The following form is a general form for a declaration of a gift of property.

New Jersey Declaration of Gift

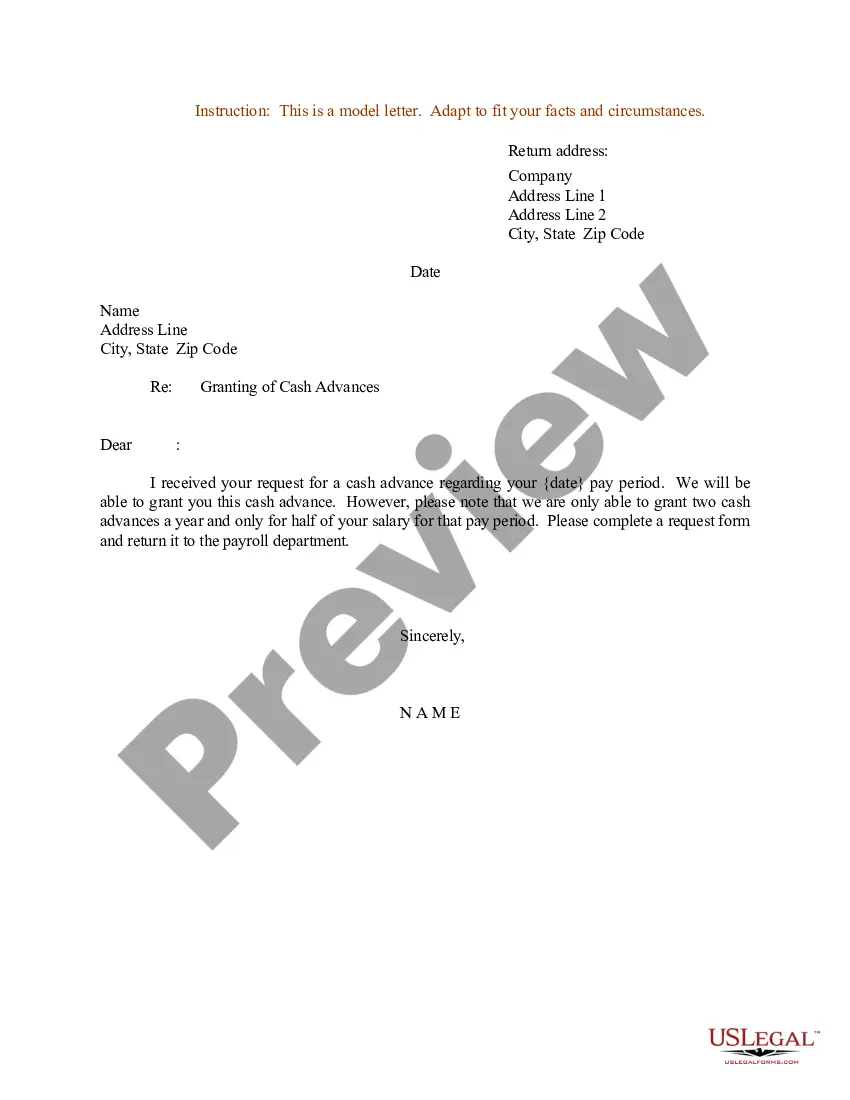

Description

How to fill out Declaration Of Gift?

If you want to accumulate, obtain, or produce authentic document templates, utilize US Legal Forms, the largest selection of authentic forms, accessible online.

Employ the site's straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords and phrases.

Every authentic document template you purchase is yours indefinitely. You will have access to every form you have downloaded in your account. Click on the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the New Jersey Declaration of Gift with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to retrieve the New Jersey Declaration of Gift in just a few clicks.

- If you are currently a client of US Legal Forms, Log In to your account and click the Download option to access the New Jersey Declaration of Gift.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/region.

- Step 2. Use the Review option to examine the content of the form. Remember to read the details.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the authentic form template.

- Step 4. Once you have located the form you need, choose the Buy now option. Select your preferred pricing plan and enter your details to create an account.

- Step 5. Complete the payment. You can utilize your credit card or PayPal account for the transaction.

- Step 6. Choose the format of the authentic form and download it to your device.

- Step 7. Complete, modify, and print or sign the New Jersey Declaration of Gift.

Form popularity

FAQ

Writing a gift declaration involves declaring your intent to gift a specific item or amount. Include essential details, such as the item description and the donor's information. Follow the guidelines of the New Jersey Declaration of Gift to ensure legality and clarity. Using a reliable platform like US Legal Forms can streamline this process and provide you with the right templates.

To fill out a gift letter, start by including the donor's name, address, and relationship to you. Clearly state the amount being gifted, referencing the New Jersey Declaration of Gift for confirmation. Ensure both the donor and the recipient sign the letter, which adds authenticity. It is important to keep a copy of this letter for your records and potential future needs.

When declaring a foreign gift, it's crucial to be aware of the reporting requirements set by IRS and state regulations. Foreign gifts that exceed certain amounts must be disclosed on your tax return, in line with the New Jersey Declaration of Gift rules. You should gather all pertinent documentation related to the gift and consult with a tax professional if needed. UsLegalForms can assist you in navigating these regulations and ensuring compliance to avoid any penalties.

To declare gift income in New Jersey, you are required to report it on your tax return if it meets the necessary thresholds. You need to ensure your reported gifts comply with the guidelines established under the New Jersey Declaration of Gift. Keeping thorough records of all received gifts will help streamline your reporting process. If you need assistance, consider using the resources available on platforms like UsLegalForms for clear guidelines and templates.

Yes, you can file the NJ 1040 hw online through various tax preparation platforms. This option allows for a faster and more convenient way to submit your state tax return. Additionally, using these tools often simplifies the process of claiming any gifts received, particularly in relation to the New Jersey Declaration of Gift. Make sure you choose a reputable service for a smooth filing experience.

As of now, New Jersey does not impose a gift tax, and this will remain consistent for 2024. However, it's crucial to stay updated on potential changes to both state and federal gift tax regulations. The New Jersey Declaration of Gift ensures you have the latest information at your fingertips.

When traveling internationally, you should declare gifts at customs if they exceed a certain value. The New Jersey Declaration of Gift focuses primarily on local tax compliance, but customs laws also apply. Make sure to check customs regulations to avoid issues when bringing gifts into the country.

If the gift you received exceeds the federal gift tax exclusion, you may be required to report it on your tax return. The New Jersey Declaration of Gift provides guidance on when and how to declare such gifts. Staying informed helps you fulfill your obligations without complications.

Yes, gifts may need to be declared, especially if they exceed specific thresholds. The New Jersey Declaration of Gift plays a crucial role in outlining these requirements. By declaring gifts, you maintain transparency with tax regulations.

New Jersey does not impose a state gift tax, which provides residents with a significant advantage when giving gifts. However, the federal gift tax rules still apply, so beware of limits. The New Jersey Declaration of Gift can help clarify your responsibilities regarding gifting.