New Hampshire Notice of Default on Promissory Note Installment

Description

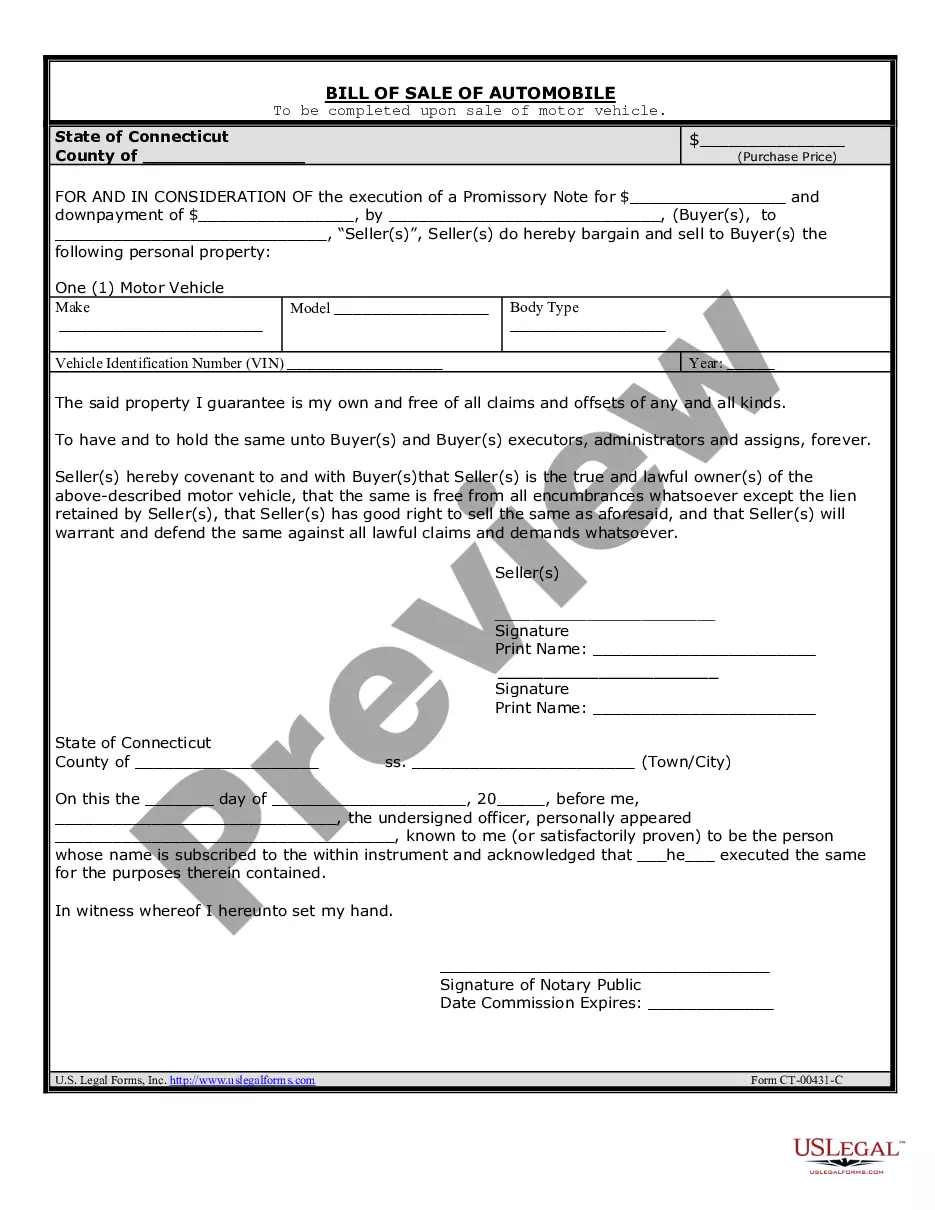

How to fill out Notice Of Default On Promissory Note Installment?

Are you presently in a scenario where you require documents for either business or specific needs almost constantly.

