In order to close an estate a petition for final distribution should be filed before the court showing that the estate can be closed and requesting distribution to be made to the beneficiaries. Usually when a petition for final distribution is filed, the court requires detailed accounting of all the monies and other items received and all monies paid out during administration. However, the accounting may be waived when all persons entitled to receive property from the estate have executed a written waiver of accounting. Waiver simplifies the closing of the estate. When all the beneficiaries are friendly obtaining waiver is not a problem.

New Hampshire Waiver of Final Accounting by Sole Beneficiary

Description

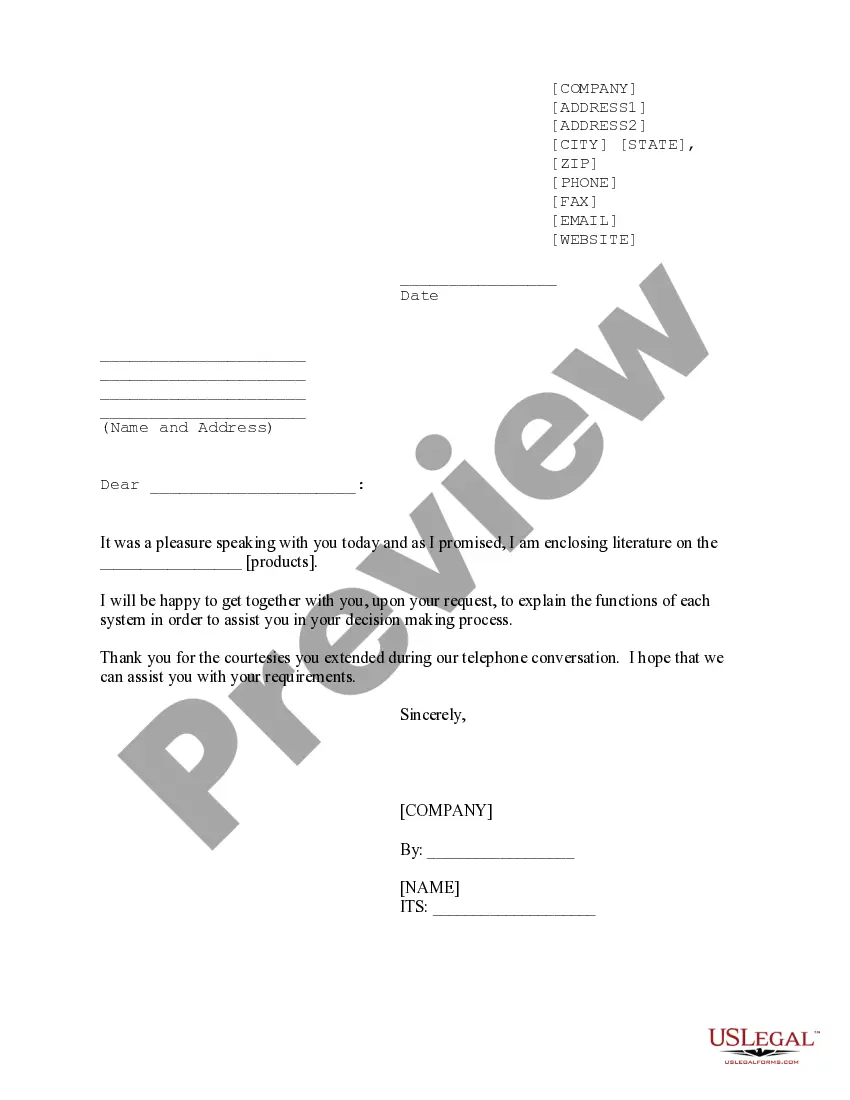

How to fill out Waiver Of Final Accounting By Sole Beneficiary?

US Legal Forms - among the largest libraries of legal types in the USA - delivers an array of legal papers themes you may download or printing. Using the site, you may get thousands of types for organization and personal reasons, categorized by groups, says, or keywords and phrases.You will discover the latest variations of types much like the New Hampshire Waiver of Final Accounting by Sole Beneficiary within minutes.

If you have a subscription, log in and download New Hampshire Waiver of Final Accounting by Sole Beneficiary from your US Legal Forms library. The Acquire key can look on every form you view. You have access to all previously delivered electronically types inside the My Forms tab of your profile.

If you wish to use US Legal Forms for the first time, listed below are easy instructions to get you began:

- Ensure you have picked out the right form for the city/county. Select the Preview key to analyze the form`s content. See the form explanation to ensure that you have selected the right form.

- In the event the form does not satisfy your demands, utilize the Lookup area near the top of the monitor to obtain the one that does.

- If you are satisfied with the form, verify your option by clicking on the Acquire now key. Then, choose the rates prepare you favor and provide your references to sign up for an profile.

- Procedure the purchase. Make use of your Visa or Mastercard or PayPal profile to perform the purchase.

- Find the format and download the form on the product.

- Make modifications. Load, edit and printing and signal the delivered electronically New Hampshire Waiver of Final Accounting by Sole Beneficiary.

Every single format you put into your money lacks an expiration time which is your own permanently. So, if you want to download or printing one more version, just proceed to the My Forms area and click in the form you need.

Get access to the New Hampshire Waiver of Final Accounting by Sole Beneficiary with US Legal Forms, one of the most comprehensive library of legal papers themes. Use thousands of professional and condition-specific themes that meet your organization or personal requires and demands.

Form popularity

FAQ

This process, which can be used for either intestate (without a will) or testate (with a will) estates, requires minimal court supervision. An inventory of estate assets, a fiduciary bond and an accounting are not required under this form of administration.

You may be able to avoid probate in New Hampshire by: Making a Revocable Living Trust. Titling property: Joint Tenancy. Community Property With Right of Survivorship. Tenancy by the Entirety. Create accounts as TOD or POD (Transfer on Death; Payable on Death) Establish beneficiaries.

The Estate Settlement Timeline: There is no specific deadline for this in New Hampshire law, but it is generally best to do so within 30 days to prevent unnecessary delays in the probate process.

If you die without a will in New Hampshire, your children will receive an "intestate share" of your property. The size of each child's share depends on how many children you have and whether or not you are married. (See the table above.)

Creditors have a certain time frame, typically six months from the date of appointment of the executor or administrator, to file their claims for payment. If the estate has enough assets, the debts are paid. If not, creditors are generally paid on a pro-rata basis.

In New Hampshire, most but not all the probate process can be avoided if a person has a Revocable Living Trust, and all their assets are in their Trust when they pass away.

Even if there are no assets, but there is a will, you must file the will, any codicils (amendments), and a death certificate with the Probate Court within thirty (30) days of the date of death.