The "look through" trust can affords long term IRA deferrals and special protection or tax benefits for the family. But, as with all specialized tools, you must use it only in the right situation. If the IRA participant names a trust as beneficiary, and the trust meets certain requirements, for purposes of calculating minimum distributions after death, one can "look through" the trust and treat the trust beneficiary as the designated beneficiary of the IRA. You can then use the beneficiary's life expectancy to calculate minimum distributions. Were it not for this "look through" rule, the IRA or plan assets would have to be paid out over a much shorter period after the owner's death, thereby losing long term deferral.

New Jersey Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account

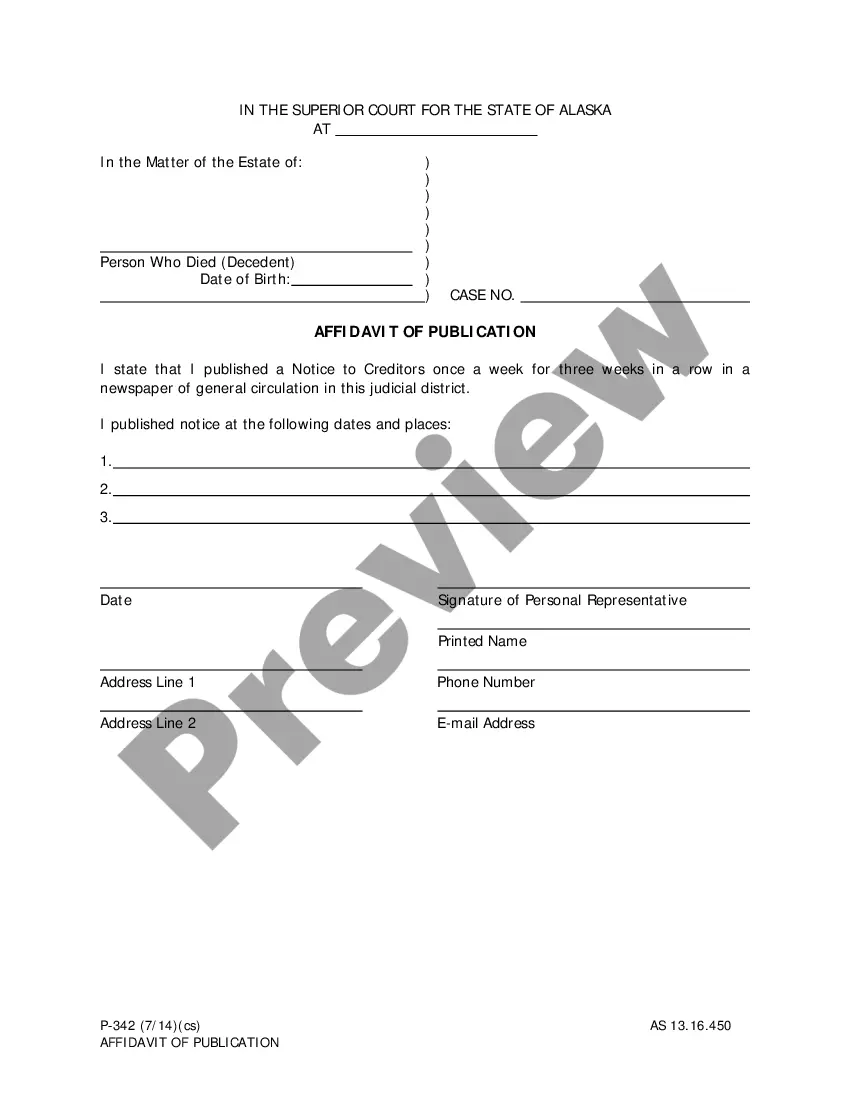

Description

How to fill out Irrevocable Trust As Designated Beneficiary Of An Individual Retirement Account?

US Legal Forms - one of the largest collections of legal documents in the USA - provides an extensive selection of legal form templates that you can download or print.

By using the website, you will access a multitude of forms for both business and personal purposes, organized by categories, states, or keywords. You can find the latest forms such as the New Jersey Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account in just minutes.

If you already have an account, Log In to download the New Jersey Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make changes. Fill out, modify, print, and sign the downloaded New Jersey Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, to download or print another copy, simply go to the My documents section and click on the form you need.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Make sure you have selected the correct form for your state/region.

- Click the Review button to evaluate the form's content.

- Check the form summary to ensure that you've selected the right document.

- If the form does not meet your needs, utilize the Search field at the top of the page to locate one that does.

- When you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Next, choose the pricing plan you prefer and provide your details to create an account.

Form popularity

FAQ

Naming your trust as a beneficiary can be a strategic decision, especially if you want to control how funds are distributed to heirs. However, it can also create tax complications and administrative challenges. A New Jersey Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account may offer a balanced approach, ensuring asset protection and tax management while benefiting your loved ones.

One downside is the potential tax implications associated with distributions from a retirement plan. When a trust receives these funds, it may face higher tax rates compared to individual beneficiaries. Consider using a New Jersey Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account to streamline the process and possibly reduce taxes.

Typically, you cannot transfer a retirement account into an irrevocable trust directly without triggering tax consequences. However, you can designate a New Jersey Irrevocable Trust as a beneficiary of the account. This strategy allows for controlled distributions while keeping assets protected for beneficiaries.

Naming a trust as a beneficiary can lead to higher tax rates on the funds when they are distributed. It often requires careful planning to ensure that the trust complies with IRS regulations. A New Jersey Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account can mitigate these disadvantages, but you should consult a professional for guidance.

Putting retirement accounts in a trust can complicate your finances significantly. Such accounts often have tax implications that can affect your heirs. Instead, consider using a New Jersey Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account to manage distributions while minimizing tax burdens.

The beneficiary of the individual retirement account (IRA) is the individual or trust named by the account owner to receive the account's assets at death. This could include a spouse, child, or a New Jersey Irrevocable Trust as designated beneficiary of an Individual Retirement Account. Carefully selecting the right beneficiary is vital for effective estate planning. Always consider legal advice to optimize these decisions.

The real beneficiary of the account is the person or organization you designate to receive the account's assets upon your death. Choosing a New Jersey Irrevocable Trust as designated beneficiary of an Individual Retirement Account can have significant advantages, such as providing for controlled distributions and asset protection. It's essential to keep your beneficiary designations updated to avoid complications down the line.

The beneficiary of an individual retirement annuity is the person or entity designated by the account owner. This could be a spouse, child, or even a New Jersey Irrevocable Trust as designated beneficiary of an Individual Retirement Account. Naming a beneficiary ensures that the funds are securely passed to your desired individual. Regularly review your choices to reflect any life changes.

Yes, an irrevocable trust can be named as the beneficiary of an IRA. This option serves to safeguard assets and control distributions after your passing. Utilizing a New Jersey Irrevocable Trust as designated beneficiary of an Individual Retirement Account can provide a structured way for your heirs to receive funds while potentially minimizing tax implications. Always seek guidance to understand the nuances involved.

The decision between naming a spouse or a New Jersey Irrevocable Trust as the beneficiary of an IRA hinges on your estate planning goals. Designating a spouse can provide immediate access to funds without complex tax implications. Conversely, if you aim for asset protection and long-term management, a trust might be the better choice. Evaluating your specific situation is crucial to making the right decision.