The Fair Credit Reporting Act regulates the use of information on a consumer's personal and financial condition. The most typical transaction which this Act would cover would be where a person applies for a personal loan or other consumer credit. Consumer credit is credit for personal, family, or household use, and not for business or commercial transactions. The purpose of the Act is to insure that consumer information obtained and used is done in such a way as to insure its confidentiality, accuracy, relevancy and proper utilization. Credit reporting bureaus are not permitted to disclose information to persons not having a legitimate use for this information. It is a federal crime to obtain or to furnish a credit report for an improper purpose.

New Jersey Complaint by Consumer against Wrongful User of Credit Information

Description

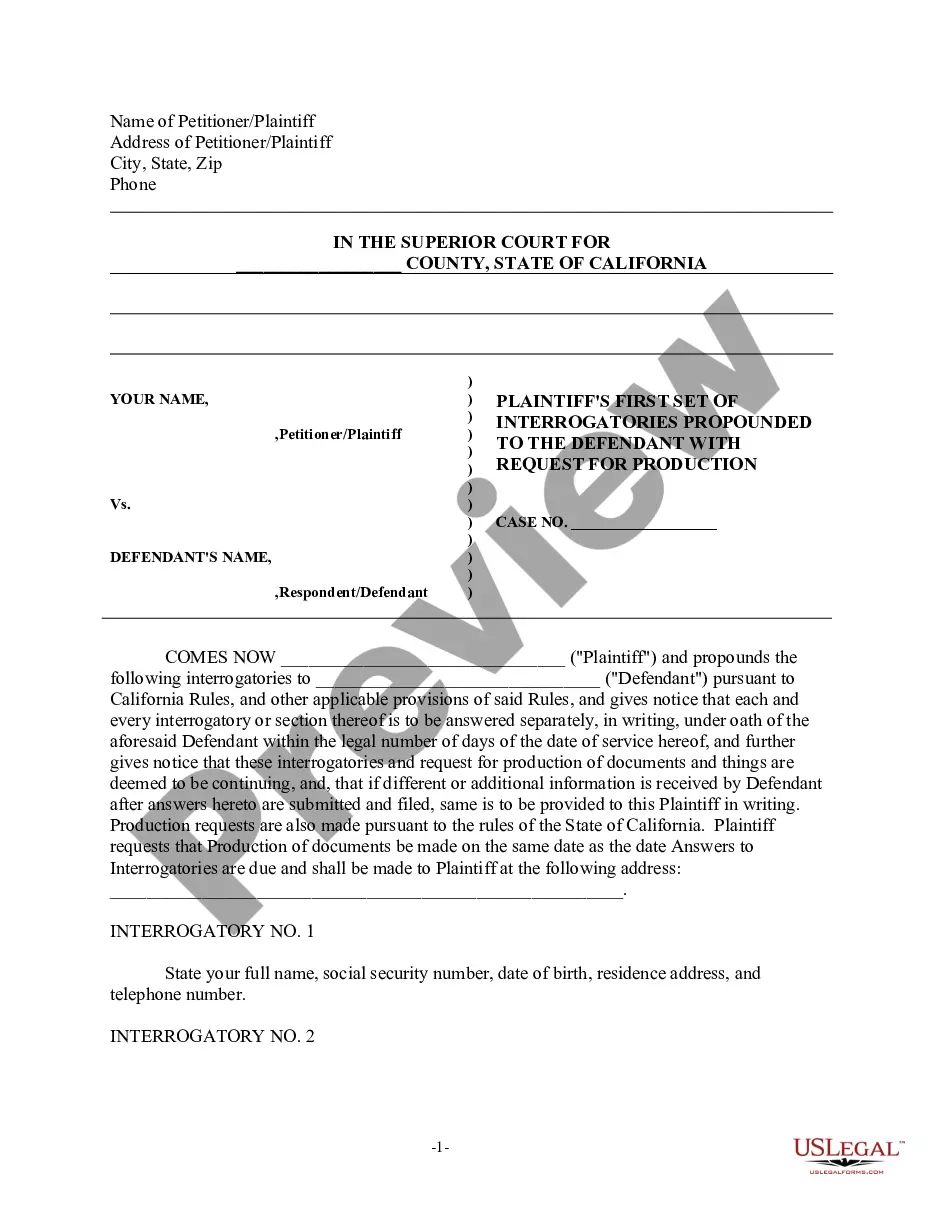

How to fill out Complaint By Consumer Against Wrongful User Of Credit Information?

