The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

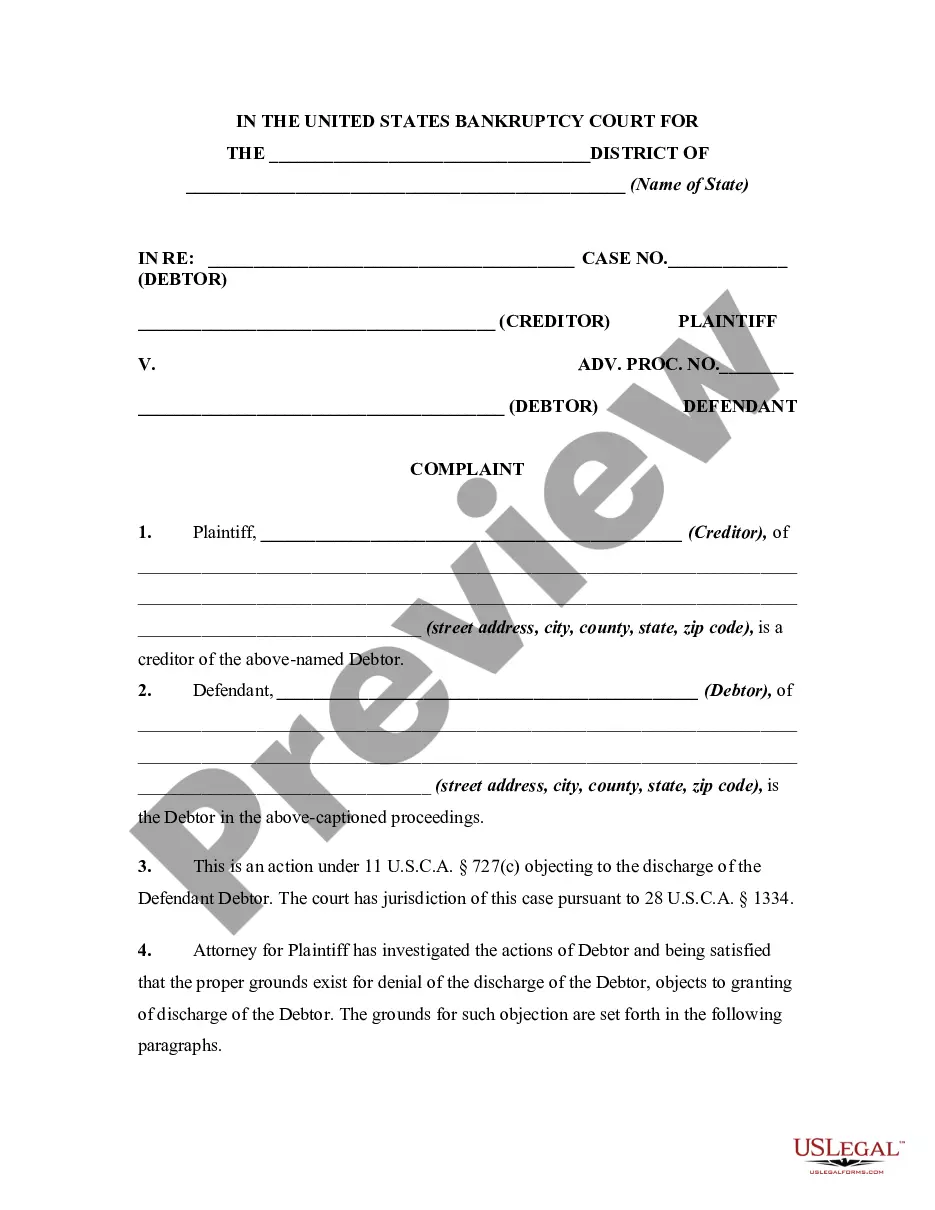

New Jersey Complaint Objecting to Discharge or Debtor in Bankruptcy Proceeding for Failure to Keep Books and Records

Description

How to fill out Complaint Objecting To Discharge Or Debtor In Bankruptcy Proceeding For Failure To Keep Books And Records?

