New Jersey Request by a Nonprofit Organization to Reprint Copyrighted Material

Description

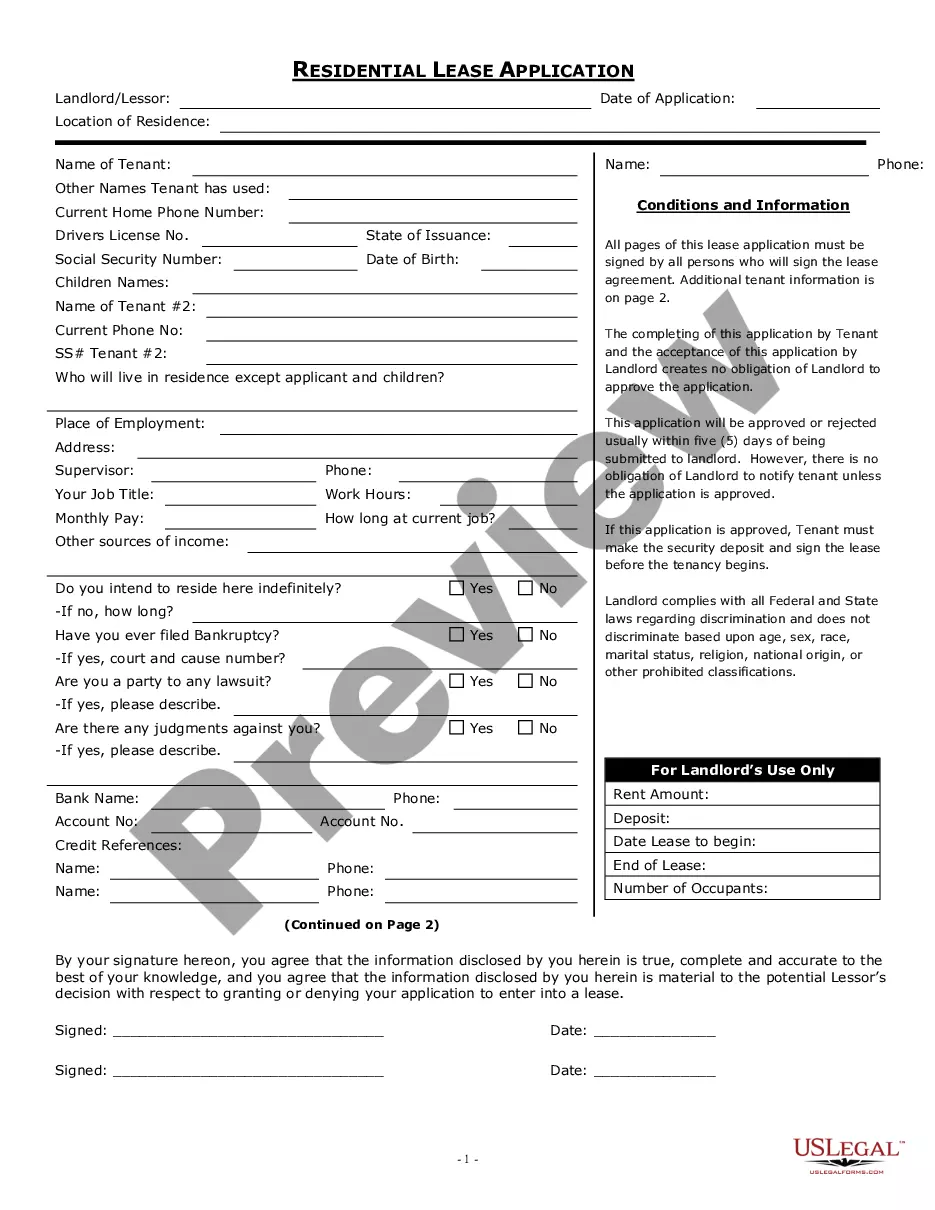

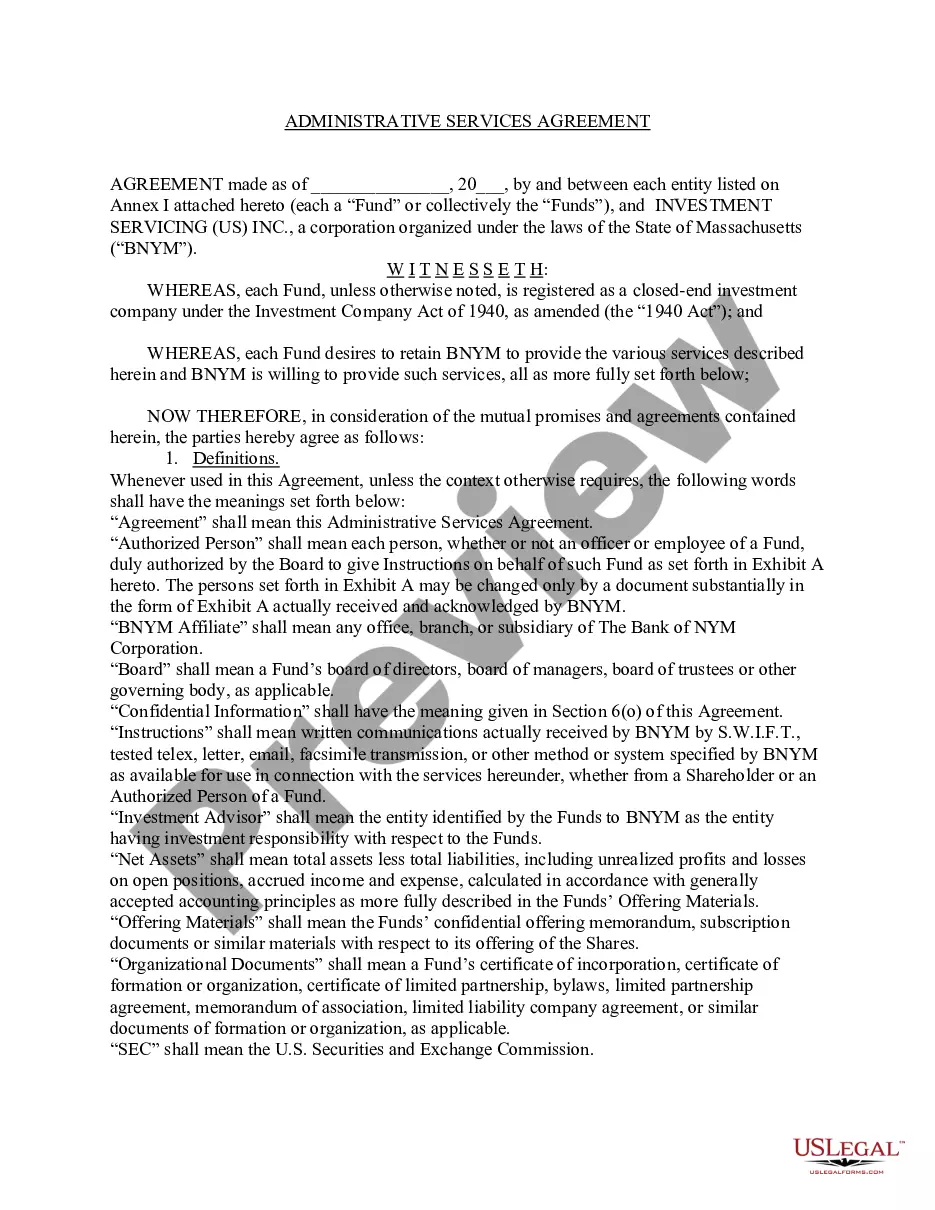

How to fill out Request By A Nonprofit Organization To Reprint Copyrighted Material?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a variety of legal form templates that you can download or create.

By utilizing the website, you can access thousands of forms for business and personal needs, categorized by types, states, or keywords.

