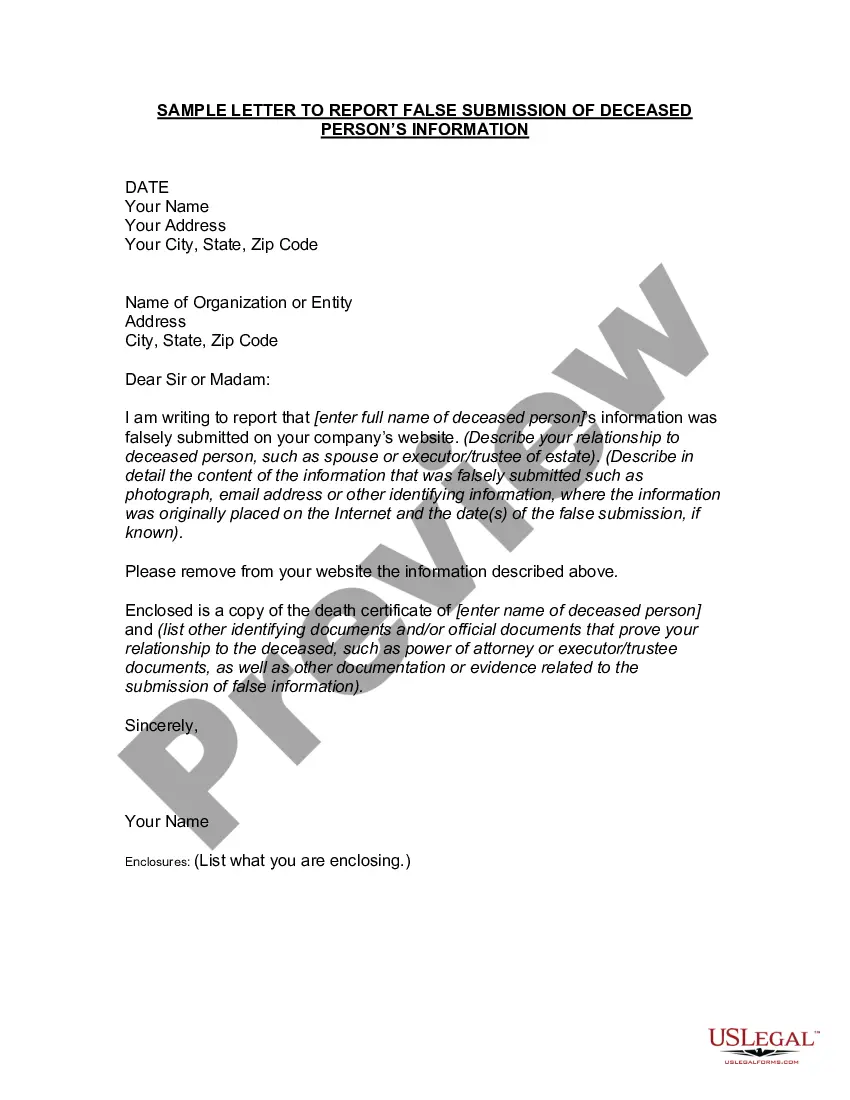

New Jersey Letter to Report False Submission of Deceased Person's Information

Description

How to fill out Letter To Report False Submission Of Deceased Person's Information?

