New Hampshire Buy-Sell Agreement between Shareholders of Closely Held Corporation

Description

A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights.

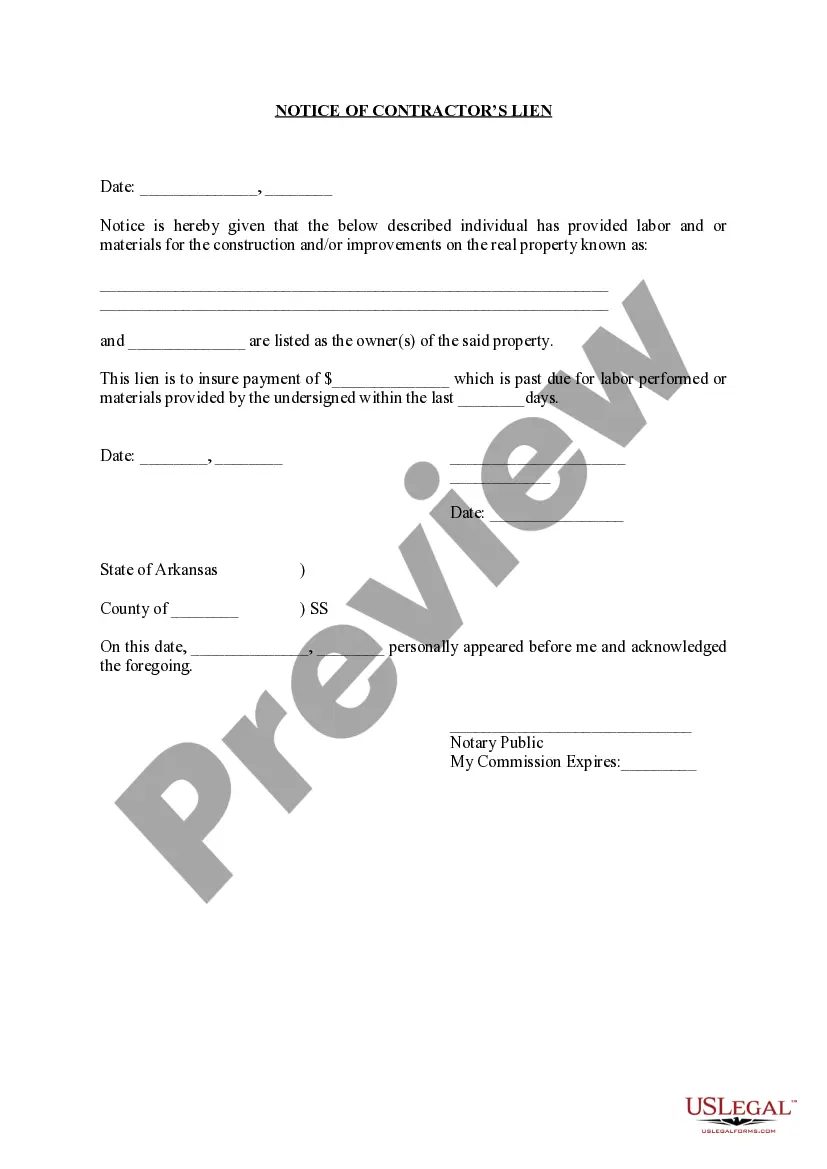

How to fill out Buy-Sell Agreement Between Shareholders Of Closely Held Corporation?

You can spend numerous hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that are reviewed by professionals.

It is easy to download or print the New Hampshire Buy-Sell Agreement among Shareholders of Closely Held Corporation from the service.

If available, use the Review option to browse through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain option.

- Next, you can complete, modify, print, or sign the New Hampshire Buy-Sell Agreement among Shareholders of Closely Held Corporation.

- Each legal document template you receive is yours to keep for years.

- To acquire another copy of the obtained form, visit the My documents tab and click on the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate document template for your region/area of choice.

- Read the form description to ensure you have chosen the correct form.

Form popularity

FAQ

Selling shares without the consent of other shareholders depends on the terms outlined in your shareholders' agreement. In the case of a New Hampshire Buy-Sell Agreement between Shareholders of Closely Held Corporation, the agreement typically stipulates the conditions under which shares can be sold. If there are no specific terms allowing independent sales, it's generally advisable to seek consent from other shareholders to avoid legal issues and maintain a good relationship. A well-drafted agreement provides clarity on this matter.

An LLC does not have shareholders but instead has members. However, members of an LLC can create an Operating Agreement, which serves a similar purpose to a shareholders agreement. If you are forming an LLC in New Hampshire, consider a New Hampshire Buy-Sell Agreement between Shareholders of Closely Held Corporation to clearly outline the responsibilities and ownership if you plan to have multiple members. This agreement is vital for smooth operations and conflict resolution.

You can obtain a shareholders agreement by consulting an attorney or using online resources. A reliable option is to explore platforms like uslegalforms, which provide templates specifically for creating a New Hampshire Buy-Sell Agreement between Shareholders of Closely Held Corporation. These resources often include customizable formats to meet your company’s unique requirements. It's crucial to ensure that any agreement you use reflects the specifics of your business and complies with state regulations.

Creating a shareholder agreement involves outlining key aspects, such as share ownership, voting rights, and procedures for selling shares. To draft an effective New Hampshire Buy-Sell Agreement between Shareholders of Closely Held Corporation, consider consulting a legal professional who understands your specific needs. You can also utilize platforms like uslegalforms to guide you through the process of drafting a comprehensive agreement. This ensures the agreement meets all legal requirements and protects the interests of all parties involved.

Without a shareholders' agreement, disputes between shareholders can arise more easily, leading to confusion and potential conflicts. In the absence of a New Hampshire Buy-Sell Agreement between Shareholders of Closely Held Corporation, the default laws in New Hampshire govern the ownership transfer and management issues. This can result in unwanted outcomes, such as difficulty in selling shares or resolving disagreements. It's essential to have a clear agreement to outline responsibilities and handling of shares.

To write a shareholders agreement, start by outlining the roles and responsibilities of each shareholder, including voting rights and profit sharing. It's vital to include mechanisms for resolving disputes and outlining the procedure for selling shares, which is where the New Hampshire Buy-Sell Agreement between Shareholders of Closely Held Corporation plays a crucial role. You can utilize our templates to guide you through the process and ensure all necessary aspects are covered.

Yes, you can write your own shareholder agreement, but it's essential to ensure that it includes all necessary provisions and complies with local regulations. A New Hampshire Buy-Sell Agreement between Shareholders of Closely Held Corporation can be customized through our platform, guiding you in crafting a document that protects your interests while aligning with state laws. Consider consulting a legal professional to verify compliance.

A shareholder agreement outlines the relationship and rights of shareholders within a corporation, while a buy-sell agreement specifically covers the sale of shares. Both documents are vital in a New Hampshire Buy-Sell Agreement between Shareholders of Closely Held Corporation, but they serve different purposes. Understanding these differences can help you create robust agreements that protect shareholder interests.

In most cases, all shareholders do not need to agree to sell shares, but the terms are typically defined in the buy-sell agreement. The New Hampshire Buy-Sell Agreement between Shareholders of Closely Held Corporation can specify conditions for selling, such as requiring majority consent or outlining options for remaining shareholders. Clarity on these terms helps maintain harmony among shareholders.

Selling shares to another shareholder involves negotiating terms and executing a formal agreement. First, determine the value of the shares and any conditions for the sale, which can be detailed in the New Hampshire Buy-Sell Agreement between Shareholders of Closely Held Corporation. Utilize our platform to create legally binding documents that streamline this process, ensuring all requirements are met.