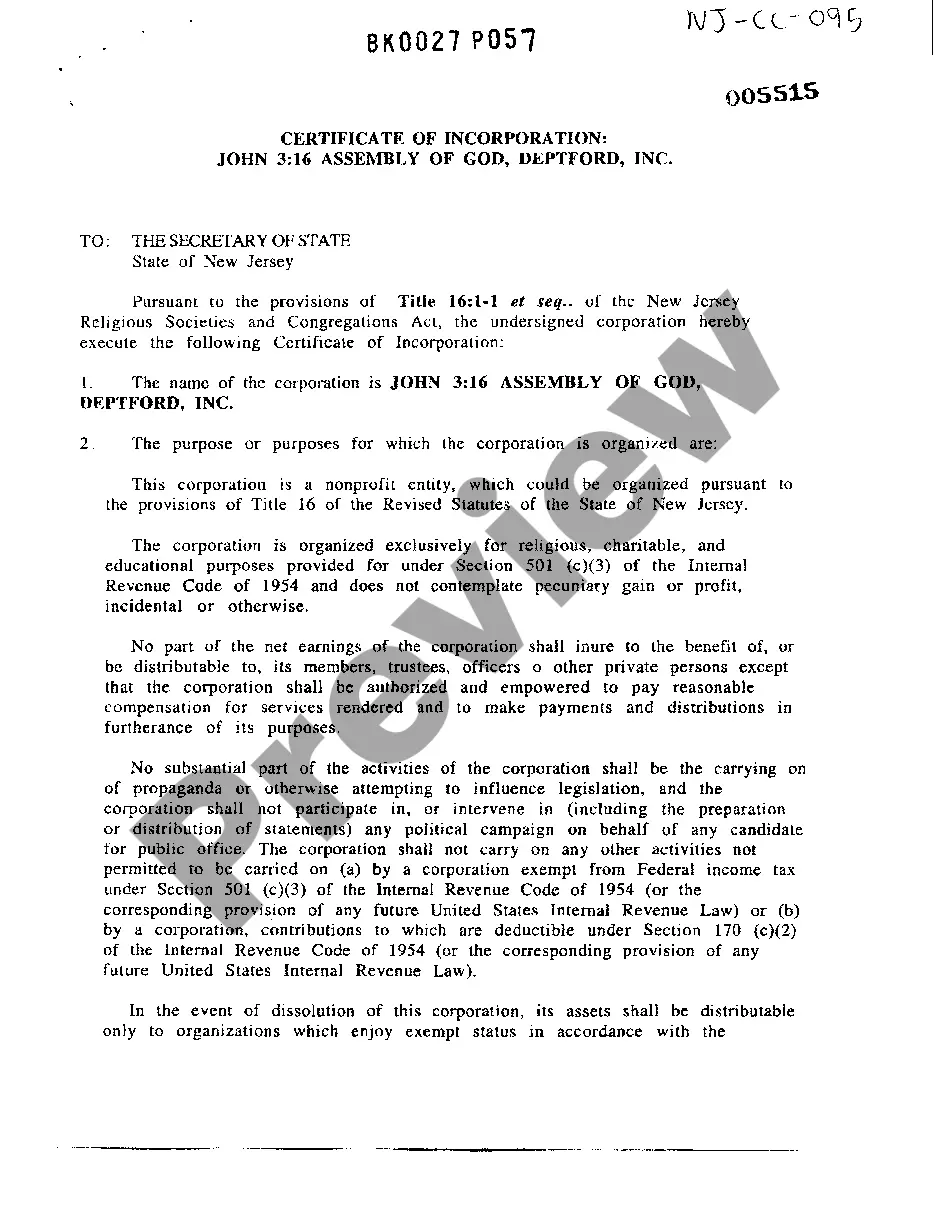

New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization

Description

How to fill out New Jersey Certificate Of Incorporation For Nonprofit, Religious Organization?

US Legal Forms is a unique platform to find any legal or tax form for submitting, including New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization. If you’re tired with wasting time looking for ideal samples and spending money on record preparation/lawyer fees, then US Legal Forms is precisely what you’re trying to find.

To reap all the service’s benefits, you don't need to download any application but just select a subscription plan and sign up your account. If you already have one, just log in and find an appropriate template, save it, and fill it out. Downloaded files are all saved in the My Forms folder.

If you don't have a subscription but need New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization, check out the recommendations listed below:

- check out the form you’re taking a look at applies in the state you want it in.