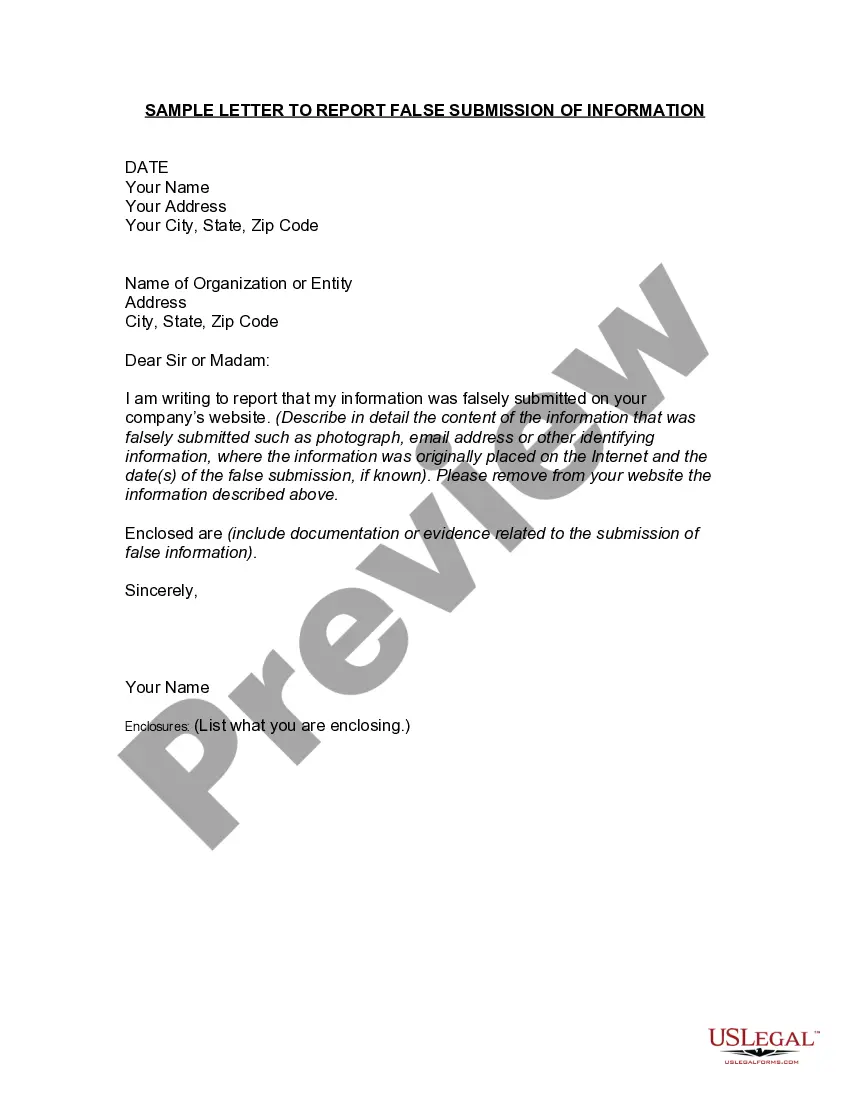

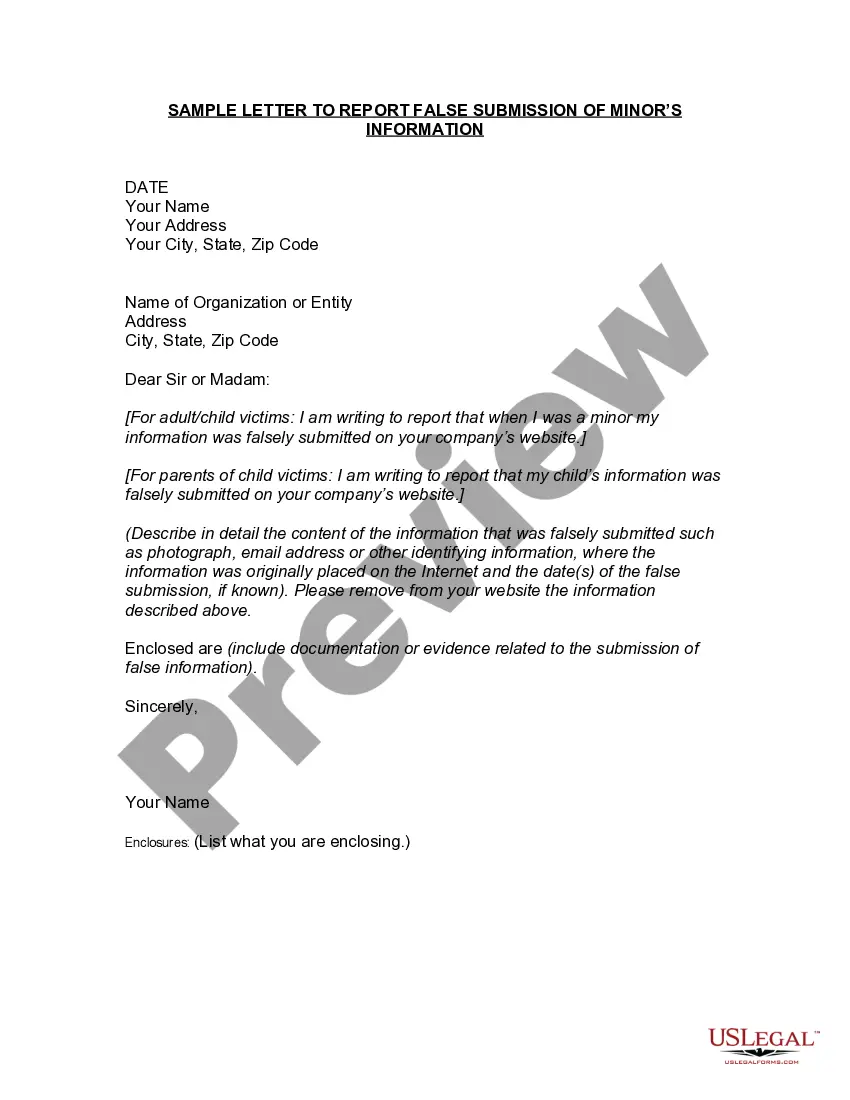

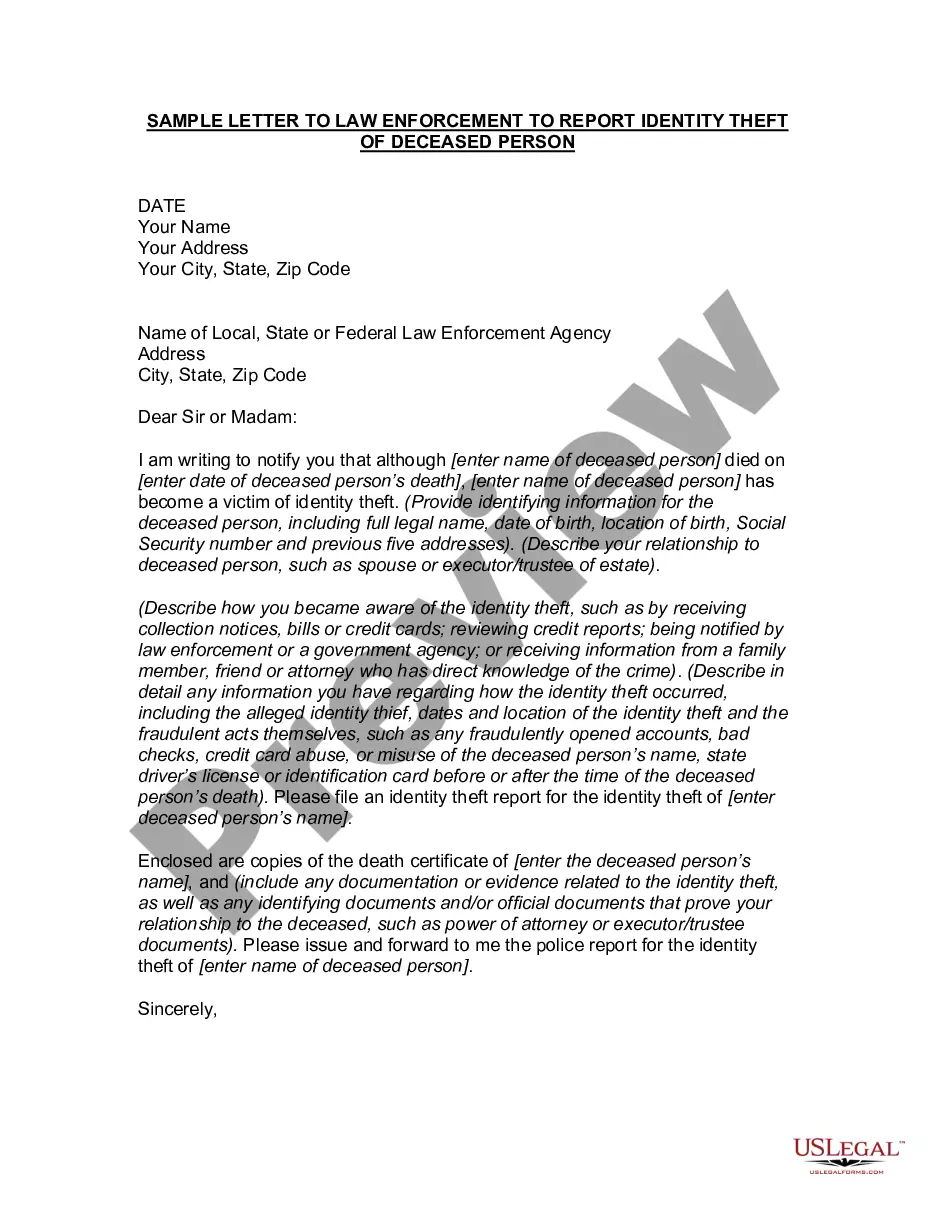

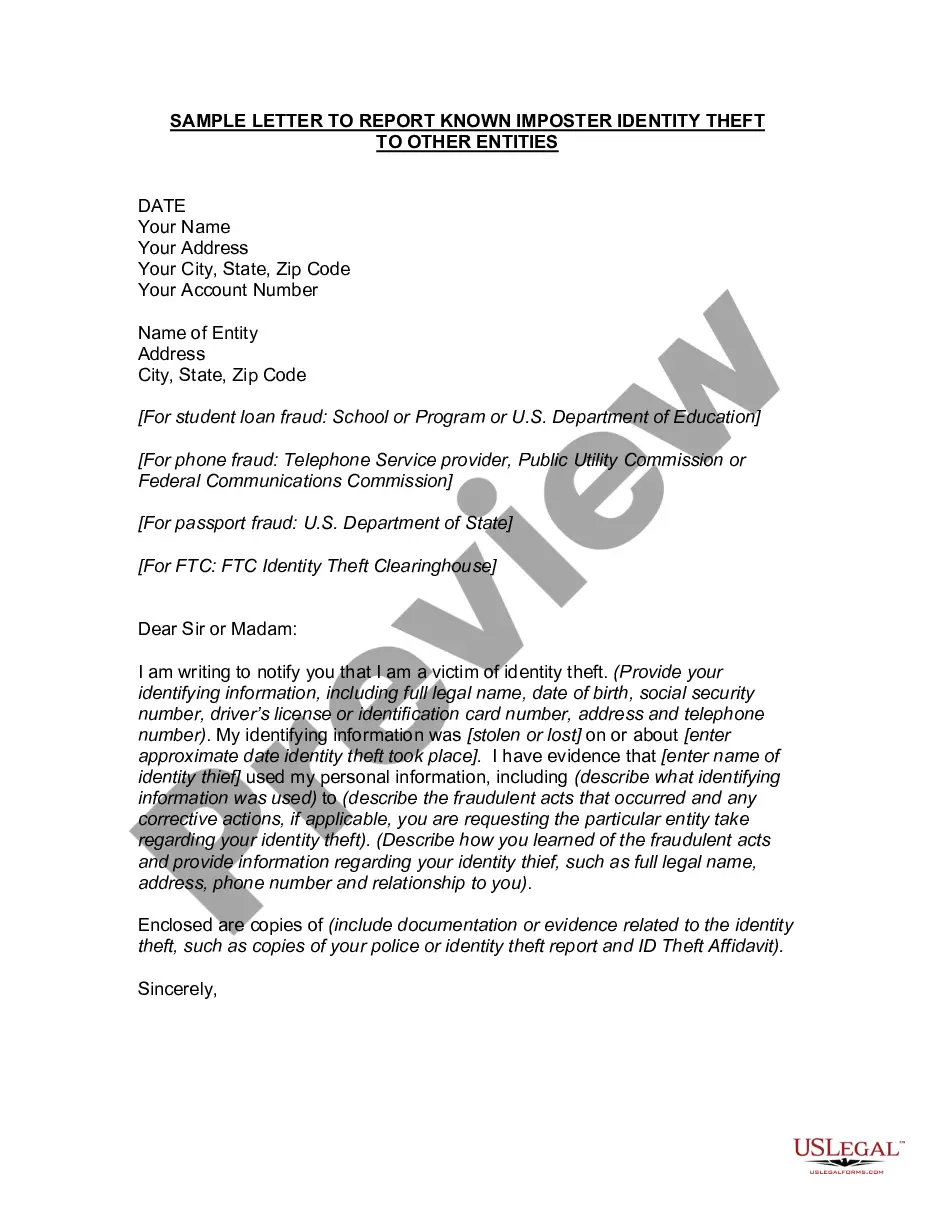

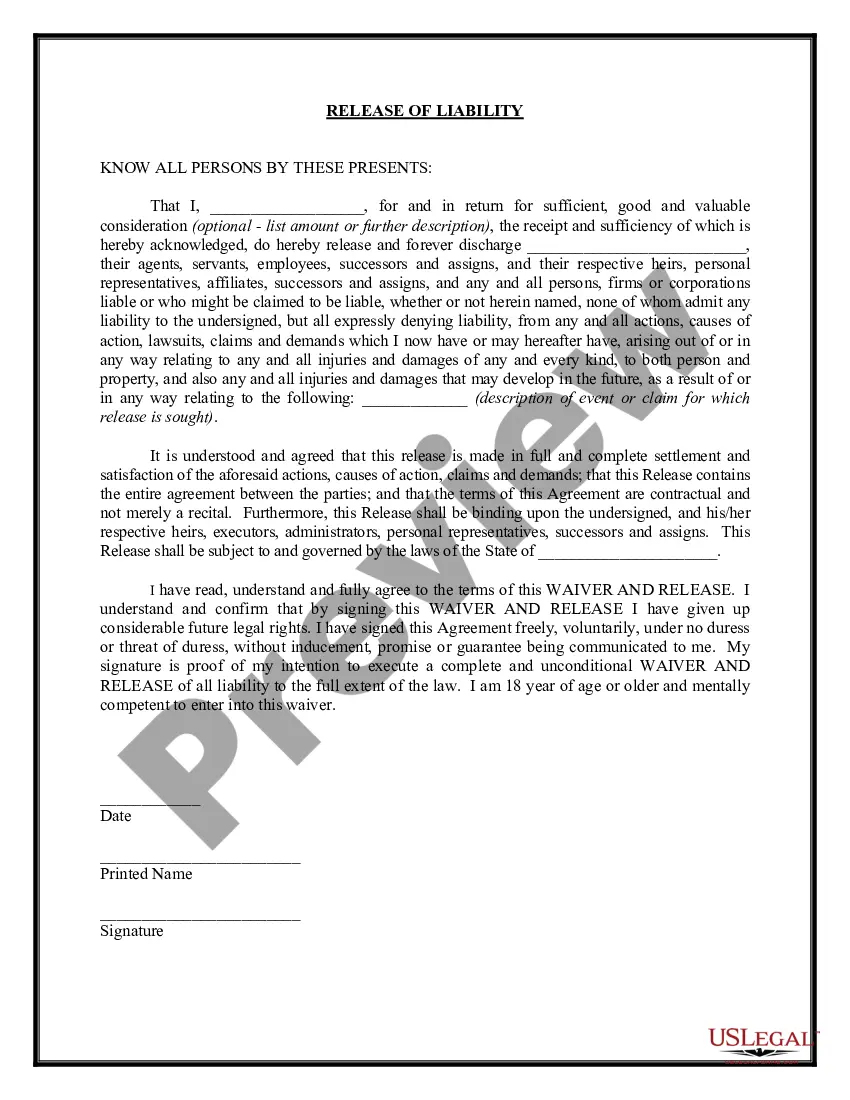

Choosing the best legitimate file web template could be a have a problem. Needless to say, there are plenty of themes available on the net, but how do you find the legitimate form you want? Take advantage of the US Legal Forms web site. The support provides a large number of themes, such as the New Jersey Letter to Report False Submission of Deceased Person's Information, that can be used for enterprise and private requires. All the varieties are checked out by experts and meet up with state and federal requirements.

Should you be previously registered, log in to your accounts and click on the Acquire key to have the New Jersey Letter to Report False Submission of Deceased