New Jersey Acknowledgment by Charitable or Educational Institution of Receipt of Gift

Description

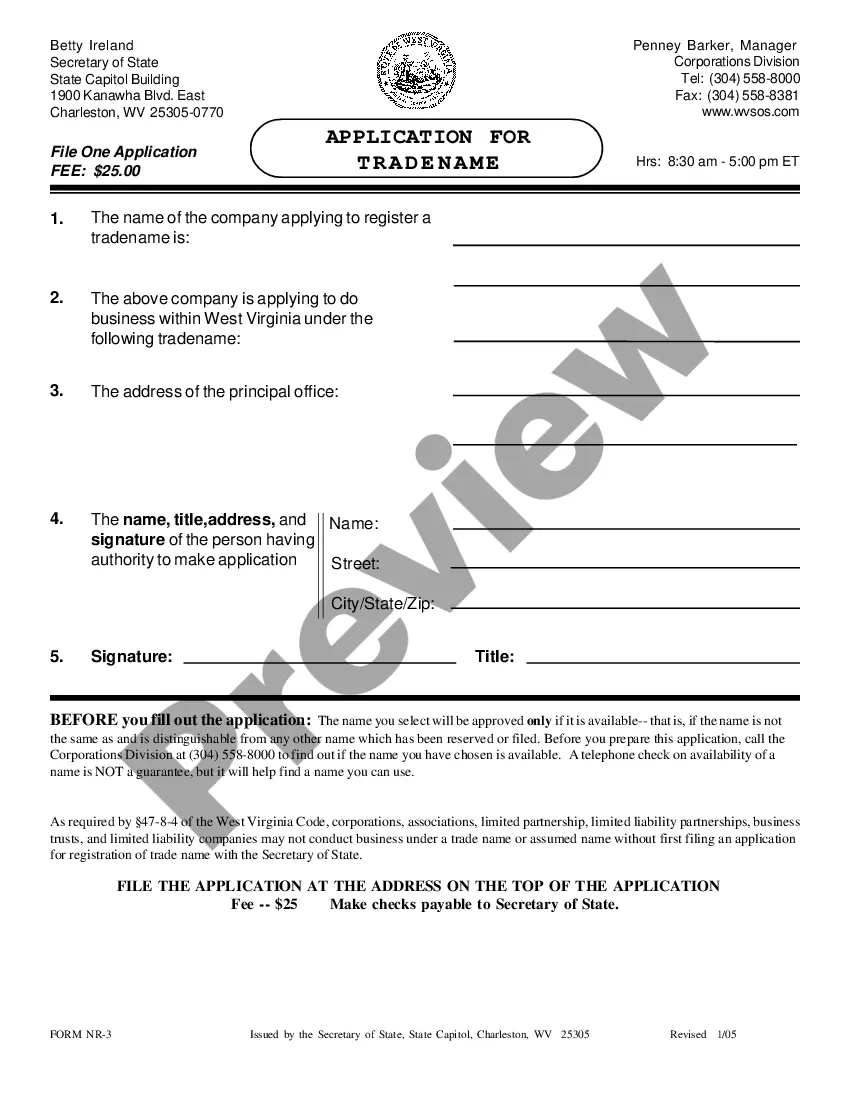

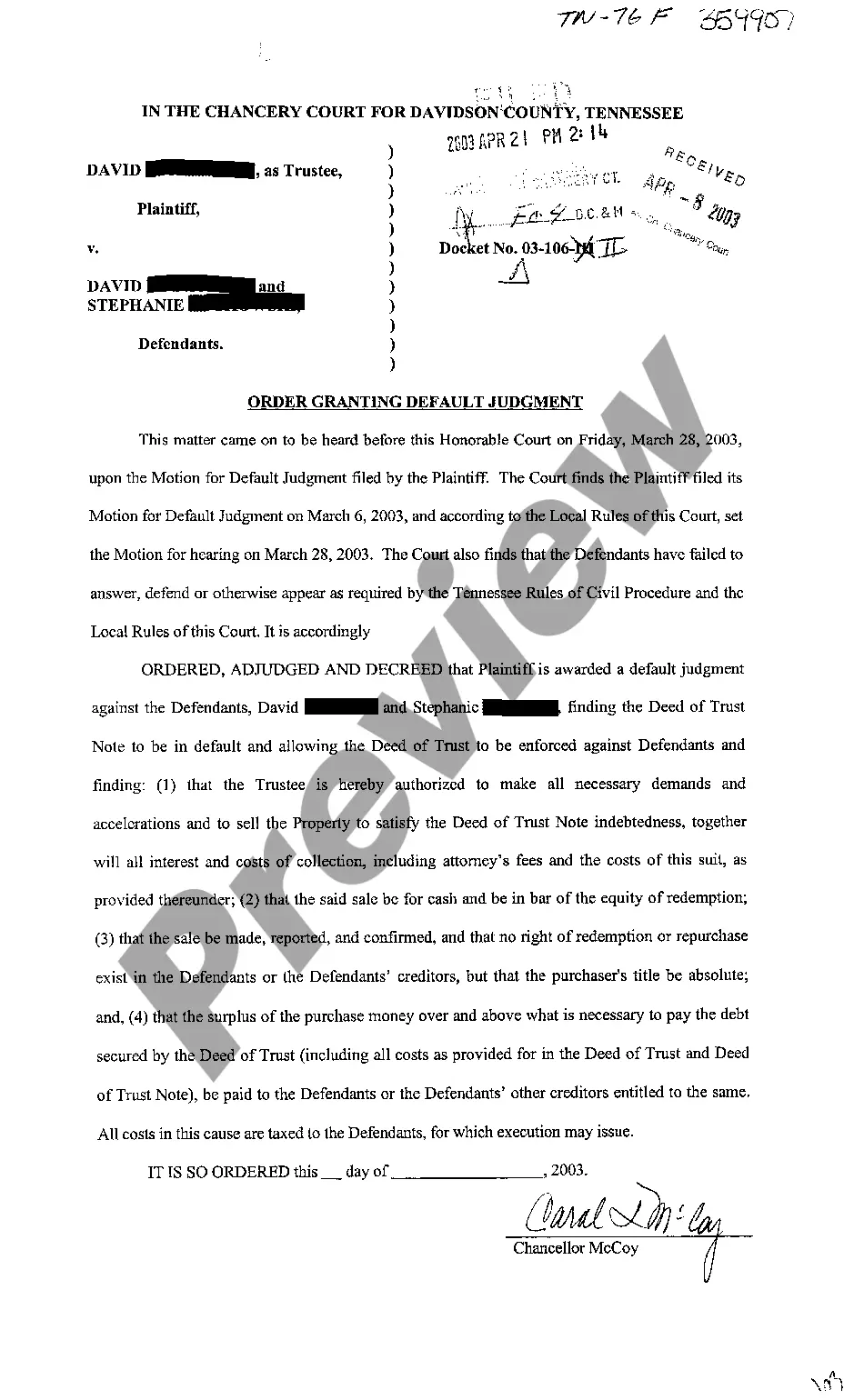

How to fill out Acknowledgment By Charitable Or Educational Institution Of Receipt Of Gift?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a wide range of legal document templates that you can obtain or print.

By using the website, you can access thousands of forms for both business and personal purposes, categorized by types, states, or keywords. You will find the most recent versions of forms such as the New Jersey Acknowledgment by Charitable or Educational Institution of Receipt of Gift in just minutes.

