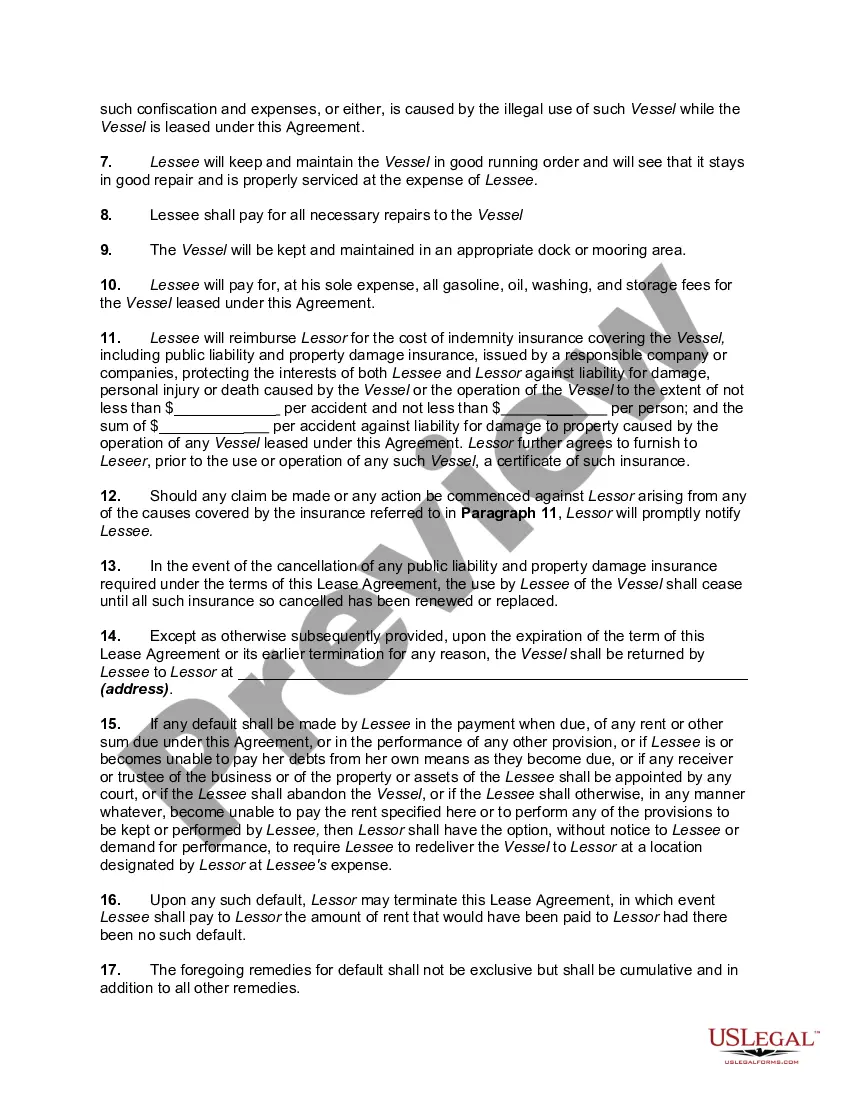

The following Lease or Rental Agreement is meant to be used by one individual dealing with another individual rather than a dealership situation. It therefore does not contain disclosures required by the Federal Consumer Leasing Act.

New Hampshire Lease or Rental Agreement of Vessel with Option to Purchase and Own at the End of the Term for a Price of $1.00 - Lease or Rent to Own