Person's Information. Use your accounts to look from the legitimate varieties you possess bought in the past. Check out the My Forms tab of the accounts and obtain another duplicate of your file you want.

Should you be a new consumer of US Legal Forms, listed here are basic directions so that you can stick to:

- Initial, be sure you have selected the right form for your metropolis/region. You may look over the shape using the Preview key and study the shape information to guarantee it is the best for you.

- When the form fails to meet up with your needs, utilize the Seach industry to discover the correct form.

- Once you are sure that the shape is suitable, select the Get now key to have the form.

- Choose the prices program you want and enter the needed information and facts. Make your accounts and pay money for an order with your PayPal accounts or charge card.

- Choose the data file structure and obtain the legitimate file web template to your system.

- Comprehensive, change and print out and signal the received New Jersey Letter to Report False Submission of Deceased Person's Information.

US Legal Forms will be the biggest local library of legitimate varieties for which you can discover a variety of file themes. Take advantage of the service to obtain skillfully-created paperwork that stick to condition requirements.

Form popularity

FAQ

You may need to file Form 1040-NR if you: Were a nonresident alien engaged in a trade or business in the United States. Represented a deceased person who would have had to file Form 1040-NR.

File Form NJ-1040NR if you had in- come from New Jersey sources. Part-year residents: If you had a per- manent home in New Jersey for only part of the year and you received income from New Jersey sources while you were a nonresident, also file NJ-1040NR.

