New Jersey Dissolution Package to Dissolve Limited Liability Company LLC

Definition and meaning

A New Jersey Dissolution Package to Dissolve Limited Liability Company (LLC) is a set of legal documents required to formally dissolve an LLC in the state of New Jersey. This package provides the necessary forms and instructions to assist members in the voluntary dissolution of their business entity. It outlines the process of winding up the affairs of the LLC, addressing any outstanding obligations, and finalizing the cancellation of the Certificate of Formation with the state authorities.

How to complete a form

To properly complete the forms included in the New Jersey Dissolution Package, follow these steps:

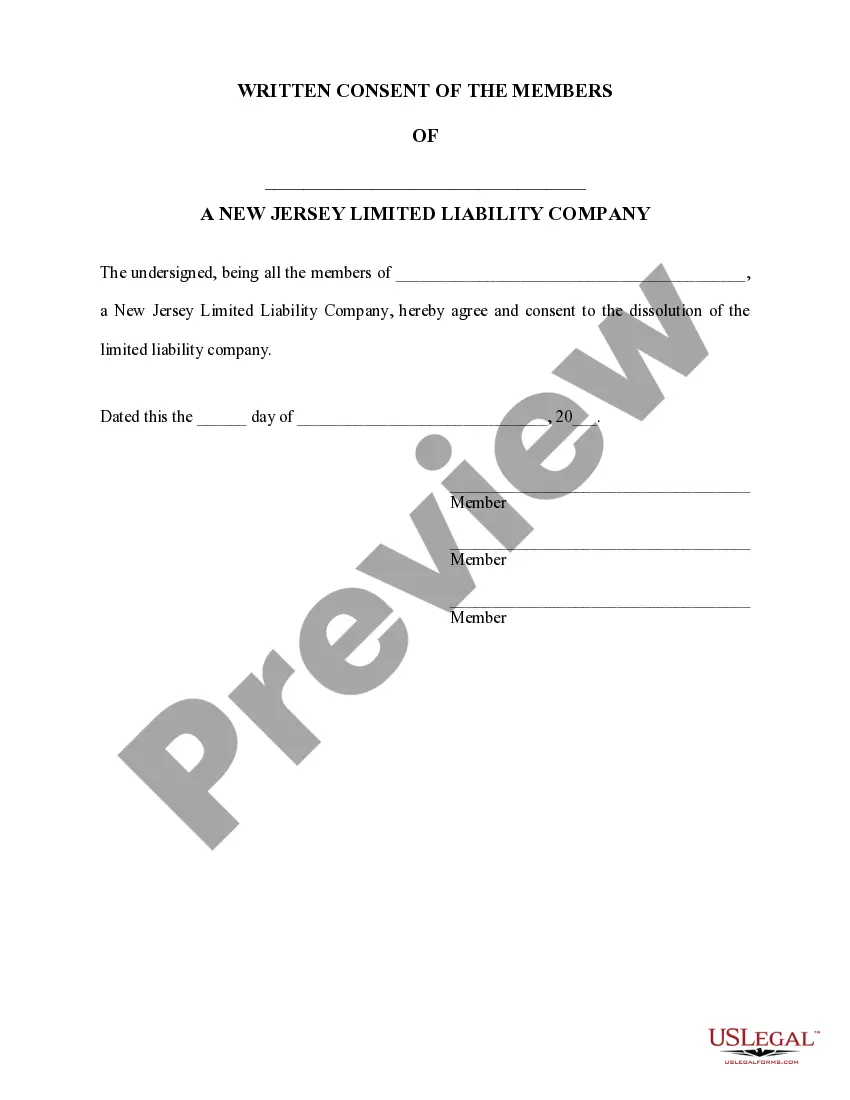

- Review the written consent form to ensure all members agree to the dissolution. Each member must sign this document.

- Fill out the Certificate of Cancellation accurately by providing the required details such as the LLC name, identification number, formation date, and reason for cancellation.

- Sign the Certificate of Cancellation and provide printed names and dates as needed.