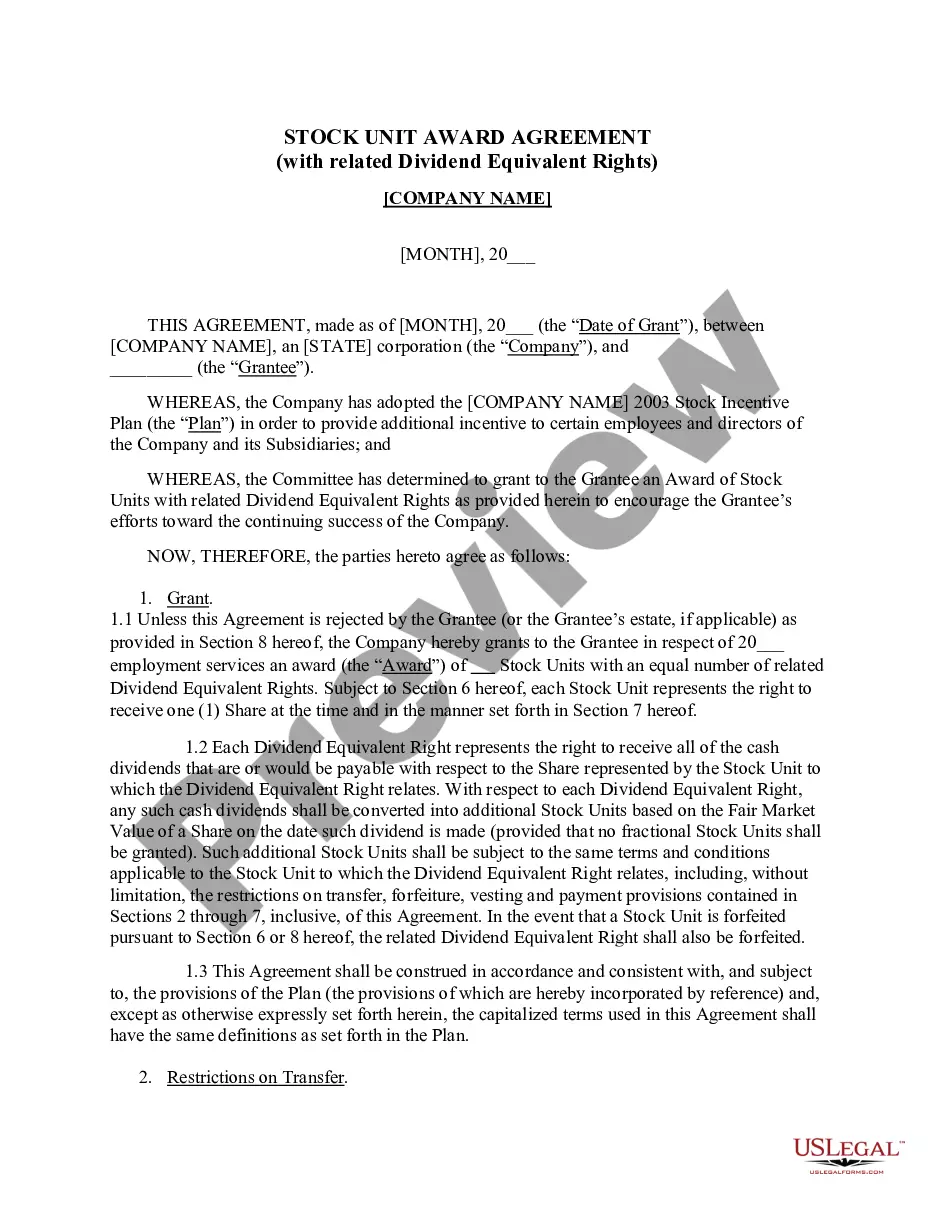

If you need to finalize, acquire, or produce legal document templates, utilize US Legal Forms, the best assortment of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you need.

A range of templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your credentials to register for the account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase.

- Employ US Legal Forms to access the New Jersey Complaint Objecting to Discharge or Debtor in Bankruptcy Proceeding for Failure to Maintain Books and Records in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click on the Download button to obtain the New Jersey Complaint Objecting to Discharge or Debtor in Bankruptcy Proceeding for Failure to Maintain Books and Records.

- You can also access forms you have previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types of the legal form template.