Affordable New Jersey Communities for Homeowners and Renters (ANCHOR) This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits.

The tax rate is 6.37% for nonresident noncorporate partners (e.g., individuals, trusts, and estates), and 9% for nonresident corporate partners of the allocable share of entire net income. The partnership must remit the nonresident partner tax with the Corporation Business Tax Partnership Payment Voucher (NJ-CBT-V).

The Division will trace the check. The New Jersey Gross Income amount from your 2021 return can be found on line 29 of your 2021 NJ-1040 return. Please note, if the Division of Taxation has made adjustments to your return for the previous year, the amount on the . pdf of your return may not match what is on file.

New Jersey accepts both generic and unformatted records for the NJ-1040, NJ-1040 Part ?year, and Non-resident returns. The generic electronic return provides a basis for e-filing the NJ-1040 (Income Tax Resident Return), and the NJ-1040NR (Non-resident Income Tax Return).

Corrections to death certificates shall be signed by the physician, registered professional nurse, county or intercounty medical examiner or assistant county or intercounty medical examiner, Chief State Medical Examiner, Deputy Chief State Medical Examiner, funeral director or informant, whose name appears upon the ...

Form NJ 1040NR Income Tax Nonresident Return - YouTube YouTube Start of suggested clip End of suggested clip Step 2 and to your name. And social security number. Include the same information for your spouse.MoreStep 2 and to your name. And social security number. Include the same information for your spouse. If filing jointly. Step 3 and to your address separately enter the state in which you live.