New Hampshire Assessing the Support Activities in the Value Chain

Description

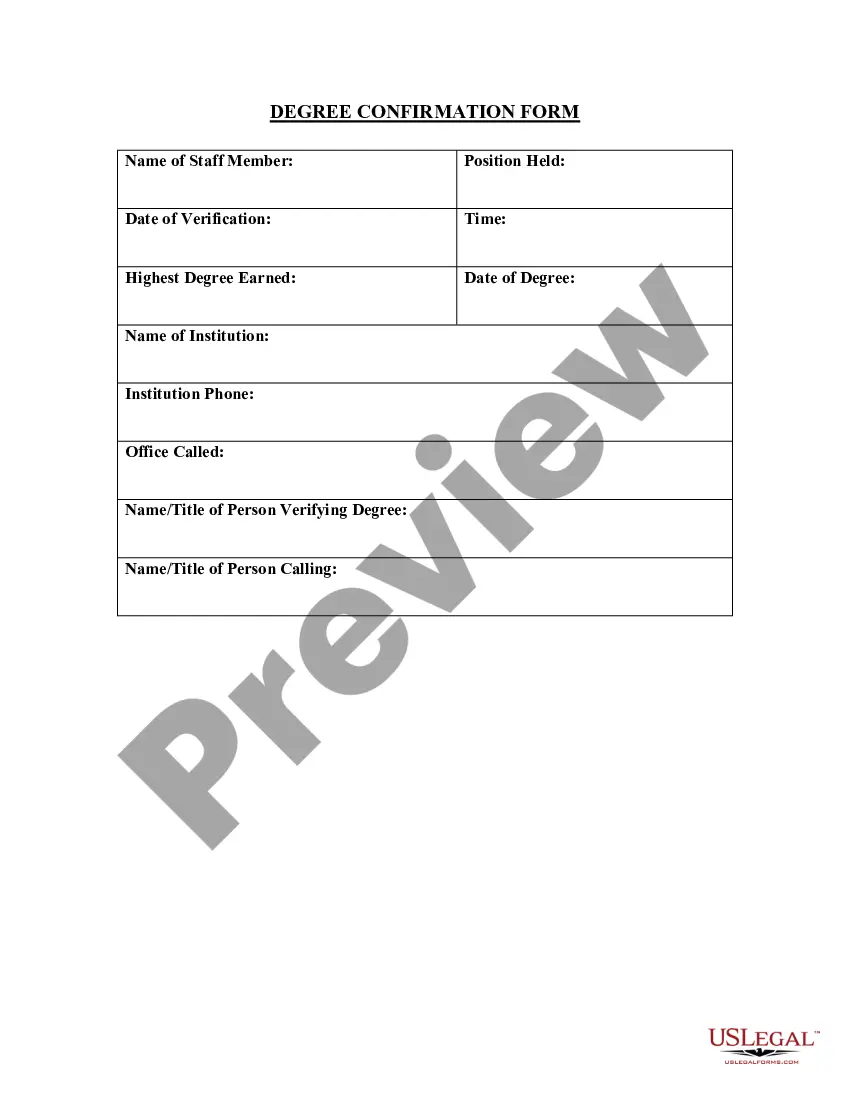

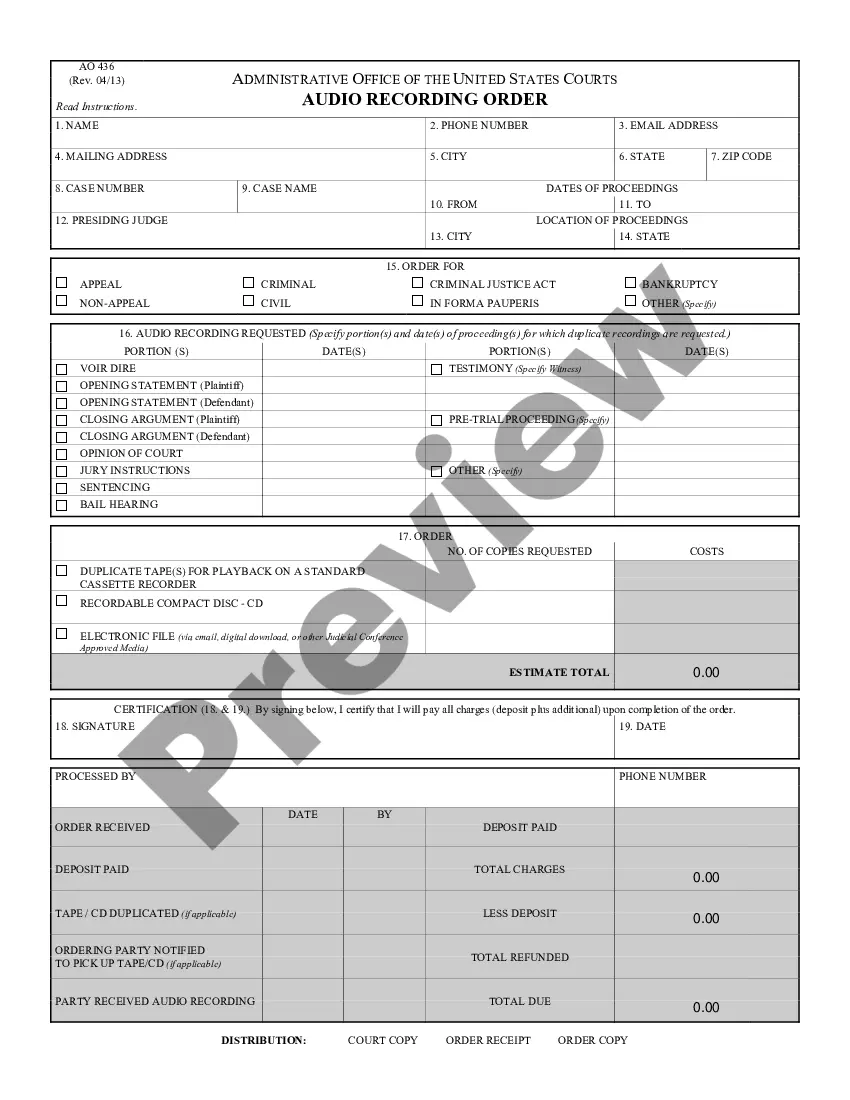

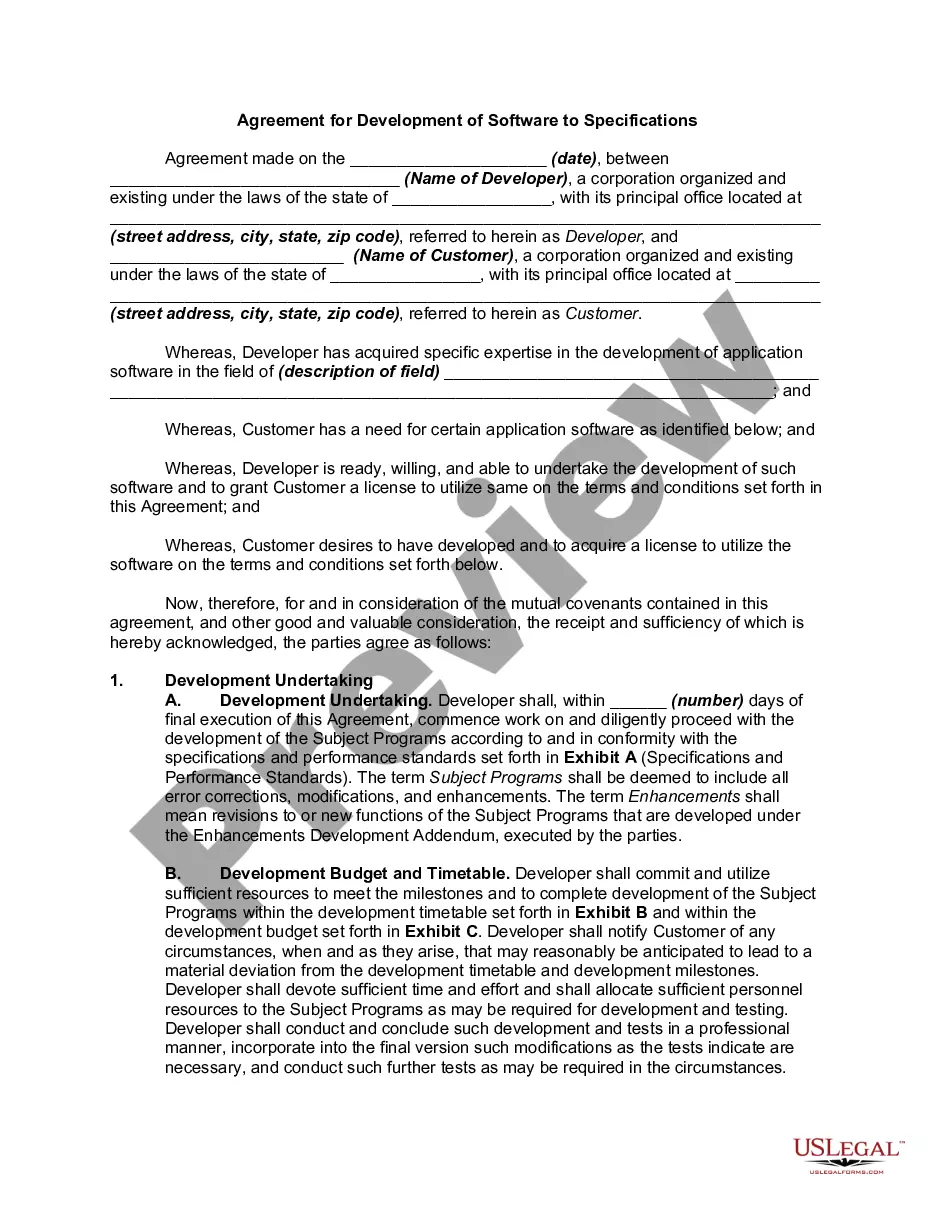

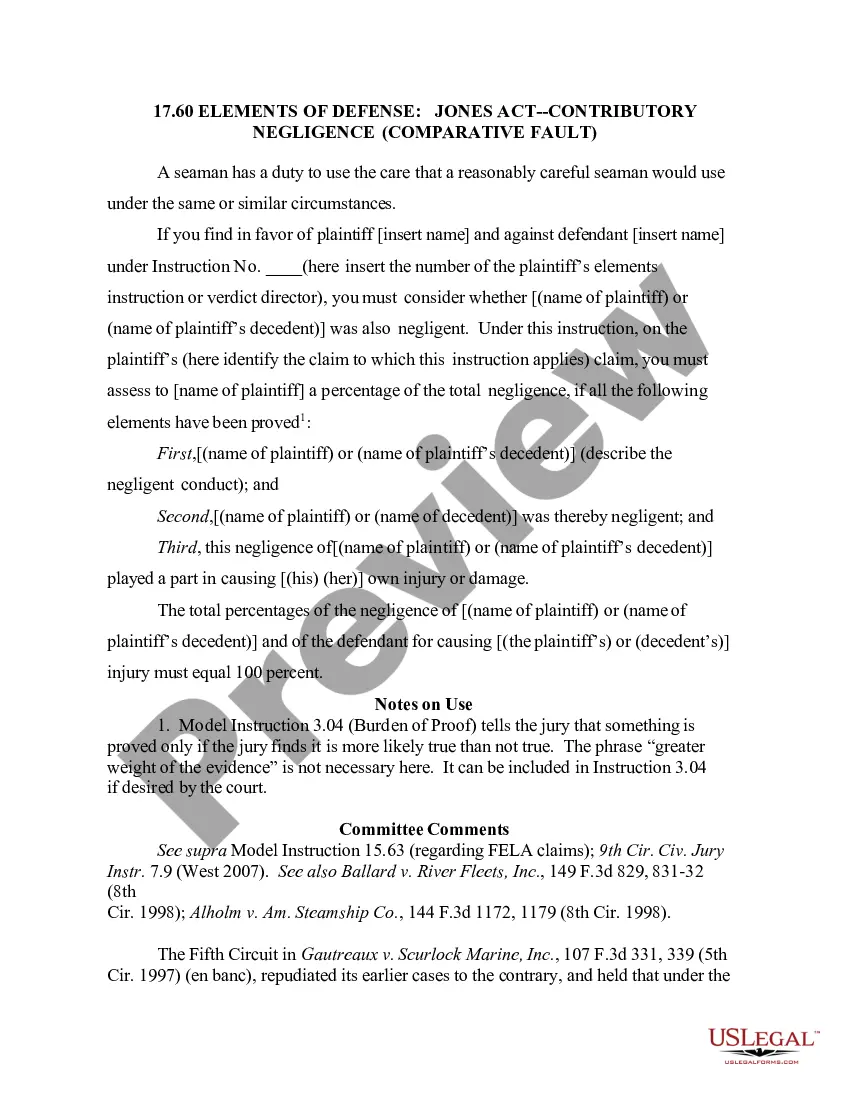

How to fill out Assessing The Support Activities In The Value Chain?

If you require exhaustive, obtain, or printing legal document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Employ the site’s user-friendly and straightforward search to find the documents you need.

Numerous templates for corporate and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, select the Purchase now option. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to obtain the New Hampshire Assessing the Support Activities in the Value Chain with just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and then click the Download option to receive the New Hampshire Assessing the Support Activities in the Value Chain.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Confirm you have selected the form for the appropriate area/region.

- Step 2. Use the Review option to examine the form’s content. Remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

