New Hampshire Choreographer Services Contract - Self-Employed

Description

How to fill out Choreographer Services Contract - Self-Employed?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal document templates you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the New Hampshire Choreographer Services Contract - Self-Employed in just minutes.

If you already have a monthly subscription, Log In and download the New Hampshire Choreographer Services Contract - Self-Employed from the US Legal Forms library. The Download option will be available on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

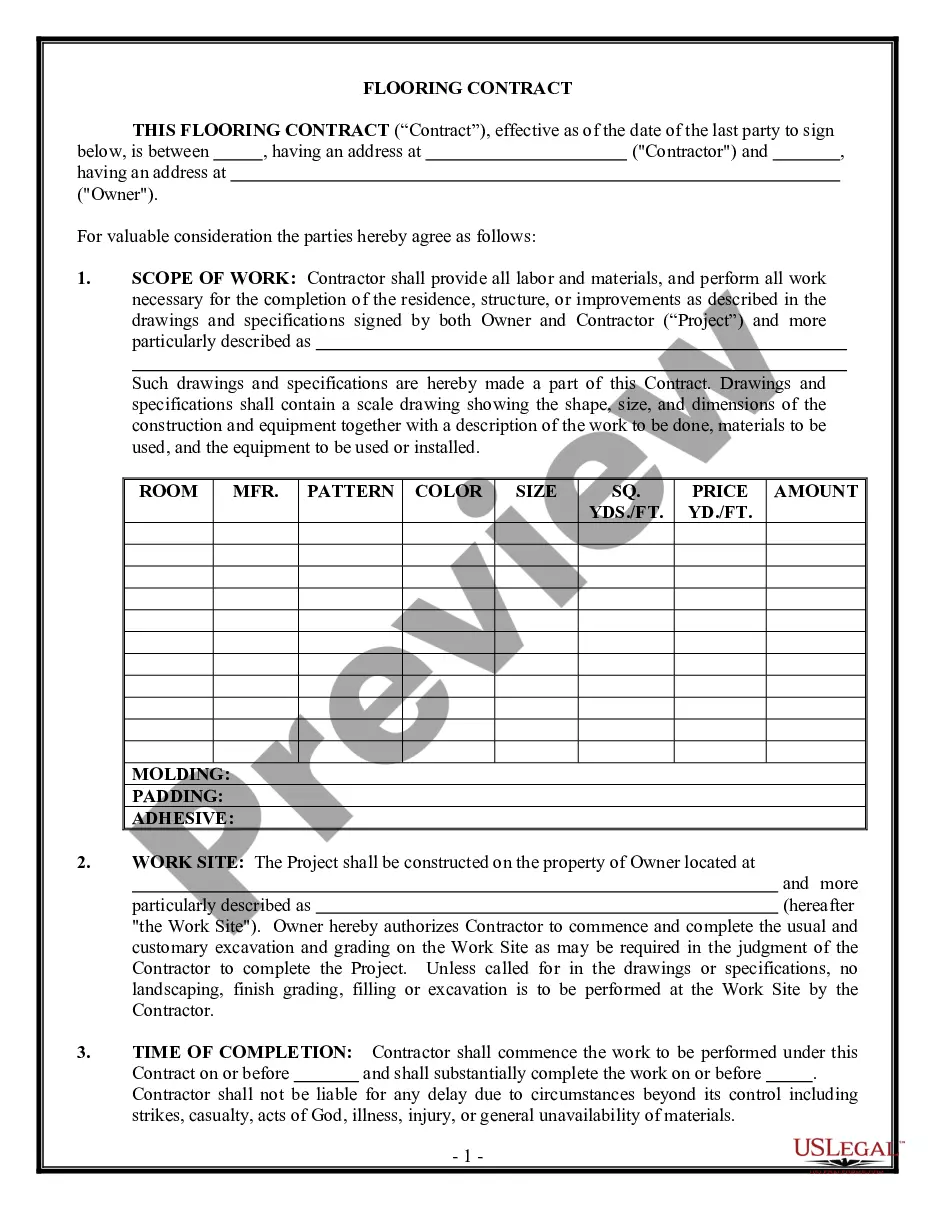

If you are using US Legal Forms for the first time, here are simple instructions to get started: Ensure you have selected the correct form for your area/region. Click on the Review button to examine the content of the form. Check the description of the form to confirm that you have selected the right one. If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

Access the New Hampshire Choreographer Services Contract - Self-Employed with US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If you are satisfied with the form, confirm your selection by clicking on the Purchase now button.