US Legal Forms - one of several most significant libraries of legal forms in America - delivers a wide range of legal document themes you are able to obtain or print. Utilizing the internet site, you may get thousands of forms for enterprise and specific purposes, categorized by classes, claims, or keywords and phrases.You can get the newest variations of forms just like the New Jersey Complaint by Consumer against Wrongful User of Credit Information within minutes.

If you already possess a registration, log in and obtain New Jersey Complaint by Consumer against Wrongful User of Credit Information from the US Legal Forms local library. The Obtain option will appear on each and every type you view. You have access to all earlier saved forms in the My Forms tab of your own profile.

If you would like use US Legal Forms for the first time, listed here are easy guidelines to get you started out:

- Make sure you have picked out the proper type to your town/area. Click the Review option to analyze the form`s content. Read the type information to ensure that you have selected the appropriate type.

- If the type doesn`t fit your needs, take advantage of the Look for industry at the top of the monitor to find the one who does.

- In case you are satisfied with the form, affirm your choice by clicking the Purchase now option. Then, pick the rates prepare you prefer and give your accreditations to sign up to have an profile.

- Method the transaction. Make use of charge card or PayPal profile to finish the transaction.

- Choose the formatting and obtain the form on your own device.

- Make adjustments. Complete, edit and print and indicator the saved New Jersey Complaint by Consumer against Wrongful User of Credit Information.

Every single design you put into your money does not have an expiry particular date and it is yours eternally. So, if you would like obtain or print one more copy, just go to the My Forms section and click on on the type you want.

Get access to the New Jersey Complaint by Consumer against Wrongful User of Credit Information with US Legal Forms, the most extensive local library of legal document themes. Use thousands of professional and status-certain themes that meet your company or specific requirements and needs.

Form popularity

FAQ

The CCPA requires that the total cost of a loan or credit product be disclosed, including how interest is calculated and any fees involved. It also prohibits discrimination when considering a loan applicant and bans misleading advertising practices. What Is the Consumer Credit Protection Act (CCPA)? Definition investopedia.com ? terms ? consumer-credit... investopedia.com ? terms ? consumer-credit...

The FCRA lays out the following basic consumer rights: You have a right to know what information your credit reports contain. By request, you may obtain a free copy from each of the three national credit bureaus (Equifax, Experian and TransUnion) every year. You have a right to know your credit scores. Credit Protection Laws - The Consumer Credit Protection Act debt.org ? credit ? your-consumer-rights ? t... debt.org ? credit ? your-consumer-rights ? t...

The New Jersey Consumer Fraud Act The Consumer Fraud Act prohibits merchants, sales people and contractors from using deceptive practices in the sales of goods or services to consumers. The deceptive practice need not be explicit - it can be an omission of information.

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act. Fair Credit Reporting Act | Federal Trade Commission ftc.gov ? legal-library ? browse ? statutes ? f... ftc.gov ? legal-library ? browse ? statutes ? f...

A few major laws that affect your credit life include: the Fair Credit Reporting Act, Fair Debt Collection Practices Act, Truth in Lending Act, and the Equal Credit Opportunity Act. Here are five important rights granted to you by those laws. You Have the Right: 5 Credit Rights Consumers Should Know - myFICO myfico.com ? credit-education ? blog ? five... myfico.com ? credit-education ? blog ? five...

If, as a consumer, you realise that the shopkeeper is charging more than the MRP, you can file a complaint with the Legal Metrology Department of the state where the shop is located. It is considered to be illegal and a violation of the law if a shopkeeper charges more than the Maximum Retail Price (MRP) in India.

We investigate complaints and answer hundreds of consumer questions every day. If we can't help, we will provide you with the contact information for a State or Federal agency that can help.

The Consumer Credit Bill of Rights is designed to empower and protect your financial life and credit history. As a New Jersey resident, you are entitled to a free copy of your credit report once a year from each of the major credit agencies (Equifax, Experian and TransUnion) or view all three at AnnualCreditReport.com.