New Hampshire Articles of Association of Unincorporated Charitable Association

Description

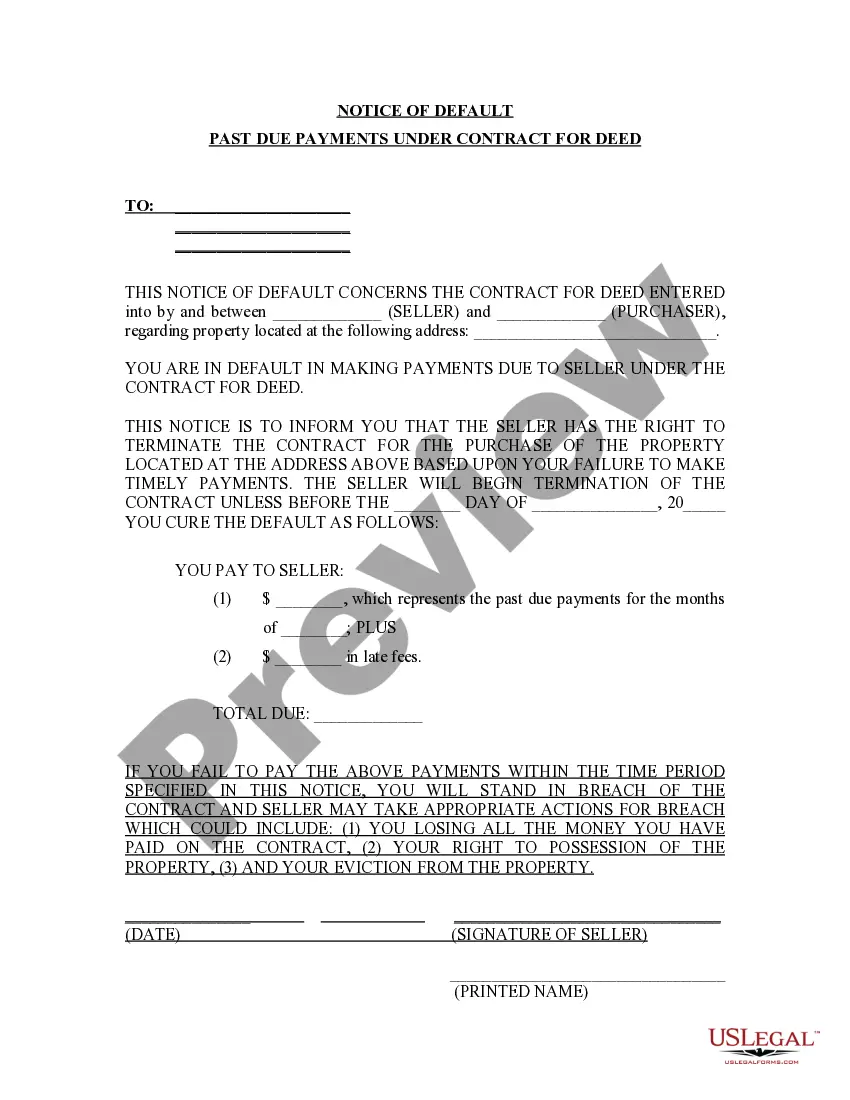

How to fill out Articles Of Association Of Unincorporated Charitable Association?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can quickly find the most recent versions of forms such as the New Hampshire Articles of Association of Unincorporated Charitable Association.

If you are already a member, Log In to download the New Hampshire Articles of Association of Unincorporated Charitable Association from the US Legal Forms library. The Download button will appear on each document you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the purchase process. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit it as needed. Fill out, modify, and print the downloaded New Hampshire Articles of Association of Unincorporated Charitable Association.

Every template you add to your account does not expire and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

Access the New Hampshire Articles of Association of Unincorporated Charitable Association through US Legal Forms, which boasts one of the most comprehensive libraries of legal document templates. Utilize a wide array of professional and state-specific templates that cater to your business or personal needs and requirements.

- Ensure that you have chosen the correct form for your region/county.

- Click the Preview button to review the information of the form.

- Read the description of the form to confirm you have selected the right one.

- If the form does not meet your needs, use the Search box at the top of the screen to find the appropriate one.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose the pricing plan you prefer and enter your information to register for an account.

Form popularity

FAQ

Registering a non-profit in New Hampshire involves several straightforward steps, including drafting your articles of incorporation and filing with the Secretary of State. You will need to comply with state regulations, submit necessary forms, and apply for tax exemption if eligible. The New Hampshire Articles of Association of Unincorporated Charitable Association provide a helpful framework that guides you through this process, ensuring you establish your organization correctly.

Unincorporated associations are taxed as separate entities under certain conditions, particularly if they generate significant income. Depending on their financial status, they may be liable for income tax or required to file returns. If your association qualifies for tax-exempt status, it’s important to reference the New Hampshire Articles of Association of Unincorporated Charitable Association for guidelines on maintaining that status.

The articles of association outline the fundamental structure and purpose of a nonprofit organization. They typically include the organization's name, mission, governance structure, and the procedures for handling financial activities. The New Hampshire Articles of Association of Unincorporated Charitable Association serve as a crucial framework, helping to ensure compliance and clarity in your organization’s operations.

Yes, unincorporated associations can receive Form 1099 if they earn income from contracts or services provided. This form is used to report various types of income, including those received by non-profit organizations. If your association is involved in business operations, understanding how 1099 forms apply can clarify your financial reporting requirements.

Unincorporated associations may have to file taxes based on their financial activities and income level. If they earn income above the IRS threshold, they must report it. It’s important to review the New Hampshire Articles of Association of Unincorporated Charitable Association to ensure you meet your tax obligations accurately and timely.

While it is possible to start a nonprofit by yourself, involving a team can provide support and diverse skills essential for growth. Nonprofits often benefit from varying perspectives and expertise, especially in areas like fundraising and governance. The New Hampshire Articles of Association of Unincorporated Charitable Association encourage collaboration, making it easier to establish effective practices and fulfill your mission.

An unincorporated association typically requires an Employer Identification Number (EIN) for tax purposes if it has employees or certain financial activities. This number is essential for filing any required tax returns or managing finances. Obtaining an EIN is an important step in establishing your organization, especially if you are working with the New Hampshire Articles of Association of Unincorporated Charitable Association.

Yes, unincorporated associations may need to file a tax return depending on their income level and activities. If your association earns more than a certain threshold, the IRS requires you to file taxes. Additionally, unincorporated associations that qualify as tax-exempt entities must still submit annual information returns to maintain their status. Consulting the New Hampshire Articles of Association of Unincorporated Charitable Association can help you understand your obligations.

An unincorporated nonprofit association consists of individuals working together for a charitable purpose without formal incorporation. This type of organization operates based on the principles outlined by its members rather than adhering to state regulations. While it allows for easy collaboration, it's crucial to establish clear guidelines, such as those in the New Hampshire Articles of Association of Unincorporated Charitable Association, to ensure smooth functioning.

Choosing between incorporated and unincorporated depends on your organization's goals and needs. An incorporated entity provides legal protection and can help with fundraising efforts through grants and donations. Conversely, an unincorporated association allows for more operational flexibility and fewer formalities. It's beneficial to consider your long-term plans, and US Legal Forms can help you weigh your options.