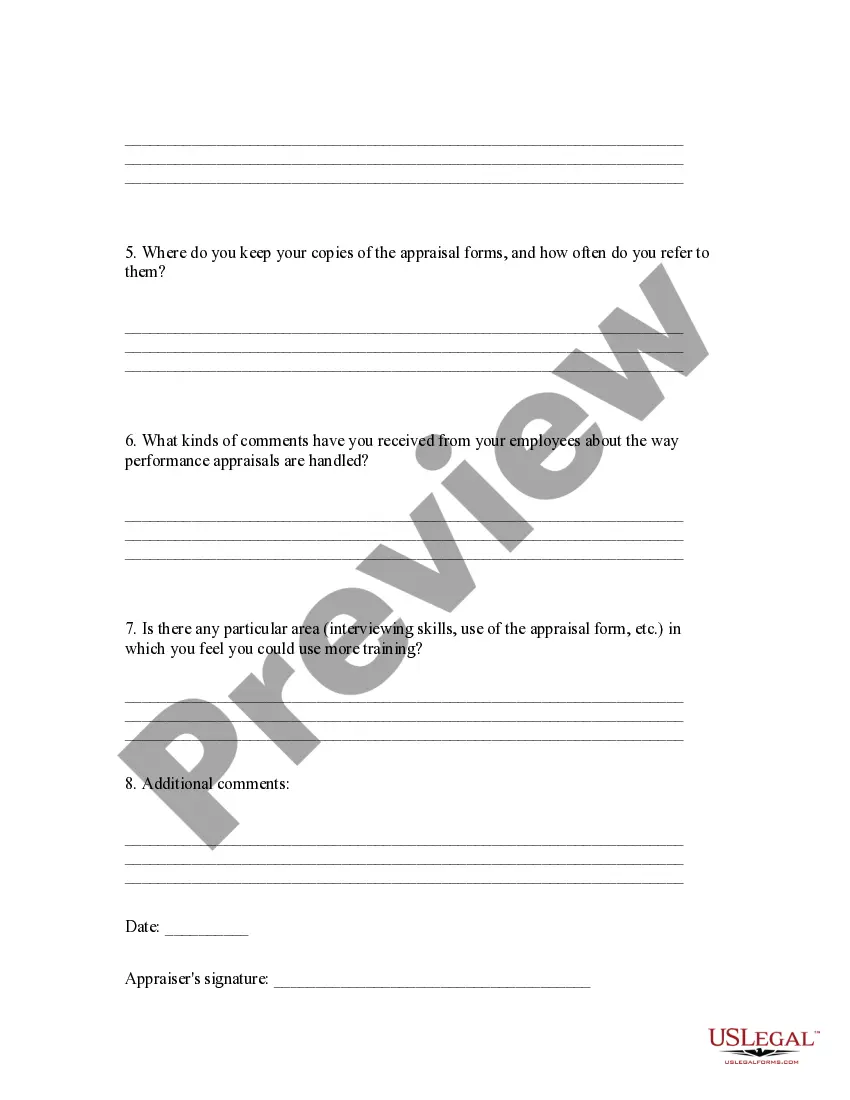

New Hampshire Appraisal System Evaluation Form

Description

How to fill out Appraisal System Evaluation Form?

If you require to obtain, download, or print authentic document templates, utilize US Legal Forms, the largest selection of legal forms accessible on the Internet.

Take advantage of the site's user-friendly and convenient search feature to find the paperwork you need. Various templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to find the New Hampshire Appraisal System Evaluation Form in just a few clicks.

Every legal document template you acquire is yours indefinitely. You have access to every form you saved in your account. Visit the My documents section and select a form to print or download again.

Compete, download, and print the New Hampshire Appraisal System Evaluation Form with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to get the New Hampshire Appraisal System Evaluation Form.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your appropriate town/region.

- Step 2. Use the Preview option to review the content of the form. Remember to check the summary.

- Step 3. If you are unsatisfied with the form, utilize the Search bar at the top of the screen to find alternative versions in the legal form template.

- Step 4. Once you have found the form you need, select the Get Now button. Choose your preferred pricing plan and provide your details to create an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the New Hampshire Appraisal System Evaluation Form.

Form popularity

FAQ

Sales Tax Formulas/Calculations:State Tax Amount = Price x (State Tax Percentage / 100)Use Tax Amount = Price x (Use Tax Percentage / 100)Local Tax Amount = Price x (Local Tax Percentage / 100)Total = Price + State Tax Amount + Use Tax Amount + Local Tax Amount.

You do not have to allow the assessors into your home. We only request the inspection in order to be as fair and accurate as possible. However, if an assessor is denied entrance, property owners give up their ability to challenge the assessed value.

Nobody is required to let an assessor into their home, though you'll probably want to. New Hampshire municipalities are required by statute to levy taxes proportionally on real estate. Most, if not all, towns hire assessing firms for this purpose.

Specifically, there is a dollar value assessed for every $1,000 of property valuation. As an example, if the tax rate is $25, and your home is valued at $250,000, your property tax would be $6,250 ($250,000/$1000 $25).

The most straightforward way to calculate effective tax rate is to divide the income tax expense by the earnings (or income earned) before taxes. Tax expense is usually the last line item before the bottom linenet incomeon an income statement.

To calculate your individual property's effective tax rate, all you have to do is divide your annual tax bill by what you estimate to be the market value of your property. So, if you own a property worth $300,000 and your annual tax bill is $10,000, then your individual effective tax rate is 3.33%.

How is Property Tax Calculated? For New Hampshire, like most other states with a property tax, the tax is assessed based on the value of the property. Specifically, there is a dollar value assessed for every $1,000 of property valuation.

The state requires that all property in a municipality be assessed at its "full and true" market value. Further the NH Constitution (Part 2 Article 6) requires that each municipality takes value anew every five years. A revaluation is the most equitable way to accomplish this.

Entry onto the property without explicit permission will be limited to what is legally known as the curtilage, which is the land and yard immediately surrounding your house. An assessor will not enter your house or dwelling unless they have specific permission.