Form popularity

FAQ

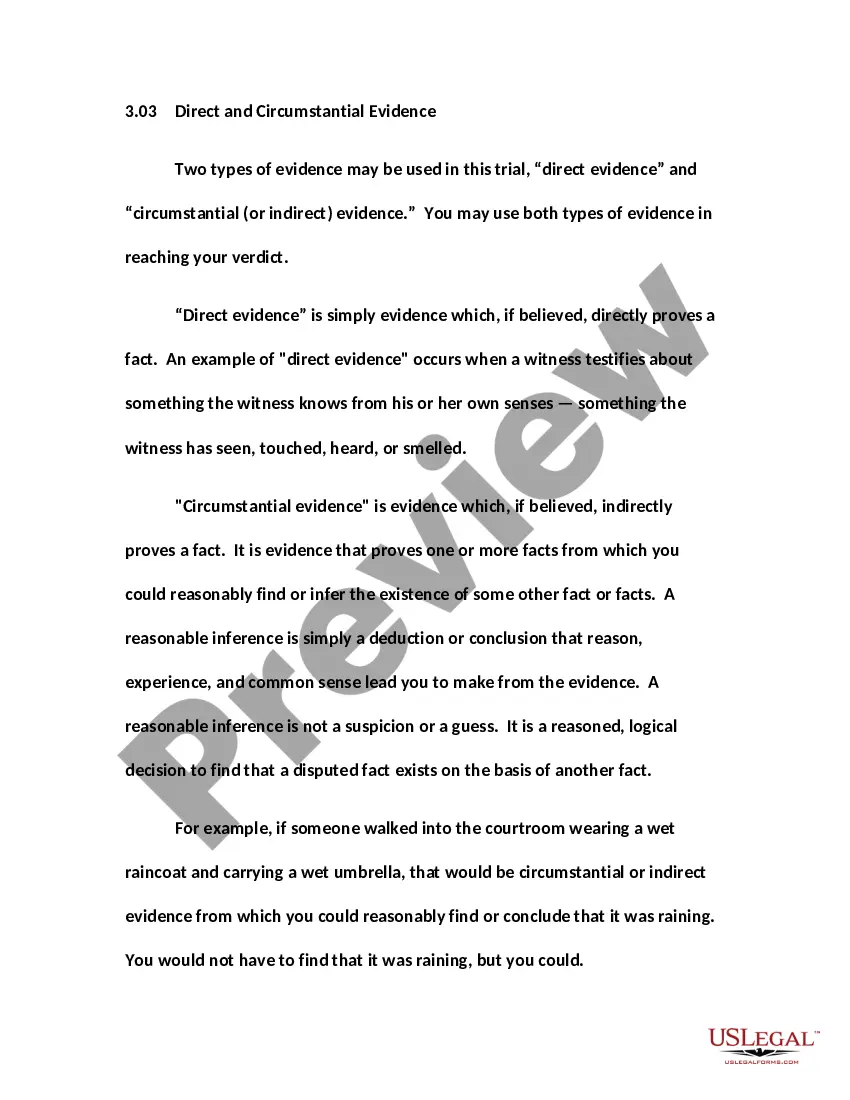

A typical party in interest would include the bankruptcy trustee, other creditors in the same bankruptcy case, and, in some situations, the debtor. For instance, a Chapter 7 debtor will have standing to object?and thereby be an interested party?only if doing so might put money in the debtor's pocket.

Filing for Chapter 7 bankruptcy eliminates credit card debt, medical bills and unsecured loans; however, there are some debts that cannot be discharged. Those debts include child support, spousal support obligations, student loans, judgments for damages resulting from drunk driving accidents, and most unpaid taxes.

Key Takeaways. Types of debt that cannot be discharged in bankruptcy include alimony, child support, and certain unpaid taxes. Other types of debt that cannot be alleviated in bankruptcy include debts for willful and malicious injury to another person or property.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

A case filed under chapter 11 of the United States Bankruptcy Code is frequently referred to as a "reorganization" bankruptcy. Usually, the debtor remains ?in possession,? has the powers and duties of a trustee, may continue to operate its business, and may, with court approval, borrow new money.

Conditions for Denial of Discharge You've hidden, destroyed, or failed to keep adequate records of your assets and financial affairs. You lied or tried to defraud the court or your creditors. You failed to explain any loss of assets. You refused to obey a lawful order of the court.

If a debt arose from the debtor's intentional wrongdoing, the creditor can object to discharging it. This might involve damages related to a drunk driving accident, for example, or costs caused by intentional damage to an apartment or other property.