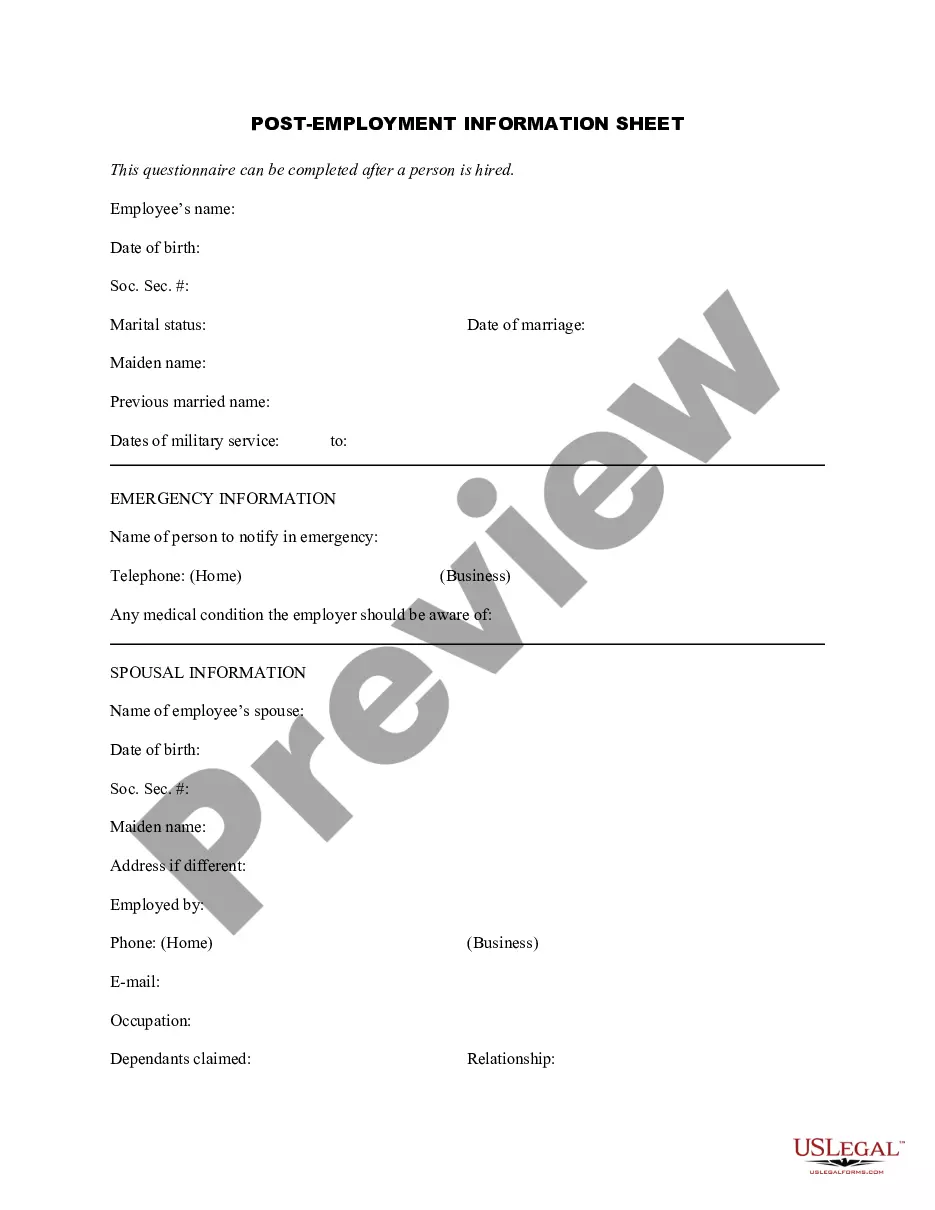

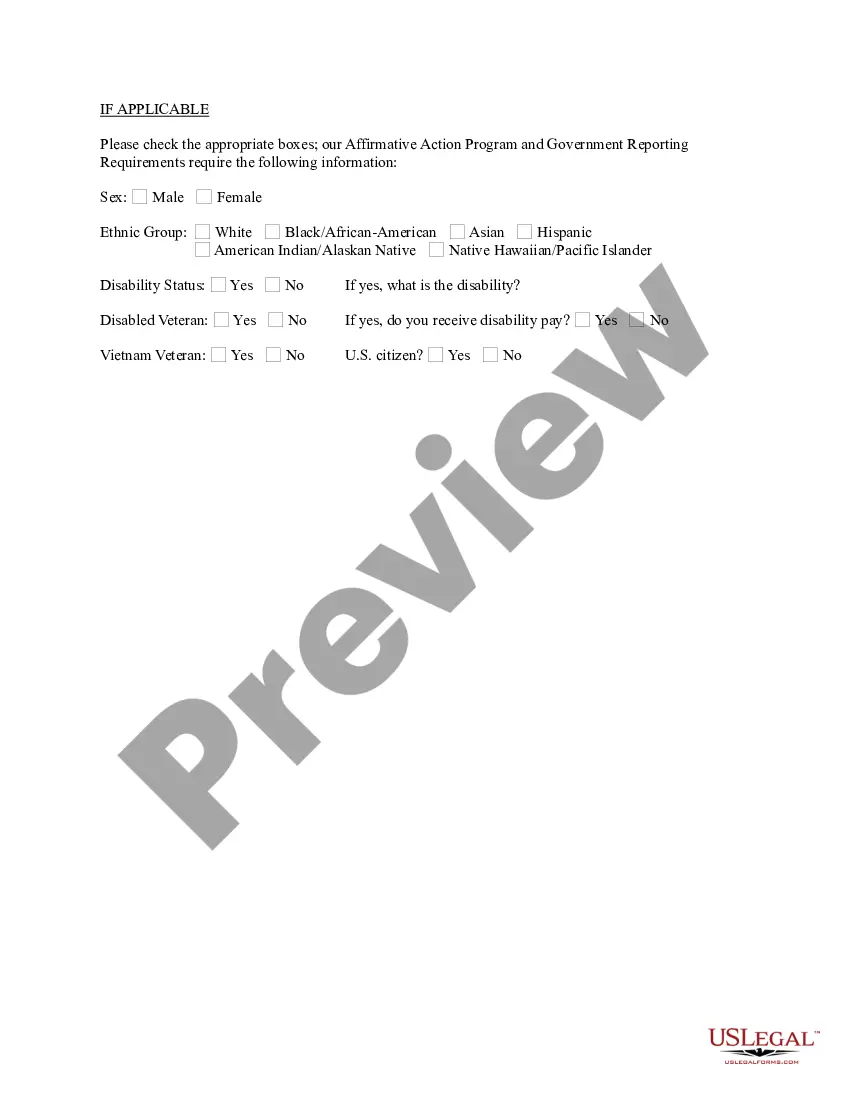

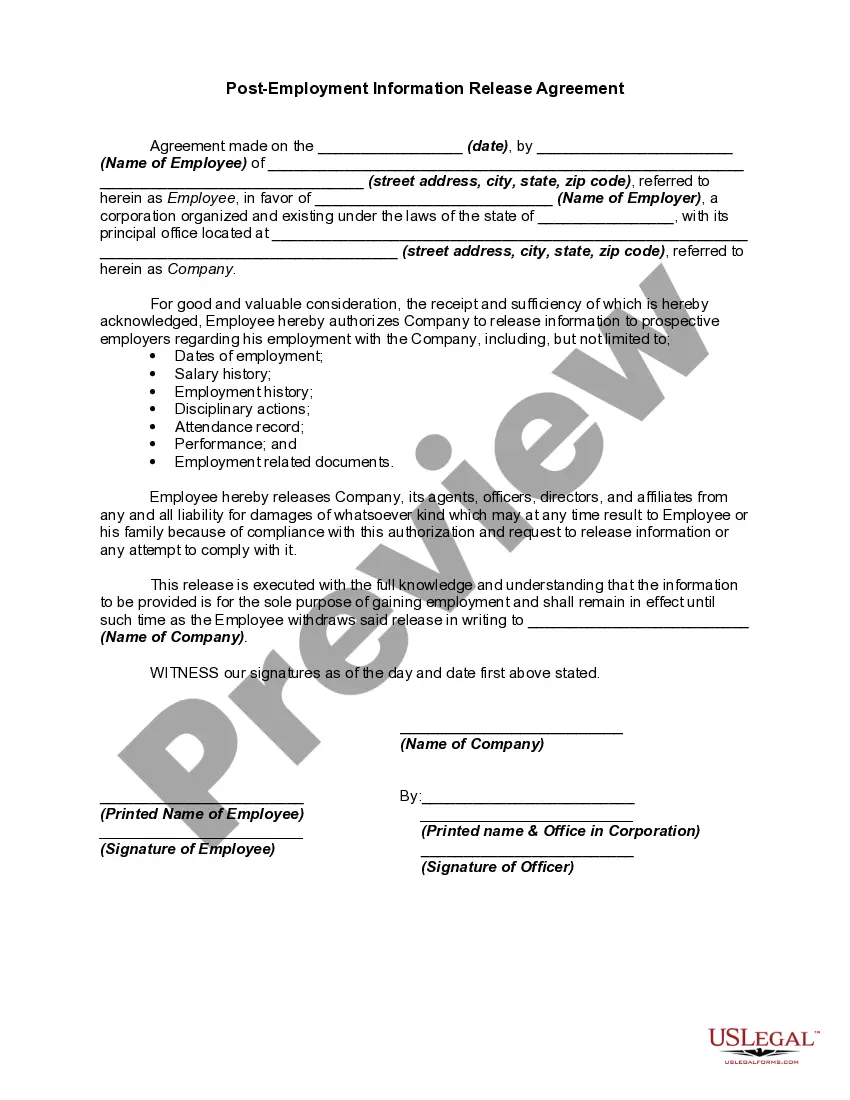

New Hampshire Post-Employment Information Sheet

Description

How to fill out Post-Employment Information Sheet?

Finding the correct authentic document template might be challenging.

Of course, there are numerous templates accessible online, but how do you find the authentic form you require.

Utilize the US Legal Forms website. The platform provides a vast array of templates, such as the New Hampshire Post-Employment Information Sheet, suitable for both business and personal needs.

If the form does not satisfy your requirements, use the Search field to find the appropriate form. Once you are confident that the form is correct, click the Buy Now button to acquire the form. Choose your preferred pricing plan and enter the necessary information. Create your account and pay for the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the received New Hampshire Post-Employment Information Sheet. US Legal Forms is the largest collection of legal forms from which you can obtain various document templates. Use the service to obtain professionally crafted documents that adhere to state requirements.

- All of the forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to retrieve the New Hampshire Post-Employment Information Sheet.

- Use your account to search for the legal forms you may have purchased previously.

