New Hampshire Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee

Description

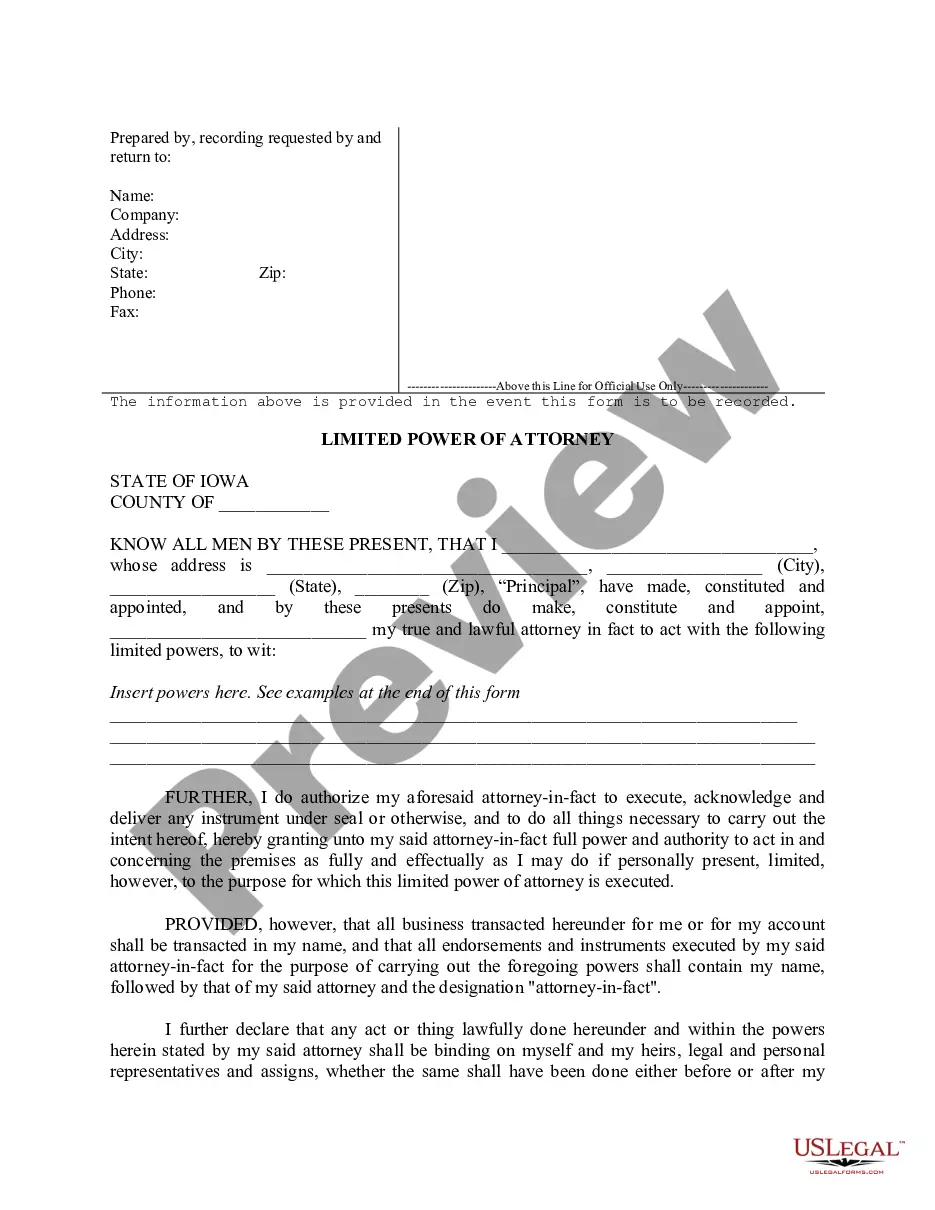

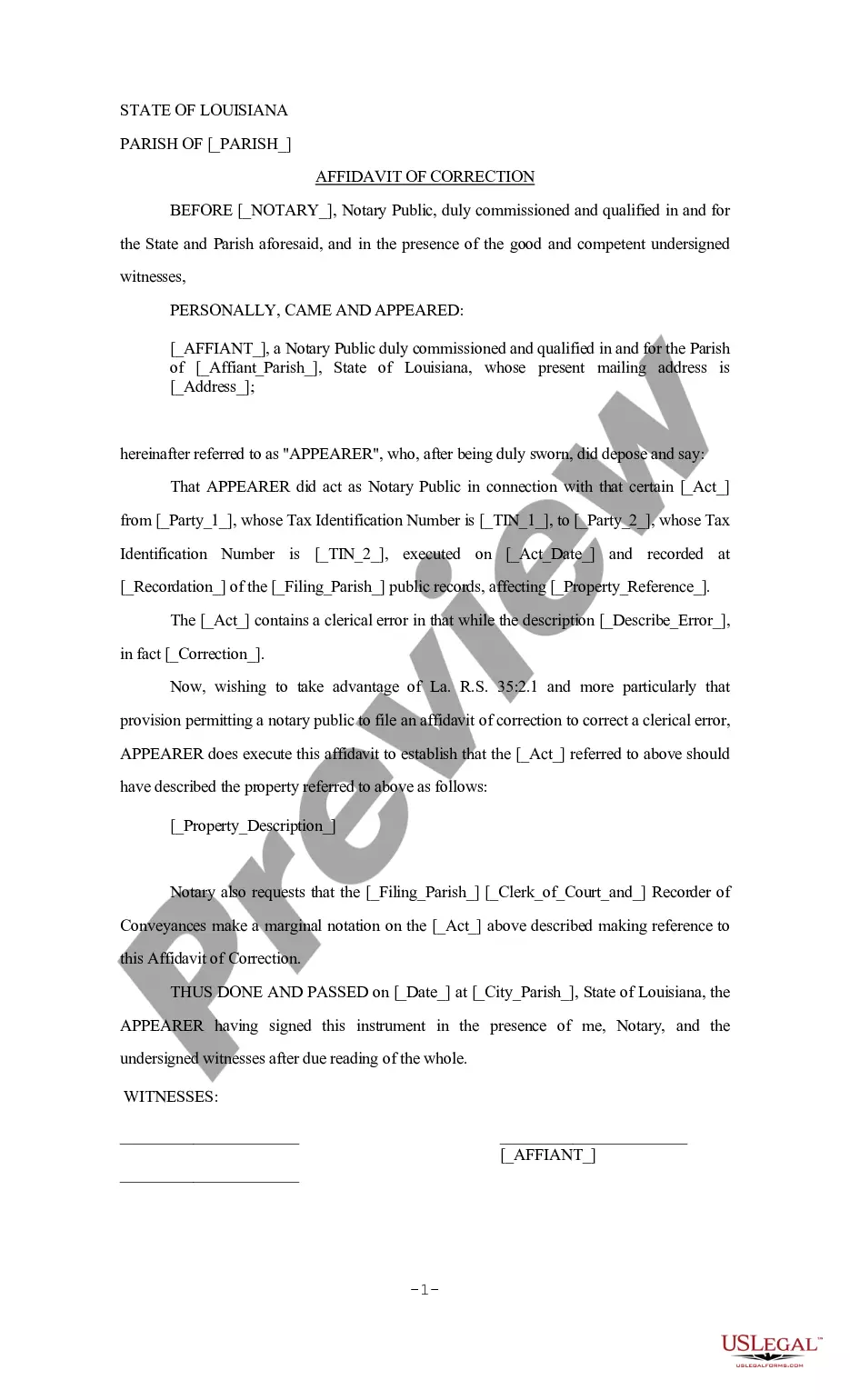

How to fill out Sample Letter For Tax Receipt For Fundraiser Dinner - Request By Attendee?

You can spend hours online trying to locate the legal document format that satisfies the federal and state requirements you need.

US Legal Forms offers thousands of legal documents that have been reviewed by professionals.

You can download or print the New Hampshire Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee from my services.

Read the form description to confirm you have chosen the right form.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the New Hampshire Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee.

- Each legal document format you purchase is yours indefinitely.

- To obtain another copy of the purchased document, go to the My documents tab and click on the appropriate button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for your area/city of choice.

Form popularity

FAQ

To write an invitation for fundraising, start with a catchy opening line that grabs attention. Clearly outline the purpose of the fundraiser and share compelling reasons why attendees should join. Include essential details like the event date, time, venue, and any special activities planned. Remember, utilizing a New Hampshire Sample Letter for Tax Receipt for Fundraiser Dinner - Request by Attendee can enhance credibility and provide an official acknowledgment of their contributions.

How to Write a Fundraising LetterAddress your recipient personally.Tell a story.Define the problem.Explain your mission and outline your goal.Explain how your donor can make an impact.Call the reader to action.

6 IRS Requirements for Every Donor Receipt to Ensure a Charitable DeductionName of the Charity and Name of the Donor.Date of the Contribution.Detailed Description of the Property Donated.Amount of the Contribution.A Statement Regarding Whether or not Any Goods or Services were Provided in Exchange for the Contribution.More items...?

