New Hampshire Security Agreement regarding Member Interests in Limited Liability Company

Description

How to fill out Security Agreement Regarding Member Interests In Limited Liability Company?

Have you ever found yourself in a situation where you need to handle documentation for both business or particular tasks nearly every day.

There are numerous legal document templates accessible online, but identifying trustworthy ones can be challenging.

US Legal Forms provides a vast array of template forms, such as the New Hampshire Security Agreement concerning Member Interests in Limited Liability Company, designed to meet federal and state requirements.

Once you locate the appropriate form, click Get now.

Choose the payment plan you prefer, fill in the necessary information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Hampshire Security Agreement regarding Member Interests in Limited Liability Company template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for your correct city/region.

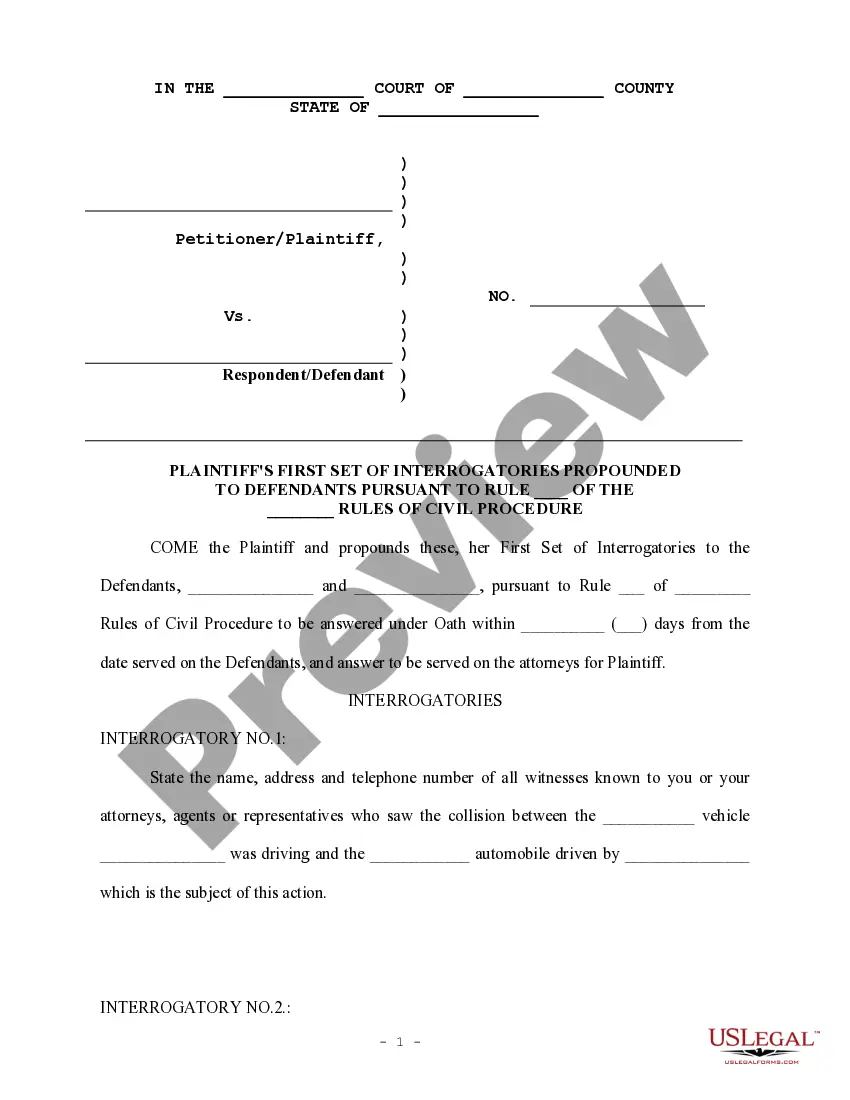

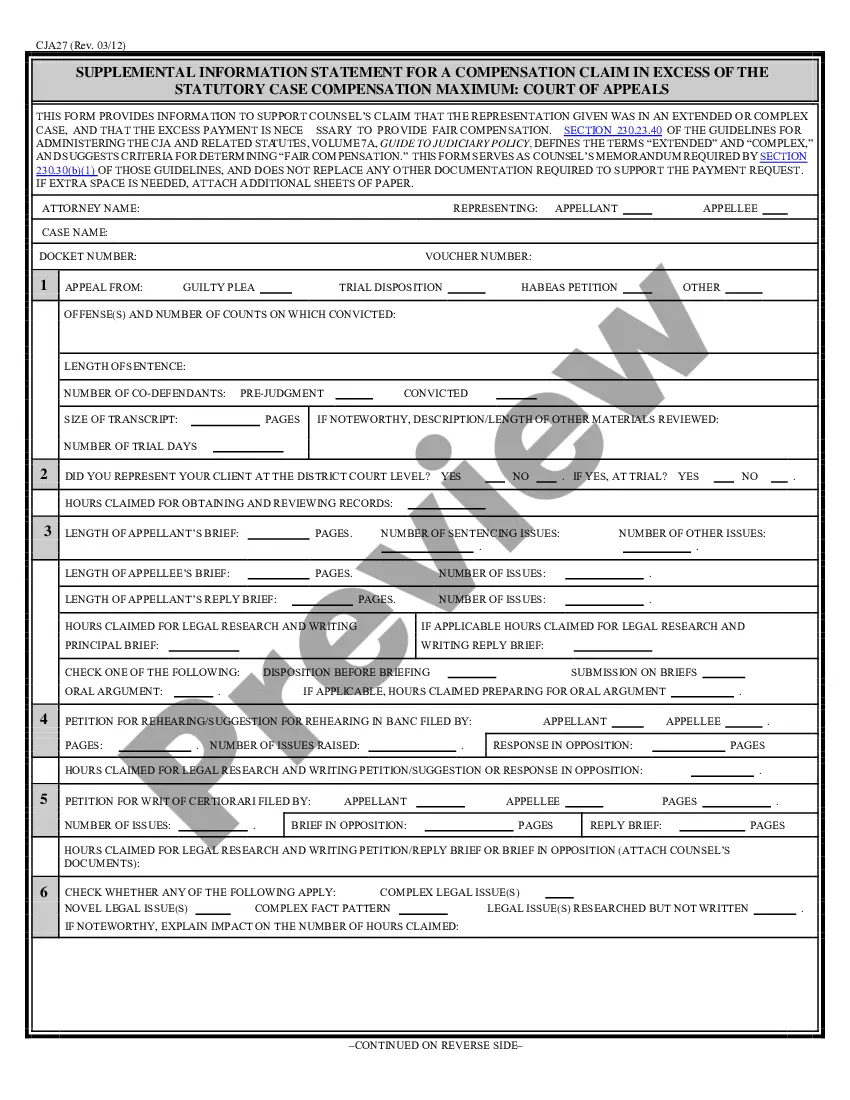

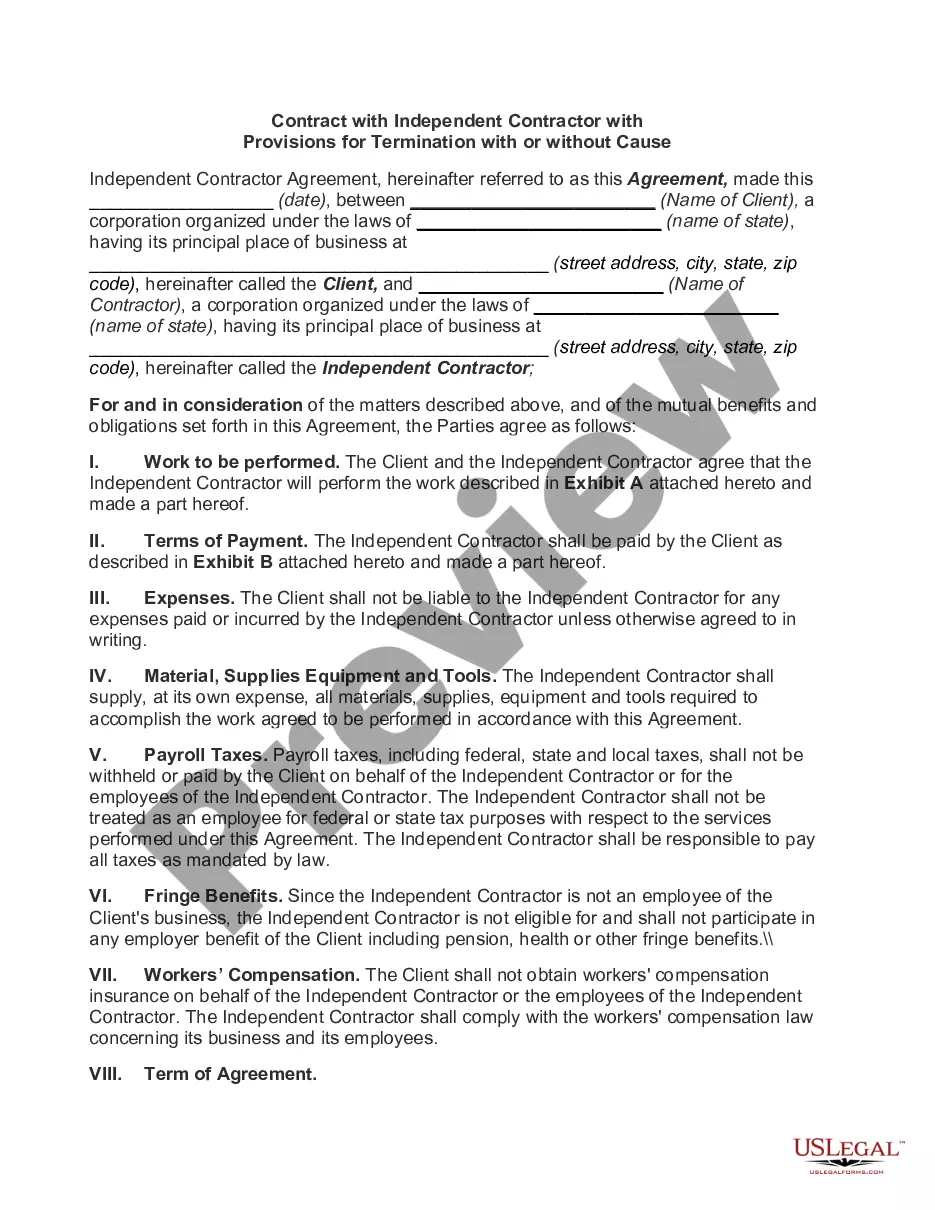

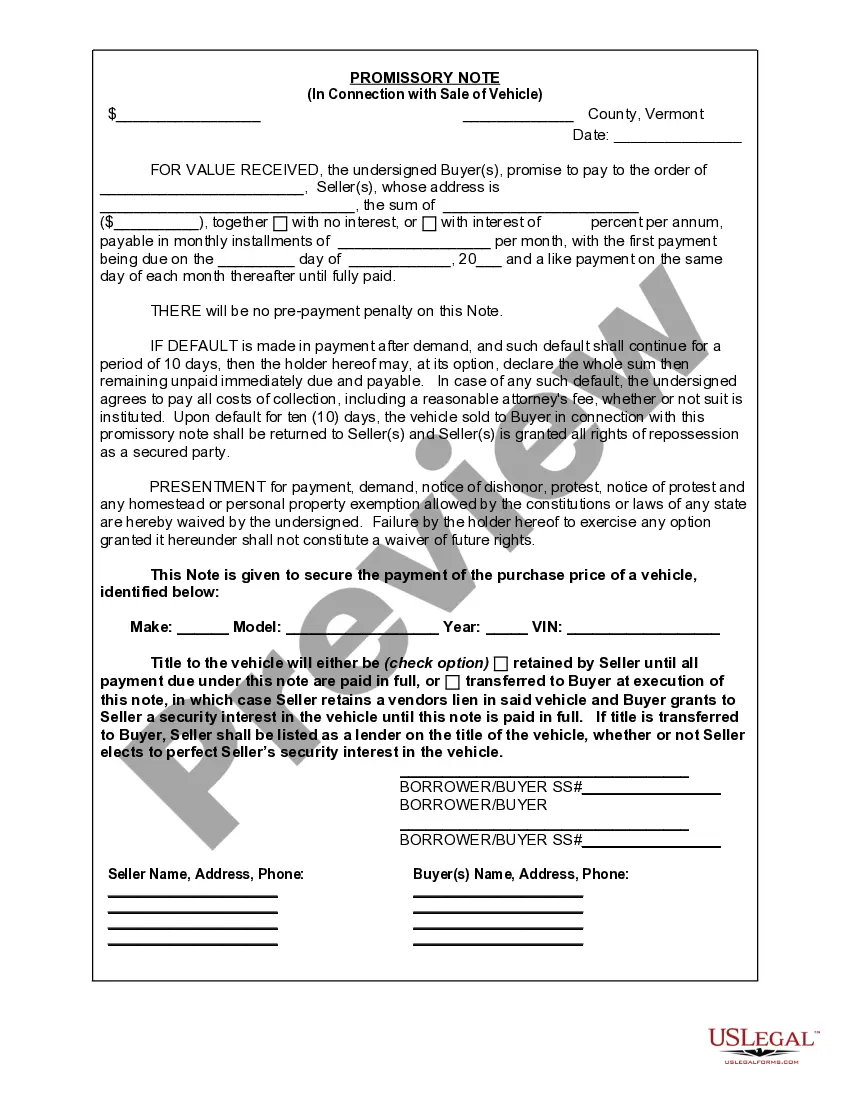

- Use the Preview button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form is not what you are looking for, utilize the Search section to find the form that meets your needs and requirements.

Form popularity

FAQ

Limited liability - The company has its own legal entity so the liability of members or shareholders is limited and generally they will not be personally liable for the debts of the company.

The transfer of membership interest in LLC entities is done through an LLC Membership Interest Assignment. This document is used when an owner (member) of an LLC wants to transfer their interest to another party. They are typically used when a member plans to leave or wants to relinquish their interest in the business.

Every New Hampshire LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

Rather than issuing stock options like you would in a corporation, in an LLC you hold membership interests. If you're the sole member of an LLC, you retain 100% equity. However, if you're part of a multiple-member LLC, equity is distributed among members based on the terms of your operating agreement.

With LLCs, members own membership interests (sometimes called limited liability company interests) in the Company which are not naturally broken down into units of measure. You simply own a membership interest in the Company and part of your agreement with the other members is to describe what and how much you own.

With LLCs, members own membership interests (sometimes called limited liability company interests) in the Company which are not naturally broken down into units of measure. You simply own a membership interest in the Company and part of your agreement with the other members is to describe what and how much you own.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

A membership interest represents an investor's (called a "member") ownership stake in an LLC. A person who holds a membership interest has a profit and voting interest in the LLC (although these may be amended by contract). Ownership in an LLC can be expressed by percentage ownership interest or membership units.

Every New Hampshire LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

While membership interests are freely transferable in the sense that any member generally can transfer his or her economic rights in the LLC (subject to the operating agreement, a stand-alone buy-sell agreement, and state law), the management or voting rights in the LLC are usually what are restrictedotherwise, other