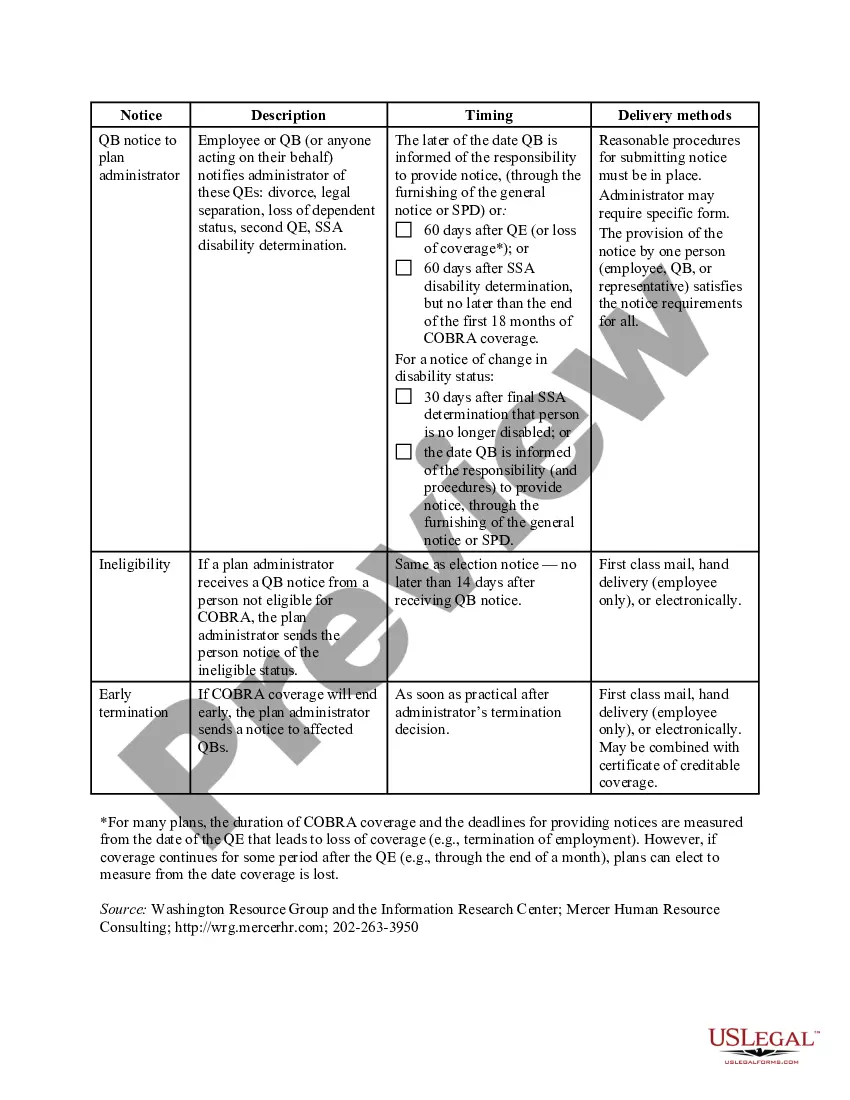

New Hampshire COBRA Notice Timing Delivery Chart

Description

How to fill out COBRA Notice Timing Delivery Chart?

If you require to finish, acquire, or create official document templates, utilize US Legal Forms, the largest collection of legal forms available on the web.

Leverage the site's simple and user-friendly search feature to obtain the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find alternate versions of the legal form template.

Step 4. Once you have located the necessary form, click the Buy now button. Select the pricing plan you prefer and enter your credentials to register for the account.

- Use US Legal Forms to access the New Hampshire COBRA Notice Timing Delivery Chart in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to find the New Hampshire COBRA Notice Timing Delivery Chart.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If this is your first time using US Legal Forms, refer to the instructions below.

- Step 1. Make sure you have selected the form relevant to the appropriate city/state.

- Step 2. Use the Preview option to review the form's content. Don’t forget to check the details.

Form popularity

FAQ

In New Hampshire, COBRA coverage can last for up to 18 months for most qualifying events, such as job loss. However, certain circumstances can extend your coverage to 36 months, especially if other health insurance access changes occur. It's essential to refer to the New Hampshire COBRA Notice Timing Delivery Chart to track the start and end dates of your coverage effectively. Staying aware of the duration helps you plan your healthcare needs more efficiently.

New York State law requires small employers (less than 20 employees) to provide the equivalent of COBRA benefits. You are entitled to 36 months of continued health coverage at a monthly cost to you of 102% of the actual cost to the employer which may be different from the amount deducted from your paychecks.

Are there penalties for failing to provide a COBRA notice? Yes, and the penalties can be substantial. Under the Employment Retirement Income Security Act of 1974 (ERISA), a penalty of up to $110 per day may be imposed for failing to provide a COBRA notice.

COBRA coverage follows a "qualifying event". An example of a qualifying event would be if your hours were reduced or you lost your job (as long as there was no gross misconduct). Your employer must mail you the COBRA information and forms within 14 days after receiving notification of the qualifying event.

If You Do Not Receive Your COBRA PaperworkReach out to the Human Resources Department and ask for the COBRA Administrator. They may use a third-party administrator to handle your enrollment. If the employer still does not comply you can call the Department of Labor at 1-866-487-2365.

In most cases, COBRA provides for continuation of health plan coverage for up to 18 months following the work separation. COBRA rights accrue once a "qualifying event" occurs - basically, a qualifying event is any change in the employment relationship that results in loss of health plan benefits.

Initial COBRA notices must generally be provided within 14 days of the employer notifying the third-party administrator (TPA) of a qualifying event.

Federal COBRA & New Hampshire Continuation of Coverage Consolidated Omnibus Budget Reconciliation Act Continuation Coverage (COBRA) is a Federal law that gives employees and their covered dependents, who lose health benefits, the right to continue their coverage, in most cases, a maximum of 18 months.

DOL ERISA Penalties An employer is liable up to an additional $110 per day per participant if they fail to provide initial COBRA notices. ERISA can also hold any fiduciary personally liable for non-compliance.

COBRA is automatically available to you if you stop working at a qualified employer that provided group health insurance, but your participation in the program is not automatic. You must complete an enrollment form within the specified period of time and pay your first insurance premium.