New Jersey Limited Partnership Agreement Between Limited Liability Company and Limited Partner

Description

How to fill out Limited Partnership Agreement Between Limited Liability Company And Limited Partner?

It is feasible to spend numerous hours online attempting to locate the valid document template that aligns with the federal and state regulations you require.

US Legal Forms offers a vast selection of valid forms that have been reviewed by professionals.

You can download or print the New Jersey Limited Partnership Agreement Between Limited Liability Company and Limited Partner from my service.

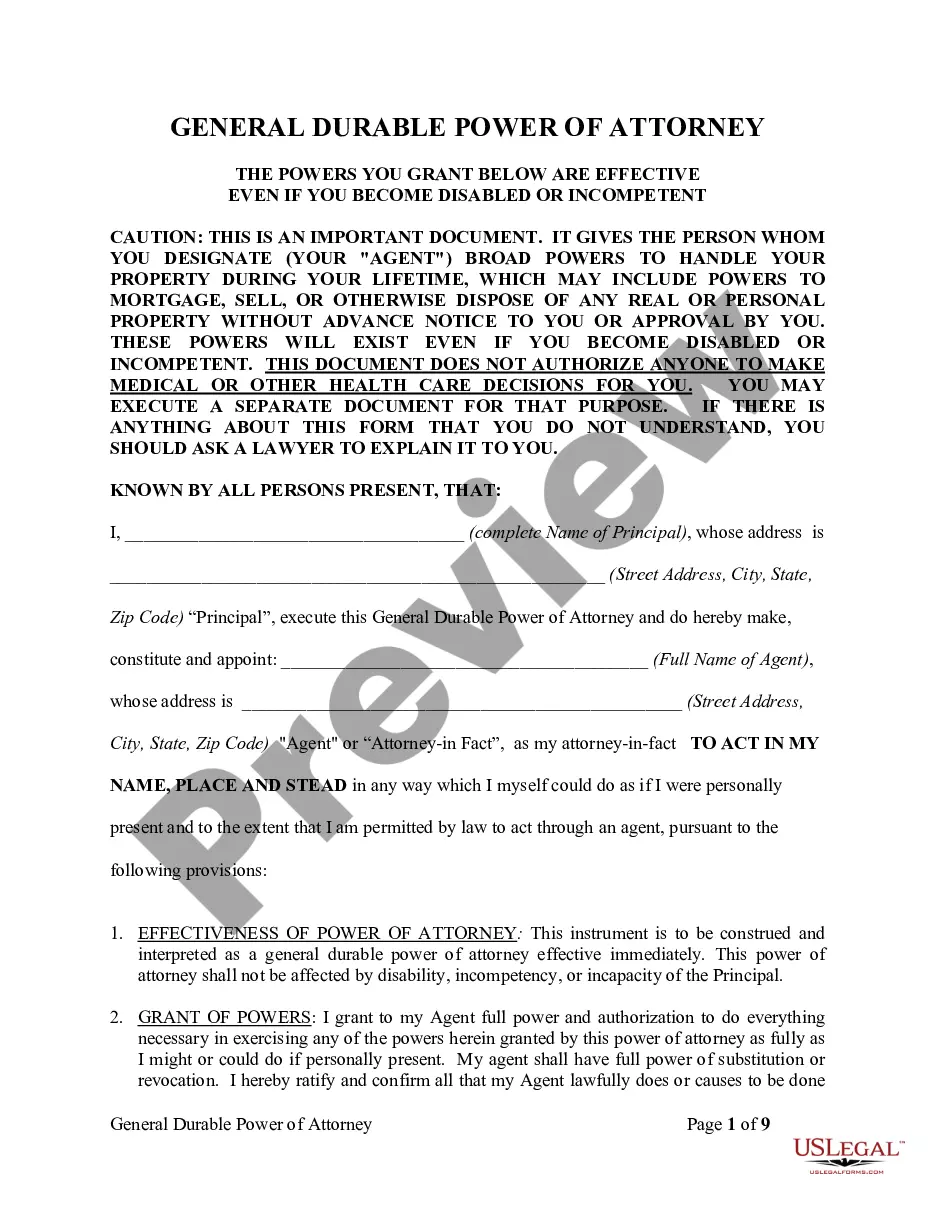

If available, utilize the Preview button to examine the document template as well. To find another version of the form, use the Search field to locate the template that suits your needs and requirements.