There are numerous legitimate document templates accessible online, but locating ones that can be trusted is challenging.

US Legal Forms offers a vast array of form templates, such as the New Hampshire Notice of Default on Promissory Note Installment, designed to comply with federal and state regulations.

When you find the correct form, click Purchase now.

Choose the pricing plan you want, fill in the necessary information to create your account, and pay for the order with your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, just Log In.

- Afterward, you can download the New Hampshire Notice of Default on Promissory Note Installment template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

- Use the Review button to assess the form.

- Read the description to ensure you have selected the appropriate form.

- If the form is not what you were looking for, use the Lookup section to find the form that meets your needs.

Form popularity

FAQ

The default rate on a promissory note is the interest rate that applies when the borrower fails to meet payment obligations. This rate is typically higher than the standard interest rate and serves as a penalty for non-payment. Borrowers need to understand this rate to avoid exorbitant fees when receiving a New Hampshire Notice of Default on Promissory Note Installment. If you feel overwhelmed, platforms like uslegalforms can help you navigate these terms and provide necessary documentation.

If you default on a promissory note, several consequences may follow, depending on the note's terms and state laws. In New Hampshire, after a Notice of Default on Promissory Note Installment is issued, the lender may initiate legal action to recover the owed amount. This could result in court proceedings, asset seizure, or wage garnishment. To mitigate these risks, it is best to communicate with your lender and explore potential solutions.

A promissory note is a legally binding document that can be enforced in court if the borrower fails to comply with the terms. In New Hampshire, lenders can file a claim based on the terms outlined in the note, and if a Notice of Default on Promissory Note Installment has been issued, this can strengthen the case against the borrower. Therefore, understanding the enforceability of your promissory note is crucial for both lenders and borrowers. Always consult with a legal expert to navigate this process effectively.

The default provisions of a promissory note outline the actions that the lender can take if the borrower fails to make scheduled payments. In New Hampshire, a Notice of Default on Promissory Note Installment is a formal notification that the borrower is in default. This notice typically includes details regarding the outstanding balance and the timeframe for resolving the issue. Understanding these provisions can help borrowers avoid default and protect their credit.

If someone defaults on a promissory note, your first step should be to communicate with the borrower to understand their situation. If informal communication does not yield results, consider sending a New Hampshire Notice of Default on Promissory Note Installment to formally document the default. If necessary, prepare to explore legal avenues for recovery, as platforms like uslegalforms can provide the resources you need to navigate this process effectively.

Legally enforcing a promissory note involves several steps, such as first attempting collection through informal methods. If those fail, you can file a lawsuit to recover the debt. A New Hampshire Notice of Default on Promissory Note Installment can help establish your intention to enforce the note in court, as it serves as documentation that the borrower has been notified of their default.

To write a notice of default, you should clearly identify the parties involved, state the specific terms of the promissory note, and detail the nature of the default. Include information such as the amount due, the due date, and any applicable penalties. Using a New Hampshire Notice of Default on Promissory Note Installment template can simplify this process and ensure that you cover all necessary components legally.

If you face default on a promissory note, several remedies are available. The creditor can seek to recover the outstanding amount through collection efforts, initiate legal proceedings, or request a judgment against the borrower. It's essential to consider a New Hampshire Notice of Default on Promissory Note Installment as a formal step to notify the borrower, potentially prompting them to fulfill their obligations before further action.

A notice of default on a promissory note, such as the New Hampshire Notice of Default on Promissory Note Installment, is a formal notification that a borrower has failed to fulfill their repayment obligations. This document is a critical warning that outlines potential legal consequences and offers a chance for the borrower to rectify the situation. Understanding this notice is vital for both lenders and borrowers to navigate potential recovery options effectively.

Writing a default notice involves clearly stating the borrower’s account status, referencing the New Hampshire Notice of Default on Promissory Note Installment, and outlining the steps needed to remedy the situation. Include specific details about the amounts due and any deadlines for payments. A well-structured notice can help ensure both parties understand their obligations and encourage timely action.