In value chain analysis, teams such as human resources, IT, and finance serve as support activities. These teams provide the necessary backbone for the primary functions of a business to thrive. Engaging in New Hampshire Assessing the Support Activities in the Value Chain allows organizations to evaluate the impact of these teams, ensuring that they contribute to overall business growth and efficiency.

Examples of support activities include human resources, which manages employee relations, and technology development, which innovates processes and products. Additionally, procurement ensures that the necessary resources are acquired efficiently. By observing these examples while New Hampshire Assessing the Support Activities in the Value Chain, companies can pinpoint areas for improvement and increased productivity.

In value chain analysis, support activities play a pivotal role in enabling primary activities to operate effectively. This includes technology development, human resource management, and the infrastructure needed for operations. By focusing on New Hampshire Assessing the Support Activities in the Value Chain, businesses can better understand how these functions drive value, leading to improved strategic decisions.

Support activities in the value chain are essential functions that help enhance the effectiveness of primary activities. These include technology development, human resource management, procurement, and company infrastructure. When you engage in New Hampshire Assessing the Support Activities in the Value Chain, you identify how these activities contribute to the overall efficiency and competitive advantage of your business.

The town with the highest property tax in New Hampshire may change frequently as local budgets are adjusted. Towns that have higher demands for public services or infrastructure often face higher tax rates. For a comprehensive understanding of these fluctuations, refer to resources that specialize in New Hampshire Assessing the Support Activities in the Value Chain, which can guide you in making informed decisions about property investments.

Local property taxes in New Hampshire depend on various factors, including property location, value, and local government budgets. These taxes fund essential services like schools, roads, and emergency services in your community. By utilizing platforms focused on New Hampshire Assessing the Support Activities in the Value Chain, you can gain clarity on local tax obligations and optimize your property investments.

Identifying the town in New Hampshire with the lowest tax rate can fluctuate each year, making it important to refer to the latest assessments. Generally, towns with lower population densities and smaller budgets tend to offer lower rates. Engaging with resources that focus on New Hampshire Assessing the Support Activities in the Value Chain can provide you with insights into these towns and their respective benefits for property owners.

The property tax rate in Alton, NH, typically varies annually based on local budget needs and assessments. This means that property owners should stay updated on the tax announcements as these changes directly affect their financial planning. New Hampshire Assessing the Support Activities in the Value Chain can help property owners better understand how these rates are determined and their implications on property value.

New Jersey frequently ranks as the state with the highest property taxes in the United States. This ranking reflects a combination of property values, funding needs for schools, and local services. Awareness of these trends can enhance your understanding of elements involved in New Hampshire Assessing the Support Activities in the Value Chain as you evaluate your own tax situation.

New Hampshire is unique as it does not impose a state sales tax, which can be advantageous for consumers and businesses alike. This absence of a sales tax may influence property values and the overall economic landscape. By understanding this aspect, you can better navigate your financial decisions, particularly when considering New Hampshire Assessing the Support Activities in the Value Chain.