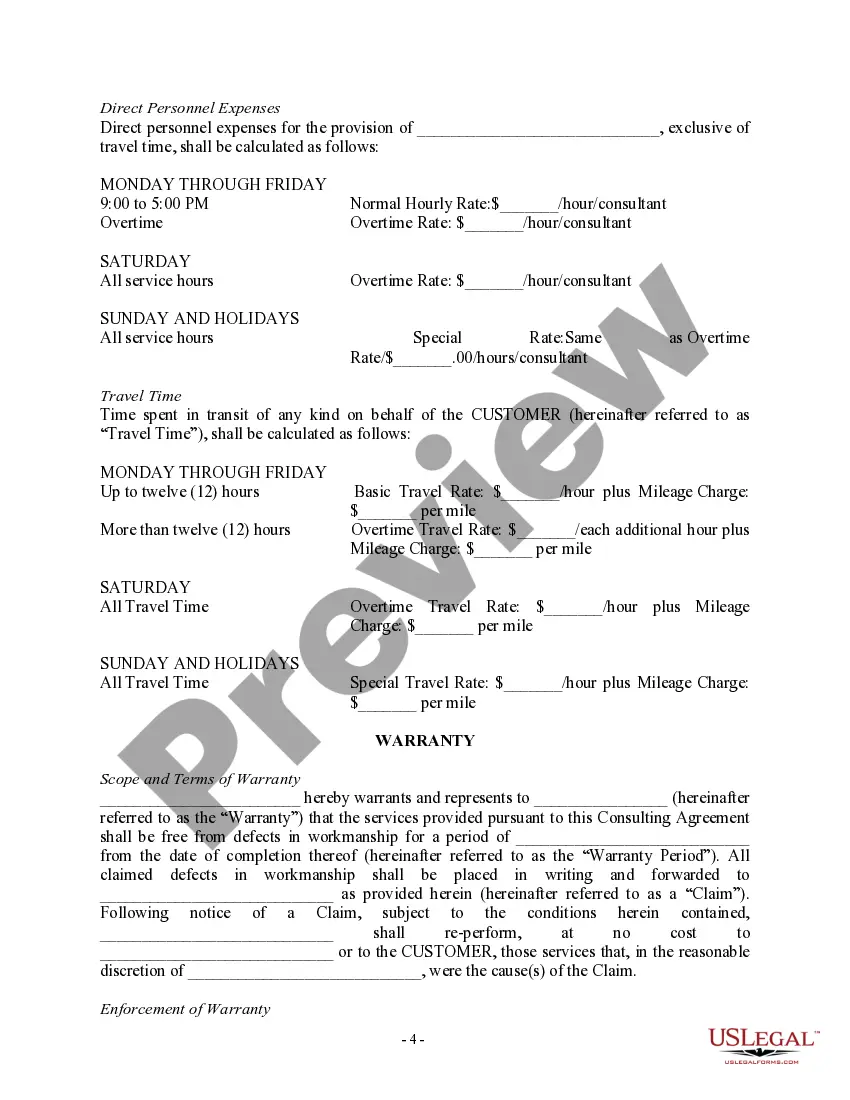

New Hampshire Self-Employed Independent Contractor Consulting Agreement - Detailed

Description

How to fill out Self-Employed Independent Contractor Consulting Agreement - Detailed?

Locating the appropriate authentic document template can be quite challenging. It is clear that there are numerous templates accessible online, but how can you locate the authentic document you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the New Hampshire Self-Employed Independent Contractor Consulting Agreement - Detailed, which you can use for both business and personal needs.

All templates are reviewed by experts and comply with state and federal regulations.

Once you are confident that the document is appropriate, click the Purchase now button to acquire the form. Choose your preferred payment plan and provide the necessary details. Create your account and complete your purchase using your PayPal account or credit card. Select the document format and download the legal paper template to your device. Finally, complete, edit, and print the New Hampshire Self-Employed Independent Contractor Consulting Agreement - Detailed. US Legal Forms is the largest repository of legal templates where you can find a variety of document formats. Use this service to obtain professionally crafted documents that adhere to state regulations.

- If you are already registered, Log In to your account and click on the Obtain button to access the New Hampshire Self-Employed Independent Contractor Consulting Agreement - Detailed.

- Use your account to search for the legal documents you have previously purchased.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple instructions to follow.

- First, ensure you have selected the correct form for your city/county. You can review the form using the Review button and examine the form summary to confirm it is suitable for you.

- If the form does not satisfy your requirements, utilize the Search field to find the correct document.

Form popularity

FAQ

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

What to Include in a ContractThe date the contract begins and when it expires.The names of all parties involved in the transaction.Any key terms and definitions.The products and services included in the transaction.Any payment amounts, project schedules, terms, and billing dates.More items...?

An independent contractor agreement between an individual independent contractor (a self-employed individual) and a client company for consulting or other services. This Standard Document is drafted in favor of the client company and is based on federal law.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.