New Jersey Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

How to fill out Acceptance Of Claim By Collection Agency And Report Of Experience With Debtor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal document templates that you can download or print.

Through the website, you can access thousands of forms for both business and personal use, organized by categories, states, or keywords. You can quickly find the latest types of forms such as the New Jersey Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

If you already have a subscription, Log In to download the New Jersey Acceptance of Claim by Collection Agency and Report of Experience with Debtor from the US Legal Forms library. The Acquire button will be displayed on each form you view. You can access all previously downloaded forms in the My documents section of your account.

If you are satisfied with the form, confirm your choice by clicking the Acquire now button. Then, select the pricing plan you want and provide your information to create an account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finish the purchase. Choose the format and download the form to your device.

Make changes. Fill out, modify, print, and sign the downloaded New Jersey Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

Every template you add to your account has no expiration date and is yours to keep indefinitely. Thus, if you want to download or print another copy, simply go to the My documents section and click on the form you need.

Access the New Jersey Acceptance of Claim by Collection Agency and Report of Experience with Debtor with US Legal Forms, one of the most comprehensive libraries of legal document templates. Utilize a plethora of professional and state-specific templates that fulfill your business or personal requirements and needs.

- If you are using US Legal Forms for the first time, here are some straightforward steps to get you started.

- Ensure you have selected the correct form for your city/state.

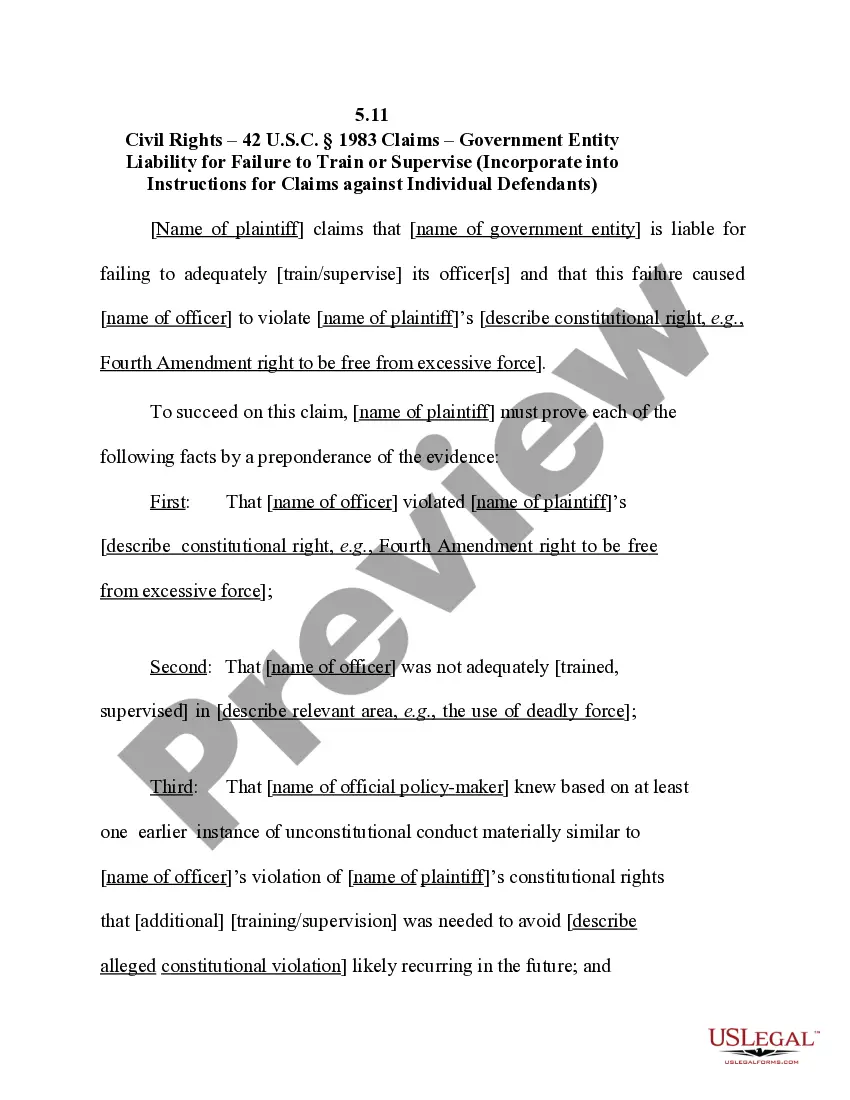

- Click the Preview button to review the content of the form.

