New Hampshire Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions

Description

How to fill out Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Noncompetition Provisions?

If you need to obtain, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the site's straightforward and user-friendly search function to locate the documents you require.

Various templates for business and personal purposes are organized by categories, states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and provide your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to acquire the New Hampshire Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to access the New Hampshire Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions.

- You can also access forms you previously downloaded from the My documents section of your account.

- For first-time users of US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the correct form for your city/state.

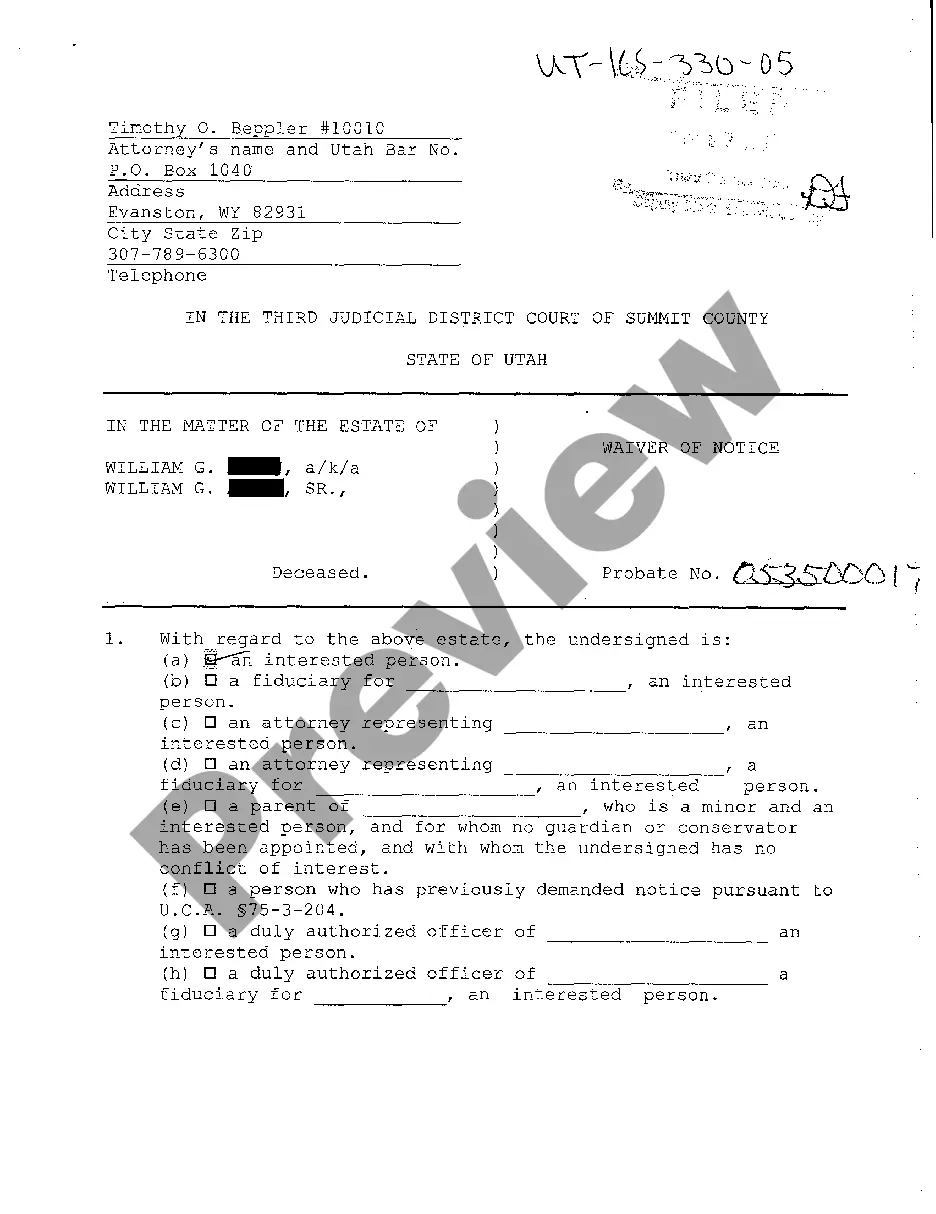

- Step 2. Use the Review option to check the form's details. Be sure to read the description.

- Step 3. If the form does not meet your needs, use the Search box at the top of the page to find other options.

Form popularity

FAQ

compete clause in a shareholders agreement restricts shareholders from pursuing business activities that directly compete with the corporation. This clause is crucial in a New Hampshire Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions, as it deters shareholders from exploiting the company’s resources for personal gain. It ensures a unified focus on the company’s growth and success. When designed properly, this clause fosters a collaborative environment within the corporation.

While a buy-sell agreement provides many benefits, there are disadvantages to consider. One potential drawback is the upfront costs involved in drafting the New Hampshire Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions. Additionally, if not regularly updated, these agreements may become outdated and fail to reflect the current value of the business or changes in ownership structure.

A Share Sale and Purchase Agreement is an agreement for the sale and purchase of a stated number of shares at an agreed price. The shareholder selling their shares is the seller and the party buying the shares is the buyer. This agreement details the terms and conditions of the sale and purchase of the shares.

sell agreement establishes the fair value of a person's share in the business, which comes in handy if a partner wants to remain in the company after another partner's exit. This helps forestall disagreements about whether a buyout offer is fair since the agreement establishes these figures ahead of time.

An equity purchase agreement, also known as a share purchase agreement or stock purchase agreement, is a contract that transfers shares of a company from a seller to a buyer. Equity purchases can be used to acquire a business in whole or in part.

Definition. 1. A buy-sell agreement is an agreement among the owners of the business and the entity. 2. The buy-sell agreement usually provides for the purchase and sale of ownership interests in the business at a price determined in accordance with the agreement, upon the occurrence of certain (usually future) events.

An agreement to sell is a crucial precursor to the sale deed. This document, which has legal sanctity, states the seller's intention to sell the property and the buyer's intention to purchase the same in the future.

The key elements of a buy-sell agreement include:Element 1. Identify the parties.Element 2. Triggered buyout event.Element 3. Buy-sell structure.Element 4. Company valuation.Element 5. Funding resources.Element 6. Taxation considerations.

Buy-sell agreements, also called buyout agreements and shareholder agreements, are legally binding documents between two business partners that govern how business interests are treated if one partner leaves unexpectedly.

The buy and sell agreement is also known as a buy-sell agreement, a buyout agreement, a business will, or a business prenup.