New Hampshire Plan of Merger between two corporations

Description

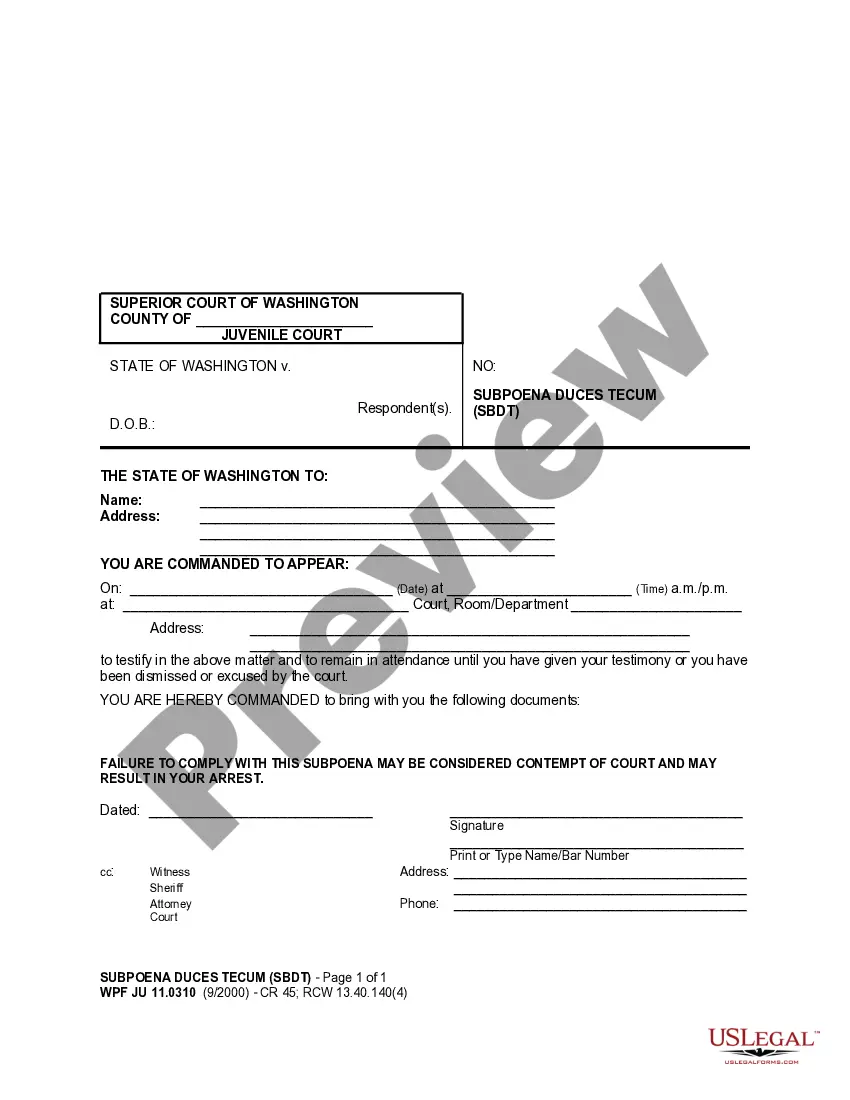

How to fill out Plan Of Merger Between Two Corporations?

If you want to total, acquire, or printing legal record web templates, use US Legal Forms, the biggest selection of legal kinds, that can be found on the web. Use the site`s simple and hassle-free lookup to get the documents you want. Various web templates for organization and person reasons are categorized by categories and says, or search phrases. Use US Legal Forms to get the New Hampshire Plan of Merger between two corporations within a few mouse clicks.

If you are already a US Legal Forms buyer, log in in your profile and click on the Download key to get the New Hampshire Plan of Merger between two corporations. Also you can access kinds you in the past saved inside the My Forms tab of your profile.

If you work with US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have selected the form to the right town/nation.

- Step 2. Utilize the Preview method to look over the form`s information. Don`t forget to learn the outline.

- Step 3. If you are unsatisfied with the develop, make use of the Lookup discipline near the top of the monitor to discover other models of your legal develop template.

- Step 4. After you have located the form you want, click the Get now key. Pick the rates prepare you like and add your qualifications to register for an profile.

- Step 5. Method the financial transaction. You can utilize your charge card or PayPal profile to perform the financial transaction.

- Step 6. Select the file format of your legal develop and acquire it on the gadget.

- Step 7. Comprehensive, modify and printing or signal the New Hampshire Plan of Merger between two corporations.

Each and every legal record template you purchase is yours permanently. You possess acces to each develop you saved inside your acccount. Click on the My Forms portion and select a develop to printing or acquire once more.

Contend and acquire, and printing the New Hampshire Plan of Merger between two corporations with US Legal Forms. There are millions of professional and status-certain kinds you can utilize for your organization or person requirements.

Form popularity

FAQ

Consolidation definition In other words, it's when two companies (or more) merge and become one. Many of the world's largest corporations were formed by business consolidation, while more recent examples include Facebook's acquisition of Instagram and Disney's acquisition of Fox.

Sec. 76. Plan or merger of consolidation. - Two or more corporations may merge into a single corporation which shall be one of the constituent corporations or may consolidate into a new single corporation which shall be the consolidated corporation.

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

Plan of merger or consolidation. ? Two or more corporations may merge into a single corporation which shall be one constituent corporations or may consolidate into a new single corporation which shall be consolidated corporation.

Merger Parties means, individually and collectively, the Company, the Shareholders, Merger Sub and Buyer.

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

The reasons behind consolidation include operational efficiency, eliminating competition, and getting access to new markets. There are different types of business consolidation, including statutory consolidation, statutory mergers, stock acquisitions, and variable interest entities.