New Hampshire Sample Letter for Letters Testamentary and Registration of Claim

Description

How to fill out Sample Letter For Letters Testamentary And Registration Of Claim?

If you wish to full, download, or print out lawful record layouts, use US Legal Forms, the largest assortment of lawful kinds, that can be found on the web. Make use of the site`s easy and handy look for to obtain the paperwork you will need. Various layouts for organization and individual uses are categorized by groups and says, or search phrases. Use US Legal Forms to obtain the New Hampshire Sample Letter for Letters Testamentary and Registration of Claim in just a number of mouse clicks.

If you are already a US Legal Forms client, log in to the bank account and click on the Down load option to obtain the New Hampshire Sample Letter for Letters Testamentary and Registration of Claim. You can even access kinds you earlier saved from the My Forms tab of your bank account.

If you work with US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for that correct city/country.

- Step 2. Utilize the Preview option to look over the form`s articles. Don`t neglect to read the information.

- Step 3. If you are not happy with the form, use the Research area on top of the screen to get other versions of the lawful form format.

- Step 4. Once you have discovered the form you will need, select the Get now option. Pick the pricing plan you choose and include your credentials to sign up for an bank account.

- Step 5. Procedure the purchase. You should use your charge card or PayPal bank account to complete the purchase.

- Step 6. Find the structure of the lawful form and download it on the system.

- Step 7. Full, revise and print out or indicator the New Hampshire Sample Letter for Letters Testamentary and Registration of Claim.

Every lawful record format you acquire is yours permanently. You might have acces to every single form you saved in your acccount. Go through the My Forms segment and pick a form to print out or download yet again.

Remain competitive and download, and print out the New Hampshire Sample Letter for Letters Testamentary and Registration of Claim with US Legal Forms. There are thousands of professional and state-particular kinds you can utilize for your organization or individual requirements.

Form popularity

FAQ

Generally, irrevocable trusts that are administered in New Hampshire (and which are not taxed to the grantor) are not subject to state income or capital gains tax. New Hampshire does have an interest and dividends tax, but irrevocable trusts administered in New Hampshire are not subject to this tax.

By using a living trust, you can avoid the necessity of the probate process for any assets that are held by the trust, and the distribution of those assets can take place immediately following your death. The living trust works to avoid probate because the trust itself owns any assets you transfer into it.

New Hampshire trust law allows for decanting, a process by which a trustee creates a new trust and transfers assets from an old trust to the new trust, enabling some level of trust modification (and modernization) of the old trust.

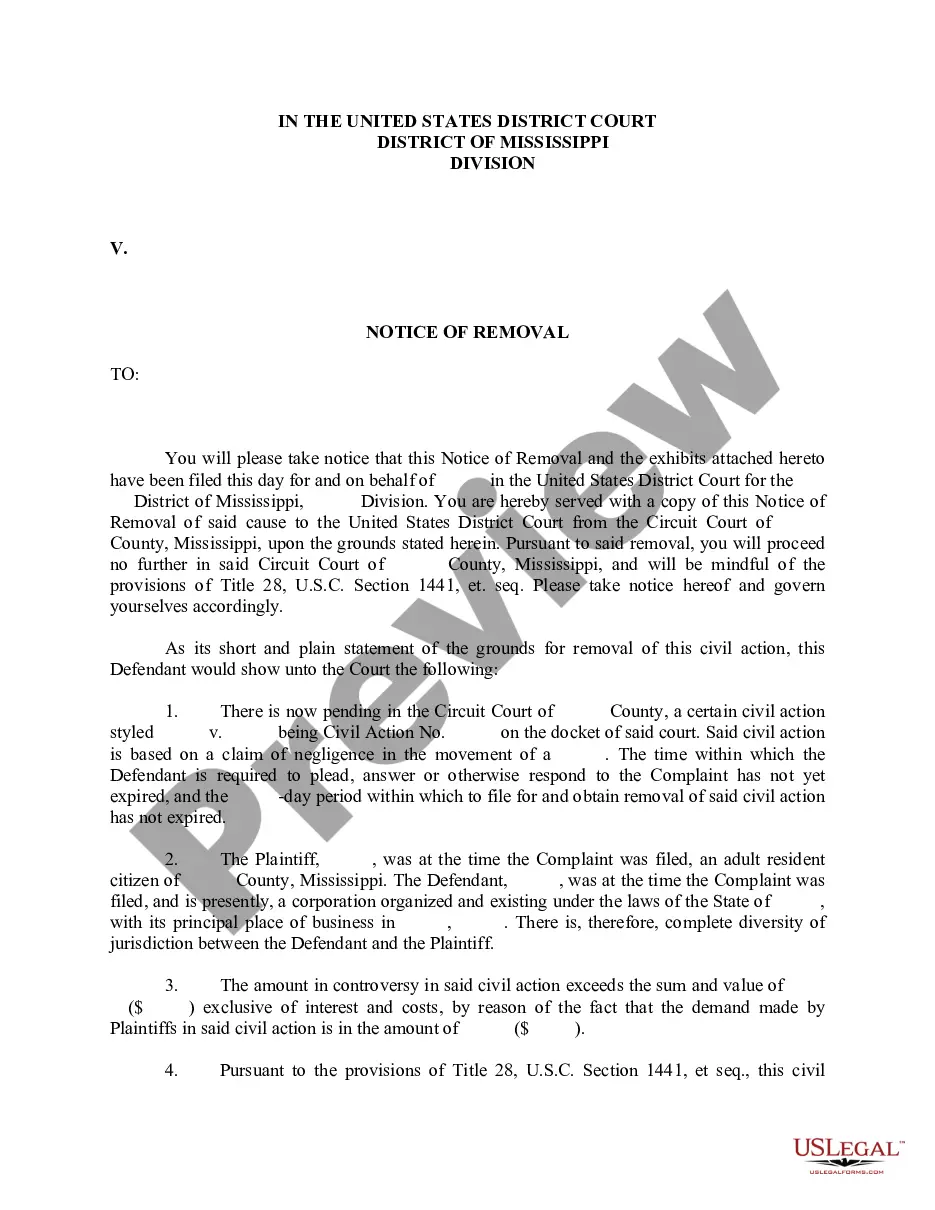

The probate process After receiving permission, called ?Letters Testamentary? in New Hampshire, the executor has 90 days to file an inventory of estate assets with the court. He or she will pay any outstanding creditors and taxes of your estate before distributing property to your heirs ing to your wishes.

The Estate Settlement Timeline: There is no specific deadline for this in New Hampshire law, but it is generally best to do so within 30 days to prevent unnecessary delays in the probate process.

Petition for Probate (DE-111) Ask the court to start the process for distributing a deceased person's property, paying debts owed by the deceased person, and settling the financial affairs of the deceased person.

You may be able to avoid probate in New Hampshire by: Making a Revocable Living Trust. Titling property: Joint Tenancy.

In New Hampshire, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).