New Hampshire Deck Builder Contractor Agreement - Self-Employed

Description

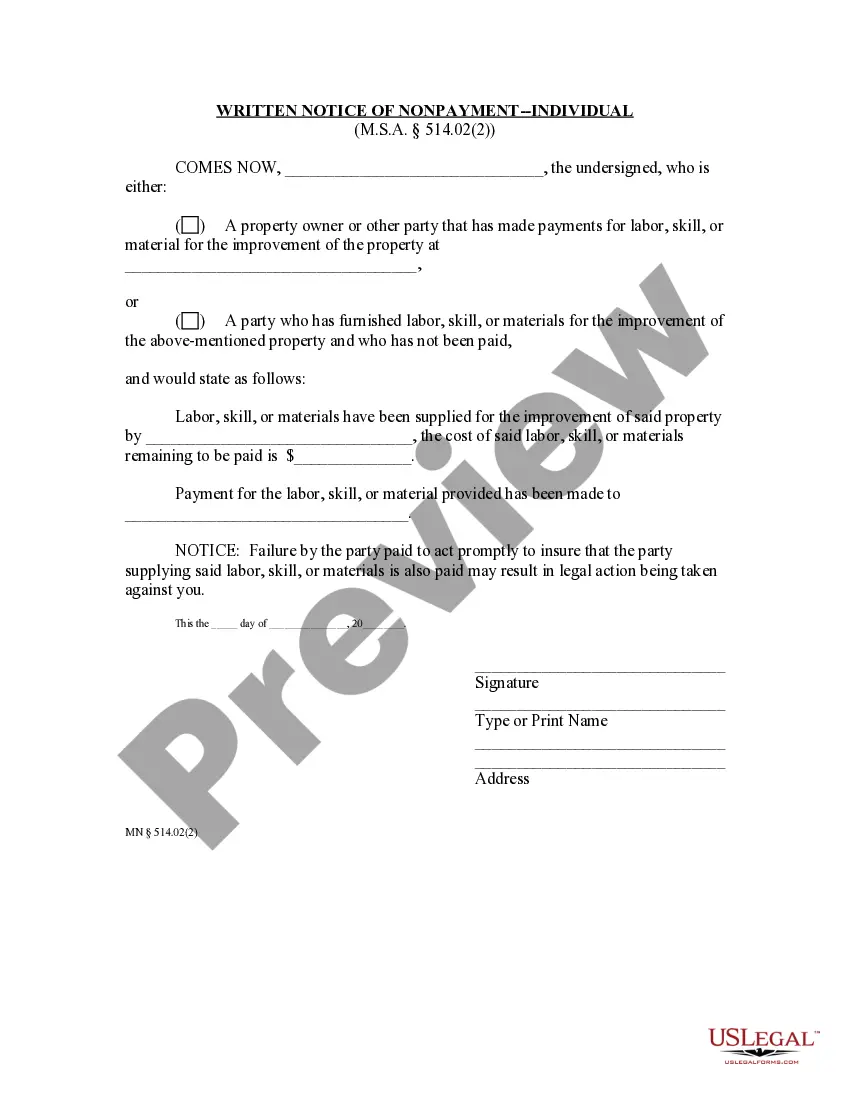

How to fill out Deck Builder Contractor Agreement - Self-Employed?

Are you presently in a situation where you require documentation for both business or specific tasks nearly every day.

There are countless legal document templates accessible online, but finding ones you can trust is not simple.

US Legal Forms offers a vast array of form templates, such as the New Hampshire Deck Builder Contractor Agreement - Self-Employed, that are designed to comply with state and federal regulations.

Once you have the correct form, click Buy now.

Choose the payment plan you prefer, fill in the necessary information to set up your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the New Hampshire Deck Builder Contractor Agreement - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/state.

- Utilize the Preview option to review the form.

- Read the description to ensure you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

To file as an independent contractor, you need to gather several important documents. Start with your earnings records, your New Hampshire Deck Builder Contractor Agreement - Self-Employed, and any 1099 forms from clients. You will also need to report expenses related to your business to claim deductions and potentially lower your tax liability. Utilizing platforms like US Legal Forms can provide you with templates and guidance to make the filing process smoother.

Yes, New Hampshire does tax self-employment income. If you earn income as a self-employed individual, you are required to report this income on your tax return. It is important to keep accurate records of your earnings and expenses associated with your New Hampshire Deck Builder Contractor Agreement - Self-Employed work. Consulting with a tax professional can help ensure you meet your obligations while maximizing your deductions.

To fill out a subcontractor agreement, include the names of both the primary contractor and the subcontractor. Clearly outline the tasks that the subcontractor is responsible for, along with payment terms and deadlines. Be sure to specify any necessary compliance with laws and regulations. You can simplify your work with a New Hampshire Deck Builder Contractor Agreement - Self-Employed template from uslegalforms, ensuring all necessary clauses are accounted for.

Setting up as a self-employed contractor starts with choosing a suitable business structure, such as a sole proprietorship or LLC. Next, obtain any necessary licenses or permits, and consider registering your business name. Finally, secure the appropriate agreements, like the New Hampshire Deck Builder Contractor Agreement - Self-Employed, to protect your interests. Uslegalforms makes this process easier by providing templates tailored to your needs.

Filling out an independent contractor form requires providing personal information, service descriptions, and tax details. Make sure to indicate the nature of the work and any specific terms regarding payment and deadlines. This ensures clarity and prevents misunderstandings later. You can streamline this process with the New Hampshire Deck Builder Contractor Agreement - Self-Employed form available through uslegalforms.

Writing an independent contractor agreement involves specifying important details such as the scope of work, deadlines, and payment methods. Begin with an introduction identifying both parties, followed by a clear description of deliverables. It is also essential to include clauses on confidentiality and termination to protect both parties. For guidance, you can utilize the New Hampshire Deck Builder Contractor Agreement - Self-Employed template from uslegalforms.

To fill out an independent contractor agreement, start by entering your business details and the contractor's information. You should clearly define the services provided, payment terms, and the duration of the contract. Additionally, ensure that both parties sign the document, making it legally binding. For a comprehensive solution, consider using the New Hampshire Deck Builder Contractor Agreement - Self-Employed template available on uslegalforms.

While it is not mandatory to have an operating agreement for an LLC in New Hampshire, it is wise to have one. An operating agreement outlines the details of your business, which can be critical for your New Hampshire Deck Builder Contractor Agreement - Self-Employed. This document helps ensure all members are on the same page regarding roles and responsibilities. Utilizing platforms like uslegalforms can assist in creating a comprehensive operating agreement.

Yes, an LLC can exist without an operating agreement, but doing so may lead to challenges. Without this document, state laws dictate operation and management, which might not align with your vision. In the case of a New Hampshire Deck Builder Contractor Agreement - Self-Employed, it's beneficial to establish clear terms to enhance professionalism. Therefore, creating an operating agreement can save time and trouble down the road.

New Hampshire does not legally require an LLC to have an operating agreement. However, it's advantageous to create one, especially for a New Hampshire Deck Builder Contractor Agreement - Self-Employed. An operating agreement helps define ownership and operational procedures, which can guard against future disputes. Therefore, consider drafting this document to strengthen your business foundation.