Many so-called nonprofits are simply groups of people who come together to perform some social good. These informal groups are called unincorporated nonprofit associations. An unincorporated nonprofit association may be subject to certain legal requirements, even though it hasn't filed for incorporation under its state's incorporation laws. For example, an unincorporated association will generally need to file tax returns, whether as a taxable or tax-exempt entity. Additionally, there may be state registration requirements.

New Hampshire Articles of Association of Unincorporated Church Association

Description

How to fill out Articles Of Association Of Unincorporated Church Association?

Are you presently in a scenario where you require documentation for both professional and personal purposes almost every day.

There are numerous reliable document templates accessible online, but acquiring forms you can trust is not effortless.

US Legal Forms provides thousands of form templates, such as the New Hampshire Articles of Association of Unincorporated Church Association, designed to comply with federal and state regulations.

Once you find the correct form, just click Get now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the New Hampshire Articles of Association of Unincorporated Church Association template.

- If you do not possess an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

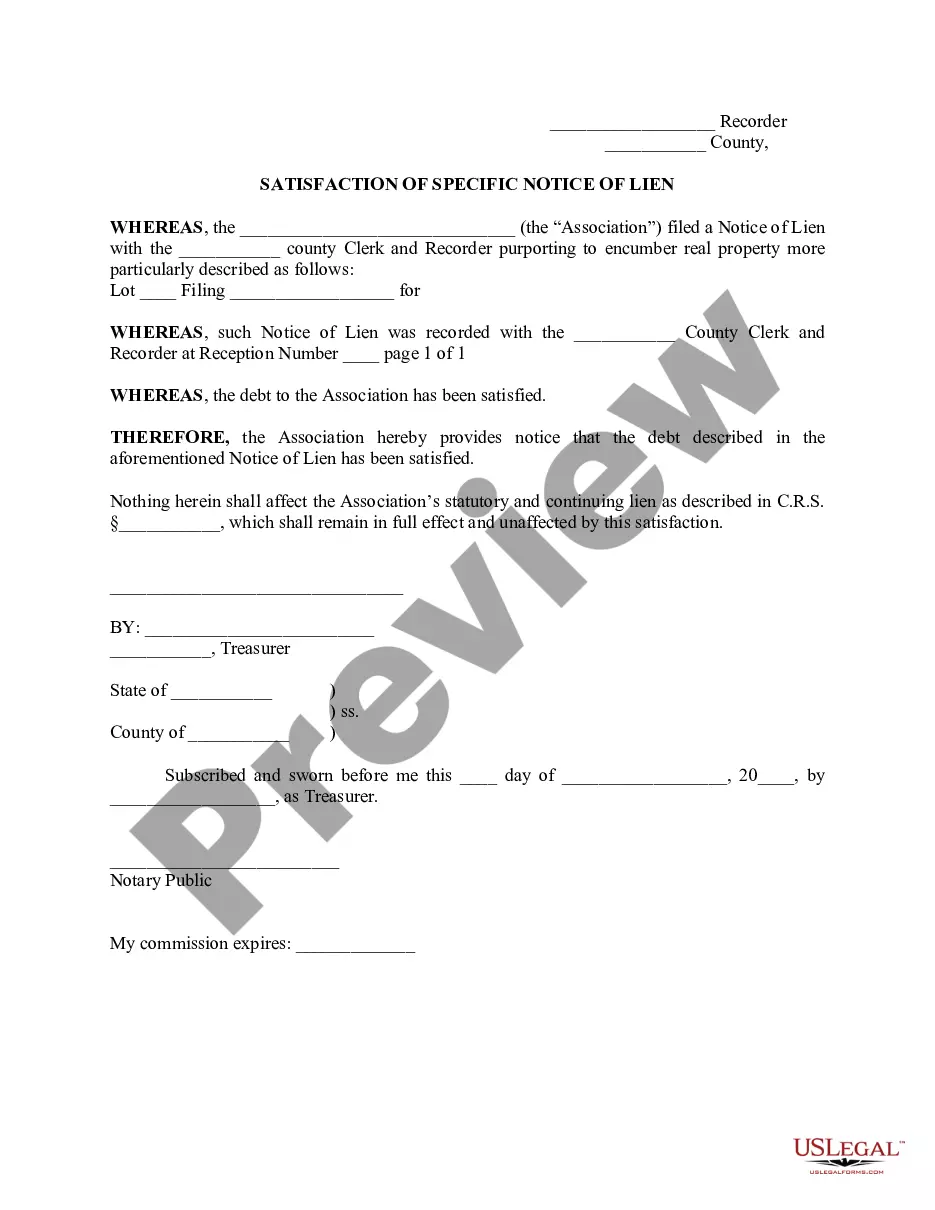

- Utilize the Preview option to inspect the form.

- Review the details to confirm that you have selected the appropriate form.

- If the form is not what you desire, use the Search field to locate the form that fits your needs and requirements.

Form popularity

FAQ

Generally, unincorporated associations may not have to file a tax return, but this depends on their income and activities. For instance, if your association earns above a certain threshold, it may be required to file an IRS Form 990. The New Hampshire Articles of Association of Unincorporated Church Association can include provisions that help you understand the tax obligations applicable to your organization. Organizations should consult with a tax professional to ensure compliance with all regulations.

Not all non-profits are unincorporated associations, but many operate as such. An unincorporated association can function similarly to a non-profit organization but lacks formal incorporation. The New Hampshire Articles of Association of Unincorporated Church Association can guide groups that prefer a simpler structure while still focusing on charitable objectives. However, it's essential to understand the legal implications and limitations associated with remaining unincorporated.

The organizing document for an unincorporated association is typically referred to as the Articles of Association. This document outlines the purpose, structure, and governance of the association. For a specific type, like the New Hampshire Articles of Association of Unincorporated Church Association, it is essential to include details about membership, meetings, and decision-making processes. Having a clear, well-drafted organizing document helps to ensure compliance with state laws and provides a foundation for smooth operations.

