New Hampshire Employment Status Form

Description

How to fill out Employment Status Form?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a wide range of legal document templates that you can download or print.

By using the website, you can locate thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest types of forms such as the New Hampshire Employment Status Form in just minutes.

If you already have a subscription, sign in and download the New Hampshire Employment Status Form from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously saved forms from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Complete, modify and print, and sign the saved New Hampshire Employment Status Form. Each design added to your account has no expiration date and is yours permanently. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the New Hampshire Employment Status Form with US Legal Forms, the most comprehensive library of legal document templates. Utilize a vast array of professional and state-specific templates that cater to your business or personal requirements.

- Be sure to select the correct form for your city/county.

- Click the Preview button to review the form's content.

- Check the form description to verify that you have picked the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose the pricing plan you desire and provide your information to register for an account.

Form popularity

FAQ

In New Hampshire, state UI tax is one of the primary taxes that employers must pay. Unlike most other states, New Hampshire does not have state withholding taxes. However, other important employer taxes, not covered here, include federal UI and withholding taxes.

Do You Need Help With SUI?Alabama. SUI Tax Rate: 0.65% - 6.8%Alaska. SUI Tax Rate: 1.00% - 5.4%Arizona. SUI Tax Rate: 0.05% - 12.76%Arkansas. SUI Tax Rate: 0.4% - 14.3%California. SUI Tax Rate: 1.5% - 6.2%Colorado. SUI Tax Rate: 0.62% - 8.15%Connecticut. SUI Tax Rate: 1.9% - 6.8%Delaware. SUI Tax Rate: 0.3% - 8.2%More items...

Form 1099Gs issued from 2009 through 2020 are available online by logging into the unemployment benefit system and going to your correspondence box. If you need a Form 1099G for a year prior to 2009 please contact the Unemployment Hotline at (603) 271-7700 and speak with a customer service representative.

New Hampshire is one of four states (New Hampshire, New Jersey, Tennessee and Vermont) that assign SUI tax rates on a fiscal year, rather than a calendar year, basis.

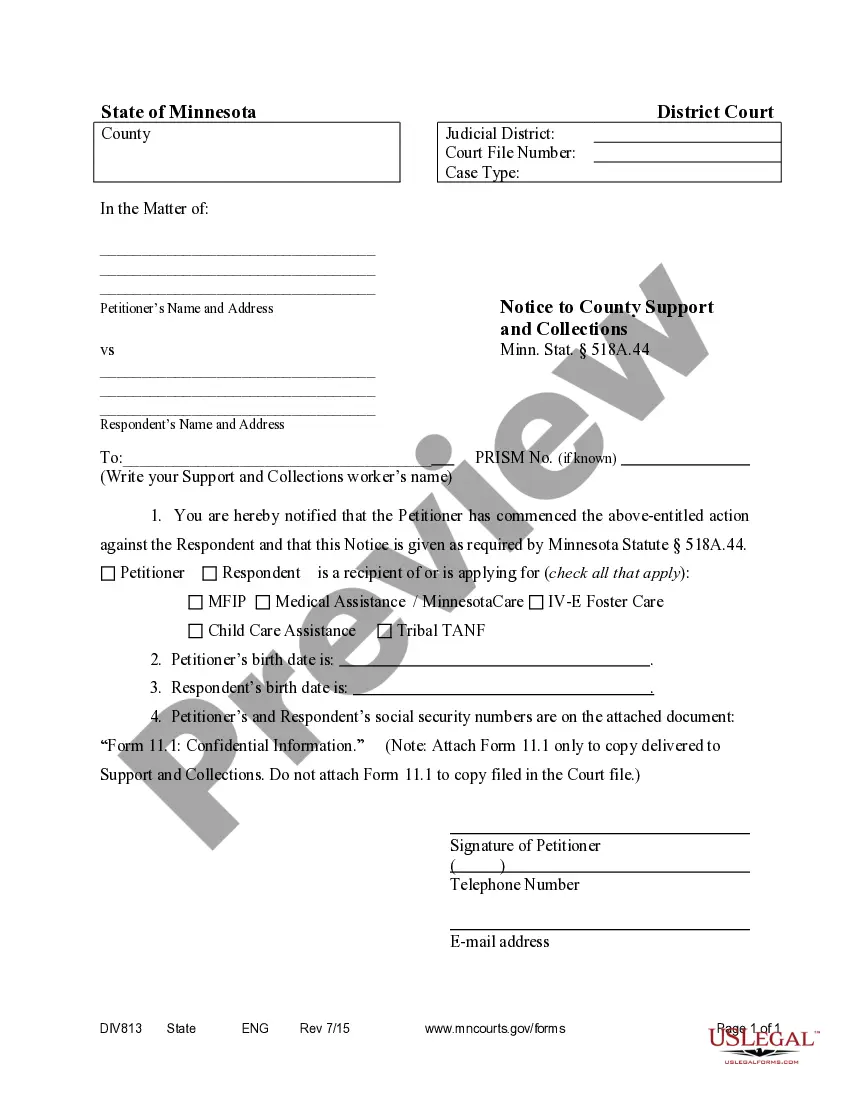

The Employer Status Report must be completed within 30 days of first furnishing employment and can be found on- line at . This is the initial registration form for a state unemployment account number.

If you've filed state payroll tax returns in the past, you can find your NHES Employer Account Number on any previously submitted quarterly tax filing. The NHES Employer Account Number is a nine-digit number in the following format: XXXXXXXXX. Contact the NHES via phone at 603-228-4033 or 603-228-4034.

A. The New Hampshire new employer tax rate is 2.7% (UI Rate: 2.3% / AC Rate: 0.4%).

NH employees do not pay any taxes for the unemployment program.