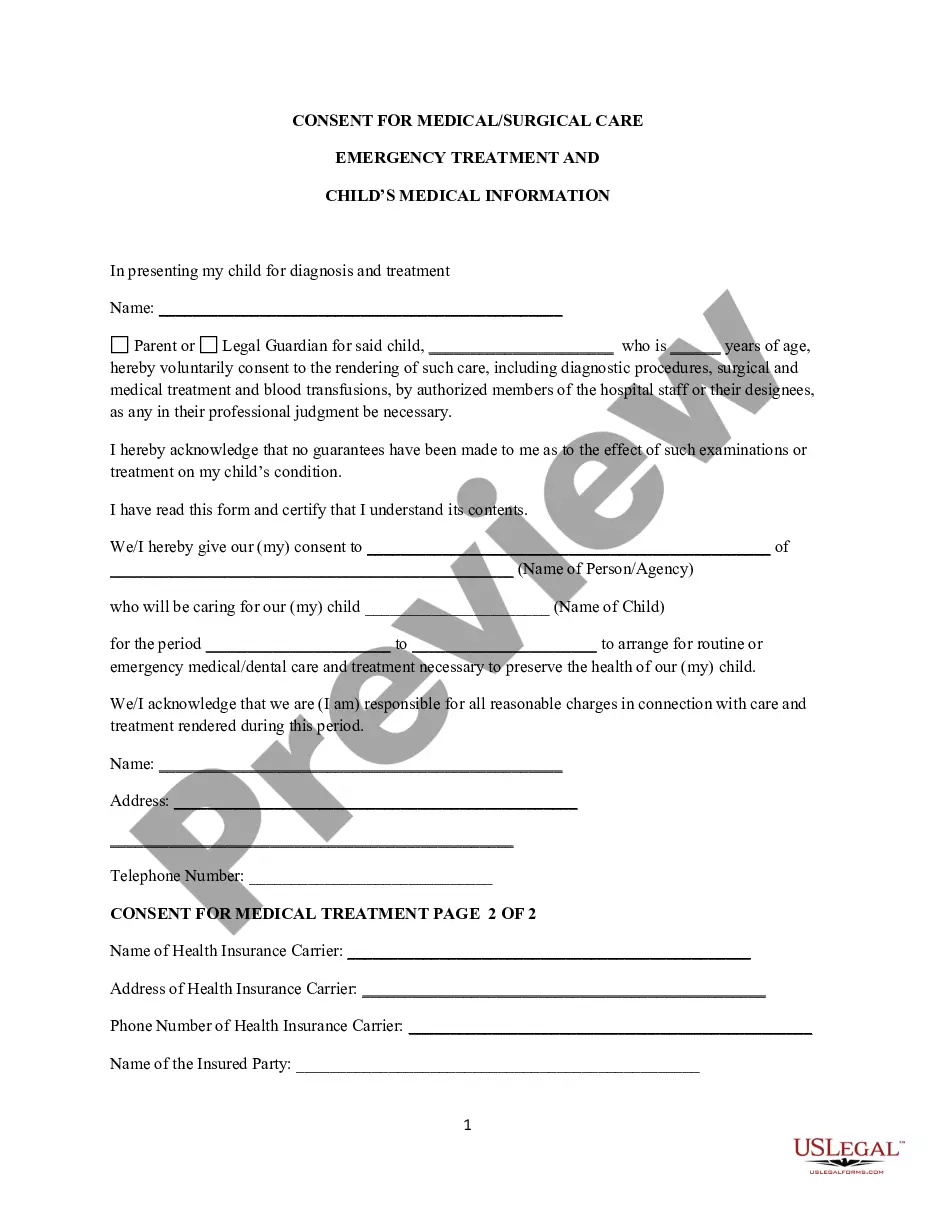

Yes, you can settle secured debt, though the process can be more complicated than settling unsecured debt. It’s important to negotiate directly with the lender to reach an agreement that benefits both parties. Using the New Jersey Agreement to Compromise Debt by Returning Secured Property can facilitate a smoother negotiation process and help ensure that both parties adhere to the agreed terms.

The 777 rule refers to a strategy some debtors use to deal with debt collectors, which involves making payments in three installments of a set amount, considering they want to settle the debt. This method can be effective in negotiations, but it's crucial to have a well-documented agreement. One approach to formalizing this process is through the New Jersey Agreement to Compromise Debt by Returning Secured Property, which can accommodate such terms.

To create a debt settlement agreement, start with a title and date, then list the creditor and debtor names. Describe the debt amount and the agreed settlement terms, including the payment method and timeline. Utilizing templates such as the New Jersey Agreement to Compromise Debt by Returning Secured Property can simplify this task and ensure that you include all essential information.

Writing a settlement agreement involves detailing the dispute, the parties involved, and the resolution terms. Clearly state the obligations of each party, including any payments to be made and deadlines for completion. To streamline this process, consider using a resource like the New Jersey Agreement to Compromise Debt by Returning Secured Property, which provides a structured approach to creating effective settlement agreements.

To write a debt agreement, start by clearly identifying the parties involved and the specific terms of the agreement. Outline the total amount owed, payment schedule, and any interest rates. Be sure to include a section on what happens in case of default. Consider using a template like the one found in the New Jersey Agreement to Compromise Debt by Returning Secured Property to ensure all necessary details are covered.

Yes, a credit card company can place a lien on your house in New Jersey if they win a judgment against you for unpaid debts. This means they can claim a portion of the equity in your home. To avoid such situations, consider a New Jersey Agreement to Compromise Debt by Returning Secured Property, which provides an avenue for resolving debts while protecting your home.

Yes, in certain circumstances, creditors can obtain a lien against your property or even seize your house to satisfy debts. However, various protections may apply, especially if you take proactive steps. A New Jersey Agreement to Compromise Debt by Returning Secured Property allows you to negotiate a resolution that could prevent such outcomes and safeguard your home from creditor claims.

New Jersey debt collection laws regulate how creditors and collection agencies can operate, ensuring fair practices. For example, collectors must provide written notice of the debt and cannot harass or threaten consumers. Utilizing a New Jersey Agreement to Compromise Debt by Returning Secured Property can also be a strategic way to meet obligations without falling into harmful collection practices.

In New Jersey, certain assets are exempt from being seized in a lawsuit, including your primary residence up to a specific value, personal property, and retirement accounts. These protections help individuals retain essential resources in difficult financial times. Engaging in a New Jersey Agreement to Compromise Debt by Returning Secured Property can be beneficial, as it allows individuals to retain key assets while addressing outstanding debts.

In New Jersey, creditors can pursue claims against an estate for a period of 4 months after the executor publishes a notice to creditors. This time frame ensures that all debts are reported and addressed. If you seek a more manageable solution to resolve debts, consider a New Jersey Agreement to Compromise Debt by Returning Secured Property, which may provide relief from creditor pressure.