New Hampshire Employee Evaluation Form for Sole Trader

Description

How to fill out Employee Evaluation Form For Sole Trader?

Selecting the appropriate legal document template can be challenging. There is undoubtedly a wide range of templates available online, but how can you find the legal form you require? Utilize the US Legal Forms platform. This service offers thousands of templates, including the New Hampshire Employee Evaluation Form for Sole Trader, suitable for business and personal needs. All forms are vetted by experts and comply with state and federal regulations.

If you are already a registered user, Log In to your account and click the Download button to obtain the New Hampshire Employee Evaluation Form for Sole Trader. Use your account to browse through the legal forms you have previously purchased. Visit the My documents section of your account and retrieve another copy of the document you need.

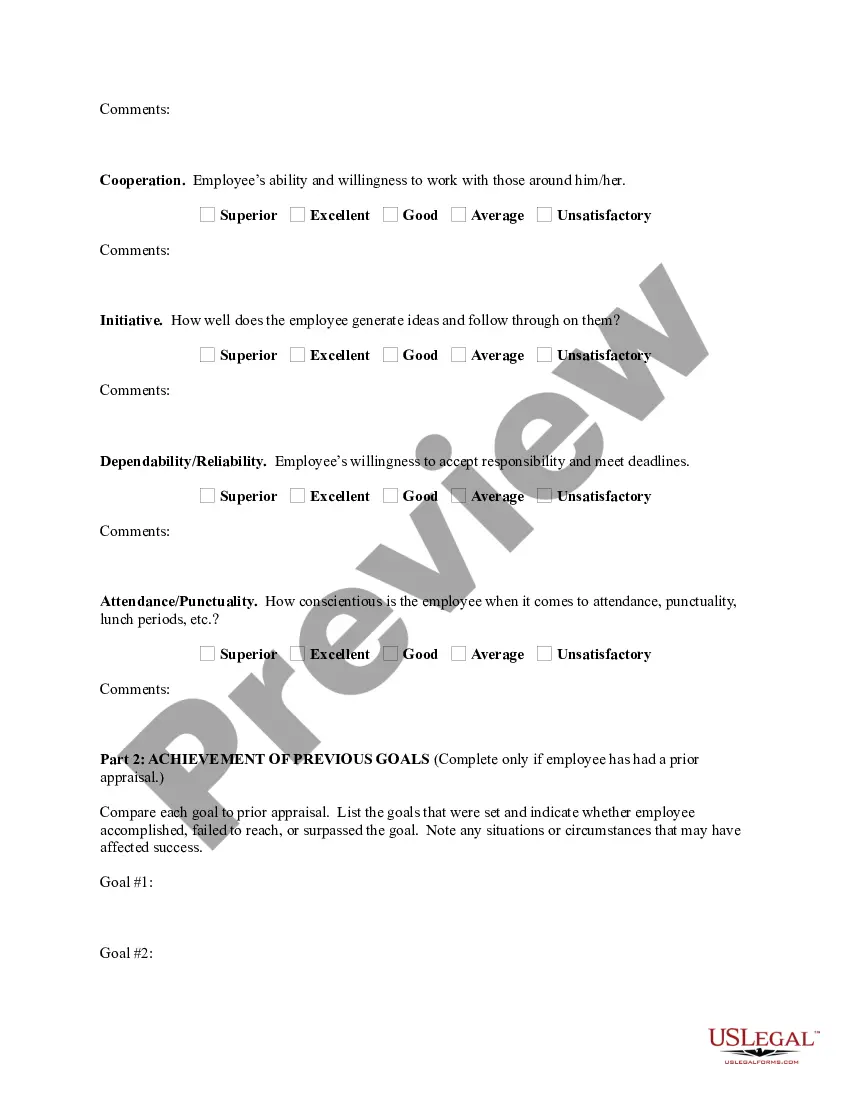

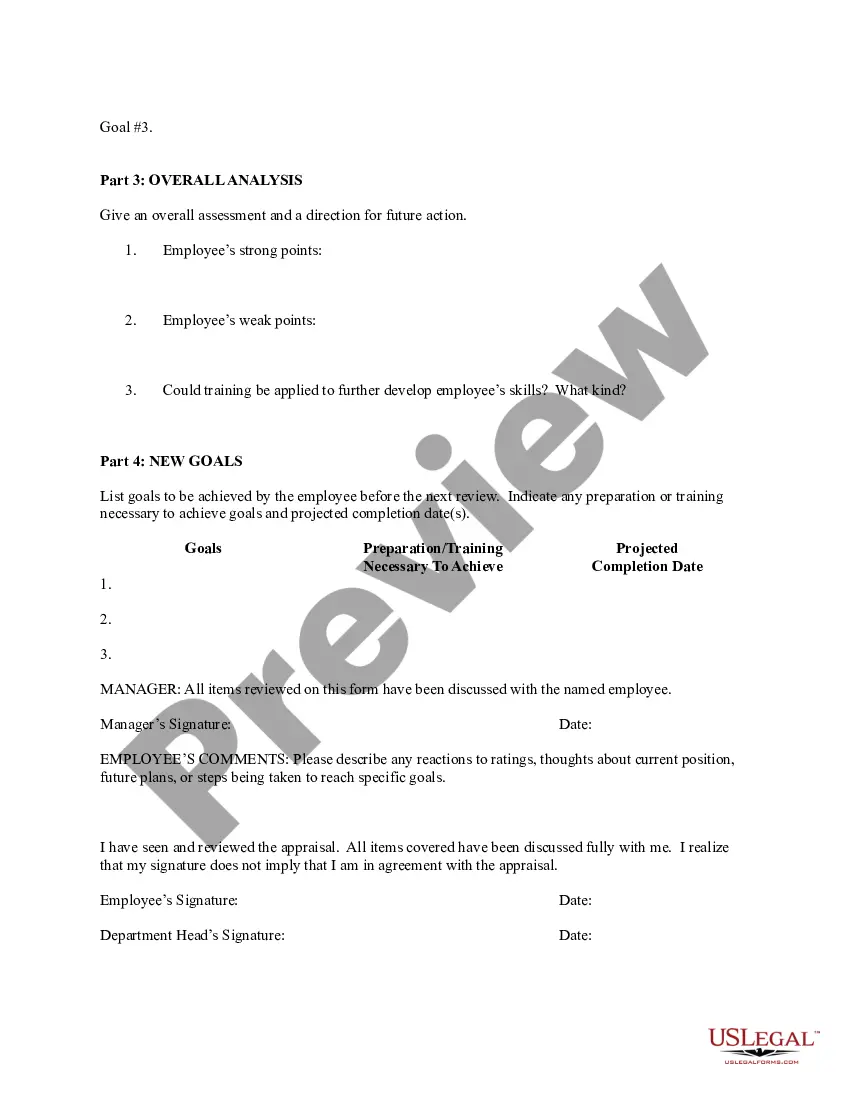

For new users of US Legal Forms, here are simple steps to follow: First, make sure you have chosen the right form for your state/county. You can review the form using the Preview button and read the form description to confirm that it is the correct choice for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are sure the form works, click the Acquire now button to obtain the form.

- Select the pricing plan you prefer and enter the necessary information.

- Create your account and complete the payment using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Fill out, modify, print, and sign the downloaded New Hampshire Employee Evaluation Form for Sole Trader.

- US Legal Forms is the largest repository of legal forms where you can find various document templates.

- Utilize the service to obtain professionally-crafted documents that comply with state regulations.

Form popularity

FAQ

Every business organization with gross business income from all business activities of more than $50,000 must file a BPT return. For taxable periods ending on or after December 31, 2022, this filing threshold is increased to $92,000. The Business Enterprise Tax ("BET") was enacted in 1993.

