New Jersey Private Annuity Agreement

Description

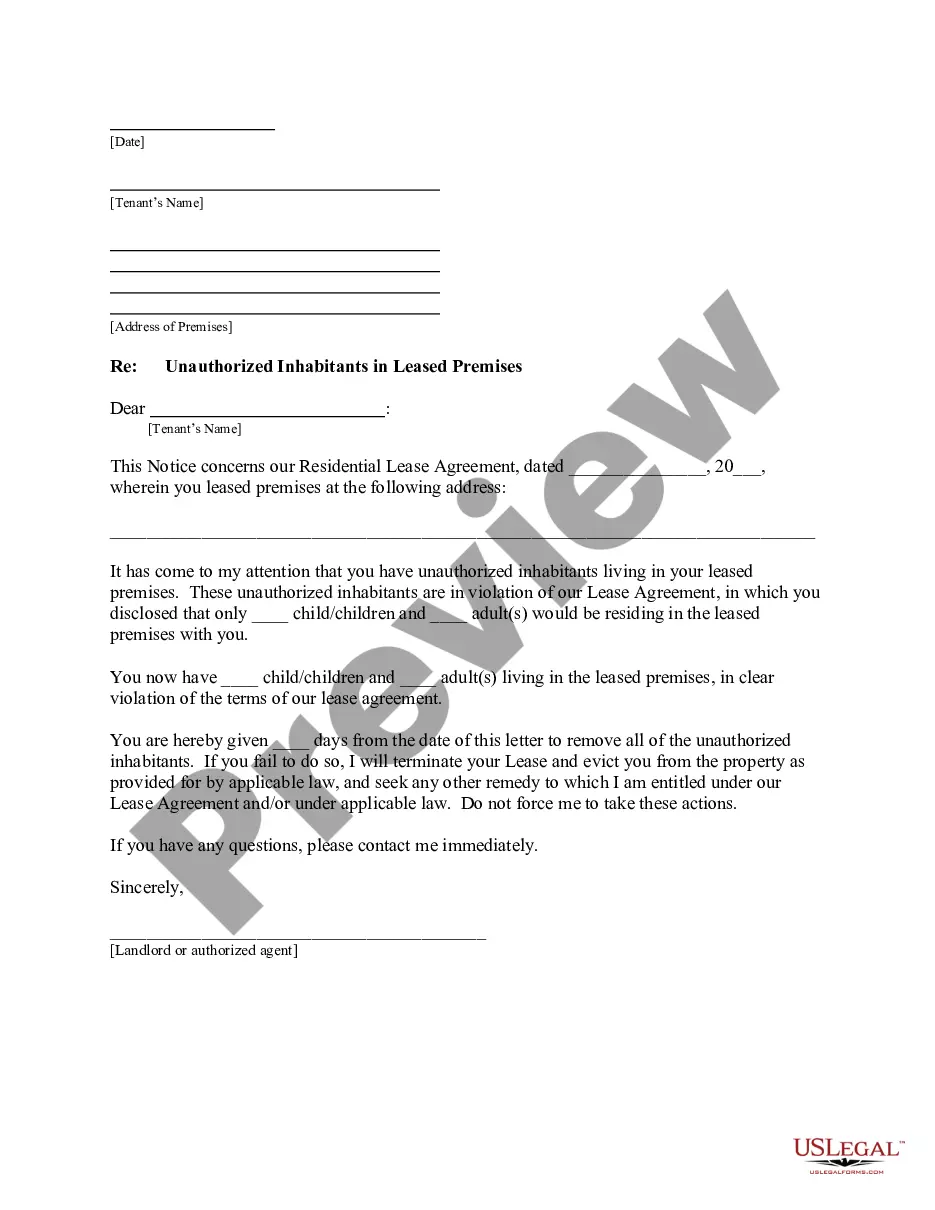

How to fill out Private Annuity Agreement?