- If you have a US Legal Forms account, you can Log In and then click the Acquire button.

- After that, you can fill out, modify, print, or sign the New Jersey Limited Partnership Agreement Between Limited Liability Company and Limited Partner.

- Every valid document template you purchase remains yours forever.

- To obtain another version of the acquired form, visit the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city of your choice.

- Review the form outline to make sure you have chosen the right template.

Form popularity

FAQ

Yes, Limited Partnerships (LPs) do require partnership agreements. A New Jersey Limited Partnership Agreement Between Limited Liability Company and Limited Partner serves as the backbone of the relationship between partners. This agreement defines the terms of partnership, including financial contributions, profit-sharing, and decision-making processes. It is essential to draft a comprehensive agreement to maintain a smooth operational relationship between all parties involved.

In New Jersey, the limited partnership law governs the formation and operation of limited partnerships. A New Jersey Limited Partnership Agreement Between Limited Liability Company and Limited Partner outlines the roles and responsibilities of both general and limited partners. This legal framework ensures clarity in management, liability, and profit distribution. Understanding these laws is crucial for anyone looking to create a partnership in New Jersey.

The decision between a limited company and a partnership depends largely on your specific business needs and goals. A limited company offers liability protection and potential tax advantages, while a partnership allows for more straightforward management and less regulatory burden. Using a New Jersey Limited Partnership Agreement Between Limited Liability Company and Limited Partner can help you assess which structure aligns best with your objectives while providing necessary legal safeguards.

Yes, a partnership can indeed be formed between two companies, such as two LLCs or other business entities. This type of partnership should be accompanied by a well-drafted agreement that outlines the contributions and profit-sharing arrangements. For this purpose, a New Jersey Limited Partnership Agreement Between Limited Liability Company and Limited Partner serves as an ideal foundation, ensuring that both parties' interests are protected.

One significant disadvantage of a limited company is the dual taxation that can occur, where both the corporation's profit and individual dividends may be taxed. Furthermore, setting up and maintaining a limited company often involves more regulatory requirements and administrative costs compared to a partnership. If you opt for a New Jersey Limited Partnership Agreement Between Limited Liability Company and Limited Partner, it could provide a simpler structure tailored to your needs.

Yes, you can form a partnership with a company, such as a limited liability company (LLC) or a corporation. In this case, the partnership agreement should detail the roles and responsibilities of each party involved. By utilizing the New Jersey Limited Partnership Agreement Between Limited Liability Company and Limited Partner, you can ensure clarity and legal protection for both the individuals and the entity.

A Limited Partnership (LP) involves at least one general partner who manages the business and assumes full liability, along with one or more limited partners who contribute capital but have limited liability. In contrast, a Limited Liability Partnership (LLP) protects all partners from personal liability for business debts, allowing for equal management responsibilities. The New Jersey Limited Partnership Agreement Between Limited Liability Company and Limited Partner should clearly outline these roles to minimize confusion.

Yes, a limited partnership can have multiple limited partners. Having two or more limited partners allows for shared investment and collective benefits, as defined in the New Jersey Limited Partnership Agreement Between Limited Liability Company and Limited Partner. However, it is essential to clearly outline each partner's contributions, responsibilities, and profit-sharing arrangements in the agreement. This clarity will help prevent disputes and ensure smooth collaboration among partners.

If a limited partner breaches the terms of the New Jersey Limited Partnership Agreement Between Limited Liability Company and Limited Partner, several consequences may follow. The partner could lose their limited liability status, exposing them to personal liability for partnership debts. In some cases, the limited partnership may face litigation or termination depending on the severity of the breach. Understanding your responsibilities under the agreement is crucial to avoid such scenarios.

While limited partners enjoy many benefits, they also encounter some disadvantages. The most significant drawback is the lack of control over the management of the business, which can lead to decisions that may not align with their interests. Additionally, limited partners may be unable to significantly influence the direction of the partnership as outlined in the New Jersey Limited Partnership Agreement Between Limited Liability Company and Limited Partner. Consulting with uslegalforms can clarify these potential pitfalls.