- Preview the example its description.

- Click on Buy Now button to reach the register webpage.

- Choose a pricing plan and keep on signing up by entering some information.

- Decide on a payment method to complete the sign up.

- Save the file by choosing the preferred format (.docx or .pdf)

Now, submit the file online or print it. If you feel unsure regarding your New Jersey Certificate Of Incorporation for Nonprofit, Religious Organization form, contact a lawyer to review it before you send out or file it. Start hassle-free!

Form popularity

FAQ

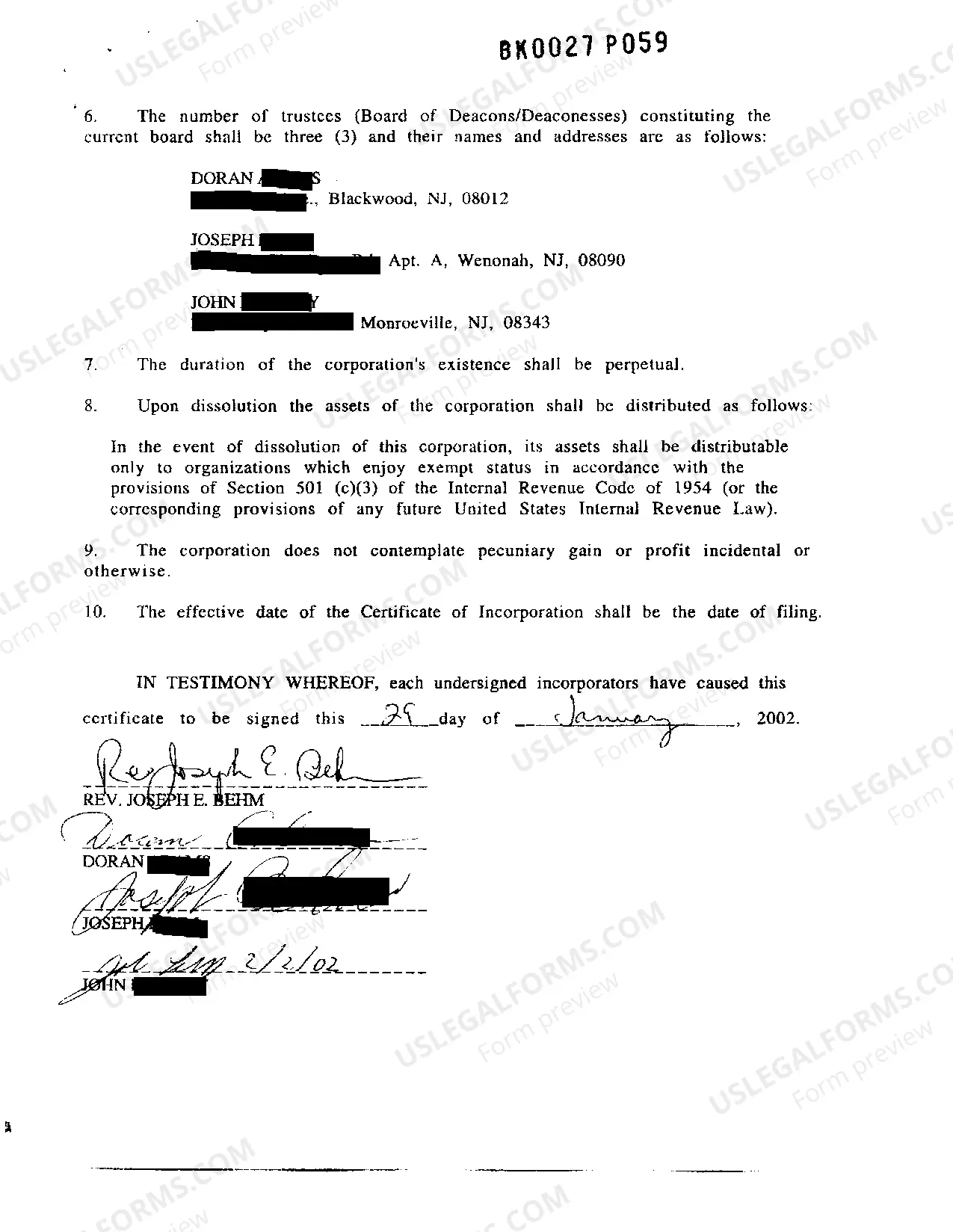

Choose directors for your nonprofit. Choose a name for your nonprofit. Appoint a registered agent. File New Jersey nonprofit Certificate of Incorporation. Prepare nonprofit bylaws. Hold a meeting of your board of directors.