Thank you for your generous gift of (Full Description) which we received on (Date). Your generous contribution will help to further the important work of our organization.

What's the best format for your donation receipt?The name of the organization.A statement confirming that the organization is a registered 501(c)(3) organization, along with its federal tax identification number.Date that the donation was made.Donor's name.Type of contribution made (cash, goods, services)More items...

Each donor receipt should include the name of the donor as well....Whatever the form, every receipt must include six items to meet the standards set forth by the IRS:The name of the organization;The amount of cash contribution;A description (but not the value) of non-cash contribution;More items...?

6 IRS Requirements for Every Donor Receipt to Ensure a Charitable DeductionName of the Charity and Name of the Donor.Date of the Contribution.Detailed Description of the Property Donated.Amount of the Contribution.A Statement Regarding Whether or not Any Goods or Services were Provided in Exchange for the Contribution.More items...?

How Do I Write Donation Receipts?The name of the donor.The name of your organization.Your organization's federal tax ID number, and a statement indication your organization is a registered 501(c)(3)The date of the donation.The amount given OR a description of items donated, if any.

Here's what you should include in your own donation receipts:The donor's name.The organization's name, federal tax ID number, and a statement indicating that the organization is a registered 501(c)(3)Date of the donation.The amount of money or a description (but not the value) of the item(s) donated.More items...

The charity you donate to should supply a receipt with its name, address, telephone number and the date, preferably on letterhead. You should fill in your name, address, a description of the goods and their value. If the charity gives you anything in return, it must provide a description and value.