If the method of changing beneficiaries in insurance policies is prescribed by statute or by the policy itself, the required formalities must be observed. If the beneficiary has a vested right in the policy or if the policy does not reserve the right of the insured to change the beneficiary, the consent of the beneficiary must be obtained to change the beneficiary. Relevant state statutes must be consulted to determine if they require the consent of the beneficiary to effectuate a change of the beneficiary.

New Jersey Request for Change of Beneficiary of Life Insurance Policy

Description

Form popularity

FAQ

Only the policy owner can change a life insurance beneficiary. Life insurance is a private contract between a policy owner and the life insurance company.

The policyholderPolicyholderThe person who owns an insurance policy is the only person allowed to make changes to your life insurance beneficiaries. The only exception is if you've granted someone power of attorney, a legal document that lets someone make financial, legal, or medical decisions on your behalf.

The owner is the person who has control of the policy during the insured's lifetime. They have the power, if they want, to surrender the policy, to sell the policy, to gift the policy, to change the policy death benefit beneficiary.

Irrevocable beneficiaries cannot be removed once designated unless they agree to it?even if they are divorced spouses. Children are often named irrevocable beneficiaries to ensure their inheritance or secure child support payments.

A beneficiary may change after death through contestation due to the following reasons: Policy terms and conditions: If the policy explicitly allows changing the beneficiary after the policyholder's death, it is possible to proceed with the update.

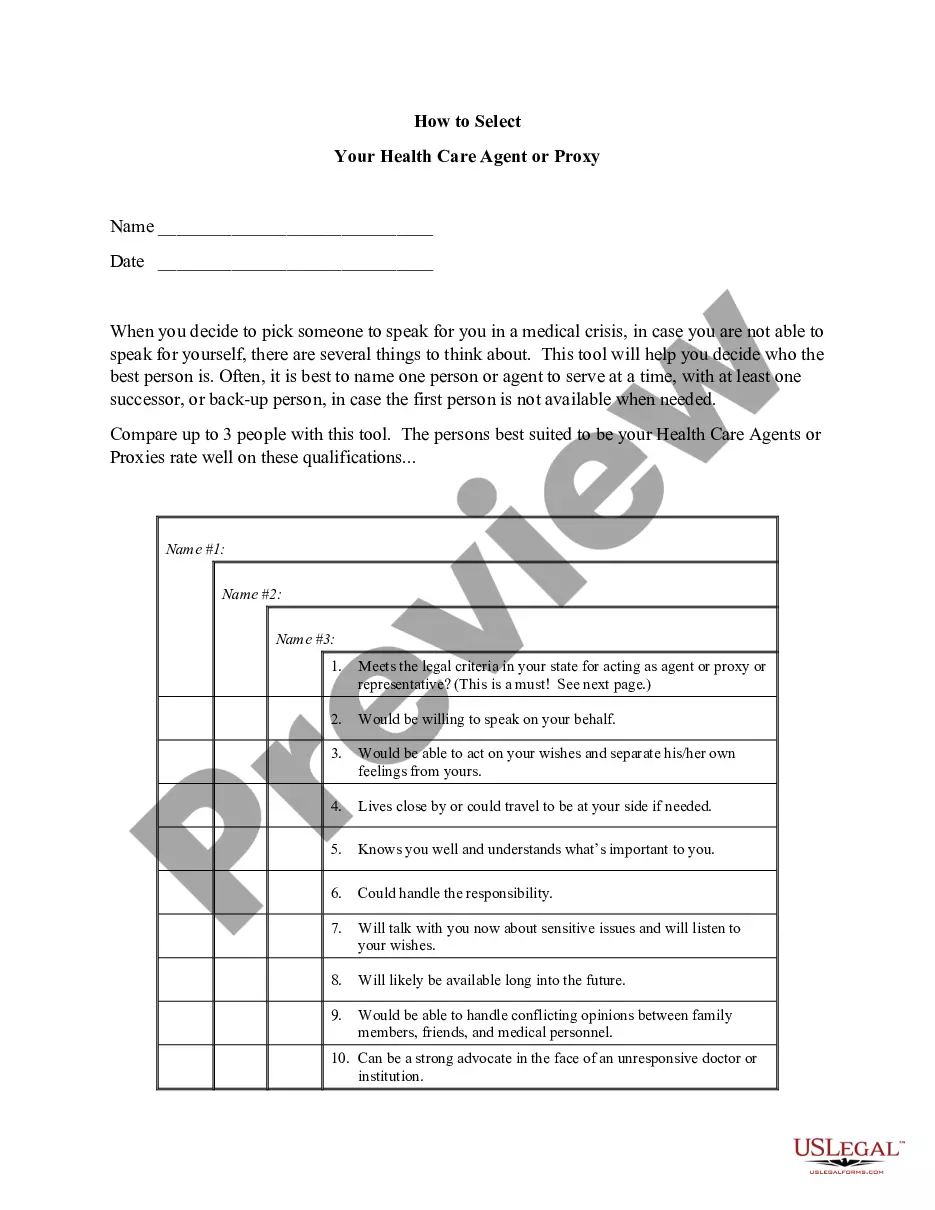

The beneficiary can be either revocable or irrevocable. A revocable beneficiary can be changed at any time. Once named, an irrevocable beneficiary cannot be changed without his or her consent. You can name as many beneficiaries as you want, subject to procedures set in the policy.

Your ability to change your beneficiary or have multiple beneficiaries depends on the pension option you chose when you retired. You may only change your beneficiary if: You chose a single life pension option with a guarantee period. Your spouse gave up their beneficiary rights to your pension by signing a waiver.

Generally, you can review and update your beneficiary designations by contacting the company or organization that provides your insurance or retirement plan. You can sometimes do this online. Otherwise, you'll have to complete, sign, and mail a paper form.