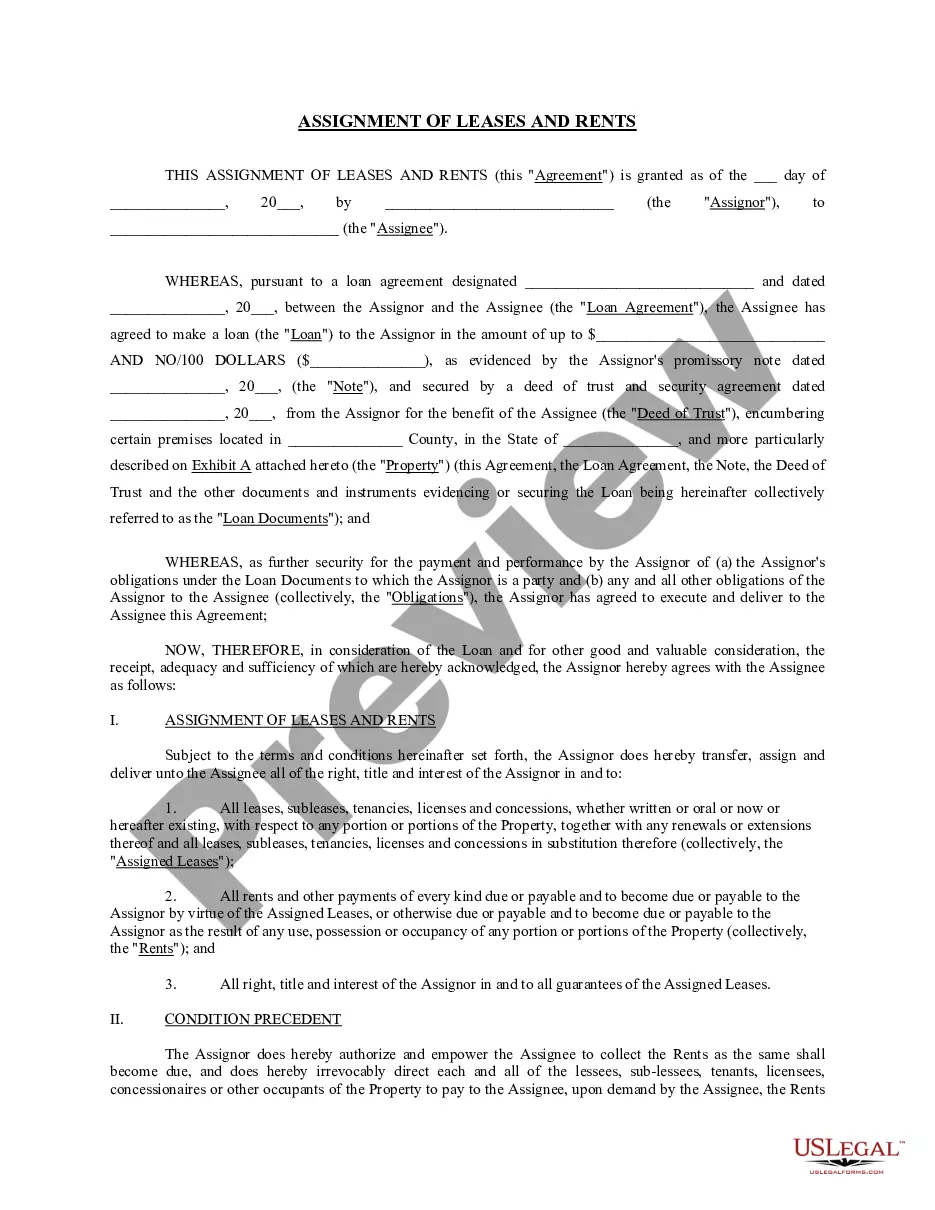

Description

How to fill out Lease Or Rental Agreement Of Vessel With Option To Purchase And Own At The End Of The Term For A Price Of $1.00 - Lease Or Rent To Own?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal document templates that you can purchase or create.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the most recent versions of documents such as the New Hampshire Lease or Rental Agreement of Vessel with Option to Purchase and Own at the End of the Term for a Cost of $1.00 - Lease or Rent to Own in just a few minutes.

If the form does not meet your needs, use the Search area at the top of the screen to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the payment plan you prefer and provide your information to register for an account.

- If you already have a subscription, Log In to access the New Hampshire Lease or Rental Agreement of Vessel with Option to Purchase and Own at the End of the Term for a Cost of $1.00 - Lease or Rent to Own in the US Legal Forms database.

- The Download button will appear on every form you review.

- You can find all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple steps to help you get started:

- Make sure to have selected the correct form for your location/region.

- Click the Review button to examine the form's content.

Form popularity

FAQ

The New Hampshire standard residential lease agreement is a legal document that governs the rental of residential properties within the state. It includes provisions related to the rent amount, payment terms, security deposits, and rules for property maintenance. Familiarizing yourself with this lease can empower you to make informed decisions when renting a property.

The most common residential lease is the standard lease agreement. This lease typically outlines the terms and conditions under which a tenant can occupy a property. In New Hampshire, the lease agreement usually includes important details like the duration of the rental, the amount of rent, and the responsibilities of both the landlord and tenant.

