New Hampshire Approval of employee stock purchase plan for The American Annuity Group, Inc.

Description

How to fill out Approval Of Employee Stock Purchase Plan For The American Annuity Group, Inc.?

US Legal Forms - one of many most significant libraries of legitimate forms in the USA - delivers a variety of legitimate document layouts you can acquire or print out. Using the internet site, you may get 1000s of forms for enterprise and person uses, categorized by classes, states, or search phrases.You can get the newest versions of forms much like the New Hampshire Approval of employee stock purchase plan for The American Annuity Group, Inc. in seconds.

If you currently have a monthly subscription, log in and acquire New Hampshire Approval of employee stock purchase plan for The American Annuity Group, Inc. from the US Legal Forms catalogue. The Obtain option will appear on each and every develop you view. You have accessibility to all formerly downloaded forms inside the My Forms tab of your respective account.

If you would like use US Legal Forms initially, listed here are easy instructions to get you started out:

- Be sure you have selected the right develop for the metropolis/area. Select the Preview option to analyze the form`s content. Look at the develop information to actually have chosen the correct develop.

- In case the develop does not match your requirements, take advantage of the Look for industry towards the top of the display screen to obtain the one who does.

- If you are content with the form, confirm your decision by clicking on the Get now option. Then, select the prices program you favor and give your references to register for the account.

- Procedure the purchase. Make use of credit card or PayPal account to complete the purchase.

- Pick the formatting and acquire the form on your own gadget.

- Make modifications. Fill out, revise and print out and indicator the downloaded New Hampshire Approval of employee stock purchase plan for The American Annuity Group, Inc..

Each and every format you included with your money lacks an expiration time and is also yours permanently. So, if you want to acquire or print out another backup, just proceed to the My Forms area and then click on the develop you require.

Obtain access to the New Hampshire Approval of employee stock purchase plan for The American Annuity Group, Inc. with US Legal Forms, probably the most extensive catalogue of legitimate document layouts. Use 1000s of skilled and state-particular layouts that meet up with your company or person demands and requirements.

Form popularity

FAQ

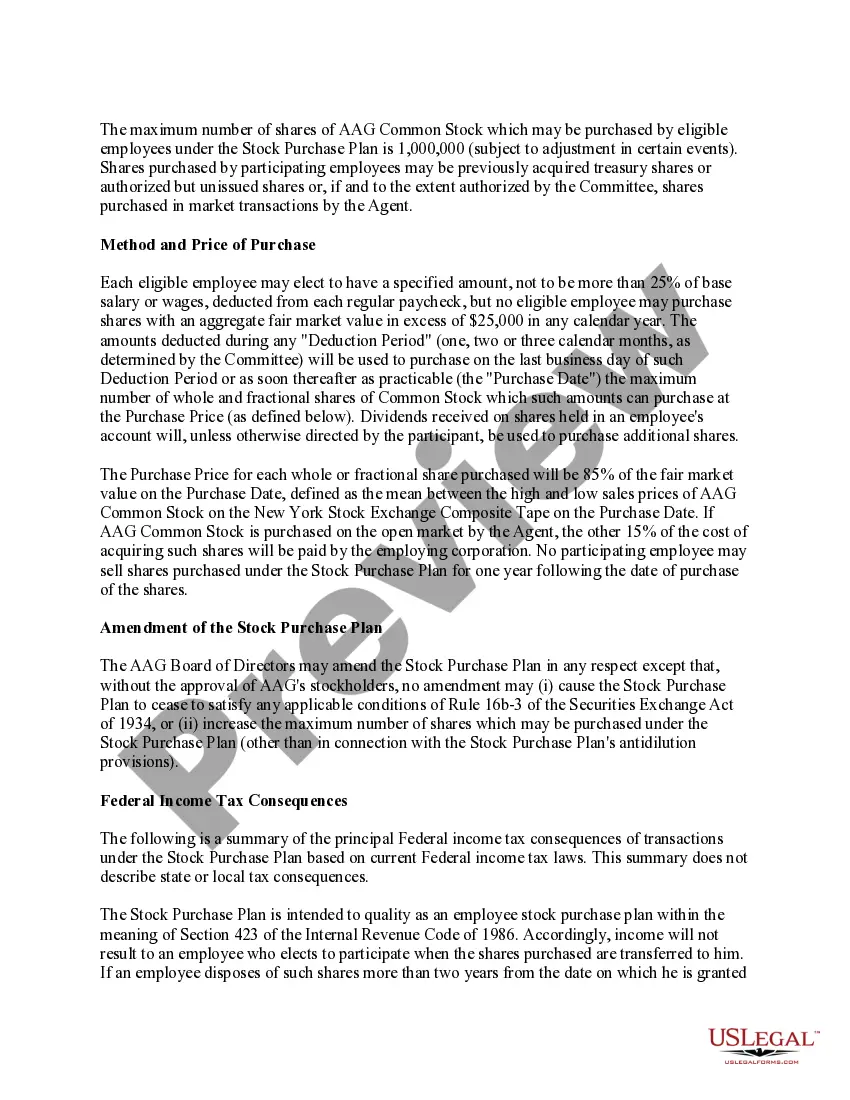

Once approved by the stockholders, an ESPP does not need to be approved by the stockholders again unless there is an amendment to the ESPP that would be considered the ?adoption of a new plan.? As a practical matter, this means a change in the number of shares reserved for issuance or a change in the related ...

Under a Section 423 plan, the IRS limits purchases to $25,000 worth of stock value (based on the FMV on the offering date) for each calendar year.

If you are risk-averse, you might consider selling your ESPP shares right away so you don't have overexposure in one stock, particularly that of your own employer. ESPP shares can put you in an overexposed position. If the stock value goes down, you may suffer losses and in extreme cases, even lose your job.

How is the $25,000 limit calculated? The basic rule is that each employee cannot purchase more than $25,000 per year, valued using the fair market value on the date he/she enrolled in the current offering.

You may withdraw from the ESPP by notifying Fidelity and completing a withdrawal election. When you withdraw, all of the contributions accumulated in your account will be returned to you as soon as administratively possible and you will not be able to make any further contributions during that offering period.

Qualifying disposition: You sold the stock at least two years after the offering (grant date) and at least one year after the exercise (purchase date). If so, a portion of the profit (the ?bargain element?) is considered compensation income (taxed at regular rates) on your Form 1040.

Employee Stock Purchase Plans (ESPPs) are widely regarded as one of the most simple and straightforward equity compensation strategies available to businesses today. There are two major types of ESPP: 1) Qualified ESPP offering tax advantages and 2) Non-qualified ESPP offering flexibility.

If your company offers a tax-qualified ESPP and you decide to participate, the IRS will only allow you to purchase a maximum of $25,000 worth of stock in a calendar year. Any contributions that exceed this amount are refunded back to you by your company.