US Legal Forms - one of the largest collections of legal forms in the United States - offers a broad selection of legal document templates that you can download or print.

By using the site, you will find thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can access the latest forms like the New Jersey Private Annuity Agreement instantly.

If you already have a subscription, Log In to download the New Jersey Private Annuity Agreement from the US Legal Forms collection. The Download button will display on every form you view. You have access to all previously downloaded forms in the My documents tab of your account.

You can make edits. Complete, modify, and print and sign the downloaded New Jersey Private Annuity Agreement.

Each template you add to your account does not have an expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

Access the New Jersey Private Annuity Agreement with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your personal and business requirements.

- If you want to use US Legal Forms for the first time, here are simple instructions to help you get started.

- Make sure you have selected the correct form for your county/city. Click the Preview button to review the content of the form. Check the form description to confirm that you have chosen the appropriate form.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase Now button. Then, select the payment plan you prefer and provide your credentials to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

Form popularity

FAQ

New Jersey does not tax most private pensions, which can be a significant benefit for retirees. However, understanding how your pension interacts with other income sources is crucial. You should consult with experts familiar with New Jersey Private Annuity Agreement to ensure you're making informed decisions about your retirement income and tax obligations.

Yes, you can file your NJ 1040 hw online, making the process quicker and more efficient. The NJ Division of Taxation provides options for electronic filing, which can simplify your experience. When filing, consider the implications of your New Jersey Private Annuity Agreement for accurate reporting of your income and annuity distributions.

To file an annuity in New Jersey, begin by gathering all necessary documents related to the agreement, including the policy and related tax forms. You can choose to work with a professional who specializes in New Jersey Private Annuity Agreement for guidance. Proper filing is essential to ensure compliance with local tax regulations and to benefit from the annuity.

Several assets are typically exempt from New Jersey inheritance tax, including property passed to a spouse or children. Additionally, life insurance policies and retirement accounts designated for those beneficiaries generally fall outside the tax. Understanding these exemptions can help in effectively planning your estate under the New Jersey Private Annuity Agreement.

In New Jersey, life insurance proceeds may be subject to inheritance tax depending on the beneficiary. Generally, if the beneficiary is a spouse, child, or another close relative, they may not face this tax. However, when the beneficiary is someone outside of these categories, the proceeds could be taxed. It’s essential to consult with a professional familiar with New Jersey Private Annuity Agreement to ensure compliance.

Annuity contracts are issued by insurance companies licensed to operate in New Jersey. These companies must adhere to strict regulatory requirements to ensure consumer protection. When entering into a New Jersey Private Annuity Agreement, it's crucial to choose a reputable insurer with a solid track record. This choice impacts both the safety of your investment and the reliability of your income stream.

In New Jersey, annuities are generally not insured like bank deposits. However, state insurance regulations enforce strict standards that protect consumers. When you engage in a New Jersey Private Annuity Agreement, you should consider the financial strength and reputation of the issuing insurance company. This diligence helps ensure the security of your investment.

If you decide to quit your job in New Jersey, your pension benefits may be affected based on the time you've contributed. Generally, if you have less than 10 years of service, you may lose the right to receive a pension. For those with 10 years or more, your contributions may remain on hold until retirement. A New Jersey Private Annuity Agreement could serve as a valuable alternative to ensure continued income after you leave your job.

In New Jersey, there is no specific age at which pension income becomes completely tax-exempt. However, retirees over 62 are eligible for certain tax deductions, which can reduce taxable pension income. It's crucial to know your options to minimize your tax burden effectively. A New Jersey Private Annuity Agreement can be structured to optimize your retirement strategy in consideration of taxes.

WF SWF stands for the Worker's Fund Supplemental Work Fund in New Jersey. This fund is designed to assist certain state workers with supplemental benefits or services. Understanding such funds is essential for maximizing your retirement benefits. A New Jersey Private Annuity Agreement can work hand-in-hand with these benefits to enhance your retirement planning.