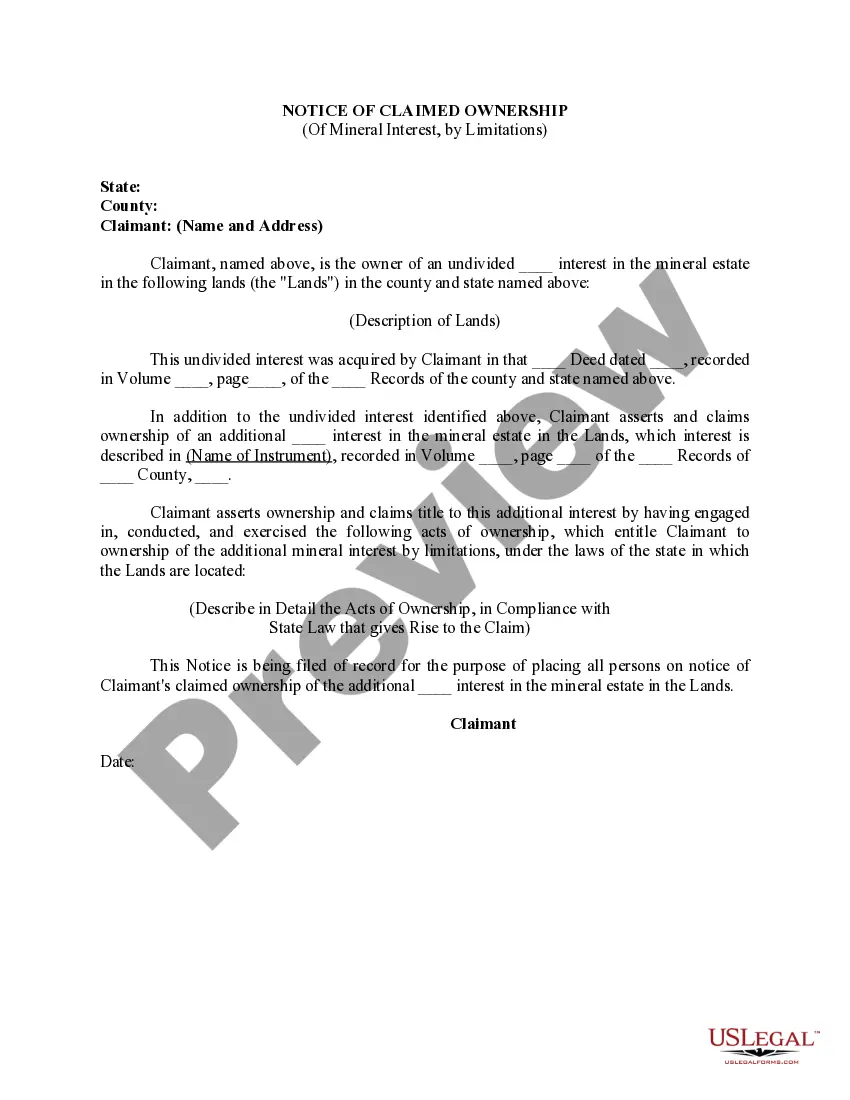

New Hampshire Notice of Claim of Mineral Interest for Dormant Mineral Interest

Description

How to fill out Notice Of Claim Of Mineral Interest For Dormant Mineral Interest?

You are able to commit several hours on the Internet trying to find the legitimate file format that fits the federal and state demands you want. US Legal Forms gives 1000s of legitimate forms which are analyzed by pros. You can actually obtain or printing the New Hampshire Notice of Claim of Mineral Interest for Dormant Mineral Interest from your services.

If you already possess a US Legal Forms bank account, you may log in and click on the Obtain option. Following that, you may comprehensive, modify, printing, or indicator the New Hampshire Notice of Claim of Mineral Interest for Dormant Mineral Interest. Each legitimate file format you get is the one you have eternally. To acquire yet another duplicate of any obtained type, visit the My Forms tab and click on the corresponding option.

Should you use the US Legal Forms site for the first time, stick to the straightforward instructions below:

- Initially, be sure that you have selected the proper file format to the area/area that you pick. See the type outline to ensure you have picked out the correct type. If readily available, utilize the Preview option to search through the file format at the same time.

- If you wish to locate yet another edition of the type, utilize the Research industry to discover the format that suits you and demands.

- Once you have discovered the format you need, just click Acquire now to continue.

- Select the costs strategy you need, key in your credentials, and sign up for your account on US Legal Forms.

- Full the financial transaction. You may use your Visa or Mastercard or PayPal bank account to pay for the legitimate type.

- Select the formatting of the file and obtain it in your product.

- Make changes in your file if possible. You are able to comprehensive, modify and indicator and printing New Hampshire Notice of Claim of Mineral Interest for Dormant Mineral Interest.

Obtain and printing 1000s of file themes making use of the US Legal Forms web site, which provides the biggest variety of legitimate forms. Use specialist and condition-specific themes to handle your business or specific requires.

Form popularity

FAQ

New Hampshire does not tax individuals' earned income, so you are not required to file an individual New Hampshire tax return. The state only taxes interest and dividends at 5% on residents and fiduciaries whose gross interest and dividends income, from all sources, exceeds $2,400 annually ($4,800 for joint filers).

New Hampshire uses Form DP-10 for full or part-year residents. The DP-10 only has to be filed if the taxpayer received more than $2400 (single) or $4800 (joint) of interest and/or dividends.

Mineral ownership, or mineral rights, are understood to be the property rights to exploit an area for the minerals, gas, or oil it harbors. The four types of mineral ownership are: Mineral Interest ? interest generated after the production of oil and gas after the sale of a deed or a lease.

Tax Year 2022 Filing Thresholds by Filing Status Filing StatusTaxpayer age at the end of 2022A taxpayer must file a return if their gross income was at least:singleunder 65$12,950single65 or older$14,700head of householdunder 65$19,400head of household65 or older$21,1506 more rows

INDIVIDUALS: Individuals who are residents or inhabitants of New Hampshire for any part of the tax year must file if they received more than $2,400 of gross interest and/or dividend income for a single individual or $4,800 of such income for a married couple filing a joint New Hampshire return.

New Hampshire derives 63.8 percent of its revenue from property tax money, the most of any U.S. state. Cost of living is also a prominent factor.

New Hampshire Income Taxes New Hampshire is a state that doesn't have a personal income tax. However, currently, the state has a 5% tax on dividends and interest. However, due to legislation, the tax on dividends and interest is being phased out. The rate will be 4% for 2023, 3% for 2024, 2% for 2025, and 1% for 2026.

Tax-free states Alaska. Florida. Nevada. South Dakota. Texas. Washington. Wyoming.