- Then, select the pricing plan you prefer and provide your information to register for an account.

- Complete the transaction. Use a credit card or PayPal account to finalize the purchase.

- Choose the file format and download the form to your device.

- Edit. Fill out, modify, print, and sign the downloaded New Hampshire Choreographer Services Contract - Self-Employed.

- Every template you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another version, simply go to the My documents section and click on the form you want.

Form popularity

FAQ

Several states do not impose a self-employment tax, including Florida and Texas. These locations attract many self-employed individuals looking for favorable financial environments. However, if you're operating in New Hampshire, your focus should be on optimizing your New Hampshire Choreographer Services Contract - Self-Employed to ensure compliance and maximize your earnings. Always evaluate your options and consult resources to find the best state for your business needs.

Yes, New Hampshire does impose self-employment tax on individuals who operate as self-employed, including those providing services under a New Hampshire Choreographer Services Contract - Self-Employed. This tax applies to your net earnings from self-employment. It's essential to keep your records organized and consult with a tax professional to ensure compliance. Understanding this aspect can help you better manage your finances while working as a choreographer.

Yes, you can write your own legally binding contract as long as it meets the legal requirements of your state. The contract should be clear about the terms and obligations of both parties involved and include signatures. While it's possible to create one, using a template like the New Hampshire Choreographer Services Contract - Self-Employed from USLegalForms can ensure you include all necessary elements.

The employment agreement in New Hampshire is a legal document outlining the terms of employment between an employer and employee. It typically includes provisions regarding duties, compensation, benefits, and termination policies. Understanding these details is essential for compliance and clarity. For specific needs like a New Hampshire Choreographer Services Contract - Self-Employed, USLegalForms provides templates to help you draft an effective agreement.

Writing a self-employed contract involves presenting clear terms regarding services offered and payment rates. Make sure to define the start and end dates of the project, if applicable, along with cancellation conditions. A well-structured document protects the interests of both parties. For an easy solution, consider using a New Hampshire Choreographer Services Contract - Self-Employed from USLegalForms.

When writing a contract for a 1099 employee, specify the work to be done along with payment details. Clarify the nature of the working relationship to establish independence, which is important for taxes. Include terms for termination and any necessary compliance language for the state. For an effective structure, explore USLegalForms, where you can find a New Hampshire Choreographer Services Contract - Self-Employed template.

Proof of self-employment can be provided through various documents such as tax returns, invoicing records, or a business license. You might also include contracts with clients that indicate your independent status. Maintaining organized records strengthens your position. If you need appropriate forms or guidance, USLegalForms offers useful resources tailored for a New Hampshire Choreographer Services Contract - Self-Employed.

To write a self-employment contract, start by clearly stating the names of the parties involved. Include essential details such as the scope of services, payment terms, and duration of the agreement. It's crucial to outline responsibilities and expectations to prevent misunderstandings. For a robust framework, consider utilizing a New Hampshire Choreographer Services Contract - Self-Employed template from USLegalForms.

Whether you use 'self-employed' or 'independent contractor' can depend on context. Both terms cover similar concepts, but 'independent contractor' is often used in legal settings, especially in contracts like a New Hampshire Choreographer Services Contract - Self-Employed. Clarity in terminology helps convey your work relationship accurately.

Absolutely, a self-employed person can and should have a contract. A New Hampshire Choreographer Services Contract - Self-Employed establishes the terms of your working relationship, which protects both you and your clients. Clear contracts lead to clearer expectations and smoother transactions.