New Hampshire Community Property Agreement

Description

How to fill out Community Property Agreement?

If you need to compile, acquire, or print legal document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Utilize the site's straightforward and user-friendly search feature to locate the documents you need.

Numerous templates for business and personal use are organized by categories and states, or keywords.

Every legal document template you purchase belongs to you indefinitely.

You will have access to every form you downloaded within your account. Navigate to the My documents section and select a form to print or download again. Stay competitive and obtain, and print the New Hampshire Community Property Agreement with US Legal Forms. There are millions of professional and state-specific templates you can use for your business or personal needs.

- Utilize US Legal Forms to locate the New Hampshire Community Property Agreement in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to obtain the New Hampshire Community Property Agreement.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure that you have chosen the form for the correct city/region.

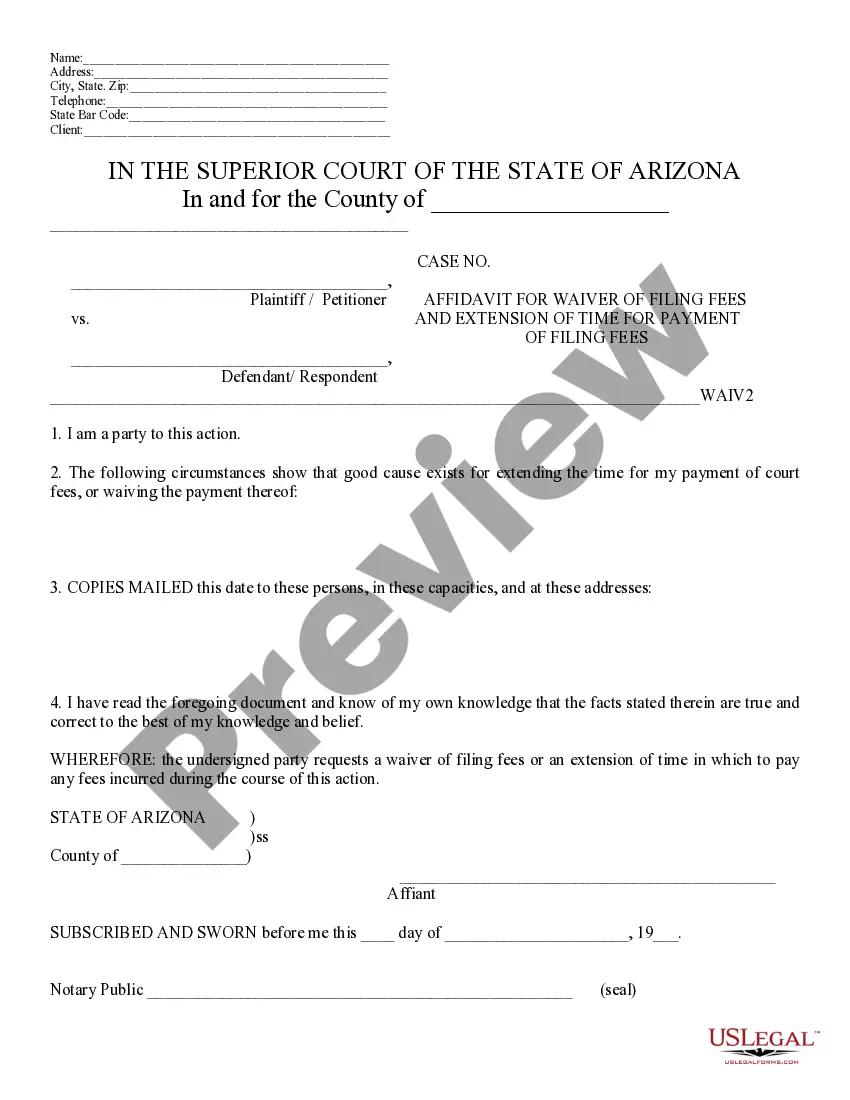

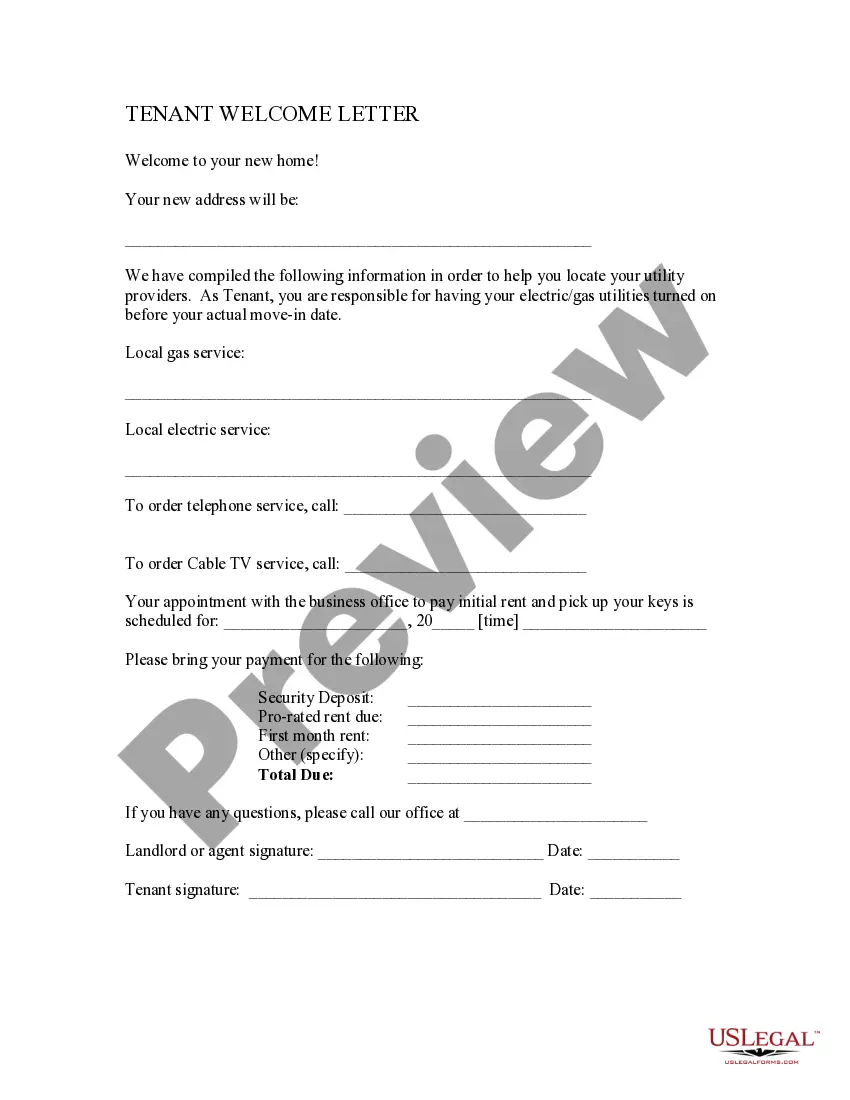

- Step 2. Use the Review option to examine the form's content. Remember to read the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative forms of your legal document template.

- Step 4. Once you have located the form you need, click the Purchase now button. Select the pricing plan you prefer and input your information to register for the account.

- Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the New Hampshire Community Property Agreement.

Form popularity

FAQ

New Hampshire is not strictly a 50/50 divorce state, but it generally aims for equitable distribution of marital assets. This means that, during divorce proceedings, the court considers various factors to determine a fair division of property. Establishing a New Hampshire Community Property Agreement before a divorce can simplify this process and clarify your wishes.

One disadvantage of community property is that it can complicate asset division in the event of a divorce. Since all assets acquired during marriage are generally shared, disputes may arise about what property counts as community property versus separate property. A clear New Hampshire Community Property Agreement can help mitigate these issues by detailing asset distribution and reducing potential conflicts.

The IRS views community property as assets acquired during marriage that belong equally to both spouses. This includes income earned and property purchased while married, which may affect how taxes are filed. Understanding these rules is essential for proper tax reporting and planning, and a New Hampshire Community Property Agreement can help clarify ownership and responsibilities.