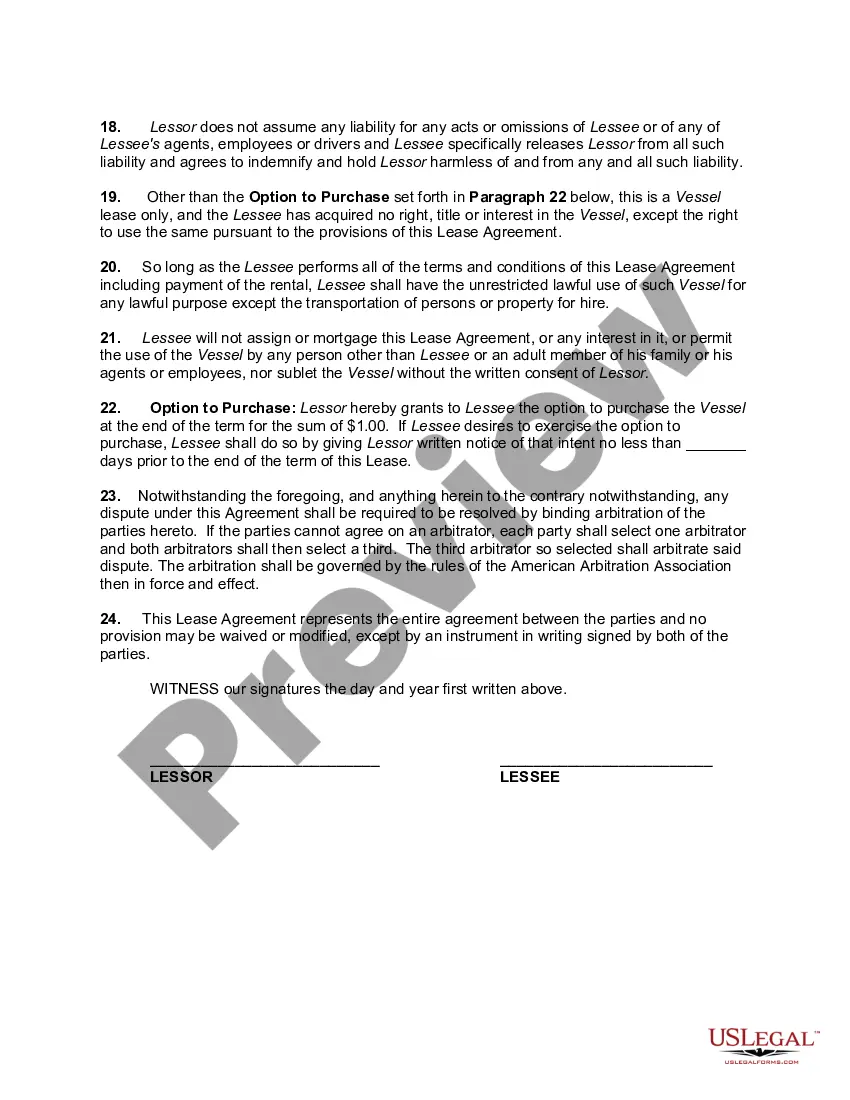

Unlike a sale agreement with seller financing, a lease-option allows the owner to continue to receive tax deductions as the owner. Interest, taxes, maintenance and depreciation may still be deducted against the rent received.

Fixed monthly cost: When leasing, you generally won't have to pay for any significant maintenance, repairs or upkeep to the property, though you may be expected to pay for minor repairs. Instead, you'll know exactly what you need to pay each month without the worry of unanticipated, expensive repair costs.

What Is a Lease Option? A lease option is an agreement that gives a renter a choice to purchase the rented property during or at the end of the rental period. It also precludes the owner from offering the property for sale to anyone else. When the term expires, the renter must either exercise the option or forfeit it.

Advantages of Lease Purchases for Sellers ExplainedIncreased return on investment: The upfront option payment can increase the return on investment, and it stays with the owner even if the tenant does not purchase the property.Locked-in sale price: The owner can lock in a reasonable price for the home in advance.More items...?

The main difference between a lease and rent agreement is the period of time they cover. A rental agreement tends to cover a short termusually 30 dayswhile a lease contract is applied to long periodsusually 12 months, although 6 and 18-month contracts are also common.

A lease option is a legal agreement that allows you to control a property and generate income from it, with the right (but not the obligation) to buy it later. .

optiontobuy arrangement can be a solution for some potential homebuyers, but it's not right for everyone. If you're not certain that you're going to be able to purchase the rental home at the end of the lease period, you might be better served with a standard rental agreement.

Sellers agreeing to lease option deals arguably have more to lose than buyers. If house prices rise they're likely to regret agreeing a price at the time the option was taken out. If prices fall there's a risk the buyer or investor will not exercise their option to buy, and they'll still be stuck with the property.