- Visit the My documents section of your account to obtain an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward instructions to follow.

- First, ensure you have selected the correct form for your city/state. You can examine the form using the Preview button and review the form details to confirm it is suitable for you.

Form popularity

FAQ

The State Unemployment Insurance or SUI tax is funded by employers and offers short-term benefits to employees who have lost or left a job for various reasons.

Weekly claims, also known as Continued Claims, filed on Saturday or Sunday are normally processed on Monday evening and eligible benefit payments and documents issued on Tuesday morning.

The New Hampshire Department of Employment Security announced that as a result of the state's decreased unemployment insurance (UI) trust fund balance due to COVID-19 UI benefits, employers will see an increase in their state unemployment insurance (SUI) tax rates for second- and third-quarter 2020.

How to File your Weekly Continued ClaimStep 1: Login. From this welcome screen, you will need to click on Login at the bottom of the page.Step 2: Select File for Benefits on The Dashboard.Step 3: Select Your Location.Step 4: Click the link File for weekly benefits for week ending2026Step 5: Weekly Claim.

As a general matter, you are likely to be eligible for PUA due to concerns about exposure to the coronavirus only if you have been advised by a healthcare provider to self-quarantine as a result of such concerns.

This can be done online or by visiting the nearest NH Employment Security office to file your claim on a computer in one of our Resource Centers. You must open your claim during the week your hours are reduced or, if you became unemployed from full-time work on Thursday or Friday, open your claim on Sunday or Monday.

The Employer Status Report must be completed within 30 days of first furnishing employment and can be found on- line at . This is the initial registration form for a state unemployment account number.

New Hampshire's unemployment tax rates for the third quarter of 2021 are unchanged, the state Employment Security department said July 9. Effective from July 1, 2021, to Sept 30, 2021, tax rates for positive-rated employers range from 0.1% to 2.7% and rates for negative-rated employers range from 4.3% to 8.5%.

SUI, which stands for State Unemployment Insurance, is an employer-funded tax that offers short-term benefits to employees who lost their jobs through a layoff or a firing that is not misconduct related. As with many things payroll and taxes, SUI tax rates vary by state, and we have the most current rate ranges below.

New Hampshire is one of four states (New Hampshire, New Jersey, Tennessee and Vermont) that assign SUI tax rates on a fiscal year, rather than a calendar year, basis.