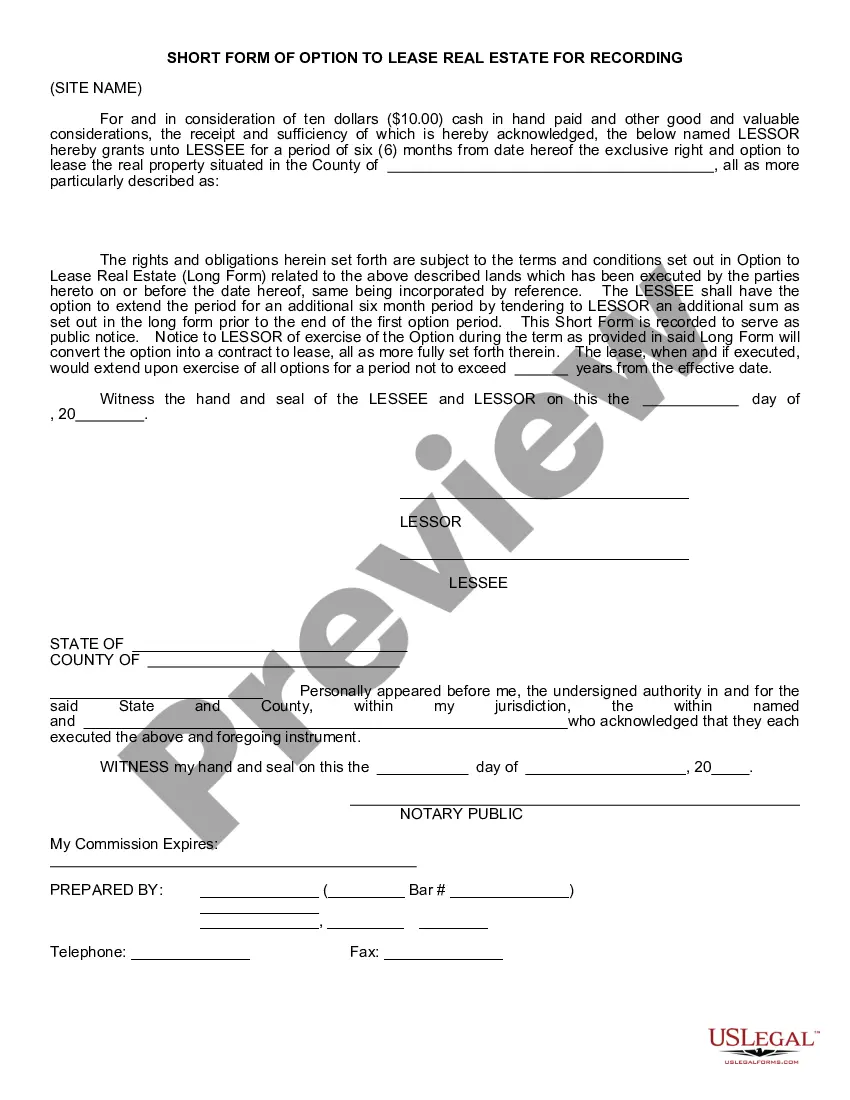

New Hampshire Option to Lease Real Estate - Short form for recording

Description

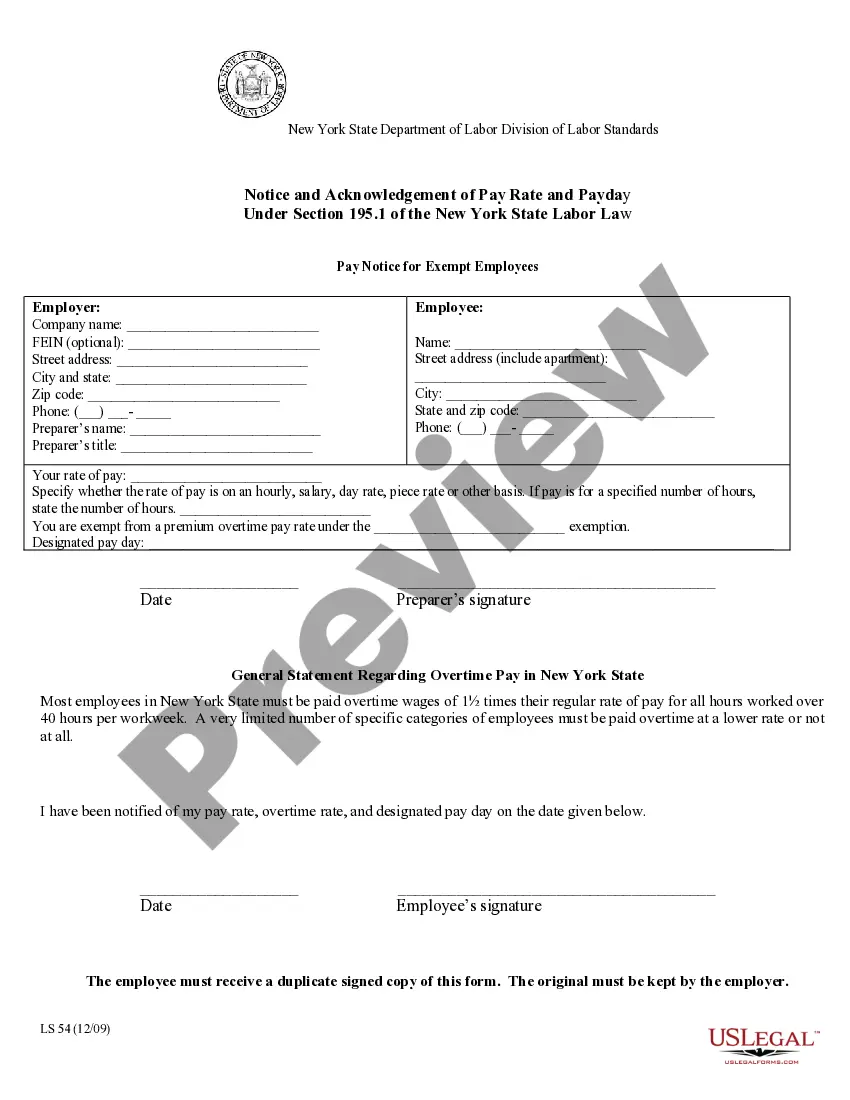

How to fill out Option To Lease Real Estate - Short Form For Recording?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates that you can download or print.

By using the site, you can access thousands of documents for business and personal purposes, organized by categories, states, or keywords. You will find the latest versions of documents such as the New Hampshire Option to Lease Real Estate - Short form for quick recording.

If you already have a subscription, Log In and download the New Hampshire Option to Lease Real Estate - Short form for recording from the US Legal Forms library. The Download button will be visible on every document you view. You can access all previously downloaded documents in the My documents tab of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Choose the format and download the document to your device. Make changes. Complete, modify, print, and sign the downloaded New Hampshire Option to Lease Real Estate - Short form for recording. Each template you add to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the document you desire. Access the New Hampshire Option to Lease Real Estate - Short form for recording with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have selected the correct document for your city/state.

- Click the Preview button to review the document's content.

- Check the document information to ensure you have chosen the right one.

- If the document does not meet your needs, use the Search box at the top of the screen to find the suitable one.

- Once you are satisfied with the document, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you want and provide your details to create your account.

Form popularity

FAQ

Let's start by defining a NNN lease a lease in which the tenant agrees to be responsible for paying rent in addition to all of the operating expenses, including taxes, insurance, repairs and utilities. When any one of these items is covered by the landlord, the roof for example, it becomes a NN lease.