Articles of association outline the fundamental details about the organization, including its purpose and structure, while bylaws define the internal rules for governance and procedures. Together, these documents provide a comprehensive framework for managing the organization effectively. When working on your New Hampshire Articles of Association of Unincorporated Church Association, understanding the distinction between these two documents will help ensure clear governance.

A nonprofit can be considered an association if it meets certain requirements and operates for a collective benefit. Nonprofits often function as associations to carry out collaborative efforts towards their shared missions. If you are drafting your New Hampshire Articles of Association of Unincorporated Church Association, realizing this classification can help you structure your entity effectively.

Yes, a 501(c)(3) organization must have articles of incorporation as part of its establishment. These articles not only describe the organization’s purpose but also help in obtaining tax-exempt status from the IRS. If you are focusing on creating a New Hampshire Articles of Association of Unincorporated Church Association, understanding the role of articles of incorporation in achieving 501(c)(3) status is critical.

To register a nonprofit in New Hampshire, you need to file the required documents with the Secretary of State and follow state-specific guidelines. This process often includes submitting your articles of incorporation and applying for federal tax-exempt status if applicable. Using resources like US Legal Forms can simplify this procedure, especially for drafting your New Hampshire Articles of Association of Unincorporated Church Association.

A nonprofit organization doesn't necessarily have to be incorporated, especially when operating as an unincorporated association. However, incorporation can offer legal protections and benefits, such as limited liability for members. If you are planning to create a New Hampshire Articles of Association of Unincorporated Church Association, consider the implications of incorporation on your organization’s structure and governance.

The article for a nonprofit organization typically outlines its purpose, mission, and operational structure. These articles serve as foundational documents that guide the organization’s activities and governance. When establishing a New Hampshire Articles of Association of Unincorporated Church Association, these articles are vital for clarifying your entity's objectives and ensuring compliance with state regulations.

In general, an association does not have to be nonprofit. However, many unincorporated church associations choose to adopt nonprofit status to gain financial and tax benefits. By doing so, you can enhance your credibility and attract more support from members and donors. If you are considering forming a New Hampshire Articles of Association of Unincorporated Church Association, nonprofit status is often a practical choice.