New Hampshire Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage

Description

How to fill out Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage?

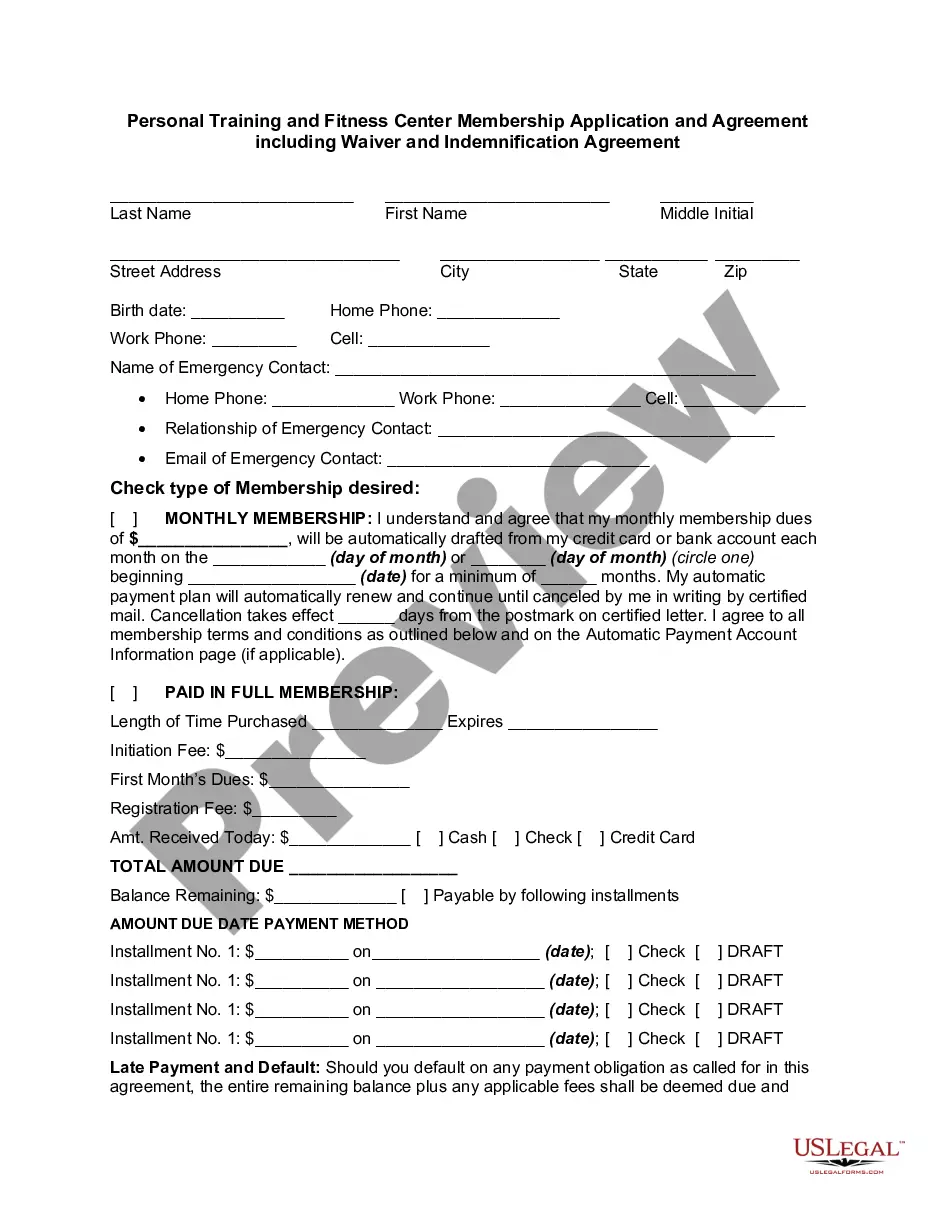

You may devote several hours on-line trying to find the legal record web template that fits the federal and state needs you need. US Legal Forms provides 1000s of legal forms which are reviewed by pros. You can easily down load or print out the New Hampshire Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage from my assistance.

If you already possess a US Legal Forms account, you are able to log in and click the Obtain button. Afterward, you are able to total, revise, print out, or signal the New Hampshire Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage. Every single legal record web template you get is the one you have forever. To acquire yet another version of any bought type, visit the My Forms tab and click the corresponding button.

If you use the US Legal Forms site the first time, keep to the basic guidelines listed below:

- Very first, ensure that you have chosen the correct record web template for your county/town of your choosing. Read the type explanation to ensure you have picked the appropriate type. If available, use the Preview button to search with the record web template at the same time.

- In order to discover yet another edition of your type, use the Search discipline to obtain the web template that suits you and needs.

- Upon having found the web template you desire, click Purchase now to move forward.

- Choose the costs strategy you desire, key in your qualifications, and register for your account on US Legal Forms.

- Complete the deal. You should use your credit card or PayPal account to fund the legal type.

- Choose the file format of your record and down load it for your gadget.

- Make modifications for your record if necessary. You may total, revise and signal and print out New Hampshire Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage.

Obtain and print out 1000s of record layouts while using US Legal Forms web site, which provides the biggest selection of legal forms. Use expert and status-certain layouts to tackle your small business or personal needs.

Form popularity

FAQ

To be approved for a second mortgage, you'll likely need a credit score of at least 620, though individual lender requirements may be higher. Plus, remember that higher scores correlate with better rates. You'll also probably need to have a debt-to-income ratio (DTI) that's lower than 43%.

You could lose your home if you don't pay back a second mortgage. Interest rates can be higher than refinancing. You might not qualify if you don't have enough equity or appraisal value. Second mortgages can be costly with appraisal fees, credit checks and closing costs.

Over time, as the homeowner makes good on their monthly payments, the home also tends to appreciate in value. Second mortgages are often riskier because the primary mortgage has priority and is paid first in the event of default.

? You'll need a higher credit score than first mortgage programs. A 620 credit score is the minimum for many second mortgage lenders, while others set the bar as high as 680. ? You must qualify with two mortgage payments. A second mortgage means you'll make two house payments.

The right of rescission doesn't apply when you're buying a home, and it only applies to a loan against your primary residence. So, for instance, you won't be able to rescind your mortgage if you're buying or refinancing a second home, vacation home, or investment property.

You might also need to get an appraisal to confirm the current value of your home. Equity requirements vary, but many lenders prefer that you have at least 15 percent to 20 percent equity in your home. You can typically borrow up to 85 percent of your home's value, minus your current mortgage debts.

Second mortgages are called that because they are secondary to the main, primary mortgage used for the home purchase. In the event of a foreclosure, the primary mortgage gets fully paid off before any second mortgages get a dime. They are second liens, behind the first lien of the primary mortgage.

A second mortgage is a second loan that you take on your home. You can borrow up to 80% of the appraised value of your home, minus the balance on your first mortgage. The loan is secured against your home equity. While you pay off your second mortgage, you also need continue to pay off your first mortgage.