You can find the latest editions of forms such as the New Jersey Request by a Nonprofit Organization to Reprint Copyrighted Material in just minutes.

If the form does not meet your requirements, use the Lookup box at the top of the screen to find the one that does.

Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select your preferred payment plan and provide your information to register for an account.

- If you have a monthly subscription, Log In to download the New Jersey Request by a Nonprofit Organization to Reprint Copyrighted Material from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all the previously downloaded forms in the My documents section of your account.

- If you wish to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have chosen the correct form for your area/county.

- Click the Preview button to review the form's content.

Form popularity

FAQ

To effectively dissolve a nonprofit in New Jersey, begin by securing a resolution from your board of directors. Once you have the necessary approval, prepare and file a Certificate of Dissolution with the state. Using templates or resources from platforms like USLegalForms can simplify the process, particularly when handling related tasks like a New Jersey Request by a Nonprofit Organization to Reprint Copyrighted Material.

A Certificate of Dissolution in New Jersey serves as an official document that signifies the end of a nonprofit's operations. This certificate is essential for clearing any legal obligations and formally notifying the state of your decision to dissolve. If you are navigating the details of a New Jersey Request by a Nonprofit Organization to Reprint Copyrighted Material, understanding the certificate's role can enhance your compliance efforts.

To dissolve a nonprofit in New Jersey, you must first hold a meeting with your board and obtain approval for dissolution. Next, you will need to file a Certificate of Dissolution with the New Jersey Division of Revenue and Enterprise Services, along with any necessary fees. During this process, you may want to consult a legal service or use a platform like USLegalForms for guidance and to ensure that your New Jersey Request by a Nonprofit Organization to Reprint Copyrighted Material is properly addressed.

In New Jersey, dissolution refers to the formal process through which a nonprofit organization concludes its existence. Termination, on the other hand, can imply the end of an organization without necessarily going through the official dissolution process. When you submit a New Jersey Request by a Nonprofit Organization to Reprint Copyrighted Material, understanding this distinction can be crucial for compliance and legal clarity.

While you cannot copyright a nonprofit organization itself, you can copyright the original works produced by it. This includes materials like publications, art, and other creative outputs. Securing copyright for these works is vital for nonprofits wishing to protect their intellectual property when they file a New Jersey Request by a Nonprofit Organization to Reprint Copyrighted Material.

New Jersey requires all corporations, including nonprofit organizations engaged in business activities, to file a corporate tax return if they earn income. This compliance is important for demonstrating accountability and ensuring the organization's tax-exempt status is maintained. Accurate tax returns support requests, such as a New Jersey Request by a Nonprofit Organization to Reprint Copyrighted Material.

In New Jersey, an inheritance tax return must be filed by anyone receiving an inheritance from a decedent. This includes all estates where beneficiaries inherit property or assets exceeding certain limits. Nonprofit organizations, if named in a will or trust, are also subject to these rules when receiving bequests.

Nonprofit organizations in New Jersey must operate for charitable, educational, or other exempt purposes as defined by state and federal law. These organizations must comply with regulations regarding financial reporting and transparency. By adhering to these rules, nonprofits can effectively file a New Jersey Request by a Nonprofit Organization to Reprint Copyrighted Material, ensuring their legacy and rights in creative works.

An OPRA request in New Jersey refers to the Open Public Records Act request, allowing citizens access to government records. Nonprofit organizations often leverage this tool to obtain necessary documentation for their activities, including copyright-related concerns. Understanding how to file an OPRA request can assist in facilitating a New Jersey Request by a Nonprofit Organization to Reprint Copyrighted Material.

A NJ Corporate Business Tax return must be filed by corporations doing business in New Jersey, including those engaged in nonprofit activities. Nonprofits should ensure compliance to maintain their eligibility to make a New Jersey Request by a Nonprofit Organization to Reprint Copyrighted Material. Filing correctly helps organizations avoid penalties and support their mission.