New Jersey Sale of Business - Promissory Note - Asset Purchase Transaction

Description

How to fill out Sale Of Business - Promissory Note - Asset Purchase Transaction?

Are you in a situation where you need documents for both professional or specific purposes almost every day.

There are numerous legal document templates available online, but locating trustworthy versions isn’t simple.

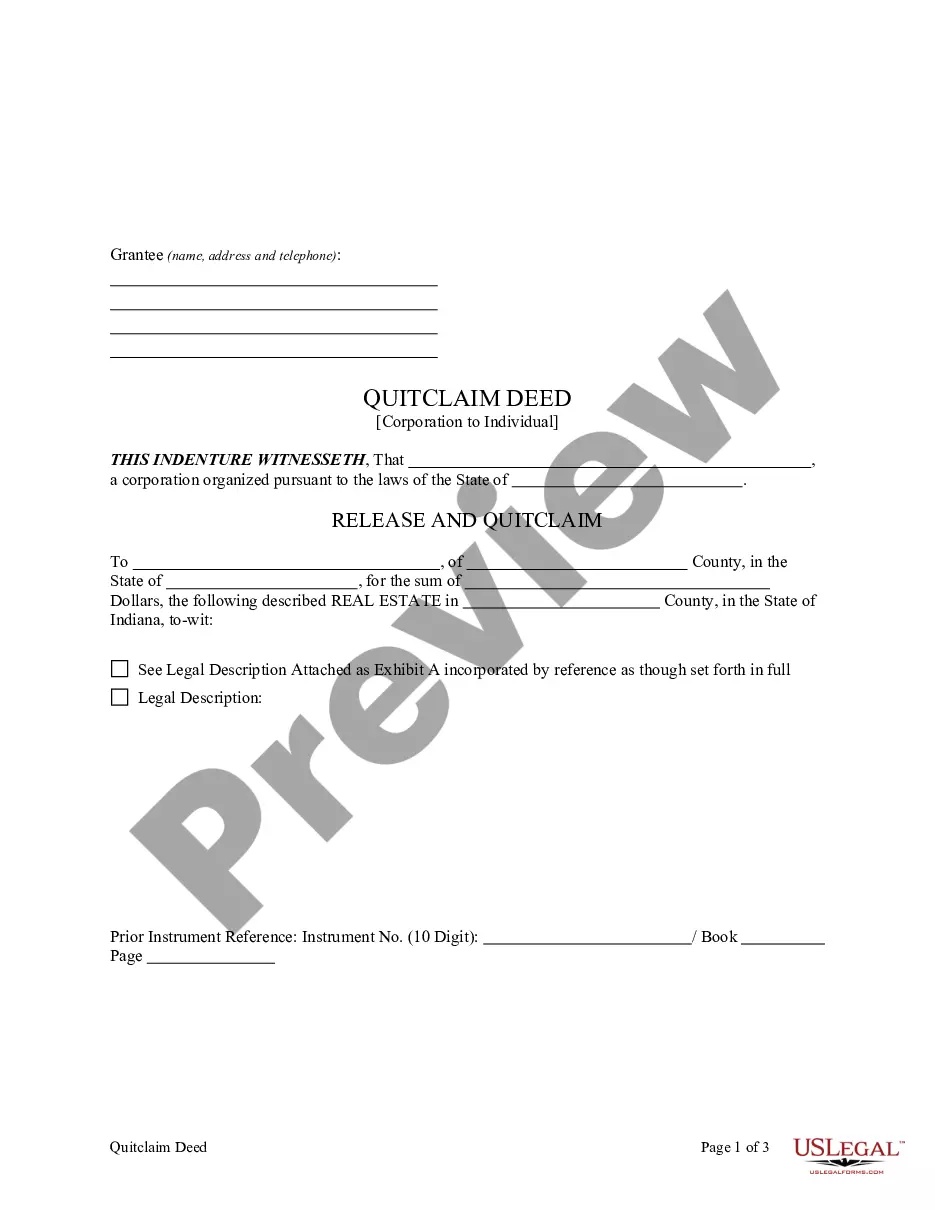

US Legal Forms offers thousands of form templates, such as the New Jersey Sale of Business - Promissory Note - Asset Purchase Transaction, designed to meet federal and state regulations.

Access all the document templates you have purchased in the My documents section.

You can download an additional copy of the New Jersey Sale of Business - Promissory Note - Asset Purchase Transaction at any time if needed. Just click on the necessary form to download or print the document template.

- If you are already familiar with the US Legal Forms site and have an account, just Log In.

- Then, you can download the New Jersey Sale of Business - Promissory Note - Asset Purchase Transaction template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it corresponds to the correct city/state.

- Use the Review button to verify the document.

- Read the description to ensure you have chosen the right form.

- If the form isn’t what you’re looking for, use the Search field to find the form that fulfills your needs and requirements.

- Once you have the correct form, click on Get now.

- Select the pricing plan you prefer, complete the required information to create your account, and pay for the order with either PayPal or a credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

Legal Documents Needed to Sell a BusinessNon-Disclosure Confidentiality Agreement.Personal Financial Statement Form for Buyer to Complete.Offer-to-Purchase Agreement.Note of Seller Financing.Financial Statements for Current and Past Two to Three Years.Statement of Seller's Discretionary Earnings and Cash Flow.More items...

Compile the following documents in preparation for your business sale:Profit & loss statements for the current and past 2-3 years.Current balance sheet.Cash flow statement.Business tax returns for the past 2-3 years.Copy of the current lease.Insurance policies.Non-disclosure/confidentiality agreement.More items...

While buyer's counsel typically prepares the first draft of an asset purchase agreement, there may be circumstances (such as an auction) when seller's counsel prepares the first draft.

The bill of sale is typically delivered as an ancillary document in an asset purchase to transfer title to tangible personal property. It does not cover intangible property (such as intellectual property rights or contract rights) or real property.

The key difference is that a purchase order is sent by buyers to vendors with the intention to track and control the purchasing process. On the other hand, an invoice is an official payment request sent by vendors to buyers once their order is fulfilled.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

How to Sell a Small Business in 7 StepsDetermine the value of your company.Clean up your small business financials.Prepare your exit strategy in advance.Boost your sales.Find a business broker.Pre-qualify your buyers.Get business contracts in order.

An asset sale transaction involves the sale of some or all of the assets used in a business from a selling company to a buyer.

There are four main financial statements. They are: (1) balance sheets; (2) income statements; (3) cash flow statements; and (4) statements of shareholders' equity. Balance sheets show what a company owns and what it owes at a fixed point in time.

You need to provide all sellers with comprehensive and organized financial documentation. If your business does not have books or records, you must create them before any sale can occur.