To record a lease agreement means to file a copy of the lease agreement with the local county land records office.

Recording and Constructive Notice. California law does not require a lease or a memorandum of a lease to be recorded to recognize the validity of an unrecorded lease: Between the landlord and the tenant.

In New York, to record a memorandum of lease, it must contain:The names and addresses of the landlord and tenant.A reference to the full unrecorded lease.The date of execution of the lease.A description of the leased premises in the form contained in the lease.The lease term, including:More items...

Lease payments. As the company receives lease invoices from the lessor, record a portion of each invoice as interest expense and use the remainder to reduce the balance in the capital lease liability account. Eventually, this means that the balance in the capital lease liability account should be brought down to zero.

A lease purchase agreement in real estate is a rent-to-own contract between a tenant and a landlord for the former to purchase the property at a later point in time. The renter pays the seller an option fee at an agreed-upon purchase price, giving them exclusive rights to buy the property.

Generally, recording of the lease protects the tenant against subsequent claims to the property. If the Landowner dies or sells the property during the lease term, a recorded lease helps ensure that the new owner adheres to the lease agreement (if that is specifically stated in the lease).

A double net lease is a rental agreement whereby the tenant agrees to cover the costs of two of the three primary property expenses: taxes, utilities, or insurance premiums. Also known as a net-net (NN) lease, these are most commonly found among commercial tenants.

A break clause (also known as Option to Determine) can be included in a lease to allow either the landlord or the tenant to bring the lease to an end early.

A single net lease requires the tenant to pay only the property taxes in addition to rent. With a double net lease, the tenant pays rent plus the property taxes as well as insurance premiums. A triple net lease, also known as a net-net-net lease, requires the tenant to pay rent plus all three additional expenses.