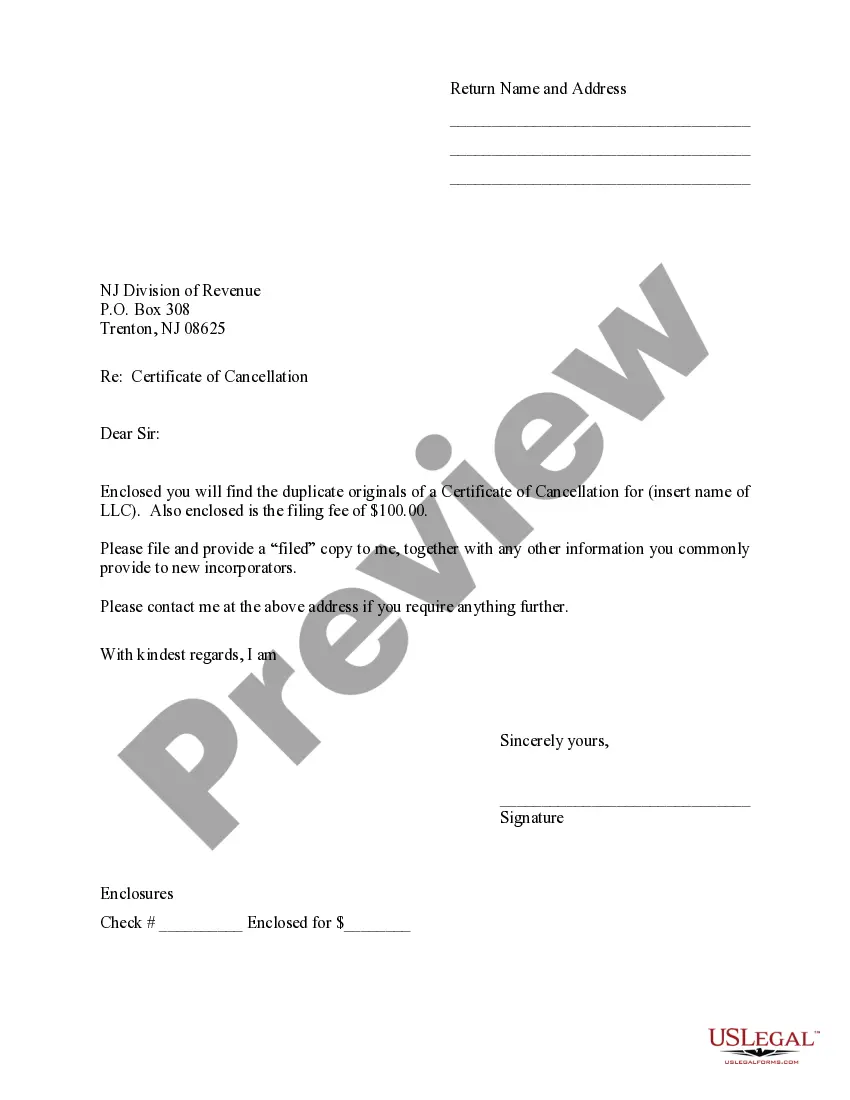

- Prepare a transmittal letter to accompany the Certificate of Cancellation when submitting it to the state.

Ensure that all forms are completed with the correct information to avoid delays in processing.

Who should use this form

The New Jersey Dissolution Package is intended for use by members of an LLC that has decided to formally dissolve the business. This includes any individual or entity that has a stake in the LLC and wishes to ensure that the dissolution process is handled correctly according to New Jersey state law. It is especially useful for LLCs that have completed their business operations and need to settle their affairs before dissolution.

Key components of the form

The New Jersey Dissolution Package contains the following key components:

- Written Consent of Members: A document that signifies all members agree to dissolve the LLC.

- Certificate of Cancellation: The official form filed with the state to finalize the dissolution.

- Transmittal Letter: A cover letter that accompanies the Certificate of Cancellation when submitted to the New Jersey Division of Revenue.

These forms must be accurately completed and submitted together to ensure proper dissolution of the LLC.

Common mistakes to avoid when using this form

Avoid these frequent errors when completing the New Jersey Dissolution Package:

- Failing to obtain all member signatures on the Written Consent form, which is essential for validation.

- Providing incorrect information on the Certificate of Cancellation, such as the LLC identification number or date of formation.

- Neglecting to include the required filing fee when submitting documents to the state.

- Forgetting to keep copies of all submitted documents for your records.

By being aware of these common pitfalls, users can navigate the dissolution process more smoothly.

State-specific requirements

When using the New Jersey Dissolution Package, it’s important to comply with state-specific requirements:

- The LLC must be voluntarily dissolved, as judicial dissolution is not covered under this package.

- All members must agree to the dissolution if the operating agreement does not dictate otherwise.

- Businesses must settle their debts and obligations before filing for cancellation.

- Forms must be submitted to the New Jersey Division of Revenue along with a $100 filing fee.

Adhering strictly to these requirements can prevent legal complications and ensure a smooth dissolution process.

Form popularity

FAQ

The corporation should be wound up, adopt a plan of dissolution, pay or make provision for payment of creditors, obtain a tax clearance certificate from the state, file 'final' tax returns, withdraw from other states in which it has qualified to do business, and dissolve, said Stuart Pachman, an attorney with Brach

New Jersey requires business owners to submit their Certificate of Cancellation by mail or online. You can also have a professional service provider file your Articles of Dissolution for you. Incfile prepares the Articles of Dissolution for you, and files them to the state for $149 + State Fees.

To dissolve a limited liability company (LLC) in New Jersey, you must file a certificate of cancellation or dissolution with the state Division of Revenue, pay the required fees, and wind up the company's remaining business.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.