In community property states like New Hampshire, both spouses are considered equal owners of any property acquired during the marriage. This means that assets and debts earned in the marriage typically belong to both partners, regardless of whose name is on the title. A well-crafted New Hampshire Community Property Agreement can specify how you wish to manage and divide these assets, offering clarity and protection for both partners.

Creating a community property agreement in New Hampshire involves defining what you and your spouse consider as jointly owned property. This agreement should clearly outline how assets and debts will be managed during your marriage and divided in the event of a divorce. Utilizing uslegalforms can simplify this process, providing templates and resources to help you draft a comprehensive New Hampshire Community Property Agreement.

In New Hampshire, marital property generally includes all assets acquired during the marriage, regardless of whose name is on the title. This can include homes, vehicles, and any other shared belongings. To manage these assets effectively, consider setting up a New Hampshire Community Property Agreement, which can provide clarity and fairness in the division process.

The first step in the separation process typically involves having an open discussion with your spouse about the decision to separate. This conversation is crucial as it sets the tone for future discussions. Initiating a New Hampshire Community Property Agreement at this stage can establish boundaries and clarify how assets will be managed during the separation.

No, you do not have to be legally separated before pursuing a divorce in New Hampshire. This provides flexibility for couples who wish to transition directly to divorce. A solid New Hampshire Community Property Agreement can facilitate clear communication and help address financial matters right from the start.

New Hampshire does not require couples to be separated before filing for divorce. However, separation might help resolve conflicts and clarify individual priorities. Having a New Hampshire Community Property Agreement supports discussions about asset and property division during either separation or divorce, benefiting both parties.

The time it takes to get divorced in New Hampshire varies based on several factors, including court schedules, complexity of the case, and whether both parties agree on key issues. Generally, an uncontested divorce may take less time than a contested one. Utilizing a New Hampshire Community Property Agreement can streamline discussions around property and support, potentially speeding up the process.