Choose a name. File articles of incorporation. Apply for your IRS tax exemption. Apply for a state tax exemption. Draft bylaws. Appoint directors. Hold a meeting of the board. Obtain licenses and permits.

Nonprofit incorporation usually involves these steps: Choose a business name that is legally available in your state and file for an EIN (Employment Identification Number) Prepare and file your articles of incorporation with your state's corporate filing office, and pay a filing fee.

Churches (including integrated auxiliaries and conventions or associations of churches) that meet the requirements of section 501(c)(3) of the Internal Revenue Code are automatically considered tax exempt and are not required to apply for and obtain recognition of exempt status from the IRS.

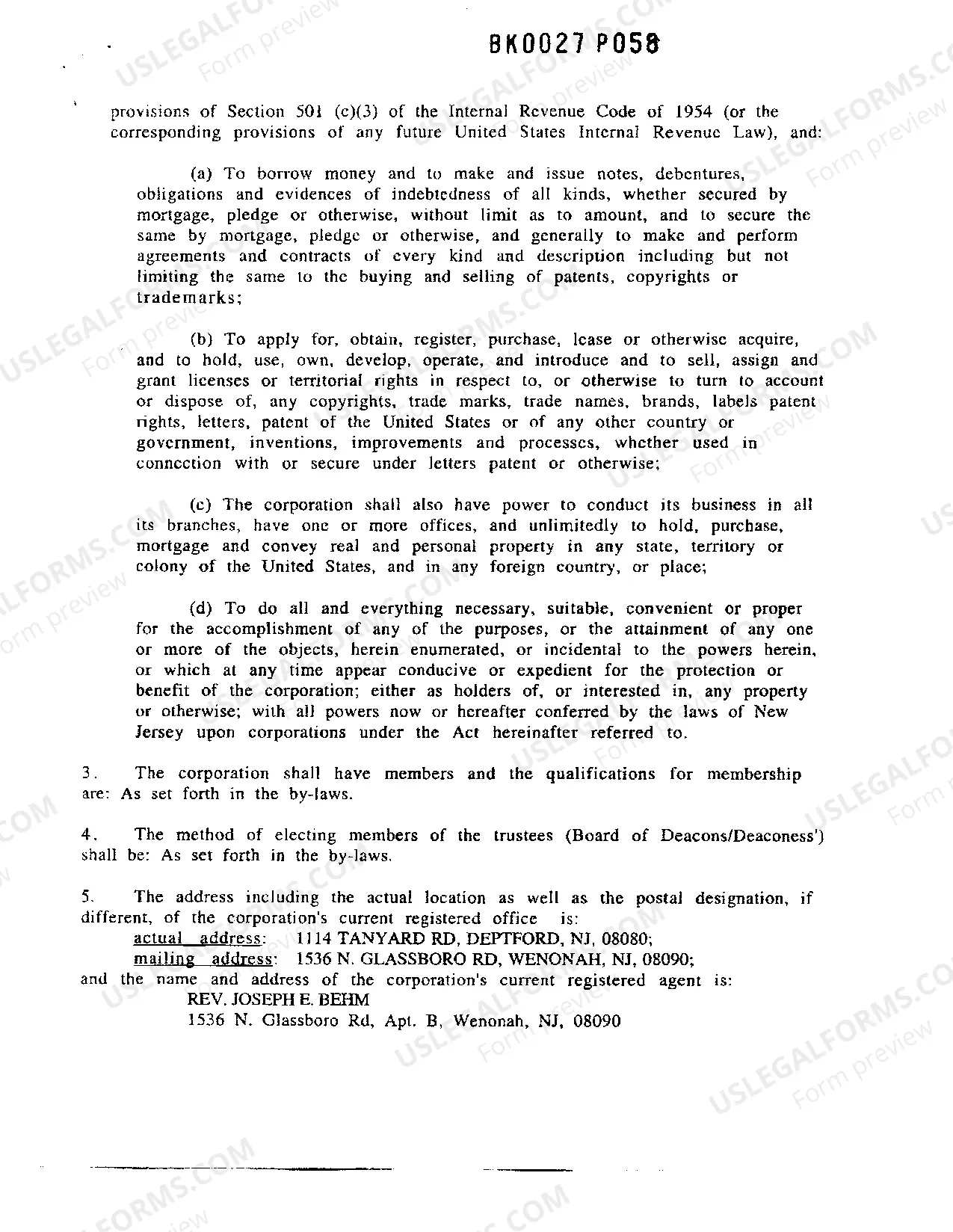

The name of your corporation. your corporation's principal place of business. the name and address of your corporation's registered agent. a statement of the corporation's purpose. the corporation's duration. information about the number of shares and classes of stock the corporation is authorized to issue.

