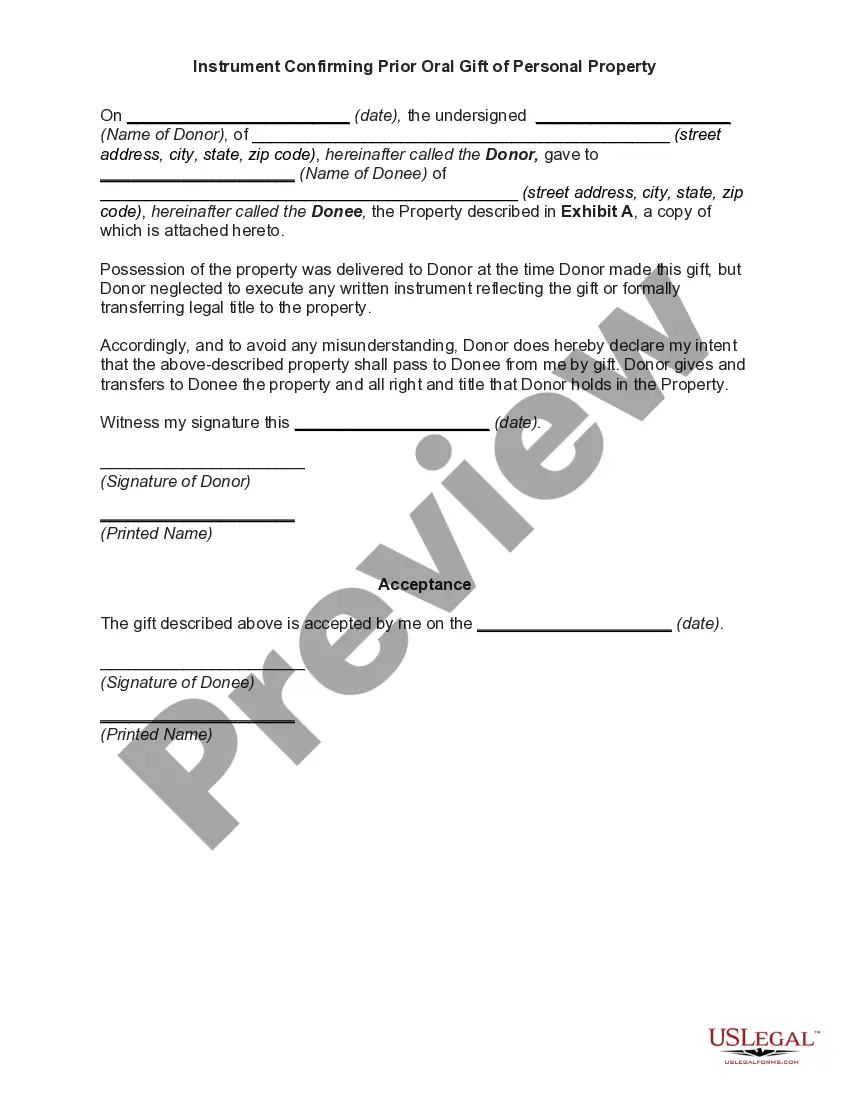

New Jersey Declaration of Gift with Signed Acceptance by Donee

Description

How to fill out Declaration Of Gift With Signed Acceptance By Donee?

You have the capability to invest time online searching for the legal document templates that comply with the federal and state guidelines you require.

US Legal Forms offers a vast array of legal forms that can be examined by professionals.

It is easy to obtain or print the New Jersey Declaration of Gift with Signed Acceptance by Donee from their services.

First, ensure that you have selected the correct document template for the area/town of your choice. Review the form description to verify you have chosen the right form. If available, utilize the Review button to go through the document template as well. If you wish to find another version of your form, use the Search field to locate the template that fits your needs and requirements. Once you have found the template you want, click on Purchase Now to proceed. Select the pricing plan you desire, enter your details, and register for an account on US Legal Forms. Complete the transaction. You may use your credit card or PayPal account to pay for the legal form. Choose the format of your document and download it to your device. Make modifications to your document if necessary. You can complete, edit, sign, and print the New Jersey Declaration of Gift with Signed Acceptance by Donee. Download and print numerous document templates using the US Legal Forms website, which provides the largest variety of legal forms. Utilize professional and state-specific templates to meet your business or personal requirements.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the New Jersey Declaration of Gift with Signed Acceptance by Donee.

- Each legal document template you purchase is yours indefinitely.

- To acquire another version of a previously obtained form, navigate to the My documents tab and click on the respective button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

Form popularity

FAQ

In New Jersey, the deed must be in English, identify the seller/buyer (grantor/grantee), name the person that prepared the deed, state the consideration (amount paid) for the transfer, contain a legal description of the property (a survey), include the signature of the grantor and be signed before a notary.

A gift to be valid must be made by a person voluntarily and not under compulsion without any exchange of money. 2....What can be gifted?It must be well defined existing movable or immovable property.It must be transferable.It should exist today and should not be a future property.It should be tangible.

Acceptance The final requirement for a valid gift is acceptance, which means that the donee unconditionally agrees to take the gift. It is necessary for the donee to agree at the same time the delivery is made. The gift can, however, be revoked at any time prior to acceptance.

Guidelines say no gifts can be solicited, and only gifts of minimal value, such as inexpensive cups or pens, can be accepted. Gifts such as fruit baskets are to be shared with a work group or donated.

You may accept a gift given under circumstances that make it clear that the gift is motivated by a family relationship or personal friendship rather than your official position.

Acceptance The final requirement for a valid gift is acceptance, which means that the donee unconditionally agrees to take the gift. It is necessary for the donee to agree at the same time the delivery is made. The gift can, however, be revoked at any time prior to acceptance.

A gift is a transfer made voluntarily. If it proved that the gift was not made voluntarily and the consent of the Donor was not free, the gift must be revoked. In a simpler term gift must be an express or implied contract, in which an offer made by the Donor and the acceptance by the Donee.

In general.If you gave gifts to someone in 2021 totaling more than $15,000 (other than to your spouse), you probably must file Form 709.Certain gifts, called future interests, are not subject to the $15,000 annual exclusion and you must file Form 709 even if the gift was under $15,000.More items...

According to The Transfer of Property Act, 1882, acceptance of gift must be made by the donee during the lifetime of the donor and while the donor is still capable of giving the gift. If the donee dies before accepting the gift, then it is void.

The donor and donee should sign on all pages of the gift deed and must be attested by at least two witnesses. The donee must accept the gift in the lifetime of the donor and when the donor is of sound mind for it to be valid. The value of the stamp paper on which the gift deed is executed varies from state to state.