If you already have a subscription, Log In and obtain the New Jersey Acknowledgment by Charitable or Educational Institution of Receipt of Gift from the US Legal Forms library. The Download button will appear on every form you view. You can access all your previously saved forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the saved New Jersey Acknowledgment by Charitable or Educational Institution of Receipt of Gift. Every form you add to your account has no expiration date and is yours permanently. Therefore, if you wish to obtain or print another copy, simply visit the My documents section and click on the form you need. Access the New Jersey Acknowledgment by Charitable or Educational Institution of Receipt of Gift with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a multitude of professional and state-specific templates that cater to your business or personal needs and requirements.

- Ensure you have selected the correct form for the city/region.

- Click the Review button to examine the form’s details.

- Read the form description to confirm you have selected the appropriate form.

- If the form does not meet your requirements, use the Search bar at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

To write a receipt for a charitable donation, start by including the name of your organization, the donor's name, and the donation date. Clearly state the amount donated and specify if any goods or services were provided in return. Using uslegalforms can simplify this process by providing templates that comply with the New Jersey Acknowledgment by Charitable or Educational Institution of Receipt of Gift, ensuring you meet all legal requirements.

An example of a written acknowledgment for a charitable contribution includes a letter that states the donor's name, the date of the donation, and the amount given. Additionally, it should mention any benefits received by the donor, if applicable. Ensuring this letter aligns with the New Jersey Acknowledgment by Charitable or Educational Institution of Receipt of Gift guidelines helps ensure that both the organization and donor fulfill their obligations.

Showing proof of a charitable donation typically involves providing a written acknowledgment from the organization that received the gift. This acknowledgment should clearly outline the details of the donation, including the date, amount, and purpose. Utilizing a reliable platform like uslegalforms can help you generate proper documentation that meets the requirements of a New Jersey Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

To acknowledge receipt of a donation, an organization should provide a written statement to the donor. This statement should include the name of the charitable or educational institution, the amount of the gift, and a declaration of whether any goods or services were provided in exchange for the donation. Following the guidelines for a New Jersey Acknowledgment by Charitable or Educational Institution of Receipt of Gift ensures compliance and builds trust with your donors.

You can prove charity donations by retaining documents that confirm your contributions. This includes receipts, bank statements, and acknowledgment letters from charities. The New Jersey Acknowledgment by Charitable or Educational Institution of Receipt of Gift is a reliable form of proof, and having these records will help you substantiate your claims during tax season.

To get a receipt for your charitable donation, simply contact the organization you contributed to. Most charities issue receipts automatically, especially for larger donations. If you need a specific document like the New Jersey Acknowledgment by Charitable or Educational Institution of Receipt of Gift, you can use platforms like uslegalforms, which can help you generate the required documentation efficiently.

A gift acknowledgment letter is a formal document that a charitable organization provides to donors after receiving a contribution. This letter typically includes details about the donation, such as the amount and the purpose. When you receive a New Jersey Acknowledgment by Charitable or Educational Institution of Receipt of Gift, it serves as an essential record for your tax filing and demonstrates your support for the organization.

The IRS verifies charitable donations through documentation that proves the donation was made. This documentation can include a receipt or a letter from the charitable organization, such as the New Jersey Acknowledgment by Charitable or Educational Institution of Receipt of Gift. By keeping these records, you can easily provide proof when filing your taxes, making the process smoother.

Yes, you need to show proof of charitable donations on your tax return. The IRS requires that you provide documentation for any contributions you claim as deductions. This is where the New Jersey Acknowledgment by Charitable or Educational Institution of Receipt of Gift comes into play; it serves as official evidence of your donation, ensuring that you meet the IRS requirements for tax deductions.

To acknowledge a gift from a donor-advised fund, you should provide a written acknowledgment that includes the donor's name and the date the gift was made. It is important to state clearly that the gift came from a donor-advised fund, as this differentiates it from other contributions. Remember, the Acknowledgment by Charitable or Educational Institution of Receipt of Gift must reflect this distinction for transparency and compliance. For easy document creation, consider using US Legal Forms to ensure you cover all necessary aspects.