Broadly, articles of incorporation should include the company's name, type of corporate structure, and number and type of authorized shares. Bylaws work in conjunction with the articles of incorporation to form the legal backbone of the business.

Choose a name. File articles of incorporation. Apply for your IRS tax exemption. Apply for a state tax exemption. Draft bylaws. Appoint directors. Hold a meeting of the board. Obtain licenses and permits.

Legal Name of the Organization (Not taken by other companies in your State) Address of the Organization (Should be in the Incorporating State) Incorporator of the Nonprofit Organization.

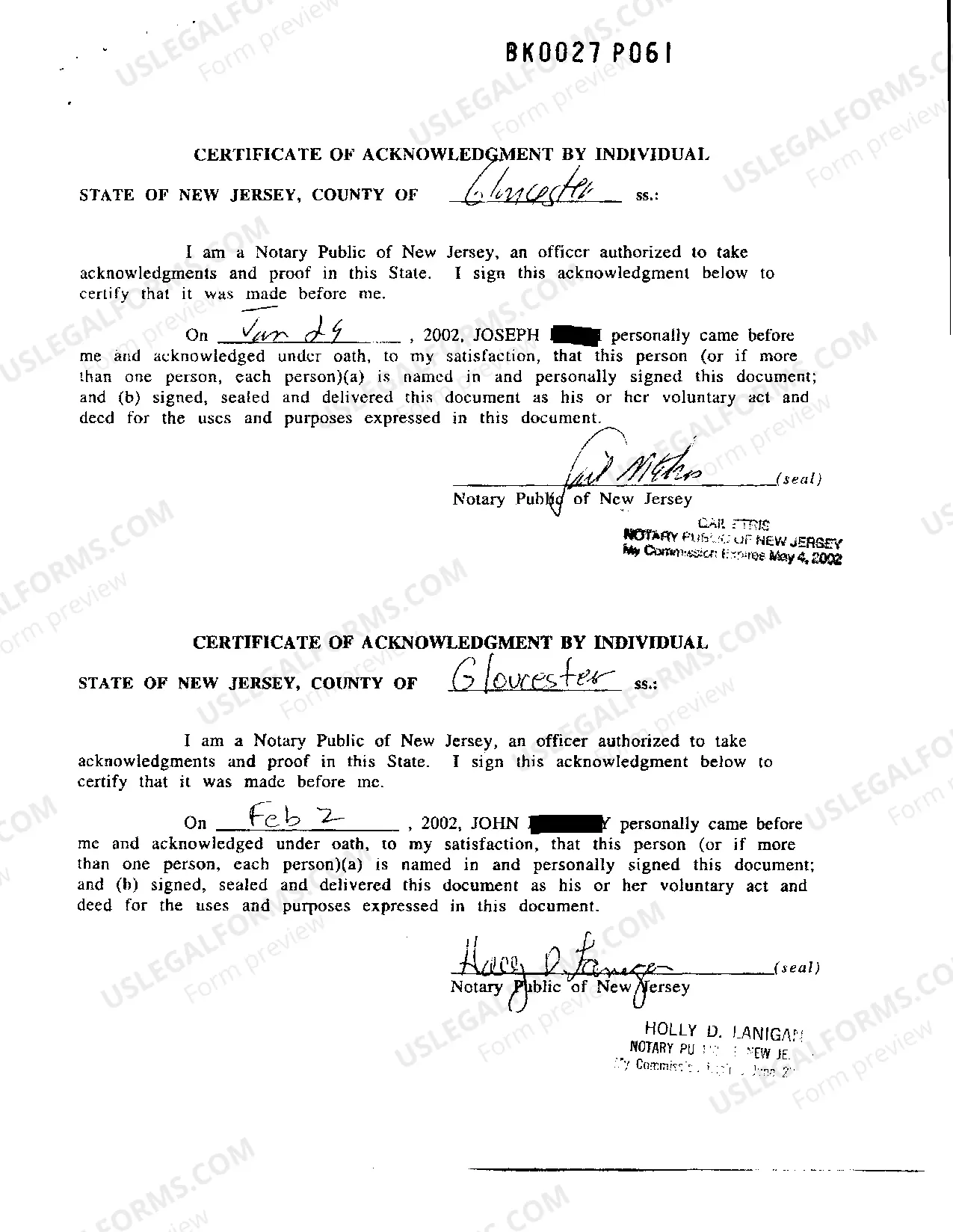

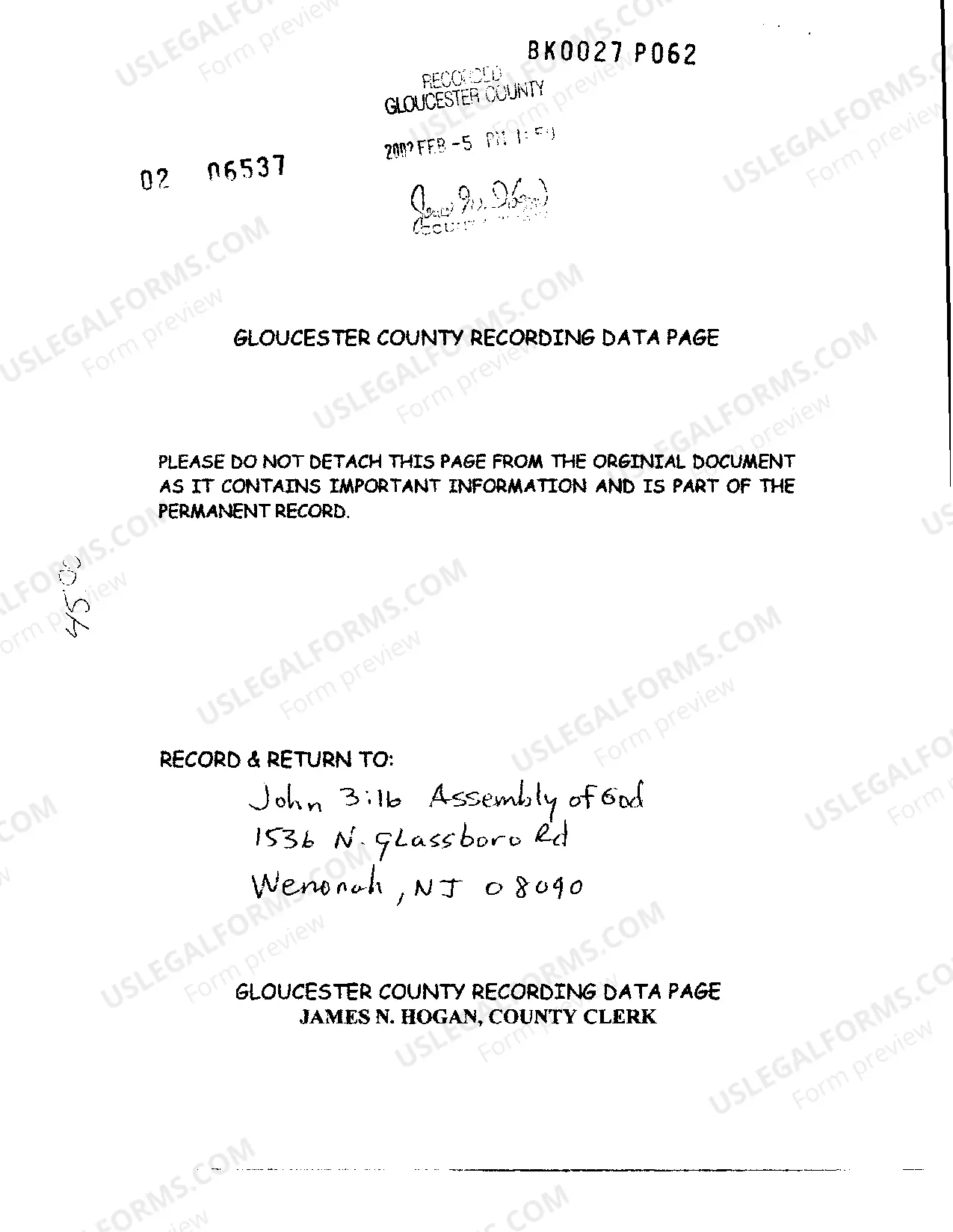

In order to form a nonprofit corporation, you must file articles of incorporation (sometimes called a "certificate of incorporation" or "charter document" or "articles of organization") with the state and pay a filing fee.