- Check the form details to make sure you have selected the appropriate one.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

Form popularity

FAQ

Yes, a debt collection agency must prove you owe the debt if you request validation. Under the guidelines of the New Jersey Acceptance of Claim by Collection Agency and Report of Experience with Debtor, agencies are obligated to provide evidence of the debt. This includes showing the original account information and any supporting documents. If they cannot provide this proof, you may have grounds to dispute the debt.

You can ask a debt collector to validate a debt by sending a formal request known as a 'debt validation letter.' Mention the New Jersey Acceptance of Claim by Collection Agency and Report of Experience with Debtor to emphasize your rights. This letter should ask for proof that you owe the debt, along with any relevant account details. Remember, once you submit this request, the collector must cease collection efforts until they validate the debt.

To get a collection agency to verify your debt, start by sending them a written request for verification. In your request, cite the New Jersey Acceptance of Claim by Collection Agency and Report of Experience with Debtor, which entitles you to validation. The agency must respond with documentation that proves you owe the debt, including details like the original creditor's name and the amount owed. If they fail to provide this information, you can dispute the debt further.

The 777 rule with debt collectors emphasizes the requirement for clear communication about debts and their legitimacy. This rule mandates that a collection agency must provide a fair and transparent representation of the debt, allowing you to verify its accuracy. Being aware of this rule helps you better manage your financial obligations and supports your rights under New Jersey Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

In New Jersey, debt collection practices must comply with both state and federal laws. Collectors cannot engage in harassment, false representation, or unfair practices while collecting debts. Familiarizing yourself with these rules, including the New Jersey Acceptance of Claim by Collection Agency and Report of Experience with Debtor, can empower you to handle collections more effectively and protect your rights.

When you receive a debt collection lawsuit in New Jersey, it is essential to respond within the specified time frame. You should file a written answer with the court, addressing each claim made by the collection agency. If you need guidance, consider using resources from USLegalForms, which can help you navigate the complexities of New Jersey Acceptance of Claim by Collection Agency and Report of Experience with Debtor effectively.

To write a debt validation letter, start by clearly stating your name and address, along with the date. Include details about the debt, such as the amount owed and the name of the collection agency. Politely request verification of the debt, and mention your rights under the Fair Debt Collection Practices Act. This ensures you initiate a proper dialogue regarding your New Jersey Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

Debt collectors are prohibited from using abusive language or threats when communicating with you. They are also not allowed to contact you at unreasonable hours or disclose your debt to unauthorized individuals. Understanding these prohibited practices can help you protect your rights under the New Jersey Acceptance of Claim by Collection Agency and Report of Experience with Debtor. If you feel that a collector has violated your rights, it may be beneficial to seek guidance from a legal expert.

The 7 day rule requires collection agencies to send you a written notice of the debt within seven days of their initial contact. This notice must detail the amount owed and the creditor's name, giving you essential information to respond appropriately. Additionally, if you dispute the debt, the collection agency must take action to validate it within the same timeframe. Familiarizing yourself with this rule, along with the New Jersey Acceptance of Claim by Collection Agency and Report of Experience with Debtor, can empower you during the collection process.

New Jersey's collection laws focus on protecting consumers from unfair practices by debt collectors. Under these laws, collectors must provide written notice of the debt, including the amount owed and the name of the creditor. Additionally, they cannot harass or threaten you regarding the debt. If you want to understand your rights further, consider reviewing the New Jersey Acceptance of Claim by Collection Agency and Report of Experience with Debtor.