New Hampshire Contract with Independent Contractor to Work as a Consultant

Description

How to fill out Contract With Independent Contractor To Work As A Consultant?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

Through the website, you can access thousands of forms for business and personal use, categorized by type, state, or keywords. You can obtain the latest versions of forms like the New Hampshire Agreement with Independent Contractor to Work as a Consultant in moments.

If you already have a subscription, Log In and download the New Hampshire Agreement with Independent Contractor to Work as a Consultant from the US Legal Forms library. The Download button will appear for each form you view. You can access all previously downloaded forms in the My documents section of your account.

Make modifications. Fill out, edit, print, and sign the downloaded New Hampshire Agreement with Independent Contractor to Work as a Consultant.

Every template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the New Hampshire Agreement with Independent Contractor to Work as a Consultant with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

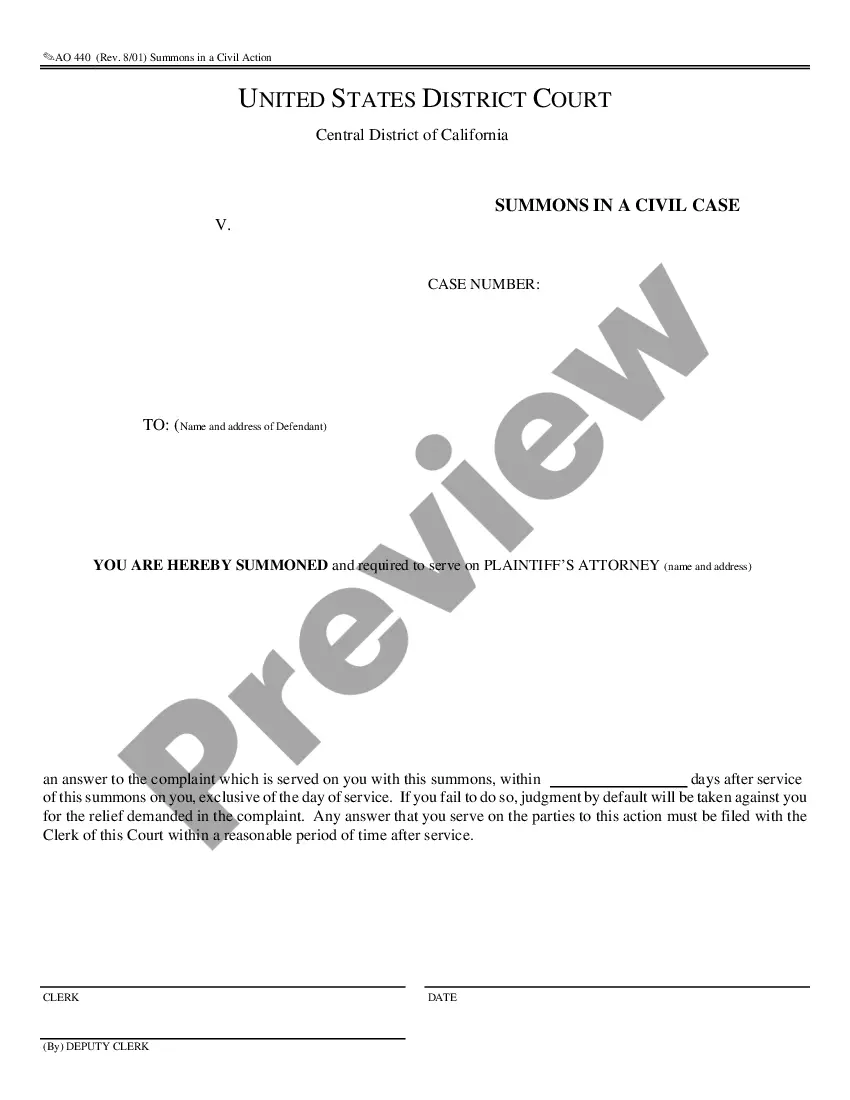

- Ensure you have selected the correct form for your city/region. Click the Review button to check the form's content. Review the form description to confirm that you have selected the appropriate form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Download now button. Then, choose the pricing plan you prefer and provide your details to register for an account.

- Process the payment. Utilize your credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

When you do consulting work in the U.S., you can be paid two different ways: as an employee on a W-2 tax basis, or on a 1099 tax basis as an independent contractor. As a consultant, being paid on a 1099 tax basis is a huge plus for two key reasons: You save more for retirement.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

In general, the difference is that the consultant's role is to evaluate a client's needs and provide expert advice and opinions on what needs to be done, while the contractors role is generally to evaluate the client's needs and actually perform the work.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.