Individuals: Individuals who are residents or inhabitants of New Hampshire for any part of the tax year must file a return if they received more than $2,400 of gross interest and/or dividend income for a single individual or $4,800 of such income for a married couple filing a joint New Hampshire return.

All business organizations, including corporations, fiduciaries, partnerships, proprietorships, combined groups, and homeowners' associations must file a Business Profits Tax return provided they are carrying on business activity within New Hampshire and their gross business income from everywhere is in excess of

All business organizations, including corporations, fiduciaries, partnerships, proprietorships, combined groups, and homeowners' associations must file a Business Profits Tax return provided they are carrying on business activity within New Hampshire and their gross business income from everywhere is in excess of

New Hampshire does not tax individuals' earned income, so you are not required to file an individual New Hampshire tax return. The state only taxes interest and dividends at 5% on residents and fiduciaries whose gross interest and dividends income, from all sources, exceeds $2,400 annually ($4,800 for joint filers).

The current self-employment tax rate is 15.3 percent.

For inquiries, call (603) 230-5920. Form BT-Summary must be filed by all business organizations that are required to file a Business Profits Tax and/or a Business Enterprise Tax return.

A BET return must be filed if a business enterprise's gross business receipts exceed $150,000 or if its enterprise value tax base is greater than $75,000. Gross business receipts is from all sources and not limited to New Hampshire sourced receipts.

In New Hampshire, state UI tax is one of the primary taxes that employers must pay. Unlike most other states, New Hampshire does not have state withholding taxes. However, other important employer taxes, not covered here, include federal UI and withholding taxes.